Identity Theft Protection Worth Having

The best protection doesn’t just monitor.

It helps you take your life back.

Who Needs Identity Theft Protection?

We recommend identity theft protection for everyone. It’s not part of the Baby Steps because it’s not about building wealth—it’s about protecting it. Just like car or life insurance, it’s a safety net that helps you stay on track when life throws you a curveball.

Why Do We Recommend Identity Theft Protection?

Even if you’re careful, your identity can still be stolen. And fixing it on your own? That takes time, money and a lot of frustration. That’s why Dave Ramsey recommends a plan that includes unlimited recovery services—so experts do the heavy lifting while you keep moving forward with confidence.

Most victims didn’t know they needed protection until it was too late. But guess what? That doesn’t have to be you.

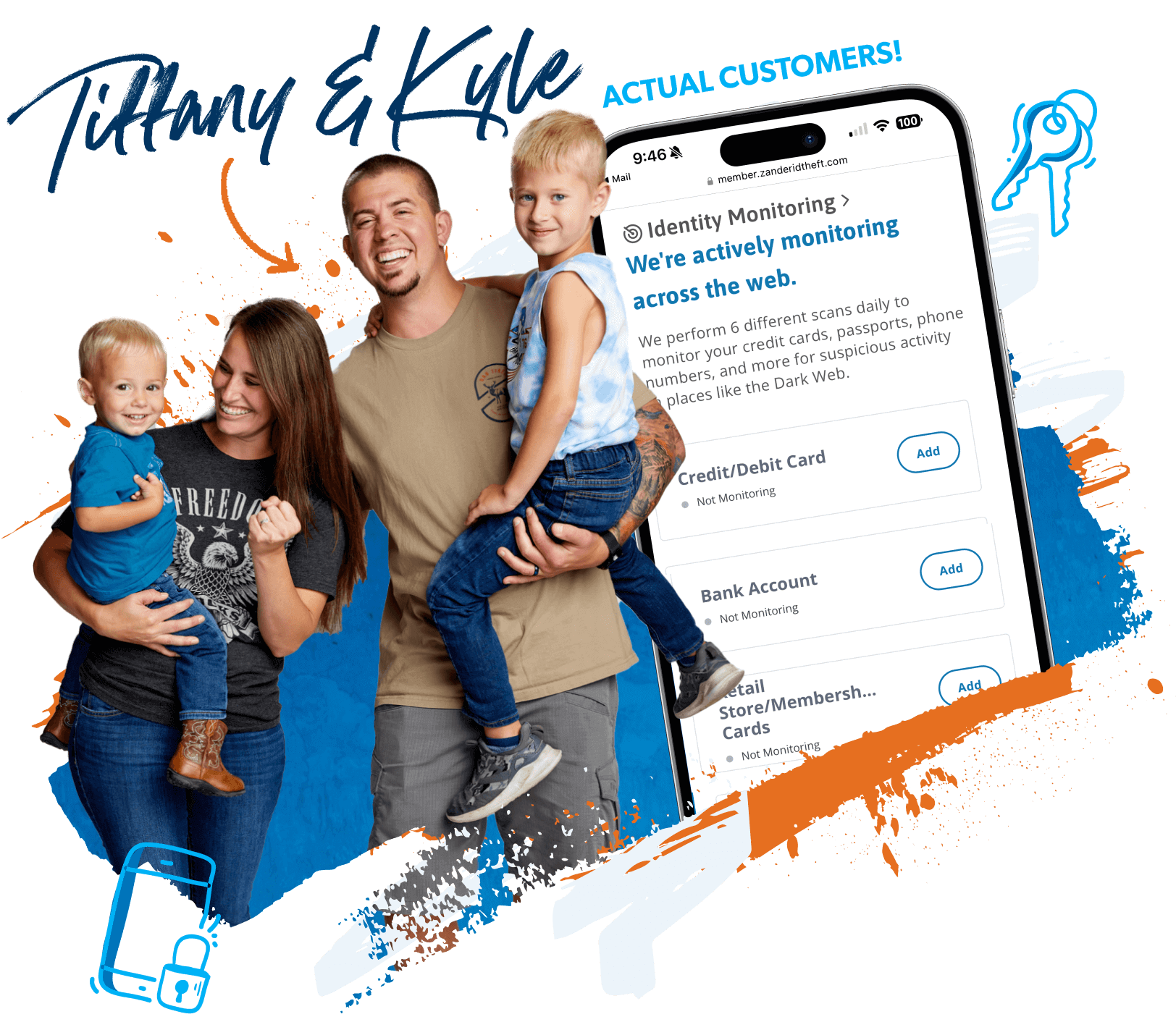

Our RamseyTrusted® Provider Has Your Back!

With Zander, even if the worst does happen, they won’t leave you hanging. They’ll stay with you every step of the way—and that’s why identity theft protection is worth having.

Recovery Work for Every Type of Identity Theft

If your identity gets stolen, they’ll clean up the mess—so you can get back to normal.

Instant Alerts and Real-Time Identity Monitoring

If your personal info starts popping up where it shouldn’t, they’ll let you know immediately.

Reimbursement of Expenses and Stolen Funds

They’ll reimburse money lost from identity theft, up to $1 million for individual plans and up to $2 million for family plans.

Choose Your Plan

Check out Zander’s Summary of Benefits, Reimbursement Benefits and Terms and Conditions for the full story of what they can do for you.

ID Theft Protection is not an insurance product. It is an administrative service that provides identity recovery, reimbursement, monitoring and alert services.

Zander Insurance Is RamseyTrusted

That’s right—RamseyTrusted. And it’s a big deal. It means they’re the only company we recommend for identity theft protection. Zander has faithfully served our fans for over two decades and will do whatever it takes to help you win. They offer all the coverage you need and nothing you don’t. Seriously, we’d send our moms to them (and most of us have).

What's your risk of identity theft?

Take this quiz to assess your risk.

Think You’re Playing It Safe Online? Let’s Find Out.

Our free Identity Theft Risk Assessment Tool gives you a quick, personalized look at how secure your habits really are—and what steps you can take to tighten things up.

It’s fast and simple—and it puts you in control of your information. Peace of mind starts here.

Common Schemes to Be on the Lookout For

Fraud is more common than you think—and it’s not just about shady emails from foreign princes. From imposter scams and tax refund fraud to job cons and elder scams, crooks are getting smarter and bolder.

The best defense? Learning how to spot the red flags and protect your hard-earned money.

What You Need to Know About Data Breaches

Data breaches happen a lot and don’t always happen the way you’d expect. The good news? You don’t need to be a tech expert to stay safe.

A few smart habits—like updating passwords and staying alert online—can go a long way. Stay informed and take action to keep your personal information safe.

DATA BREACH NEWS

What’s Going On?

According to Cybernews, cybersecurity experts just uncovered a massive data dump of up to 16 billion stolen credentials—we’re talking usernames, passwords and even session cookies. This wasn’t from one big company getting hacked. Instead, it came from computers infected by sneaky malware called “infostealers.” These little monsters quietly collect your logins while you go about your day, and now cybercriminals have bundled all that stolen info into massive files that were briefly exposed online. This isn’t some recycled leak from years ago—it’s fresh, dangerous and ready for bad guys to use.

