28 MIN READ | OCT 16, 2024

A humble abode. Your dwelling and domicile. Home sweet home. There’s nothing like it—it’s the best.

But what if something happened to it? Do you have the right homeowners insurance to make sure you can start over? How do you know? What exactly does homeowners insurance cover? And what doesn’t it cover?

Insurance might be complicated, but it’s not rocket science. Don’t let a simple lack of knowledge keep you from protecting your home and your finances. The reality is that many homeowners are underinsured—and they’re taking big risks they likely can’t afford.

In this homeowners insurance guide, I’ll break down everything you need to know about homeowners insurance.

What Is Homeowners Insurance?

Homeowners insurance is financial protection for your home and personal belongings in case of accidents, fires or other disasters. It protects you from financial ruin by transferring risk to an insurance company. Homeowners insurance also protects you financially from lawsuits due to accidents on your property (think dog bites or other injuries).

Here’s how it works. By paying monthly premiums, you enter into a contract with your insurance carrier. Your insurance company then agrees to pay for any incidents they’ve agreed to cover. If one of those incidents happens, you file a claim and pay a certain amount of the damages out of pocket (your deductible), then your insurance company pays any costs above your deductible, up to the policy’s limit.

The bottom line? If you own a home, you need homeowners insurance. In fact, almost all mortgage companies require you to have homeowners insurance, even though it’s not required by any state laws. Even if you rent, a lot of landlords require you to have renters insurance to protect your stuff.

What a Homeowners Policy Provides

Would you be okay financially if (God forbid) a tornado came along and destroyed your home? If the answer’s no (and it is for most of us), you need a homeowners insurance policy. Homeowners insurance provides peace of mind knowing you won’t be wiped out financially if your property is.

Here are the different areas where a homeowners policy provides peace of mind:

- Additional structures: Your home structure and detached structures like a garage are covered. Each policy differs on how much money you’ll get, but your insurance will pay to repair or replace them if they’re damaged.

- Your stuff: Do you own stuff in your house? Unless you’ve Marie Kondo’d your belongings into oblivion, you probably have a house full of stuff that would cost a lot to replace. You don’t have to worry—the right homeowners policy will cover all your belongings.

- Injuries and damages: This next one isn’t as intuitive, but you’ll sure be glad it’s there if your neighbor’s kids come over and fall out of the janky tree fort in your backyard. Your homeowners policy has a clause for personal liability to cover things like this. Purchasing liability protection on your homeowners insurance policy is one of the best buys in the business.

Homeowners Insurance and Mortgages

Maybe you’re looking into buying your first home. (Congrats are in order, if so!) And you’re thinking, This deal is already so expensive—do I have to get homeowners insurance? Here’s the thing about buying a home: Most people get a mortgage. And the banks that give you that mortgage require homeowners insurance.

After all, until you pay off your mortgage, the bank actually owns your house—and they don’t want their collateral going up in smoke.

Now, if you pay cash for that sweet bungalow, you can do whatever you want. But I’m still going to recommend you get homeowners insurance that covers the entire cost to replace your house—unless you’ve got some Scrooge McDuck-level money and you could pay for it without flinching. But I doubt it.

Homeowners Insurance vs. Home Warranty

Let’s get this straight: Homeowners insurance is not the same thing as a home warranty. A warranty is a guarantee against something in the house, like a refrigerator, turning out to have a problem. Home insurance is a guarantee against something having a problem with the house—like a tornado.

A home warranty pays to repair or replace a broken appliance or HVAC system, for example. Home insurance would pay to repair or replace damage to your home caused by a fire.

Similarities:

- You purchase both from a company, and separate from the house.

- Neither covers problems from the actual construction process like structural issues.

- Neither covers rust, corrosion or normal wear and tear, deterioration from time, poor maintenance, or faulty installation.

Differences:

- Home warranties cover appliances and home systems if they break, while insurance covers your structure and everything inside it—including appliances if they’re damaged or destroyed.

- Home warranties are unnecessary. That’s right, you heard it here. Your emergency fund is meant to cover any issues a home warranty would—without a monthly premium! (But if a paid-for home warranty is included in your home purchase, don’t turn it down. Take it happily.) Homeowners insurance, on the other hand, is absolutely necessary.

|

Home Insurance vs. Home Warranty

|

|

Home Insurance

|

Home Warranty

|

|

Pays to repair or replace house structure and contents if damaged or destroyed by covered incident

|

Pays to repair or replace some appliances and home systems if they break down

|

|

Policies last for one year and are renewed each year

|

Warranties typically last for one to two years

|

|

Does not cover problems from construction, wear and tear, poor maintenance, or faulty installation

|

Does not cover problems from construction, wear and tear, poor maintenance, or faulty installation

|

|

Comes with varying levels of coverage; best level pays full cost to replace everything

|

Pays partial cost for repairs or replacements

|

|

Necessary

|

Unnecessary

|

(If you’re researching homeowners insurance because you’re just starting to shop for a home, check out our free Home Buyers Guide.)

