Estate Planning Basics: What It Is and How to Get Started

11 Min Read | Nov 5, 2025

Key Takeaways

- An estate plan includes a will, a trust or both, plus powers of attorney and sometimes a living will and letter of instruction.

- For most people, estate plans can be pretty simple.

- To build an estate plan, follow these six steps: List your assets, decide if you need a lawyer, talk with your family, gather important documents, write your will or trust (and any other documents you need), and keep your plan up to date.

- Mistakes to avoid when estate planning include procrastinating, not telling your family what’s in your will, and forgetting to name contingent beneficiaries.

Oh yay, time to think about your death. And finances. And taxes. Actually, let’s just forget it, grab another Cosmic Brownie, and keep scrolling.

Get expert money advice to reach your money goals faster!

Except you’re not going to do that, are you? Because you came here with a purpose. You want to be intentional and make things easier for your loved ones by estate planning.

To do that, you need to know the basics. So let’s jump into estate planning 101, beginning with what it is and then moving along to six steps that’ll get you started.

What Is Estate Planning?

Estate planning is the process of creating an estate plan, which is a set of documents that lay out what you want to happen when you die. A good estate plan is made to follow the laws of your state and help your loved ones avoid unnecessary taxes and legal fees.

Why Estate Planning Matters

If you’ve experienced the death of a loved one and been part of what happens after, you already know how important it is to have a good estate plan in place. If your loved one didn’t have a good plan, then you really know. But for those who haven’t experienced this yet, we’re here to tell you: Get your estate plan done.

But we’re not talking about prepaying for your funeral—we’re talking about creating a thoughtful plan that helps your family make decisions and divide everything the way you wanted. If you die without a plan in place, your family will have to make big, hard decisions while they’re overwhelmed by losing you.

Or you could end up leaving them a big mess to sort out—like what happened to Michael M.’s relations. He told this story in the Ramsey Baby Steps Community on Facebook:

His sister-in-law owned property jointly with her three siblings, but she never made a will. Then she died. That meant her share in the property went to her husband—even further away from the original family unit. And then he moved away and wouldn’t talk to anyone.

“So now the deed is ‘encumbered,’ and we can’t even buy him out because he refuses to go to the courthouse and prove he is the legal heir and owner,” said Michael. “What a mess.”

“My sister-in-law died without a will . . . What a mess.”

And don’t forget to appoint a medical power of attorney. If you don’t, your family could have to make tough choices about your end-of-life care—and you might not like the decisions they make.

Who Needs an Estate Plan?

Anyone who owns anything needs an estate plan.

In the context of financial estate planning, estate simply refers to what you own and will leave behind. We’re talking assets—the stuff you own that has monetary value. Things like houses, cars, jewelry, investments, coin collections, etc. If you can drive it, wear it, or shine it, it’s part of your estate.

Core Parts to an Estate Plan

Your estate plan covers who gets your stuff, how they get it, what happens to you when you die or become disabled, what your medical wishes are, and who takes care of any kids or pets. For most people, estate plans end up being pretty simple.

Here’s everything you’ll need when you’re planning an estate:

- A will or living trust

- A letter of instruction

- Financial power of attorney

- Medical power of attorney

- Living will (maybe—more on that later)

- Beneficiary designations (that’s legal talk for who you’re giving your stuff to)