What Should You Do?

If you’ve ever reused passwords or skipped two-factor authentication, now’s the time to get serious. Change your passwords (especially on your bank, email and social accounts), set up multi-factor authentication, and consider using a password manager. Better yet, lock arms with a solid identity theft protection plan that includes monitoring, alerts and expert recovery if something ever goes sideways. Because in a world full of digital threats, protection isn’t optional—it’s essential.

Zander Identity Theft Solutions

Terms and Conditions

YOU UNDERSTAND THAT BY ACCEPTING THESE TERMS AND CONDITIONS YOU ARE PROVIDING "WRITTEN INSTRUCTIONS" TO ZANDER IDENTITY THEFT SOLUTIONS ("We" or "Us") AND ITS, EMPLOYEES, AGENTS, SUBSIDIARIES, AFFILIATES, CONTRACTORS, THIRD PARTY DATA PROVIDERS, AND ALL NATIONAL CREDIT REPORTING AGENCIES UNDER THE FAIR CREDIT REPORTING ACT (FCRA), AS AMENDED, INCLUDING, WITHOUT LIMITATION, EXPERIAN, TRANSUNION, EQUIFAX AND AFFILIATED ENTITIES, TO ACCESS YOUR CREDIT FILES FROM EACH NATIONAL CREDIT REPORTING AGENCY AND TO EXCHANGE INFORMATION ABOUT YOU WITH EACH SUCH NATIONAL CREDIT REPORTING AGENCY IN ORDER TO VERIFY YOUR IDENTITY AND TO PROVIDE THE SERVICES TO YOU.

1. Terms Of Use

Your use of this service confirms that you have accepted these terms in their entirety. If you do not agree with these terms in their entirety, please terminate the service. These Terms and Conditions (this "Agreement" or "Terms and Conditions") identify what you can expect from Zander Identity Theft Solutions and what We expect from you. These Terms and Conditions apply to your purchase of any identity theft products and/or services offered or provided by Zander Insurance Group and govern the relationship between Us and you, even if you have agreed to other or conflicting terms and conditions of third parties associated with this business relationship or the provision of such services and/or products.

2. Introduction

Please read the following information carefully before using any of the products or services (the "Services") provided by this website (this "Site"). By accessing or using any of the Services, you acknowledge that you have read, understood, and agree to these Terms and Conditions and to follow all applicable laws and regulations. Please check the Terms and Conditions each time you visit this Site as these Terms and Conditions may be changed by Us from time to time, and you agree to abide by any such changes.

3. Privacy and Information Sharing

Since it affects your use of the Services, please review our Privacy Policy and Zander Insurance Group Website Terms of Use ("Website Terms of Use"). We collect, use and disclose information about you as provided in our Privacy Policy. We will share your personal information with third parties only in the ways that are described in this Privacy Policy. Our Privacy Policy and Website Terms of Use are located on the Site and are incorporated into this Agreement, and you agree to the terms of the Privacy Policy as a condition to your acceptance of this Agreement.

You agree and authorize Zander Identity Theft Solutions, its agents and employees, to provide your personally identifiable information (or information about your child that you have enrolled) to third parties from time to time as provided in our Privacy Policy. You further authorize Zander Identity Theft Solutions, its agents and employees to obtain various information and reports about you (or about your child that you have enrolled) in order to perform the Services, including, but not limited to, address history reports, name and alias reports, criminal reports, and all other relevant reports.

In order for Us to provide you with our identity protection service and for the prevention and detection of fraud, We will share your personal information with third parties who perform services on our behalf. Depending on the service you have requested, We may share your name, email address, national identifier or social security number (as applicable). We will also share your billing information with a credit card processing company in order to bill you for goods and services. These companies are authorized to use your personal information only as necessary to provide these Services to you.

4. Disclaimer of Warranties and Limitation of Liability

A. UNLESS OTHERWISE EXPLICITLY STATED, ZANDER IDENTITY THEFT SOLUTIONS, FOR ITSELF AND ITS LICENSORS, MAKES NO EXPRESS, IMPLIED OR STATUTORY REPRESENTATIONS, WARRANTIES, OR GUARANTEES IN CONNECTION WITH THE SERVICES, RELATING TO THE QUALITY, SUITABILITY, TRUTH, ACCURACY OR COMPLETENESS OF ANY INFORMATION OR MATERIAL CONTAINED OR PRESENTED IN THE SERVICES. UNLESS OTHERWISE EXPLICITLY STATED, TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, THE SERVICES, AND ANY INFORMATION OR MATERIAL CONTAINED OR PRESENTED THROUGH THE SERVICES IS PROVIDED TO YOU ON AN "AS IS," "AS AVAILABLE" AND "WHERE-IS" BASIS WITH NO WARRANTY OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, OR NON-INFRINGEMENT OF THIRD-PARTY RIGHTS. ZANDER IDENTITY THEFT SOLUTIONS DOES NOT PROVIDE ANY WARRANTIES AGAINST VIRUSES, SPYWARE OR MALWARE THAT MAY BE INSTALLED ON YOUR COMPUTER.

B. NOTHING IN THESE TERMS AND CONDITIONS, INCLUDING SECTIONS 4 AND 5, SHALL EXCLUDE OR LIMIT OUR WARRANTY OR LIABILITY FOR LOSSES WHICH MAY NOT BE LAWFULLY EXCLUDED OR LIMITED BY APPLICABLE LAW. SOME JURISDICTIONS DO NOT ALLOW THE EXCLUSION OF CERTAIN WARRANTIES OR CONDITIONS OR THE LIMITATION OR EXCLUSION OF LIABILITY FOR LOSS OR DAMAGE CAUSED BY NEGLIGENCE, BREACH OF CONTRACT OR BREACH OF IMPLIED TERMS, OR INCIDENTAL OR CONSEQUENTIAL DAMAGES. ACCORDINGLY, ONLY THE LIMITATIONS WHICH ARE LAWFUL IN YOUR JURISDICTION WILL APPLY TO YOU AND OUR LIABILITY WILL BE LIMITED TO THE MAXIMUM EXTENT PERMITTED BY LAW.

C. We are not a credit repair organization, or similarly regulated organization under other applicable laws, and do not provide credit repair advice.

D. If you use the SSN Trace services (Social Security Number Monitoring), you represent and warrant to Us that you will use such services (or any of the information therein) to protect against or prevent actual fraud, unauthorized transactions, claims or other liabilities, and not for any other purpose.

