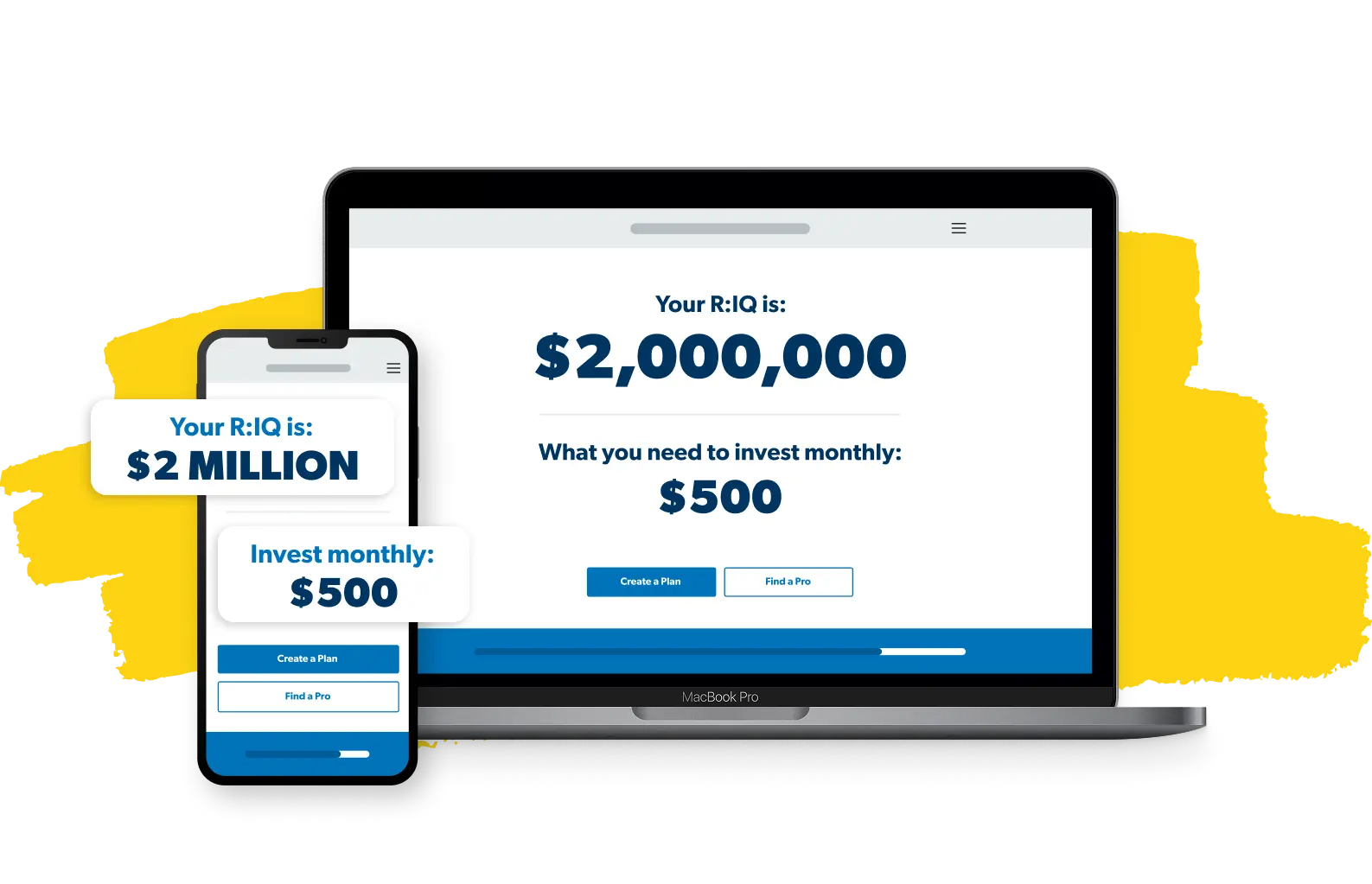

Retirement Calculator

Get an idea of how much your investments could be worth when it’s time to retire.

Find the tools, resources and knowledge you need to plan for retirement on purpose.

Find out how big of a nest egg you may need to fund your dream retirement. And get an idea of how much to invest each month to reach your goals.