How to Build Your Estate Plan

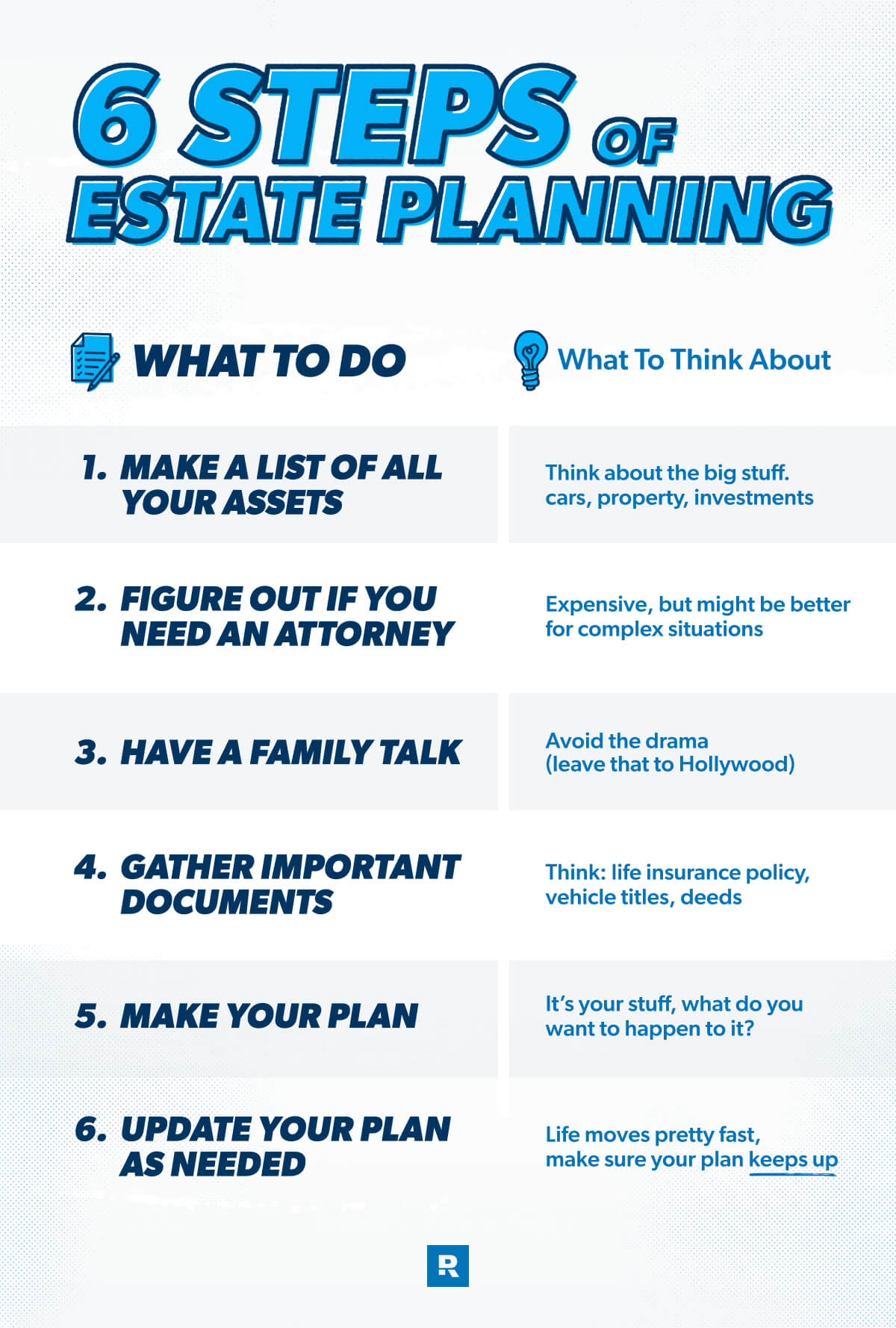

Estate planning may sound intimidating, but we’ll break it down as simply as possible. Here are six steps to getting your estate plan in place.

6 Steps to Estate Planning

1. Make a list of all your assets.

Your assets are the things you own that make up your estate and contribute to your overall net worth. This includes items like:

- Your home and real estate properties

- Vehicles

- Cash in checking and savings accounts

- Retirement and investment accounts

- Stocks, bonds and CDs

- Businesses you own

- Valuable possessions—like jewelry, antiques and furniture

Do an inventory of your wealth, whether your estate is worth $200 or $2 million. Regardless of your net worth, every person over 18 needs a will and estate planning—or at least a will—to make things easier on your family if something happens to you

2. Figure out if you need an estate planning attorney.

If you have a small estate and a straightforward family situation, you’re probably fine saving some money and creating a will online without hiring an attorney.