5. Limitation of Liability

A. SUBJECT TO SECTION 4 ABOVE, YOU EXPRESSLY UNDERSTAND AND AGREE THAT WE AND OUR SUBSIDIARIES, AFFILIATES, AGENTS, CONTRACTORS AND OUR THIRD PARTY DATA AND SERVICE PROVIDERS SHALL NOT BE LIABLE TO YOU FOR:

(i) ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL, CONSEQUENTIAL OR EXEMPLARY DAMAGES WHICH MAY BE INCURRED BY YOU, HOWEVER CAUSED AND UNDER ANY THEORY OF LIABILITY. THIS SHALL INCLUDE, BUT NOT BE LIMITED TO, ANY LOSS OF PROFIT (WHETHER INCURRED DIRECTLY OR INDIRECTLY), ANY LOSS OF GOODWILL OR BUSINESS REPUTATION, ANY LOSS OF DATA SUFFERED, COST OF PROCUREMENT OF SUBSTITUTE GOODS OR SERVICES, OR OTHER INTANGIBLE LOSS; OR

(ii) ANY LOSS OR DAMAGE WHICH MAY BE INCURRED BY YOU, INCLUDING BUT NOT LIMITED TO LOSS OR DAMAGE AS A RESULT OF:

- ANY RELIANCE PLACED BY YOU ON THE COMPLETENESS, ACCURACY OR EXISTENCE OF ANY ADVERTISING, OR AS A RESULT OF ANY RELATIONSHIP OR TRANSACTION BETWEEN YOU AND ANY ADVERTISER OR SPONSOR WHOSE ADVERTISING APPEARS ON THE SERVICES OR SITE;

- ANY CHANGES WHICH WE MAY MAKE TO THE SERVICES, OR FOR ANY PERMANENT OR TEMPORARY CESSATION IN THE PROVISION OF THE SERVICES (OR ANY FEATURES WITHIN THE SERVICES);

- THE DELETION OF, CORRUPTION OF, OR FAILURE TO STORE, ANY CONTENT AND OTHER COMMUNICATIONS DATA MAINTAINED OR TRANSMITTED BY OR THROUGH YOUR USE OF THE SERVICES;

- YOUR FAILURE TO PROVIDE US WITH ACCURATE ACCOUNT INFORMATION; OR

- YOUR FAILURE TO KEEP YOUR PASSWORD OR ACCOUNT DETAILS SECURE AND CONFIDENTIAL.

B. THE LIMITATIONS ON OUR LIABILITY TO YOU IN SECTION 4 ABOVE OR THIS SECTION 5 SHALL APPLY WHETHER OR NOT WE HAVE BEEN ADVISED OF OR SHOULD HAVE BEEN AWARE OF THE POSSIBILITY OF ANY SUCH LOSSES ARISING.

6. Payment and Billing

You agree that you will make any required payments to Us on a timely basis on a monthly or annual basis (as determined by you when you enroll). You authorize Us to bill your credit card or other account that you have designated, unless you tell Us in advance to cancel your order. In the case of direct payment, you authorize Us to: (1) charge your credit card, (2) automatically charge your credit card on a monthly or annual basis for your recurring monthly or annual renewals, as the case may be, and (3) obtain automatic updates for any expiring credit cards you have provided Zander Identity Theft Solutions. Monthly or annual fees and renewal fees will be billed at the rate agreed to upon purchase. At cancellation, your Zander Identity Theft account will be de-activated and you will no longer be able to log into our Site and/or have any access to the Services. Except in the case of annual subscription commitments you have agreed to, which shall be nonrefundable, as permitted by law, if you cancel, you agree that fees for the first month of Service and any start-up costs associated with setting up your account ("Start-up Costs") shall be nonrefundable, as permitted by law. With the exception of any subscription commitments agreed by you, if you paid fees in advance for any period longer than one month, then you may, with the exception of fees for the first month of Service and any Start-up Costs, obtain a refund on a pro rata basis for the period remaining after you cancel.

7. Unsolicited Idea Submission Policy

When you provide Us with comments, suggestions, or ideas (collectively, "Feedback"), such Feedback is not considered confidential and becomes the property of Zander Identity Theft Solutions. We are free to use, copy, or distribute the Feedback to others for any purpose.

8. International Use

Because you can access this Site and use the Services internationally, you agree to follow all local rules about the Internet, data, e-mail, and privacy. Specifically, you agree to follow all laws that apply to transmitting technical data exported from the United States or the country of your residence.

9. Fair Credit Reporting Act

The Fair Credit Reporting Act allows you to obtain from each credit reporting agency a disclosure of all the information in your credit file at the time of the request. Full disclosure of information in your file at a credit reporting agency must be obtained directly from such credit reporting agency. The credit reports provided or requested through our Site are not intended to constitute the disclosure of information by a credit reporting agency as required by the Fair Credit Reporting Act or similar laws.

Under the Fair Credit Reporting Act you are entitled to receive an annual free disclosure of your credit report from each of the national credit reporting agencies. To request your free annual report under the FCRA, you must go to www.annualcreditreport.com. You can also contact the central source to request this free annual disclosure by calling toll free (877) 322-8228 or by using the mail request form available at the central source website.

You are entitled to receive a free copy of your credit report from a credit reporting agency if:

- You have been denied or were otherwise notified of an adverse action related to credit, insurance, employment, or a government granted license or other government granted benefit within the past sixty (60) days based on information in a credit report provided by such agency.

- You have been denied house/apartment rental or were required to pay a higher deposit than usually required within the past sixty (60) days based on information in a credit report provided by such agency.

- You certify in writing that you are unemployed and intend to apply for employment during the sixty (60) day period beginning on the date on which you made such certification.

- You certify in writing that you are a recipient of public welfare assistance.

- You certify in writing that you have reason to believe that your file at such credit reporting agency contains inaccurate information due to fraud.

10. Applicable Law

We perform the Services through Zander Insurance headquarters located in the State of Tennessee. This Agreement shall be governed, interpreted, and enforced according to the laws of the State of Tennessee, regardless of Tennessee conflict of laws. Subject to Section 11 below (which provides for arbitration of claims between Us to the maximum extent possible), you irrevocably and unconditionally consent and submit to the exclusive jurisdiction of the federal and state courts located in Davidson County, Tennessee for any dispute or litigation arising out of, relating to, or the use or purchase of Services from Us.

11. Arbitration

Notwithstanding any other agreement to arbitrate or other agreement between you and any third party associated with this relationship or the provision of the Services, both We and you agree that any dispute, controversy or claim arising out of, or relating to this Agreement or the relationship contemplated hereby, or any interpretation, construction performance or breach of this Agreement or the Services provided by Us shall be settled by confidential arbitration, in accordance with the American Arbitration Association's ("AAA") Commercial Arbitration Rules (including without limitation the Supplementary Procedures for Consumer Related Disputes) as then in effect. The arbitrator may grant injunctions or other relief in such dispute or controversy. The decision of the arbitrator will be final, conclusive and binding on all the parties to the arbitration. Judgment may be rendered on the arbitrator's decision in any state or federal court. Although the cost of the filing fee for the arbitration will be borne equally by you and Us, all other expenses of the arbitration will be paid by the party who incurred them, other than as set forth in Section 12 below.

12. Indemnification

YOU AGREE TO INDEMNIFY, DEFEND AND HOLD HARMLESS US, OUR OFFICERS, DIRECTORS, EMPLOYEES, AGENTS, LICENSORS, SUBSIDIARIES, AFFILIATES, CONTRACTORS, SUPPLIERS AND ANY THIRD PARTY PROVIDERS OF INFORMATION OR SERVICES TO THE SITE FROM AND AGAINST ALL LOSSES, EXPENSES, DAMAGES AND COSTS, INCLUDING REASONABLE ATTORNEYS' FEES, RESULTING FROM ANY VIOLATION OF THESE TERMS AND CONDITIONS OR YOUR VIOLATION OF APPLICABLE LAWS, RULES OR REGULATIONS. IN THE EVENT THAT WE ARE SUBJECT TO ANY CLAIM FOR WHICH WE HAVE THE RIGHT TO BE INDEMNIFIED BY YOU, WE WILL HAVE THE RIGHT TO, AT YOUR EXPENSE, ASSUME THE EXCLUSIVE DEFENSE AND CONTROL OF ANY SUCH CLAIM, AND YOU WILL NOT IN ANY EVENT SETTLE ANY CLAIM WITHOUT OUR PRIOR WRITTEN CONSENT.

