Trusted Tax Experts for Small-Business Owners

Connect with pros who’ve earned our seal of approval to handle your books, payroll and taxes—so you can focus on your business.

How Can Our Tax Advisors Help Your Small Business?

We all know bookkeeping, payroll and taxes can be time-consuming. But they don't have to be. Here's what our tax pros can help you with:

-

Bookkeeping—ugh. We feel your pain. Give that paperwork to a pro and take back more time for your small business.

-

How do tax changes affect your small business? Our pros can guide you through the changes, big and small.

-

Ah! Are quarterly taxes due again? A small-business tax pro will keep you on track so filing deadlines don’t sneak up on you.

Find Virtual and In-Person Pros Who Serve Your Area

No matter how you connect with your RamseyTrusted pro, you’ll have someone who’s experienced in navigating small-business tax codes in your area. They have the heart of a teacher and will walk you through everything you need to know, acting as your guide and partner.

“My tax pro was prompt with my questions/inquiries and was quick and efficient with getting my taxes done . . . They also suggested the amount of extra money to withhold for taxes with each paycheck . . . I am very happy with their values, their professionalism (communication, results, assistance) and will plan to use them again for taxes next year.”

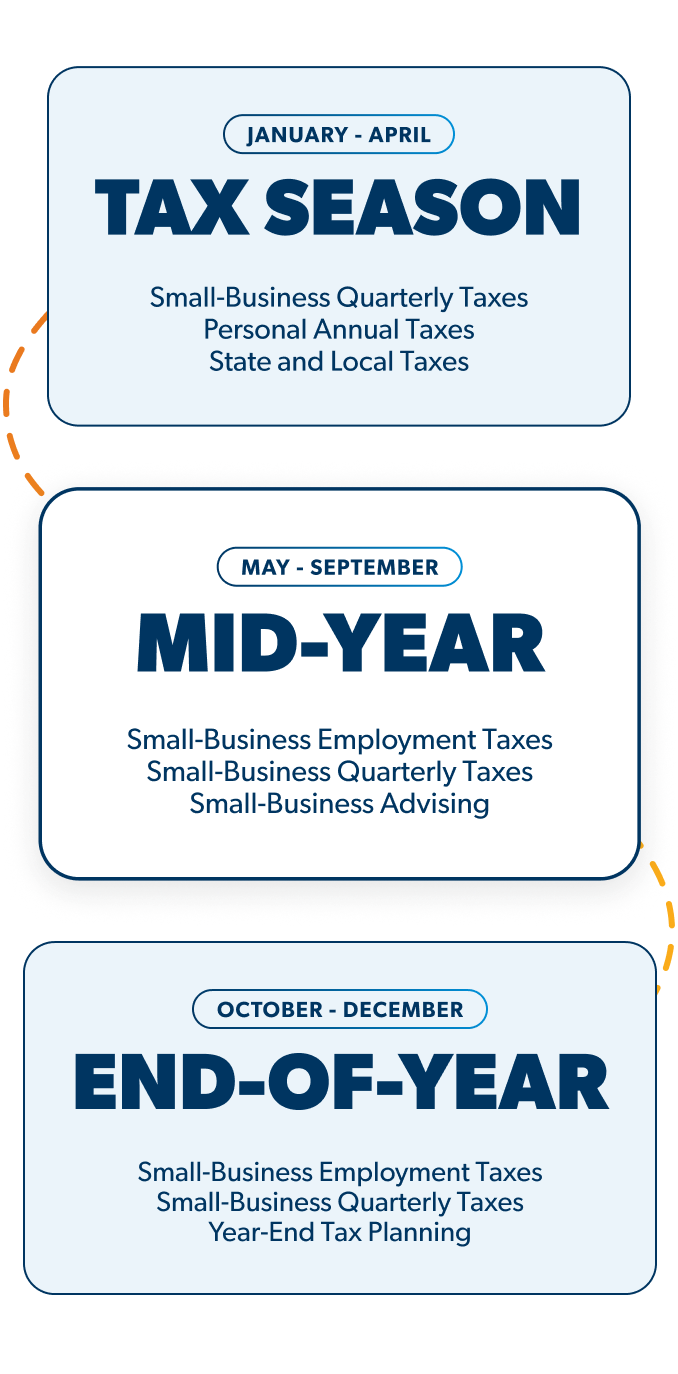

Ways a Tax Pro Can Help You All Year Long

You work hard at your business, and you can think of RamseyTrusted tax pros as an extension of it. They don’t just stop at filing taxes. They get to know the ins and outs of your business and can provide year-round support for bookkeeping, payroll and more—so you can focus more on serving your customers.