But you will need to meet with an attorney if you have a complicated estate. These involve a higher net worth (generally anything over $1 million), require tax planning, and include beneficiaries who either need continuing care or need their assets distributed in a controlled way over time.

Still not sure? Take our quiz. It’s not legal advice, but it’ll give you a good idea about whether you need to schedule a consultation with an attorney.

If you’re looking for a good estate planning attorney, ask around. Talk to your financial advisor. Get a referral from your tax pro. Ask your parents. Read online reviews. Then get an appointment on the calendar!

3. Have a family talk.

Most of the time, surprises are fun—like a surprise vacation to Miami or an unexpected bouquet of sunflowers. But, “Surprise! I named you as agent in my power of attorney. Please sort out my finances,” doesn’t get quite the same reaction.

You’ll need to pick people for these roles and let them know they got the part:

- Executor of estate

- Medical power of attorney

- Financial power of attorney

- Guardians (if you have minor children)

Sit down with your family and make sure everyone is on the same page about what will take place when you’re the star of the funeral.

4. Gather your important documents.

After you’ve made a list of your assets, you need to gather corresponding paperwork and important documents related to your estate. Here’s what we’re talking about:

- Life insurance policy

- Long-term care insurance policy

- Housing or land deeds

- Vehicle titles

- Marriage license

- Divorce papers

- Military discharge papers

- Partnerships or business agreements

Got any usernames or passwords on any of these accounts or documents? Include that information too.

All of these estate planning documents need to be stashed together in a secure place with the rest of your plan. Think a safe deposit box or legacy drawer. (If a digital legacy drawer makes more sense for you, try storing everything in a secure online file.) Once you’ve created your estate plan documents, you’ll add these to the drawer.

Make sure the executor of your will and key family members know where to find it!

5. Make your plan.

You’ll create the actual documents next. The basic paperwork in an estate plan usually includes:

- Will or living trust

- Power of attorney

- Living will

- Letter of instruction

Let’s talk about each one.

Will

A will (or last will and testament) is a legal document that tells other people what you want done with your possessions when you die. Every adult over age 18 needs to have a will. Period.

Living Trust

A living trust is similar to a will, with one exception: You transfer your money, property, investment earnings and other valuable stuff into a trust while you’re still alive. If you have a large estate, a trust might be a good idea. When you die, your trust doesn’t have to go through probate, so it stays private and saves your beneficiaries a lot of time.

Powers of Attorney

Every estate plan includes a power of attorney (POA), which is a document giving someone the legal authority to make financial or health care decisions on your behalf. There are two main types you need to be aware of: a medical power of attorney and a financial power of attorney. You can appoint the same person to serve as your agent in both your medical and financial POA, or you can select two different people.

Living Will

A living will, also called a health care directive, is kind of similar to a medical POA, but it only addresses your wishes for end-of-life medical care, like whether to resuscitate you if you’re in a nonresponsive state. If you have a medical power of attorney, there’s no need to have a living will. You can simply combine the day-to-day health care decisions and end-of-life care in the medical POA. But if you have a living will, you should definitely make sure you have a medical POA as well.

Letter of Instruction

A letter of instruction (aka a letter of intent) is an informal document where you can provide personal instructions that aren’t included in your will. And while it has no legal authority, it can make things easier on your family by spelling out your special wishes.

6. Revisit your estate plan regularly and update it as needed.

When you go through major life changes, your estate plan should too! Update your will anytime one of these events occurs:

- Moving to another state

- Getting married

- Getting divorced

- Having kids

- Buying or selling a business

Make it a habit to review your estate plan about once a year (whether or not you’ve had any major life changes).

Will an online will work for you?

Find out if an online will works for you in less than 5 minutes.

Common Mistakes and Pitfalls

Since we went over what you should do, hopefully you can just laugh at these common mistakes. But in case you’re curious, let’s look at a few of the biggest estate planning blunders people make.

Not Keeping Your Will Up to Date

This one’s no fun. Seriously, you’ve already done the responsible thing and put in all this work. You’ve got your tidy estate plan all tucked away in a legacy drawer. In fact, it’s been tucked away so long it’s actually outdated now.