Homeowners Insurance vs. Mortgage Insurance

When it comes to home ownership, there’s a lot to keep track of, so don’t feel bad if your head is spinning . . . but there’s one more issue I’ve got to clear up. Home insurance and mortgage insurance are not the same thing—in fact, they’re very different. While home insurance kicks in if your actual home and stuff are damaged, mortgage insurance is a kind of life insurance that pays off your mortgage if you die.

You definitely want home insurance, but if you have level term life insurance (the only kind of life insurance I recommend) you don’t need mortgage insurance! It’s about as good a deal as anything you’d buy off a TV infomercial after 1 a.m.

What Does Homeowners Insurance Cover?

Homeowners insurance is a lot like porridge. Hear me out.

You need to make sure you’re in that Goldilocks sweet spot of homeowners insurance coverage—not too much coverage and not too little. Like most types of insurance, homeowners insurance isn’t just one blanket policy that covers everything. It’s a lot more complicated than that (and why getting educated is so important).

Let’s start with what homeowners insurance covers so you can understand where you’re protected. Pro tip: Your insurance declaration page will show you what coverages you currently have so you can see where the gaps are.

A typical homeowners insurance policy addresses five basic things.

1. Dwelling Coverage

This coverage pays to repair or rebuild your dwelling (aka your house and anything attached to it) due to damage from disasters like fire, windstorms, hail, lightning, theft and vandalism (also known as hazards). So, if a tornado politely takes the lid off your house and puts it in a tree, dwelling coverage will kick in and your insurance company will pay to replace it. However, there are a few exceptions to homeowners coverage, like damage from flooding and hurricanes (more on that in a bit).

2. Other Structures Coverage

Other structures coverage applies to things other than your house. Some examples are: detached garage, tool shed, barn, gazebo, swimming pool, fence or driveway.

Basically, any structure that is a permanent, valuable feature of your property falls under other structures coverage. But it does have limits—usually around 10% of the total policy you have on your house.

3. Personal Property Coverage

Personal property coverage protects what’s in your home—the stuff you use every day, like clothes, furniture and electronics. It also covers expensive stuff like jewelry, art and collectibles. But there’s often a dollar limit attached to those high-end items—so make sure you have enough insurance to replace everything. Most insurance companies cover your belongings at around 50–70% of what your house is worth. Create a thorough inventory of all your things so you have a record of your belongings and what they’re worth.

4. Personal Liability Coverage

Personal liability protection covers you from lawsuits for bodily injury, property damage that occurs on your property, and even dog bites if Rex isn’t a dangerous breed (although there’s always the possibility he’ll lick you to death). Personal liability coverage doesn’t cost much, so you can get plenty at a reasonable rate. You should carry at least $500,000 in liability because—let’s be real—no one these days sues for $250,000. And if you have a larger net worth, you should also look into umbrella insurance.

5. Additional Living Expenses (ALE)

Additional living expenses (ALE) coverage helps pay for the costs of living away from home when you can’t stay there due to damage from an insured disaster. Whether it’s for a few days or even months, ALE covers things like hotel bills, restaurant meals, pet care, transportation and even moving expenses.

However, ALE won’t pay for all your expenses. It covers costs over and above your usual living expenses (like your mortgage and regular grocery budget).