Retirement can be tricky. Finding an advisor with the heart of a teacher doesn't have to be. We'll connect you to a SmartVestor Pro who can help with income planning, withdrawals, benefits and more.

Ramsey Solutions is a paid, non-client promoter of participating pros.

Whether you’re trying to catch up or exploring retiring early, retirement begins with a plan.

Get a step-by-step guide to creating your plan for the future.

Is early retirement right for you? Get the facts you need to decide.

Feeling behind on your retirement goals? Check out nine ways to catch up.

You’ve put in the hard work—now it’s time to kick back and enjoy life! Check out these resources that will help you navigate life after retirement.

As a general guideline, first we suggest paying off all debt (except your mortgage) and building an emergency fund with 3–6 months’ worth of living expenses. Then, invest 15% of your gross (not net) annual household income each year in tax-advantaged retirement accounts.

If your employer offers a match, that’s awesome, but it doesn’t count toward the 15%!

Depending on your situation, sometimes you may want to use more than one type! As a general guideline, we recommend using the following formula to help you figure out which accounts to use:

Match beats Roth beats Traditional.

If your employer offers a Roth 401(k) with a match of 4%, for example:

Imagine your employer only offered a traditional 401(k) with a 4% match:

If you don’t have access to an employer-sponsored retirement account:

It depends on the type of account! For instance, if you want to set up an employer-sponsored account like a 401(k), your human resources (HR) department should be able to walk you through the process.

These days, you can also open an investment account on the website of any major brokerage. As a general rule, we recommend working with a financial advisor, who will be able to help you select and set up the right account for your needs.

We recommend investing evenly across four different categories of growth stock mutual funds:

The content on this page provides general guidelines about investing topics. Your situation may be unique.

To discuss a plan for your situation, connect with an investment professional.

SmartVestor™ is an advertising and referral service for investment professionals operated by The Lampo Group, LLC d/b/a Ramsey Solutions (“Ramsey Solutions”). When you provide your contact information through the SmartVestor site, Ramsey Solutions will introduce you to up to five (5) investment professionals (“Pros”) that cover your geographic area. Each Pro has entered into an agreement with Ramsey Solutions under which the Pro pays Ramsey Solutions a combination of fees, including a flat monthly membership fee and a flat monthly territory fee to advertise the Pro’s services through SmartVestor and to receive client referrals from interested consumers who are located in the Pro’s geographic area. Each Pro may also, if applicable, pay Ramsey Solutions a one-time training fee.

The fees paid by the Pros to Ramsey Solutions are paid irrespective of whether you become a client of a Pro and are not passed along to you. However, you should understand that all of the Pros that are available through SmartVestor pay Ramsey Solutions fees to participate in the program. Further, the amount of compensation each Pro pays to Ramsey Solutions will vary based on certain factors, including whether the Pros choose to advertise in local or national markets. Ramsey Solutions has a financial incentive to present certain Pros that offer their services on a national basis (“National Pros”) more often than other National Pros that pay lower fees.

It is up to you to interview each Pro and decide whether you want to hire them. If you decide to hire a Pro, you will enter into an agreement directly with that Pro to provide you with investment services. Ramsey Solutions is not affiliated with the Pros and neither Ramsey Solutions nor any of its representatives are authorized to provide investment advice on behalf of a Pro or to act for or bind a Pro. Ramsey Solutions introduces you to Pros that cover your geographic area based on your zip code. Neither Ramsey Solutions nor its affiliates provide investment advice or recommendations as to the selection or retention of any Pro, nor does Ramsey Solutions evaluate whether any particular Pro is appropriate for you based on your investment objectives, financial situation, investment needs or other individual circumstances.

No investment advisory agreement with a Pro will become effective until accepted by that Pro. Ramsey Solutions does not warrant any services of any SmartVestor Pro and makes no claim or promise of any result or success by retaining a Pro. Your use of SmartVestor, including the decision to retain the services of a Pro, is at your sole discretion and risk. Any services rendered by a Pro are solely that of the Pro. The contact links provided connect to third-party websites. Ramsey Solutions and its affiliates are not responsible for the accuracy or reliability of any information contained on third-party websites. Each Pro has signed a Code of Conduct under which they have agreed to certain general investment principles, such as eliminating debt and investing for the longer-term, and, if applicable, have completed Ramsey Pro Training. However, Ramsey Solutions does not monitor or control the investment services the Pros provide.