13. Your Passwords and Account Security

You agree and understand that you are responsible for maintaining the confidentiality of passwords associated with any account you use to access the Services. Accordingly, you agree that you will be solely responsible to Us for all activities that occur under your account. If you become aware of any unauthorized use of your password or of your account, you agree to notify Us immediately.

14. Termination of Relationship

A. These Terms and Conditions will continue to apply until terminated by either you or Us as set out below.

B. If you want to terminate your legal agreement with Us, you may do so, with or without cause, by (a) notifying Us at any time and (b) closing your accounts for all of the Services which you use, where We have made this option available to you. Please contact Us to close your account.

C. We may at any time terminate our legal agreement with you with or without cause (and for any or no reason). We may also terminate our legal agreement with you if, among other reasons:

(i) You have breached any provision of the Terms and Conditions (or have acted in manner which clearly shows that you do not intend to, or are unable to comply with the provisions of the Terms and Conditions);

(ii) We are required to do so by law (for example, where the provision of the Services to you is, or becomes, unlawful); or

(iii) The provision of the Services to you by Us is, in our opinion, no longer commercially viable.

D. If We terminate your Service without cause We will refund to you a pro rata portion of any fees already paid directly to Us for the Services that have yet to be provided. If this Agreement has not been terminated, it shall continue indefinitely, and you shall pay the corresponding fees for the Services. When this Agreement terminates, all of the legal rights, obligations and liabilities that you and We have benefited from, been subject to (or which have accrued over time while the Agreement has been in force) or which are expressed to continue indefinitely, shall be unaffected by this termination and/or cessation, and the provisions of Sections 4, 5, 6, 7 and 10-15, inclusive, shall continue to apply to such rights, obligations and liabilities indefinitely.

15. Miscellaneous

A. No waiver of any breach of any provision of these Terms and Conditions or of any agreement with Us will constitute a waiver of any prior, concurrent, or subsequent breach of the same or other provisions. All waivers must be in writing. If any court of competent jurisdiction finds any part or provision of these Terms and Conditions or of any other agreement between you and Us to be invalid or unenforceable, such findings will have no effect on any other part or provision of these Terms and Conditions or any other agreement between you and Us.

B. We are not responsible for delay or failure to perform due to causes beyond our reasonable control.

C. These Terms and Conditions, together with all documents incorporated herein by reference, including but not limited to, our Privacy Policy and the Website Terms of Use, constitute the whole legal agreement between you and Us and govern your use of the Services (but excluding any services which We may provide to you under a separate written agreement), and completely replace any prior agreements between you and Us in relation to the Services.

D. You may not use, frame or utilize framing techniques to enclose any Zander Insurance Group trademark, logo or other proprietary information, including the images found at the Site, the content of any text or the layout/design of any page or form contained on a page without Zander Insurance Group's express written consent. Except as noted above, you are not conveyed any right or license by implication, estoppel, or otherwise in or under any patent, trademark, copyright, or proprietary right of Zander Insurance Group or any third party.

E. The Site contains many of the valuable trademarks, service marks, names, titles, logos, images, designs, copyrights and other proprietary materials owned, registered and used by Us and our subsidiaries, including but not limited to, the marks "Zander Identity Theft," "CyberAgent" (Personal Information Monitoring), "Protector," and others. Zander Identity Theft Solutions and the Zander Identity Theft Solutions product names referenced in the Site are either trademarks, service marks or registered trademarks of Zander Identity Theft Solutions or third party service providers. Any unauthorized use of same is strictly prohibited and all rights in same are reserved by Us. No use of any Zander Insurance Group trademark may be made by any third party without express written consent of Zander Insurance Group. Other products and company names mentioned in the Site may be the trademarks of their respective owners.

F. No part of the Site may be reproduced, modified, or distributed in any form or manner without our prior written permission.

G. The images, text, screens, web pages, materials, data, content and other information ("Content") used and displayed on the Site are our property or the property of our third party service providers or suppliers and are protected by copyright, trademark and other laws. In addition to our rights in individual elements of the Content within the Site, Zander Insurance Group owns copyright or patent rights in the selection, coordination, arrangement and enhancement of such Content. You may copy the Content from the Site for your personal or educational use only, provided that each copy includes any copyright, trademark or service mark notice or attribution as they appear on the pages copied. Except as provided in the preceding sentence, none of the Content may be copied, displayed, distributed, downloaded, licensed, modified, published, reposted, reproduced, reused, sold, transmitted, used to create a derivative work or otherwise used for public or commercial purposes without the express written permission of Zander Insurance Group or the owner of the Content.

H. Except as otherwise provided, We may send any notices to you to the most recent e-mail address you have provided to Us or, if you have not provided an e-mail address, to any e-mail or postal address that We believe is your address. If you wish to update your registration information, please log in to your account and update your information.

Effective Date: September 22, 2017

Copyright 2015 Zander Insurance Group® All rights reserved.

Zander Identity Theft Solutions

Reimbursement Benefits

INSURING AGREEMENT

We will provide the insurance described in this Policy to Subscribers in return for:

- the payment of premium; and

- compliance with all applicable provisions of this Policy.

Various provisions in this Policy restrict coverage. Read the entire Policy carefully to determine rights, duties and what is and is not covered.

The Occurrence Date must be during the term of the Program and the policy period.

We will pay up to the limit of insurance shown on the Declarations Page if the cause of Loss is shown as applicable on the Declarations Page.

COVERAGE

Identity Fraud - Expense Reimbursement

If a limit for Identity Fraud – Expense Reimbursement is listed on the Declarations Page, we will reimburse the Subscriber for Expenses and Legal Costs incurred by the Subscriber, less any deductibles set forth on the Declarations Page or Certificate of Insurance, as the direct result of the following:

- Fraud or Embezzlement For Loss arising out of Fraud or Embezzlement perpetrated against the Subscriber, during the term of the Program.

- Theft For Loss resulting directly from Theft of property related to the Subscriber’s information, checkbook, savings record, ATM access or securities from the Subscriber, during the term of the Program.

- Forgery For Loss resulting directly from forgery or alteration of checks, drafts, promissory notes, or similar written promises, orders or directions to pay money that are:

- made or drawn by or drawn upon the subscriber’s account; or

- made or drawn by one purporting to act as the subscriber’s agent.

- Data Breach For Loss resulting directly from the misuse of Subscriber’s information as a result of a data compromise of information from a financial institution, a credit reporting agency, a credit granter or a securities firm that results in monies stolen from the Subscriber’s accounts or misuse of data to obtain property, credit or monies using the Subscriber’s information.

- Stolen Identity Event For Loss resulting from a Stolen Identity Event.