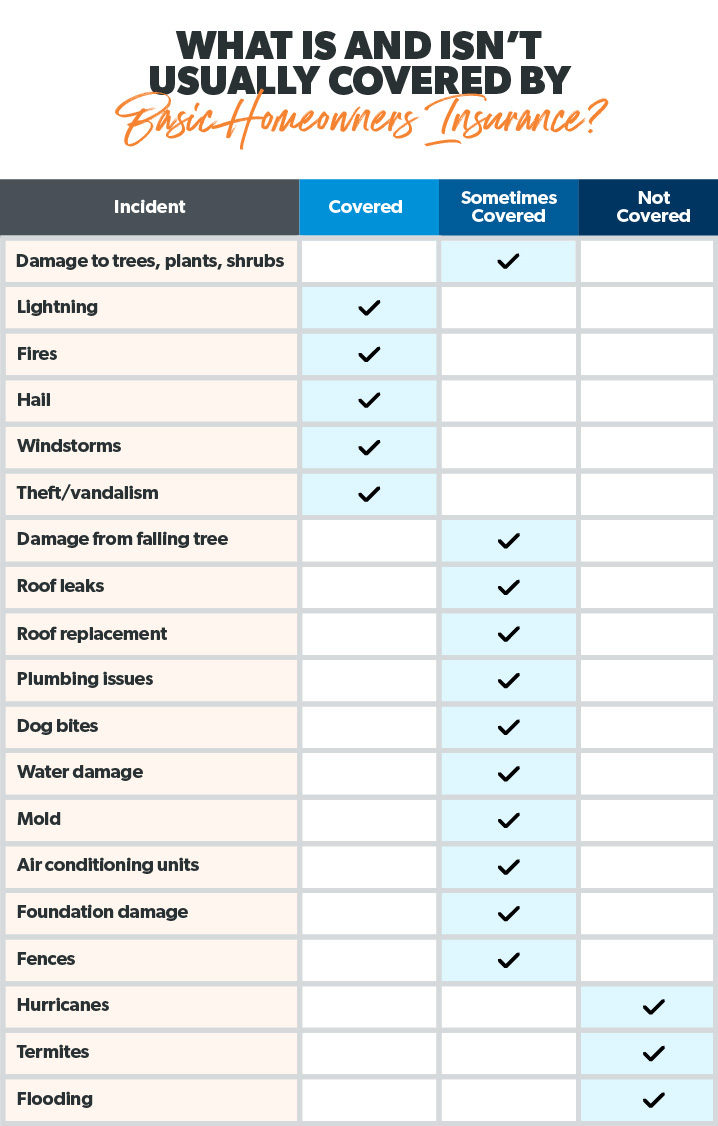

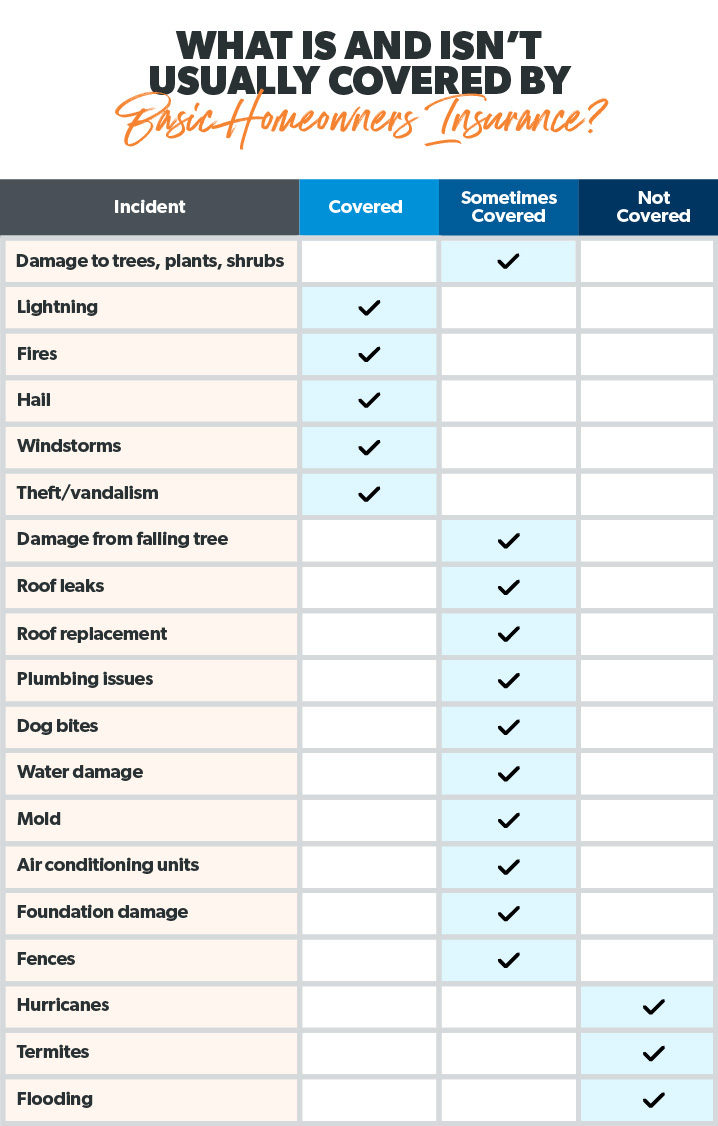

Now that we’ve seen the good news of what a typical homeowners insurance policy covers, we’re ready for the bad news—what’s not covered.