Picture this: Cousin Larry croaks, his wife gets weird and remarries, and now you don’t want her getting the Revolutionary War musket that your great-great-great-great-great-grandpappy used to shoot a Redcoat. Don’t let an outdated will bite you in the butt. Review and update your plan every few years.

Not Telling Loved Ones What’s in Your Will

If you’re planning on leaving someone out of your will, we could understand how you might not want to tell them. But . . . it’s not a good idea to leave your family in the dark.

Don’t pull a Harlan Thrombey and create a real-life example of Knives Out. Tell everyone what’s in your will so there are no surprises and so nobody can question what you wanted.

Not Keeping Your Beneficiaries Consistent

Your will doesn’t determine the outcome of certain assets including your retirement accounts, annuities and life insurance. Each of those lets you name a beneficiary (the person who gets your money when you die), and you should make sure you do.

You should also make sure the beneficiaries on your accounts match the beneficiaries in your will! The person named on the account trumps the person named in the will.

Not Thinking Through a Well-Intended Gift

Saddling someone with an inheritance they don’t want—like a business—might not be the kindest thing. You may have loved running Dave’s Bird Store, but your nephew who’s studying to be an accountant might not be into it.

Sometimes you might need to think about putting specific terms on a gift. For example, handing a large stack of money to a person dealing with alcohol or drug addiction could just make their life worse.

Naming Only One Beneficiary

You should always name a contingent beneficiary. Car accidents and other tragedies can take out more than one family member at a time. If you leave everything to your husband and don’t name anyone else but tragically both drive off a cliff on your second honeymoon in Monaco, your will is useless.

Procrastinating

A funny thing happens when it comes time to face hard stuff like our own death: We just don’t want to do it, so we put it off. But dying without a will can create a mess. Make your estate plan!

For most people, getting started is as simple as going online and putting their wishes into an online will maker. A simple will from a reputable online will maker like RamseyTrusted® provider Mama Bear Legal Forms is a great option for people with simple estates. Mama Bear even includes powers of attorney with their will package, so you can knock two things off your estate planning list for the price of one.

The peace of mind you'll have from knowing your wishes are clear is matched only by the comfort of knowing you've made things easier for your loved ones as they grieve.

Next Steps

- Take our quiz and find out if a simple online will is the right fit for your estate.

- Fill out our worksheet to see what you need to gather to write a will.

- Dive deeper into estate planning with our guide.

- Check out our article to see what it’s like to make your will online with Mama Bear Legal Forms.

- Start your online will with RamseyTrusted provider Mama Bear Legal Forms.

- Learn how to write a letter of instruction—then use our online template to write your own.

Complete Last Will Package for Married Couples

Complete Last Will Package for Individuals

Frequently Asked Questions

-

Is estate planning only for the wealthy?

-

No, everyone over 18 needs an estate plan. Even if you have modest assets, your loved ones need to know what to do with them. Otherwise, they can get bogged down in an expensive probate process and the state will end up making all the decisions.

-

Why do I need an estate plan?

-

If you die or become incapacitated without a plan, you’re giving away control of your stuff and even your own self in some cases. If you have any preferences about who gets your stuff or what happens to you in an end-of-life scenario, you need to set up instructions in an estate plan.

-

Why is a will important in estate planning?

-

Wills and estate planning pretty much go hand in hand. If you’re writing a will then you’ve started an estate plan. If you’re estate planning, then you’re going to have to write a will (or living trust).

The will is the bedrock of an estate plan. It’s the biggest single instrument for directing where, what and how things will go.

Your other option is a living trust, but because these are very complicated, a will usually is the best way to go.

-

Do I need an estate planner?

-

Probably not. Unless you have a business or a really large or complex estate, you can usually set up a will, letter of instruction and powers of attorney quickly and easily online.

-

What is the difference between a power of attorney and an executor?

-

While a power of attorney and executor may have very similar duties, the big difference between the two roles is whether the person who appointed them is alive or dead. A POA takes care of financial and medical decisions during the final days of the appointee’s life. An executor, on the other hand, takes care of these things after the appointee dies and makes sure everything in the will gets done.