Unauthorized Electronic Fund Transfer Reimbursement

If a limit for Unauthorized Electronic Funds Transfer Reimbursement is listed on the Declarations Page, we will reimburse the Subscriber for a Stolen Funds Loss incurred by the Subscriber, less any deductibles set forth on the Declarations Page, as the direct result of an Unauthorized Electronic Fund Transfer .

DEFINITIONS

We, Us, and Our means Interstate Fire & Casualty Company.

Access Device means a card (including credit, debit and ATM cards), code, PIN, password, personal check or other similar means of access to the Subscriber’s account at a financial institution for the purpose of withdrawing or transferring funds, making purchases, or making long distance or cellular/digital (wireless) telephone calls.

Date of Discovery occurs when the Subscriber first becomes aware of facts which would cause a reasonable person to assume that a Loss covered by this insurance has been or will be incurred, even though the exact amount or details of Loss may not then be known. Discovery also occurs when the Subscriber receives notice of an actual or potential claim against the Subscriber involving Loss covered under this insurance.

Expenses mean:

- Costs incurred by the Subscriber for refiling applications for loans, grants, or other credit that are rejected solely because the lender received from any source incorrect information as a result of the Identity Fraud;

- Costs for notarizing affidavits or other similar documents, long distance telephone calls, travel and postage reasonably incurred as a result of the Subscriber’s efforts to report an Identity Fraud or amend or rectify records as to the Subscriber’s true name or identity as a result of an Identity Fraud;

- Costs for contesting the accuracy or completeness of any information contained in a credit report f o l l o w i n g an Identity Fraud;

- Payment for reasonable expenses incurred that were a result of recovery from an Identity Fraud such as; credit freeze, credit thaw costs, transcript costs, appeal bond, court filing fees, expert witness or courier fees;

- Actual lost base wages that would have been earned, for time reasonably and necessarily taken off work solely as a result of efforts to amend or rectify records as to the Subscriber’s identity as a result of an Identity Fraud. Actual lost wages includes remuneration for vacation days, discretionary days, floating holidays, and paid personal days but not for sick days or any cost arising from time taken from self-employment. Coverage is limited to base wages within 12 months after discovery of an Identity Fraud.

- Child or elderly care costs that would have otherwise not been incurred, resulting from time reasonably and necessarily taken away from providing such care as a result of efforts to amend or rectify records as to the Subscriber’s identity as a result of an Identity Fraud .

Family Member means the spouse, parent, siblings, children, relations by marriage and/ or any other member of, or persons residing in the Subscriber’s household.

Forgery means the signing of the name of another person or organization as the maker, drawer, issuer or endorser of a check, draft, promissory note, letter of credit, withdrawal order or other written unconditional promise or order to pay on demand a sum certain, without the authorization of that person or organization and with the intent to deceive. Forgery does not mean a signature which consists in whole or in part of one’s own name signed with or without authority, in any capacity, for any purpose.

Fraud or Embezzlement means:

- An electronic, telegraphic, cable, teletype, telefacsimile or telephone instruction which purports to have been transmitted by the Subscriber, but which was in fact fraudulently transmitted by someone else without the Subscriber’s knowledge or consent; or

- A written instruction issued by the Subscriber, which was altered by someone other than the Subscriber, or purported to be issued by the Subscriber but was forged or fraudulently issued without the Subscriber’s knowledge or consent; or

- An electronic, telegraphic, cable, teletype, telefacsimile, telephone or written instruction initially received by the Subscriber which purports to have been transmitted by an employee but which was in fact fraudulently transmitted by someone else without the Subscriber’s or the employee's knowledge or consent

Identity Fraud means the act of knowingly transferring or using, without lawful authority, a means of identification of the Subscriber with the intent to commit, or to aid or abet, any unlawful activity that constitutes a violation of Federal, State or local law.

Loss means the expenses and Legal Costs incurred by the Subscriber.

Legal Costs means the costs for reasonable fees for an attorney with either prior approval by us or costs, up to $125 per hour, for an attorney selected by the Subscriber and related court fees, incurred by the Subscriber, for:

- Defense of any legal action brought against the Subscriber by a merchant, creditor or collection agency or entity acting on their behalf for non-payment of goods or services or default on a loan as a result of the Identity Fraud;

- Defense of or the removal of any criminal or civil judgments wrongly entered against the Subscriber as a result of Identity Fraud; and

- Challenging the accuracy or completeness of any information in a consumer credit report.

Occurrence Date means the earliest possible Date of Discovery of an incident of an actual or attempted fraudulent, dishonest or criminal act or series of related acts, whether committed by one or more persons.

Policyholder means the entity identified on the Declarations Page of this Policy.

Program means the offerings provided and issued by the Policyholder or Policyholder’s customer to the Subscribers.

Proof of Loss means receipts for reasonable out of pocket expenses.

Stolen Funds Loss means the monetary Loss arising out of an unauthorized electronic transfer of funds, exclusive of interest and fees, incurred by the Subscriber. It does not include

- any amount of which the Subscriber did not seek, or receive, reimbursement from the financial institution which issued the Access Device and holds the account from which funds were stolen, or

- any amount for which the Subscriber received reimbursement from any source.

Stolen Identity Event means the theft, unauthorized, or illegal use of the Subscriber’s credentials, passwords, credit or debit cards, bank accounts, name, address, social security number, driver’s license number, medical identification number, or other method of identifying the Subscriber.

Subscriber means the natural person on record with the Policyholder as an eligible participant in a Program of the Policyholder, and includes all eligible Family Members.

Unauthorized Electronic Funds Transfer means: Any transfer of funds that are initiated through an electronic terminal, telephone, computer, or magnetic tape for the purpose of ordering, instructing, or authorizing a financial institution to debit or credit an Subscriber’s account. Unauthorized Electronic Fund Transfer includes, but is not limited to, (i) point-of-sale transfers; (ii) automated teller machine transfers; (iii) direct deposits or withdrawals of funds; (iv) transfers initiated by phone; (v) transfers resulting from debit card transactions, whether or not initiated through an electronic terminal.

EXCLUSIONS

This policy does not cover:

- Loss due to any fraudulent, dishonest or criminal act by the Subscriber or any person acting in concert with the Subscriber, or immediate Family Member, whether acting alone or in collusion with others;

- Loss resulting directly or indirectly from any errors or omissions occurring in the following actions:

- the input of data to any computer system; or

- the processing of data bv any computer system; or

- the manual or electronic processing of any output produced by any computer system;

- Loss resulting directly or indirectly from the voluntary entrusting by the Subscriber of any Access Device, in whole or in part, to any person or entity;

- Loss resulting from any unintentional clerical error in the transfer from or debit of any account of the Subscriber which is initiated by a financial institution, or any employee(s) thereof. However, this exclusion shall not apply to a fraudulent act of an employee(s) of a financial institution where said employee(s) is acting without the permission or instruction of their employer;

- Loss in connection with any preauthorized transfer from any account, or to any other account of the Subscriber;

- indirect or consequential Loss of any nature;

- Loss of potential income not realized by the Subscriber;

- Loss other than expenses except under Stolen Funds Loss coverage;

- Loss arising out of business pursuits of the Subscriber;

- loss of valuable papers, valuable documents, jewelry, silverware and other personal property including the philatelic value of stamps and the numismatic value of coins not in circulation;

- property damage, bodily injury or personal injury;

- losses incurred from financial performance of any investment of financial product;

- loss from games of chance;

- as to Coverage, under Identity Fraud - Expense Reimbursement, items A - E, the recovery of actual financial losses of any kind from acts of Fraud or Identity Theft;

- any Loss, claims or damages that are not covered under the terms and provisions of this Policy;

- for legal fees in excess of $125 per hour unless preapproved by us;

- any Loss which occurred while the Subscriber was not part of the Program.