What Isn’t Covered by Homeowners Insurance?

What’s not covered by standard homeowners insurance? And when should you consider buying additional coverage? Let’s take a look.

Flooding

Of all natural disasters in the U.S., 90% involve flooding.1 Only 78% of homeowners who report being at risk of flooding say they have flood insurance though.2 (Come on, people! Let’s turn these numbers around.)

I’m going to be as crystal clear as I can on this one: Standard homeowners insurance policies won’t cover flood damage to your home.

And, no, you can’t call the insurance company while you’re standing knee-deep in water (nice try). You need flood insurance before the waters start rising. It’ll pay for damage to the structure of your home and anything attached to it.

Keep in mind, we’re talking flood waters from outside your home. Home insurance will cover some kinds of water damage like roof leaks.

If you live in a flood-prone area, get flood insurance. Now.

Earthquakes and Hurricanes

Basic homeowners insurance also won’t cover damage from earthquakes, unless it’s something like a house fire caused by an earthquake (look at your policy or check with your insurance agent for a full list of covered hazards). So if you live on the San Andreas Fault or another earthquake-prone area, you’ll want to look into adding earthquake insurance.

What about hurricanes? If you live in a susceptible coastal area, dwelling coverage won’t cover wind or flooding damage caused by a hurricane. You’ll need a separate policy for that.

Sinkholes

Homeowners policies typically don’t cover sinkholes—unless you live in Tennessee or Florida. Insurers in these two states are required to offer optional sinkhole protection. If you live in a state where sinkholes are common—like Tennessee, Florida, Alabama, Kentucky, Missouri, Texas and Pennsylvania—you might want to consider this extra protection.3

Maintenance Issues

In most cases, your homeowners insurance won’t cover damage caused by termites, mold, poorly maintained water pipes and sewage backups. Instead, these are considered part of the regular maintenance of owning your own home. Just like your car insurance doesn’t pay for oil changes and your dog doesn’t make his own dinner, your homeowners insurance company won’t pay to maintain your house. (Welcome to the “joys” of adulthood.)

This is why it’s important to stay up on your home maintenance. Deal with those small issues before they get big—and costly! It’s also smart to save up an emergency fund and get out of debt so you’ve got extra cash to cover things that break (because things always break).

Examples of Commonly Covered and Not Covered Homeowners Insurance Situations

Okay, we’ve covered a lot of information, but this stuff can be pretty confusing. So let’s go over a few common scenarios that are and aren’t covered by homeowners insurance.

Covered

A nasty thunderstorm hits. The wind whips the rain up into your eaves, and it gets into your attic. Now you have water damage in your attic and a corner of your ceiling. Home insurance will cover this.

Not Covered

A spring thunderstorm breaks loose over your house, dropping three inches of rain in an hour. Your gutters are clogged with leaves because playing pickleball with your friends sounded way more fun than clearing them out. Rainwater overflows into your house interior, damaging your ceiling and attic. Insurance won’t cover this because blocked gutters is considered a maintenance issue and home insurance doesn’t cover problems caused by poor maintenance.

Covered

You throw a load of laundry into the washing machine before heading out to pick the kids up from school. When you get back, the kids scream with joy because the laundry room and kitchen are now a shallow swimming pool. Your washing machine hose burst and flooded the house! This is covered by home insurance.

Not Covered

It’s been an unusually wet spring, and the river is overflowing. It starts raining again and the water creeps up higher into your house. This is not covered by homeowners insurance. You need flood insurance for this.

How Homeowners Insurance Works

Now, let’s talk about the different types of homeowners coverage.

Choosing the right kind of homeowners insurance is crucial. And it’s a balancing act. You want the most protection at the best value—without being underinsured or paying high premiums for coverage you don’t need.

Let’s look at four main types of homeowners insurance.

Actual Cash Value (ACV)

An actual cash value (ACV) homeowners policy will pay to repair or replace your personal belongings, minus depreciation. So, let’s say somebody steals your Peloton (which would be impressive considering those things are heavy as heck). The insurance company will pay what the Peloton was worth when it got stolen—not when it was new in the box.

In most policies, ACV applies to your personal property, but it can also apply to how your home structure will be replaced as well.

