How Much Does an Estate Have to Be Worth to Go to Probate?

5 Min Read | Jul 24, 2024

Did you just assume probate only applied to the estates of the rich and famous? Well not so fast!

All estates have to go through probate—no matter what they’re worth. But the probate process can vary. How it all goes down will depend on how much the estate is worth. There are two routes this can go. If the estate’s value is above a certain amount, you’ll need more legal oversight and will be taking more steps with the probate court. But for many situations, you’ll be able to use simple probate. So, where’s that dividing line?

What Is Probate?

Most of the time when lawyers refer to probate, they’re talking about the more involved process of overseeing the administration of an estate above a certain dollar amount in value. Every state has laws that spell out how much an estate would need to be worth to require the full probate process—anywhere from $10,000 to $275,000. You’ll have to check the laws in your loved one’s state of residence to find out what that minimum value is. Then, you’ll need to calculate the value of their estate to see if the full probate process will come into play for you.

Simplified Probate

But what if your loved one had a small estate? You can apply for a simplified probate process, also known as summary probate. Once again, this is going to be defined differently from state to state. But each state has a law naming the maximum value an estate needs to be under to qualify for simplified probate. So get that number for your state and get busy seeing if your estate qualifies.

Save 10% on your will with the RAMSEY10 promo code.

Don't Know Where to Start With a Will?

Download our will worksheet to get started.

How to Determine Estate Value

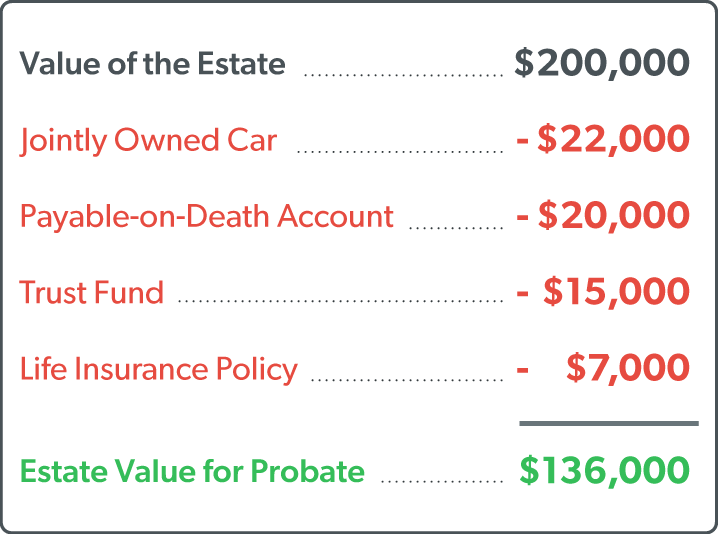

Figuring out how much an estate is actually worth takes a little work. That’s because some assets count toward the value of the estate and others don’t. Here’s what you’ll need to do:

1. Figure out how much everything is worth.

That includes real estate, vehicles, insurance policies, personal items and anything else your loved one owned.

2. Subtract the value of any assets that don’t have to go through probate.

Assets that don’t have to go through probate are things like life insurance policies, items that are owned jointly or are part of a trust, or accounts that are payable- or transferrable-on-death.

You may also be able to subtract any money the deceased owed on an item. For example, if their car is worth $15,000 and they still owed $5,000, then you would only count $10,000 toward the value of the estate. That said, not every state lets you subtract debts like this, so make sure you check the rules before you go whole hog with the math.

3. File for simplified probate with the local court.

3. File for simplified probate with the local court.

If there’s a will, the executor named in the will has to file for probate. If there’s no will, you and your family should either choose someone to file or go to the courthouse together to file. The court will appoint one of you as the estate administrator to handle the probate process.

It’s possible for your request to be denied if certain types of assets—like real estate—are involved. If that happens, the estate will have to go through the longer formal probate process. So it’s good to check for any restrictions beforehand.

In most cases, though, qualifying estates should get approved for simplified probate. Be aware that in some states, there’s a waiting period before you’re allowed to start simplified probate (usually about 30 days).

4. Carry out the simplified probate process.

The one caveat here is that if anybody contests the will, the courts will send it back to formal probate to sort it all out.

Making the Probate Process Easy

Now that we’ve worked out the players and parts to the probate process, you might be wondering: How can I be sure the probate process will be easy on my own family after I’m gone? Great question!

You need to get a will—that’s the best way to make sure your family doesn’t have to deal with a difficult probate. Don’t leave them scrambling in a really difficult time—take care of end-of-life issues today.

Online wills are an easy way to get that done. You can create your own will online with RamseyTrusted provider Mama Bear Legal Forms in less than 20 minutes. Seriously, that's about as long as it takes to drink a cup of coffee! Mama Bear provides attorney-designed documents that are state-specific and legally binding. All you need to do is answer a few questions, and the rest of the work is done for you. Once you’ve purchased, there’s no rush. You have 180 days to complete the form.

Remember: Having a will is a key step in financial planning and in loving your family well, so don't put it off!

Next Steps

- Take our quiz and find out if an online will is the right fit for your estate.

- If you're still not sure about making a will, learn more about estate planning with our guide.

- Fill out our worksheet to see what you need to gather to write a will.

- Learn how to write a letter of instruction then use our online template to write your own.

- Start your online will with RamseyTrusted provider Mama Bear Legal Forms.

Complete Last Will Package for Married Couples

Complete Last Will Package for Individuals

Interested in learning more about estate planning?

Sign up to receive helpful guidance and tools.