CONDITIONS

- Limits of Insurance - Our maximum limit of liability for Loss under this Policy shall not exceed the applicable limit stated on the Declarations Page.

All Loss incidental to an actual or attempted fraudulent, dishonest or criminal act or series of related acts, whether committed by one or more persons, shall be deemed to arise out of one occurrence.

Our total aggregate limit of liability shown on the Declarations Page will be the maximum amount we will pay for all covered Losses per Subscriber regardless of the number of Losses that occur for any one Subscriber during the term of the Program. - Loss Payment

We will pay any Loss covered under this Policy within thirty (30) days after:- We reach agreement with the Subscriber; or

- We receive acceptable Proof of Loss, or

- The entry of final judgment.

- Notice of Claim must be given to us by the Subscriber:

- in writing; and

- within a reasonable time period after the Date of Discovery.

- Duties When Loss Occurs – Upon knowledge or discovery of Loss which may give rise to a claim under the terms of this Policy, the insured is responsible for notifying the Subscriber of the following requirements:

- Give notice as soon as practicable to: (1) the appropriate authority and affected institution s, if applicable; and (2) us or any of our authorized agents; If the Loss involves a violation of law, the Subscriber shall also notify the police. The Subscriber must submit a copy of the police report when filing a claim;

- Filed detailed Proof of Loss with us as soon as practicable, but no later than ninety (90) days after agreement is reached with the Subscriber

- Upon our request, submit to examination by us, and subscribe the same, under oath if required;

- Upon our request, cooperate to help us enforce legal rights against anyone who may be liable to the Subscriber to include giving evidence and attending depositions, hearing and trials;

- Produce for our examination all pertinent records;

- Cooperate with us in all matters pertaining to Loss or claims;

- For Stolen Funds Loss reimbursement, the Subscriber must authorize the financial institution to provide certified documentation directly to us, signed by an authorized financial institution representative. This documentation must indicate that funds were fraudulently removed, the amount of the Loss, the type of the Loss suffered, and confirmation that funds are nonrecoverable from the financial institution; and

- Transfer of Rights of Recovery Against Others to us - If any person or organization to or for whom we make payment under this insurance has rights to recover damages from another, those rights are transferred to us. That person or organization must do everything necessary to secure our rights and must do nothing to impair them. Assignment - This Policy may not be assigned to another person without our written consent. We will have no liability under this Policy in the case of assignment without such written consent.

- Other Insurance - This insurance is excess of any other valid and collectible insurance or reimbursement available to the Subscriber.

- Action Against Us - No action may be brought against us unless there has been full compliance with all of the terms and conditions of this Policy and suit is filed within twenty-four (24) months from the date of Occurrence. No one will have the right to join us as a party to any against the Policyholder or Subscriber.

- Cancellation of Policy - This Policy may be cancelled by the Policyholder for any reason upon thirty (30) days written notice to us.

If we cancel, the return premium will be computed pro rata. If the Policyholder requests cancellation, the return premium will be computed pro rata.

We may cancel this Policy by mailing to the Policyholder, at the mailing address shown in the policy, written notice at least sixty (60) days, or thirty (30) days based upon non-payment of premium, before the date cancellation takes effect. The written notice will state the reason for cancellation.

When this Policy has been in effect for sixty (60) days or more, we may cancel for one or more of the following reasons:

- nonpayment of premium;

- conviction of a crime arising out of acts increasing the hazard insured against;

- discovery of fraud or material misrepresentation in the obtaining of the Pol ic y or in the presentat ion of a

- laim number

- fraud;

- failure to comply with loss control recommendations;

We may elect not to renew this Policy. We may do so by delivering to the Policyholder at their address shown in the Declarations, written notice at least sixty (60) days before the anniversary date of this Policy which is written for an indefinite term. The written notice will state the reason for Nonrenewal. Proof of mailing will be sufficient proof of notice.

All coverage under this policy will terminate at the same time as the Policy.

All notices of cancellation and nonrenewal will contain the specific reason for cancelation and nonrenewal. - Concealment or Misrepresentation - This Policy is void as to any Subscriber if, at any time, said Subscriber has:

- intentionally concealed or misrepresented a material fact or circumstance;

- engaged in fraudulent conduct; or

- made false statements; relating to this Policy.

- We shall not be liable to any Subscriber for Loss suffered as a result of action or inaction by the Policyholder, including such action or inaction as may result in voidance of coverage.

- Choice of Law – Any dispute arising under the policy, or with respect to the application of or interpretation of this policy, shall be governed by the laws of the state of Texas.

- Appraisal – In the case the Subscriber and we shall fail to agree as to the actual cash value or the amount of Loss, then, on the written demand of either, each shall select a competent and disinterested appraiser and notify the other of the appraiser selected within twenty days of such demand. The appraisers shall first select a competent and disinterested umpire; and failing for fifteen (15) days to agree upon such umpire, then on request the Subscriber or us, such umpire shall be selected by a judge of a court of record in the state in which the property covered is located. The appraisers shall then appraise the Loss, stating separately actual cash value and Loss to each item; and failing to agree, such submit their differences, only, to the umpire. An award in writing, so itemized, of any two when filed with us shall determine the amount of actual cash value and Loss. Each appraiser shall be paid by the party selecting him and the expenses of appraisal and umpire shall be paid by the parties equally.

- Currency – All premiums, limits, retentions, Loss and other amounts under this policy are expressed and payable in the currency of the United States of America. If Losses are stated or incurred in a currency other than United States of America dollars, payment of covered Loss due under this policy will be made either in such other currency or, in United States of America dollars, at the rate of exchange published in The Wall Street Journal on the date the Insurer’s obligation to pay such Loss is established (or if not published on such date the next publication date of The Wall Street Journal).

WITNESS WHEREOF, we have caused this Policy to be signed by its authorized Company officers and countersigned (where required by law) on the Declarations Page by a duly authorized representative.

Zander Identity Theft Solutions

Benefits Description

Introduction

This Benefits Description (the “Agreement”) contains the terms and conditions of your benefits coverage with Zander Identity Theft Solutions (“Company”). Please read this material carefully. If you have any questions about the Program or your benefits, please contact us.

Dependent Eligibility

If you enrolled in the family plan (or sign up in the future), eligible family members include your spouse or domestic partner. Children up to 18 years of age are eligible for Social Security monitoring, Personal Information monitoring, recovery services, reimbursement and wallet protection. Adult dependents up to the age of 26 are eligible for recovery services, reimbursement and wallet protection only.

When Your Benefits Start

Your benefits begin on the effective date stated in the welcome email/letter.