Replacement Cost Value (RCV)

Replacement cost coverage offers more protection than actual cash value because it doesn’t consider depreciation. It’ll pay to repair or replace your home at today’s prices up to the limit. For example, if you have $200,000 in dwelling coverage and the rebuild costs $250,000, you’ll have to pay $50,000 plus your deductible.

A standard homeowners policy usually offers RCV coverage for dwelling and the option of choosing either RCV or ACV coverage for your personal property. I recommend getting RCV coverage in both cases!

Guaranteed Replacement Cost

Guaranteed replacement cost coverage pays the full replacement cost if your home is destroyed—without factoring in depreciation or dwelling coverage limits. So if the rebuild costs $250,000, that’s what the insurance company will pay (minus your deductible). Simple. The only downside is that it’s very expensive and harder to find than a dress shirt that doesn’t fit like an actual dress on me.

Extended Replacement Cost

Another variation on replacement cost coverage is extended replacement cost coverage. This type of homeowners insurance pays the replacement value of your home up to the coverage limit—plus a percentage of the coverage limit. So, following the example of $200,000 in coverage with a $250,000 cost to rebuild, an extended replacement cost policy could cover $200,000 plus 10% of that limit (another $20,000).

This coverage is also more expensive. But it can be helpful if you live in an area where construction costs are rising quickly (which seems to be nationwide in the last few years) and your home is at relatively high risk of being damaged.

Types of Homeowners Insurance Policies

Not everybody’s got the same kind of home. Just look around. You might live in a modern ranch spread, but the lady down the street is in a historic Tudor Revival, while your friend owns a condo and your uncle is a landlord. Good thing homeowners insurance policies come in different types!

HO-1 and HO-2: Think of these as the Speedos of home insurance policies. They offer only bare-bones coverage—much less than what you would generally want as a homeowner.

HO-3: This is the most common type of policy homeowners selected. Keeping with the swimwear analogy, these offer 1960s-swim-trunks-length coverage (you know, the ones where you wonder, Are we sure those qualify as shorts? I’m still seeing more leg than I ever cared to). They come as either a named perils policy (you’re only covered for what’s on a list of specific incidents—not great) or an all-inclusive policy (which covers everything except what’s listed). Your personal property is protected up to a limit (usually 50% of your dwelling coverage).

These policies typically come with actual cash value (ACV) coverage for all your stuff. This means you get paid what your property is worth at the time it was damaged or destroyed (aka the used value, which includes depreciation). Not ideal.

HO-4: This is renters insurance. It covers everything the renter owns and offers personal liability coverage in case anyone is injured on the property.

HO-5: Along with HO-3, this is the other policy that the owner of a single-family home would buy. These policies are your full-on, early-2000s, below-the-knee swim trunks (which I hope never to see again—they swallow us little fellas. But when it comes to home insurance policies, they look pretty rad). They offer the highest levels of coverage and are more expensive. But they’re worth it because if your home and belongings are ever destroyed, you’ll be starting over, and you’ll need all the help you can get.

With this kind of policy, you’ll get replacement cost value (RCV) coverage, which means your insurance will pay whatever it costs to replace your stuff. You may also be able to find a policy that has guaranteed replacement cost value.

HO-6: This is condo insurance. It covers your unit’s walls, floors and ceilings (but not the building itself—your condo association has a master policy for that) plus everything else a typical HO-3 policy covers, like liability and personal property.

HO-7: Folks who live in a mobile home or manufactured home need this kind of policy. Coverage usually only applies when your home isn’t moving.

HO-8: This policy is designed to cover the proud owners of a historic home. They’re expensive because old homes aren’t usually built to current codes and standards, and repairs require special expertise and materials. (If you break a window George Washington looked out of, you have to replace it with another window George Washington looked out of, and that gets expensive.) It also provides the other typical coverages, like liability and personal property.

How Much Homeowners Insurance Do I Need?

Now that we’ve learned what is and isn’t covered by homeowners insurance, along with the types of coverage, you might be wondering, How much homeowners insurance do I need?

Well, that depends on a ton of factors. But one of the biggest pitfalls people make when buying home insurance is not having enough—the payout of your homeowners insurance will not automatically increase along with the rebuilding cost of your home. For instance, if a wildfire destroys your house, it’d be awful to find out your homeowners insurance policy only covers half of the rebuilding costs.