How Much Does It Cost to Hire a Tax Pro?

The cost for small-business taxes can vary. And there are several factors that determine what tax filing costs. It’s good practice to have an up-front conversation with your tax pro about what they charge for their services. And good news—it doesn’t cost you anything to connect with a pro and get the conversation started.

Get Tax-Ready With Our Free Resources

Make taxes a piece of cake—dig into our easy-to-digest checklists, guides and more.

Share RamseyTrusted Tax Advisors

Common Questions . . . and Answers

-

How is a RamseyTrusted tax pro vetted and what do they do?

-

A RamseyTrusted tax pro is a tax advisor who’s been vetted by the Ramsey team. They can work with you to file your taxes and can provide other tax-related services for you, your family and small business throughout the year. To earn the right to be called RamseyTrusted, tax pros must be a Certified Public Accountant (CPA) or an Enrolled Agent (EA) and have a minimum of two years full-time experience.

A CPA is a professional who takes care of all the detailed and essential math tasks that go with running a business. They can assist with bookkeeping, payroll administration, and preparing financial documents like tax returns and profit-and-loss statements. They can also provide financial planning for individuals, families and small businesses. CPAs are licensed by states.

EAs focus more narrowly on taxes and tax issues for individuals, businesses and private entities. An EA has knowledge in tax-related subjects—like income, estate, gift, payroll and retirement taxes. They're licensed by the federal government. -

Can I get more than one option for a tax pro?

-

Once you’ve submitted the form, we’ll connect you with one RamseyTrusted tax pro. It’s a great idea to ask them questions when you first get connected to see how the pro can help with your situation. If you decide this pro’s not the best fit for you, please reach out to our Customer Success Team so they can work on connecting you with a new pro. They’ll get back to you within one to two business days.

-

Why is my tax pro so far away? Is there anyone closer to me?

-

It’s probably because there isn’t a RamseyTrusted pro available in your area right now. If that’s the case, you’re matched with our national tax partner who’s uniquely qualified to serve the tax needs of all 50 states. And they’ve passed our vetting standards with flying colors, meaning they provide top-notch service and have the heart of a teacher.

-

What is the process of working with a national tax partner versus a local tax pro?

-

All RamseyTrusted tax pros work to make the process as seamless as possible. Your initial meeting is a great time to discuss your preferences and find out more about what you can expect.

Local pros generally make themselves available to meet in person, but if talking over the phone or a video call works better for you, just ask if that’s an option.

When working with our national tax partner, you can upload and view your documents through their secure portal. You can conveniently talk with them over the phone—and connect through video calls to go over your tax return or other important topics. They’ll also email you throughout the process to keep you up to date.

-

Should I use tax software to file myself or do I need a tax pro?

-

If you have personal or self-employed income and feel confident using tax software, you can easily file online with Ramsey SmartTax. If you have more complicated taxes, don’t want to take the time to do your own taxes, or want expert advice, then a RamseyTrusted tax advisor is for you.

Common Small Business Accounting Terms

-

What is an enrolled agent?

-

An enrolled agent (EA) can represent you before the IRS if you’re audited. These pros know practically everything about taxes. They must pass a comprehensive IRS exam and continue studying to meet education requirements.

-

What is a Certified Public Accountant?

-

A Certified Public Accountant (CPA) provides individuals and families with valuable knowledge and advice on taxes and financial planning. They have the smarts for everything finance-related, and they have the education, experience, and state examinations to prove it.

-

What is tax depreciation?

-

Depreciation means stuff wears out and loses value over time. For example, after five years, a $1 million crane might depreciate by $500,000. Tax depreciation takes this idea a step further. The government doesn’t want to give you a $1 million tax deduction. They’d be even more broke. Instead, they’ll take the life expectancy of a machine (say, 10 years) and divide it by the price you paid ($1 million). That number (in our case, $100,000) is how much you would deduct over the expected life of the machine.

-

What is a balance sheet?

-

Your balance sheet is a breakdown of what you owe versus what you own. It shows the assets, liabilities and owner’s equity for your business. Remember, assets are items owned by your company, and liabilities are things you owe on. Equity is the value of your business assets minus the liabilities; it’s basically the value you’d place on your company if you had to put a price tag on it today.

-

What is a profit and loss statement?

-

Your profit and loss statement is a summary of your revenue (profits) minus expenses (losses) for a period of time, usually a quarter of the year. It shows your profits or losses at a glance for that chunk of time.

-

What is a cash flow statement?

-

Your cash flow statement categorizes cash flow into three types of activities:

Operating: How much does your business make day-to-day?

Investing: Are the assets you’ve purchased for your business paying off?

Financing: How much cash have you invested in your business?