When Your Benefits End

Your benefits are in effect as long as you are enrolled as a Zander Identity Theft Solutions member and your payment method is valid. Your membership will automatically renew for monthly or annual memberships until you contact Zander Identity Theft Solutions to request termination of this Agreement, or if your payment method is no longer valid.

Description of Benefits

-

DEFINITIONS

(used in this Benefits Description)- "Program" means the Zander Identity Theft Solutions Program of personalized identity theft protection, social security number monitoring, change of address monitoring, recovery services and reimbursement.

- "Identity Theft Event" means the theft of a Participant's personal information, including a Social Security number, email, phone numbers or other identifying information about the Participant, which has or could reasonably result in the wrongful use of such information including, but not limited to, identity theft events occurring on or arising out of the Participant's use of the Internet. The Identity Theft Event shall not include the theft or wrongful use of the Participant's business name, d.b.a., or any other identifying information related to any business activity of the Participant. All losses resulting from the same, continuous, related, or repeated acts shall be treated as arising out of a single Identity Theft Event occurring at the time of the first such Identity Theft Event.

- "We," "us," and "our" mean Zander Identity Theft Solutions.

- "You" and "your" mean a member with benefits coverage under the Program.

- "Allowable expenses" means those incurred by you and fitting the definition of "costs" as set forth in the Personal Internet and Identity Coverage Insurance ("PIIC") issued by Allianz.

- "Participant" means a member or dependent covered by the Program.

-

PROGRAM COVERAGE

The Program includes personalized identity theft protection and recovery services provided by Zander Identity Theft Solutions, together with the PIIC Coverage provided by Allianz. The following is a list of the benefits for which you are eligible

-

Monitoring Services

Personal Information Monitoring - Zander’s Personal Information Monitoring system is designed for proactive detection of your personal information on the internet where cyber thieves buy and sell information.

Change of Address – monitors for requests to re-route mail on behalf of members.

Social Security Trace – detects names and addresses associated with member’s social security number.

*Monitoring services are intended as a tool to help minimize identity theft but do not guarantee to identify all ID theft events that may occur.

-

Identity Theft Recovery Benefits

If you discover that you are a victim of identity theft while enrolled in the Program, we will assign a Recovery Advocate to manage your case and help with the recovery process. They will create a Recovery Plan based on your case. The Recovery Plan will outline the actions that you and the Recovery Team will need to take to complete the recovery process. Your cooperation in completing the Recovery Plan is a condition of the continued involvement of the Recovery Advocate and the Recovery Team.

Recovery Benefits include:

- 24 hour service, 7 days a week, 365 days a year

- Unlimited Recovery Services

- Restore the victims credit file to the pre-theft status

- Notify the three major credit bureaus of fraud and place fraud alerts

- Review the member’s credit report with the member to determine the potential areas of fraud

- Notify the member's affected creditors, government agencies, the IRS, medical institutions, and all other appropriate entities of the identity theft

- Obtain a limited Power of Attorney from member allowing recovery agents to work on the member’s behalf

- Scan all proprietary databases for the misuse of victim’s personal information

Lost Wallet Protection:

- If a member has their wallet stolen or it becomes lost, we will quickly and effectively help terminate and re-order wallet contents. Our Certified Identity Theft Risk Management Specialists will work with the member to cancel and/or reissue all documents that were lost, including debit/credit cards, ID cards, health insurance IDs, social security card and more.

-

Identity Theft Lost Income and Expense Reimbursement

Lost base wages that would have been earned, for time reasonably and necessarily taken off work solely as a result of efforts to amend or rectify records as to the subscriber's identity. Actual lost wages includes remuneration for vacation days, discretionary days, floating holidays, and paid personal days, but not for sick days or any cost arising from time taken from self-employment.

-

Unauthorized Electronic Fund Transfer Reimbursement

Participants who are victims of identity theft will be reimbursed the principal amount, exclusive of interest and fees, incurred by you and caused by an Unauthorized Electronic Fund Transfer. Stolen Funds Loss shall not include any amount for which you did not seek reimbursement from the financial institution which issued the access device and holds the account from which funds were stolen, and stolen funds loss shall not include any amount for which you received reimbursement from any source.

-

Financial Reimbursement Coverage:

Fraud or Embezzlement - Loss arising out of fraud or embezzlement perpetrated against the subscriber, during the term of the program.

Theft - Loss resulting directly from theft of property related to the subscriber's information, checkbook, savings record, ATM access, etc. by a person from whom the subscriber purchased goods or services.

Forgery - Loss resulting directly from forgery or alteration of checks, drafts, promissory notes, or similar written promises drawn upon the subscriber’s account.

Data Breach - Loss resulting directly from the misuse of subscriber's information as a result of a data compromise of information from a financial institution, a credit reporting agency, a credit grantor or a securities firm wherein monies are stolen from the subscriber’s account.

Covered Expenses (as a result of the identity fraud)

- Costs incurred by the subscriber for re-filing applications for loans, grants, or other credit that are rejected solely because the lender received incorrect information.

- Costs for notarizing affidavits, incurring long-distance telephone calls, travel and postage reasonably incurred as a result of the subscriber's efforts to report an identity fraud and/or amend records.

- Costs for contesting the accuracy or completeness of any information contained in a credit report.

- Payment for reasonable expenses incurred that were a result of recovery from an identity fraud such as: credit freeze, credit thaw costs, transcript costs, appeal bond, court filing fees and expert witness fees.

- Lost base wages that would have been earned, for time reasonably and necessarily taken off work solely as a result of efforts to amend or rectify records as to the subscriber's identity. Actual lost wages includes remuneration for vacation days, discretionary days, floating holidays, and paid personal days, but not for sick days or any cost arising from time taken from self-employment.

- Child or elderly care costs that would have otherwise not been incurred, resulting from time reasonably and necessarily taken away from providing such care as a result of efforts to amend or rectify records as to the subscriber's identity.

Covered Legal Costs

Costs for reasonable fees for an attorney with either prior approval by us or costs up to $125.00 per hour for an attorney selected by the Subscriber and related court fees, incurred by the Subscriber for:

- Defense of any legal action brought against the subscriber by a merchant, creditor or collection agency or entity acting on their behalf for non-payment of goods or services or default on a loan.

- Defense of or the removal of any criminal or civil judgments wrongly entered against the subscriber.

- Challenging the accuracy or completeness of any information in a consumer credit report.

-

Identity Theft Reporting Time Limitation

The identity theft event must be reported to us as soon as you become aware of it, but in no event later than 60 days after it is discovered by you.

-

-

PROGRAM COVERAGE EXCLUSIONS

- Loss due to any fraudulent, dishonest or criminal act by the subscriber or any person acting in concert with the subscriber, or immediate family subscriber, whether acting alone or in collusion with others.

- Loss resulting directly or indirectly from errors or omissions occurring in the input of data to any computer system and/or processing of any data within a computer system.

- Loss resulting directly or indirectly from the voluntary surrendering by the subscriber of any access device, in whole or in part, to any person or entity.

- Loss resulting from any unintentional clerical error in the transfer from or debit of any account of the subscriber which is initiated by a financial institution, or any employee(s) thereof.

- Loss in connection with any pre-authorized transfer from any account to or for the benefit of a financial institution, or to any other account of the subscriber.