But this is exactly what many people could face. That’s why it’s crucial to routinely check up on your policy and make changes to it, if necessary. In the last several years, building and labor costs have skyrocketed, but homeowners aren’t making sure their insurance policies are keeping up. Only 30% of Americans have updated their home insurance policy to reflect the increased costs.4

Here's a good rule of thumb. Your homeowners insurance should:

- Rebuild your home (dwelling coverage)

- Replace your stuff (personal property)

- Cover injuries and damages that happen to others on your property or are caused by you on other people’s property (personal liability)

- Reimburse your living expenses after the loss of use of an insured home (additional living expenses)

There are a few other add-ons, or endorsements, you can add to your policy if you think you need extra coverage. Here are a few common examples:

- If you have a really expensive piece of jewelry, you can get something called scheduled personal property coverage. This will cover a specific item that you typically will need to get appraised.

- Water backup coverage will cover the costs from sump pump accidents or backed-up sewer lines.

- Ordinance or law coverage will pay to make sure your home is up to the latest building codes during a repair.

- Equipment breakdown coverage will help if your HVAC or major appliances break down (over and above the usual wear and tear).

I recommend working with an independent insurance agent who can look at your situation and find you the right coverage while making sure you don’t overpay for stuff you don’t need.

How Much Does Homeowners Insurance Cost?

So, you’re getting closer to figuring out how much you need, but what about the price tag? How much does the average homeowners insurance policy cost?

Homeowners insurance costs vary widely depending on your situation. Your monthly or annual premium is based on factors like the rebuilding cost of your home, your past history of homeowners insurance claims, what type of coverage you need, your credit score, if you live in an area with lots of insurance claims, and how much your belongings are worth.

That said, the average U.S. homeowners insurance annual premium in 2023 was $1,582 for $350,000 in dwelling coverage, according to data from Quadrant Information Services. But again, this number varies widely depending on all those different factors.

Currently, the industry is raising rates all over the place, and premiums are expected to rise more—by as much as 30% this year.5 And when it comes to flood insurance, you can expect to pay more for that as well. In fact, many Americans will see the price of flood insurance double—or more—as the Federal Emergency Management Agency (FEMA) updates rates.6

If this news has you in a tizzy, wondering how you’ll afford home insurance, don’t worry. I’ll talk about how to save money on home insurance in a minute. First, let’s look at the factors that go into your price.

How Are Homeowners Insurance Rates Determined?

How much you pay isn’t based on how the guy at the insurance company felt when he woke up that morning. Like I mentioned earlier, there are many factors that go into determining your rate, and knowing them can help you figure out how to reduce your rate.

Replacement Cost

Your replacement cost—how much it would cost to rebuild your house—is a big part of the cost of your policy. I’m not just talking size. There’s a big difference in cost to rebuild if you’ve decked out your home with marble slab countertops, raw brass fixtures, and built-in library shelves versus a cookie-cutter home with standard, builder-grade everything.

Location

Another huge factor is where your home is located. If you live near Dorothy and Toto where a lot of tornadoes crop up, expect higher premiums. Or if you live in a higher-crime zip code, you could pay more.

Age and Condition of Your Home

If your home is older, there’s a greater chance something could burst—like the plumbing—and cause damage. Beep, boop: higher rate.

Level of Coverage and Deductible

Your premium changes based on how much coverage you choose, along with how big of a deductible you pick. A higher deductible means a lower monthly rate.

Construction Type

This would involve things like what the house is made of (brick, wood, etc.). The first little piggy’s straw house would be insanely expensive to insure.

Personal Claim History

If you have a long history of filing claims for every little thing, an insurer will factor this into your premium. Filing claims on small repairs will only cost you more money in the long run. In fact, it could increase your premium even if your neighbors file a lot of claims. (It might not seem fair, but it’s a factor.)

Your Home’s Square Footage

The larger the home, the more expensive it is to insure. If you have a massive mansion with more bathrooms than people, that’s obviously going to cost more to rebuild and insure than a one-room cabin.

How Many Live There

If you, your spouse, your children and your entire extended family are all living under the same roof, you’ll pay more for liability coverage because there’s a higher likelihood of incidents.

Other Factors

Insurance companies will also take into account things like the type of roof you have, how close you are to a fire and police station, if you have a certain breed of dog (I won’t name names), if you have a swimming pool or trampoline, your credit score, and what kind of security and fire alarm systems you have.

How to Compare Homeowners Insurance Rates

Now, you may be thinking you’ll just go out, grab the cheapest insurance you can find, and run. But this isn’t a good idea. Like we talked about before, you want to make sure you get the right kind of coverage—and that won’t be the cheapest policy available. That said, you still want to get the best deal for what you need, so let’s look at how to compare homeowners insurance rates.

Here's the most important thing to remember: Make sure you’re comparing apples with apples!

When you get several quotes, look over all the coverages they offer. Are they both replacement cost value (RCV) or is one actual cost value (ACV)? ACV is cheaper—but you don’t really want ACV coverage.

What are the deductibles? If one has a bigger deductible, then it should come with a lower price.

What’s the coverage amount in each quote? A quote for $350,000 will cost more than a quote for $300,000. But if your house replacement cost is $350,000, that’s what you need.

Also, make sure you look for possible coverage gaps. Some policies have additional coverages included, while others require you to pay extra for things like coverage of sewer and water backup or additional living expenses (ALE).

Questions to ask when comparing home insurance quotes:

- Do they all have ACV or RCV coverage or are they different?

- What are the deductibles?

- Are all the quotes for the same coverage amount?

- How much liability coverage does each one have?

- Are there coverage gaps in any of the policies quoted?

Compare Homeowners Insurance Rates by State

I talked about how your location—like whether you’re close to a fire station or live in a high-crime neighborhood—affects your home insurance premium. But the state you live in will also affect your rate. Here are the average homeowners insurance premiums by state for different levels of coverage.

|

Average Homeowners Insurance Premiums by State in 2023

|

|

State

|

Total Annual Average

|

$200,000

Dwelling Coverage

|

$350,000

Dwelling Coverage

|

$500,000

Dwelling Coverage

|

$750,000

Dwelling Coverage

|

|

Alabama

|

$2,293

|

$1,303

|

$1,855

|

$2,476

|

$3,537

|

|

Alaska

|

$1,327

|

$769

|

$1,101

|

$1,446

|

$1,990

|

|

Arizona

|

$1,473

|

$893

|

$1,197

|

$1,560

|

$2,240

|

|

Arkansas

|

$2,887

|

$1,692

|

$2,363

|

$3,105

|

$4,386

|

|

California

|

$1,223

|

$707

|

$995

|

$1,299

|

$1,890

|

|

Colorado

|

$2,464

|

$1,469

|

$2,056

|

$2,663

|

$3,666

|

|

Connecticut

|

$1,333

|

$781

|

$1,083

|

$1,438

|

$2,031

|

|

Delaware

|

$1,142

|

$570

|

$872

|

$1,253

|

$1,874

|

|

Florida

|

$2,390

|

$1,201

|

$1,889

|

$2,598

|

$3,870

|

|

Georgia

|

$2,200

|

$1,179

|

$1,768

|

$2,394

|

$3,459

|

|

Hawaii

|

$469

|

$264

|

$364

|

$498

|

$751

|

|

Idaho

|

$1,291

|

$734

|

$1,040

|

$1,402

|

$1,987

|

|

Illinois

|

$1,727

|

$1,066

|

$1,416

|

$1,837

|

$2,589

|

|

Indiana

|

$1,614

|

$962

|

$1,321

|

$1,727

|

$2,445

|

|

Iowa

|

$2,032

|

$1,106

|

$1,636

|

$2,201

|

$3,183

|

|

Kansas

|

$2,938

|

$1,641

|

$2,390

|

$3,176

|

$4,543

|

|

Kentucky

|

$2,607

|

$1,411

|

$2,059

|

$2,831

|

$4,125

|

|

Louisiana

|

$4,477

|

$2,271

|

$3,549

|

$4,832

|

$7,255

|

|

Maine

|

$1,224

|

$634

|

$962

|

$1,319

|

$1,979

|

|

Maryland

|

$1,700

|

$980

|

$1,356

|

$1,829

|

$2,635

|

|

Massachusetts

|

$1,417

|

$835

|

$1,138

|

$1,499

|

$2,194

|

|

Michigan

|

$1,747

|

$903

|

$1,382

|

$1,940

|

$2,764

|

|

Minnesota

|

$1,973

|

$1,106

|

$1,606

|

$2,162

|

$3,019

|

|

Mississippi

|

$3,636

|

$1,972

|

$2,917

|

$3,930

|

$5,726

|

|

Missouri

|

$2,766

|

$1,496

|

$2,221

|

$2,988

|

$4,360

|

|

Montana

|

$2,087

|

$1,312

|

$1,764

|

$2,242

|

$3,031

|

|

Nebraska

|

$4,166

|

$2,600

|

$3,556

|

$4,487

|

$6,019

|

|

Nevada

|

$937

|

$538

|

$745

|

$998

|

$1,466

|

|

New Hampshire

|

$1,055

|

$582

|

$848

|

$1,144

|

$1,647

|

|

New Jersey

|

$1,042

|

$576

|

$858

|

$1,137

|

$1,596

|

|

New Mexico

|

$1,724

|

$847

|

$1,368

|

$1,916

|

$2,766

|

|