- Loss arising out of business pursuits of the subscriber.

- Loss of valuable papers, valuable documents, jewelry, silverware and other personal property including the philatelic value of stamps and the numismatic value of coins not in circulation.

- Property damage, bodily injury or personal injury.

- Losses incurred from financial performance of any investment of financial product.

Submitting Your Reimbursement Request and Receiving Payment

If you become a victim of an Identity Theft Event, you should notify us as soon as possible. Keep track of your expenses and time spent during your normal working hours dealing with the recovery process. (You should also get and retain receipts whenever applicable) You will need to submit a Claim Form (which we will provide). We will then submit the claim form to the Claims Department on your behalf. You will receive reimbursement for your allowable expenses and lost income after your case closes.

Cancellation

If you cancel your membership within 14 days of its effective date, and prior to utilizing the recovery service, you will receive a full refund. If you cancel after 14 days there will be no refund, however, we will discontinue the billing based on whether the method of payment you selected was month-to-month or annual. Annual memberships are valid through the entire 12 month period.

Contact Us

You may contact us by telephone at (800) 356-4282 extension 3541 or zanderidt@zanderins.com.

Intellectual Property Ownership

Trademarks, Copyrights and Restrictions: The Zander Identity Theft Solutions names and logos are trademarks of Zander Identity Theft Solutions. Everything you see in any promotional materials is copyrighted by Zander Identity Theft Solutions unless otherwise specified. All other product names and company logos found on promotional materials are the trademarks of their respective owners. All promotional materials are protected by copyrights, which are owned or licensed by Zander Identity Theft Solutions. You may not reproduce, perform, create derivative works from, republish, upload, post, transmit, or distribute in any way whatsoever any Zander Identity Theft Solutions information without the express, written consent of Zander Identity Theft Solutions.

Choice of Law

This Agreement shall be construed and controlled by the laws of the state of Tennessee. Any dispute concerning or breach of the terms of this Agreement will be governed by the laws of the state of Tennessee.

Indemnification

You agree to indemnify, defend and hold Zander Identity Theft Solutions and any of its affiliates and all of their agents, directors, employees, information providers and licensors and licensees harmless from and against any and all liability and costs (including attorneys' fees and costs) incurred by any of these parties in connection with any claim arising out of any breach by you of these terms and conditions. In the event that either (a) you are the subject of claims for which you properly seek damages from us under these terms and conditions, or (b) we are subject to any claim for which we have the right to be indemnified by you, we reserve the right at our expense in the case of claims in clause (a) and at your expense in the case of claims in clause (b), to assume the exclusive defense and control of any such claim, and you will not in any event settle any such claim without our written consent.

Modification

We may revise this Agreement at any time. However, we may not make any changes retroactive. We will notify you of any changes via telephone or at the e-mail address or mailing address associated with your account. If you do not contact Zander Identity Theft Solutions and express your objection to our changes within thirty (30) days of receiving this notice, you shall be deemed a continuing use client and agree to be bound by any such revisions. If you fail to comply with any of these terms and conditions, we may at any time terminate your rights under the Program.

Arbitration

At Company’s sole discretion, it may require you to submit any disputes arising from the use of the Program to final and binding arbitration under the Rules of Arbitration of the American Arbitration Association applying Tennessee law.

Miscellaneous

The terms and conditions of this Agreement may not be altered, supplemented, or amended by you. Any such attempt will be null and void, unless agreed to in writing and signed by you and Zander Identity Theft Solutions. The section headings used herein are for convenience of reference only and do not form a part of these terms and conditions, and no construction or inference will be derived therefrom. If any provision of this Agreement is held to be unenforceable for any reason, such provision shall be reformed only to the extent necessary to make it enforceable and shall not affect the enforceability of any other provision.

Description of Subscriber Obligations

You agree that you are only providing your own personal information and not the information of any other individual. You agree that the information you provide during the registration process and any subsequent information you provide to Zander Identity Theft Solutions will be true, accurate, and current. You are obligated to contact Zander Identity Theft Solutions member services in the event that any information you have provided Zander Identity Theft Solutions has changed.

You agree that you are eighteen (18) years of age or older.

You agree to pay us the fee we publish for our Program, less any discounts to which you may be entitled.

Limitation on Time to File Claims

ANY CAUSE OF ACTION OR CLAIM YOU MAY HAVE ARISING OUT OF OR RELATING TO THIS AGREEMENT MUST BE COMMENCED WITHIN ONE (1) YEAR AFTER THE CAUSE OF ACTION ACCRUES, OTHERWISE, SUCH CAUSE OF ACTION OR CLAIM IS PERMANENTLY BARRED.

Limitation of Liability

IN NO EVENT WILL COMPANY OR ANY OF ITS SERVICE PROVIDERS OR SUPPLIERS BE LIABLE UNDER OR IN CONNECTION WITH THIS AGREEMENT OR ITS SUBJECT MATTER UNDER ANY LEGAL OR EQUITABLE THEORY, INCLUDING BREACH OF CONTRACT, TORT (INCLUDING NEGLIGENCE), STRICT LIABILITY AND OTHERWISE, FOR ANY: LOSS OF PRODUCTION, USE, REVENUE OR PROFIT OR DIMINUTION IN VALUE; OR CONSEQUENTIAL, INCIDENTAL, INDIRECT, EXEMPLARY, SPECIAL, ENHANCED OR PUNITIVE DAMAGES, REGARDLESS OF WHETHER SUCH PERSONS WERE ADVISED OF THE POSSIBILITY OF SUCH LOSSES OR DAMAGES OR SUCH LOSSES OR DAMAGES WERE OTHERWISE FORESEEABLE, AND NOTWITHSTANDING THE FAILURE OF ANY AGREED OR OTHER REMEDY OF ITS ESSENTIAL PURPOSE.

IN NO EVENT WILL THE AGGREGATE LIABILITY OF COMPANY UNDER OR IN CONNECTION WITH THIS AGREEMENT OR ITS SUBJECT MATTER, UNDER ANY LEGAL OR EQUITABLE THEORY, INCLUDING BREACH OF CONTRACT, TORT (INCLUDING NEGLIGENCE), STRICT LIABILITY AND OTHERWISE, EXCEED THE AMOUNT YOU PAID FOR THE PROGRAM. THE FOREGOING LIMITATION APPLIES NOTWITHSTANDING THE FAILURE OF ANY AGREED OR OTHER REMEDY OF ITS ESSENTIAL PURPOSE.

Agreement Assent and Acknowledgement

You and Zander Identity Theft Solutions have entered into this Agreement, whether electronically, by recorded voice authorization, or via physical copy, intending to be bound by your acceptance of the Agreement. By using the Company website, you accept and agree to be bound and abide by the Zander Insurance Group Terms of Use, found at https://www.zanderins.com/terms-of-use.aspx, and Privacy Policy, found at https://www.zanderins.com/privacy.aspx, which are both incorporated herein by reference. In the event of any conflict or inconsistency between the terms and provisions of this Agreement and the Terms of Use, the terms of the Terms of Use will prevail. Notifications, or any other communications, including billing, payment, and/or disclosures will be made via the mail, telephone, or email address associated with your account. This Agreement may be printed or retained by you for future reference.