New York

|

$1,342

|

$718

|

$1,060

|

$1,461

|

$2,127

|

|

North Carolina

|

$1,963

|

$928

|

$1,640

|

$2,199

|

$3,085

|

|

North Dakota

|

$1,988

|

$1,183

|

$1,656

|

$2,139

|

$2,973

|

|

Ohio

|

$1,215

|

$731

|

$995

|

$1,302

|

$1,833

|

|

Oklahoma

|

$4,510

|

$2,436

|

$3,651

|

$4,967

|

$6,986

|

|

Oregon

|

$992

|

$583

|

$784

|

$1,052

|

$1,550

|

|

Pennsylvania

|

$1,223

|

$699

|

$977

|

$1,325

|

$1,892

|

|

Rhode Island

|

$1,532

|

$899

|

$1,271

|

$1,649

|

$2,307

|

|

South Carolina

|

$1,756

|

$930

|

$1,394

|

$1,881

|

$2,819

|

|

South Dakota

|

$2,564

|

$1,434

|

$2,069

|

$2,818

|

$3,935

|

|

Tennessee

|

$1,972

|

$1,147

|

$1,563

|

$2,127

|

$3,052

|

|

Texas

|

$2,983

|

$1,632

|

$2,396

|

$3,196

|

$4,709

|

|

Utah

|

$868

|

$553

|

$691

|

$898

|

$1,329

|

|

Vermont

|

$1,032

|

$566

|

$845

|

$1,145

|

$1,571

|

|

Virginia

|

$1,306

|

$710

|

$1,021

|

$1,405

|

$2,089

|

|

Washington

|

$1,355

|

$773

|

$1,088

|

$1,446

|

$2,111

|

|

West Virginia

|

$1,583

|

$875

|

$1,280

|

$1,717

|

$2,461

|

|

Wisconsin

|

$1,246

|

$677

|

$1,013

|

$1,346

|

$1,947

|

|

Wyoming

|

$1,505

|

$748

|

$1,145

|

$1,623

|

$2,502

|

Data from Quadrant Information Services

How to Save on Homeowners Insurance

While you definitely don’t want to cut corners on homeowners insurance, there are a few ways you can save some money.

- Bundle! We’ve all seen the TV ads: “Bundle and save!” Although it gets old, it’s true. You can save money on your homeowners insurance by bundling it with another policy. Try it with your auto, commercial or umbrella policies!

- Improve safety features. By simply installing things like burglar alarms, smoke detectors or deadbolt locks, you can sometimes score a discount.

- Be sparing with claims. If you file too many claims, it could increase your premium. Think through how many claims you make, especially on small incidents you could pay for yourself.

- Increase your deductible. You could save some money on a lower premium if you raise your deductible. But only do this if you can afford to cover the bigger deductible from your savings.

- Check for better rates. By not shopping around once in a while, or having your independent insurance agent check for you, you might be leaving money on the table.

How to Get the Best Homeowners Insurance

So, now you know all the facts, but how do you get the best home insurance policy? One way is to shop around and buy it directly from a carrier. But this can take a lot of time and still leave you without the best protection in place. With so many different coverages and add-ons, it’s easy to miss one you need or accidentally buy one you don’t need.

What if there was an expert who could do all the grunt work for you, without missing any details? Well, there is!

They’re called independent insurance agents—and they work for you, not a specific insurance company. There are a lot of them out there, though. To make it easy to know you’re working with someone you can trust, our team at Ramsey has vetted and gathered the best from around the country under one roof: RamseyTrusted.

These industry experts can shop for you and get you the best protection at the best price. They saved Adam D. from the Ramsey Baby Steps Facebook Community $700 a year—with better coverage!

“Seriously, our guy gave a 20-minute video explaining line by line the coverage of what we have versus what he was proposing and how 1) it was cheaper and 2) was better than what we had,” Adam said.

I’ve thrown a lot of info at you. If you’re feeling a bit overwhelmed, that’s understandable. So, let’s break it down. What are your next steps to getting homeowners insurance?