Imagine one day noticing a funky smell in your kitchen. Your joints hurt for no reason, and you’ve been feeling pretty fatigued lately. But you decide to pull out the cabinet where the sink is to have a look. What you find is black mold growing all over the wall down to the wood floor—which is looking pretty warped.

It’s bad. And as far as you know, the mold could be all through the wood floor. This needs to be fixed ASAP, but it’s going to cost a pretty penny. So, does homeowners insurance cover mold?

Does Homeowners Insurance Cover Mold?

The answer is: sometimes. A few decades ago, home insurance covered the costs of remediation ( that’s removing and cleaning up mold and putting your house back together) no matter what. But it got so expensive for insurance carriers they quit covering it unless it’s caused by another incident that’s already usually covered (like a busted pipe or smashed-in roof).

Home and auto insurance aren’t just about low rates—they’re about the right coverage level. Talk to a trusted pro who can help you get both.

So, when does homeowners insurance cover mold currently? Nowadays, who pays for mold remediation (you or the insurance company) depends on your personal policy, who your carrier is, and the kind of damage you have.

Regardless of who’s footing the bill, you should never live with a mold infestation in your house. Toxic molds can cause health problems ranging from mild allergies to central nervous system and liver damage.1

Because it’s caused by so many different factors and takes time to develop, mold damage is tricky. The line between what’s covered and what’s not can be pretty fuzzy—like mold—so let’s take a look at incidents where mold might be covered and where it probably won’t.

When Homeowners Insurance Will Cover Mold

Your homeowners insurance is most likely to cover mold damage if it’s discovered after a leak caused by an accident (storm, washing machine pipes burst, etc.) that resulted in unseen damage and moisture. Remember, that’s not a guarantee it’ll be covered—so check with your policy and your insurance company.

So say that black mold behind the kitchen sink we talked about earlier developed because your dishwasher hose burst and flooded behind the cabinetry. If you found the mold and reported it immediately, it might be covered.

Timing is a big deal when it comes to mold. Generally, the more sudden the mold damage is (as in, caused by a one-time incident rather than a slow leak or decay), the more likely insurance will pay out.

When Homeowners Insurance Won’t Cover Mold

Unfortunately, the list of what’s not covered is a lot longer than the list of what is covered. The origin of mold in a home can be pretty dang mysterious—especially since it often takes a long time to discover it’s even there.

But your claim will probably be denied if the mold damage relates to any of these:

Wear and tear: This would include mold from environmental moisture—like that wall in the basement of your split-level mountain house that’s covered in green and black splotches because it’s in constant contact with the cold, wet mountain.

Long-standing leaks that went unrepaired: If you ignore regular house maintenance and that leads to mold, your insurance company won’t be very sympathetic.

Water/moisture introduced during construction: As your home was built, it was likely exposed to rain or other damp weather. If you then discover mold six months or so after you move in, you won’t be covered.

Poor repairs: Maybe you had a leak and repaired it yourself or got a professional to do it, but it wasn’t done properly and mold grew. Sadly, your insurance company will not pay out for this.

Let’s go back to the black mold behind the kitchen sink. This time, it was caused because your sink drainpipe had a slow leak and you didn’t find it for weeks. In this scenario, the mold is definitely not covered by your typical homeowners insurance policy.

How Do You Know When There’s Mold in Your Home?

If you’re one of those people who don’t like the word moist, buckle up.

People are slowly becoming more aware of the dangers of living with mold in their homes, but many still aren’t familiar with why it forms or even where to check for it.

Mold is a pretty easygoing tenant. It loves to grow in cold, moist conditions—but it doesn’t mind warm, moist conditions either. If you keep your home’s humidity above 50%, mold is more likely to grow. Bathrooms, kitchens (especially around the sink or under a fridge if it’s leaking), garages, and basements (including the bottom story of split-levels) are common places to find mold.

Sometimes mold is obvious: a black, white and/or green growth on a surface (this could be a wall, floor, or even fabric like curtains or upholstery!). If you see this, you definitely have an issue. But mold can also be sneaky, growing in dark places that aren’t exposed to open air.

If you see any signs of water damage, there’s a good chance mold’s growing. Look out for water stains on ceilings, warped flooring and woodwork, and soft drywall.

Check your furnishings too. Mold will grow on curtains, upholstery and even leather. If you’ve got fungus on your furniture, you’ve probably got even more in the structure of your house.

Another tell-tale sign of a mold problem is a dank, musty smell. If you go into a room and it smells different than the rest of the house (and not in a good way), you should probably check it out.

Keep these signs in mind when you’re searching for a house to buy as well. The last thing anybody wants is to buy a house with a mold problem.

If you suspect you have mold in the walls, you can try smelling the electrical sockets to see if they smell moldy. Just make sure you explain what you’re doing to your spouse so they don’t commit you to an asylum. Also, be careful—if you have a mold allergy or other mold-related health issues, you shouldn’t go sniffing around for mold.

You can also buy mold testing kits online. Or a more expensive—and more reliable—method is hiring a mold remediator to come test your house.

Seeing mold isn’t the only way to tell if it’s in your house. Pay attention to how you feel! If you keep getting sick, have a persistent cough or cold or allergy symptoms, are tired for no reason, have brain fog or fungal problems, that’s a good sign you’re living in a moldy situation.

What to Do if You Find Mold in Your House

Mold—especially black mold—is extremely toxic and should be remediated as soon as possible. But you’ll need to take certain steps in the right order to keep the insurance company from turning down your claim.

Review your policy. Look over the terms of your policy and see if it says anything about mold or if there’s any way the mold you’ve found relates to a covered incident.

Make a claim. If you find mold in your house and you believe it’s from an accident (not a long-standing issue that’s been growing over time), contact your insurer immediately. You’ll need to convince them the mold is a recent issue and you reported it as soon as you realized there was a problem.

The worst they can say is no. Although you don’t want to rack up a history of pointless insurance claims, you also want to benefit from the coverage you’ve been paying for. So, go ahead and make a mold claim if you think you should be covered.

Advocate for yourself. Because mold is such a grey area when it comes to insurance, be ready to fight for coverage. The truth is, insurance companies often deny claims without doing their due diligence.

For instance, say your washing machine drain bursts and floods the wood flooring in the kitchen and living room. You do your best to dry it out, but several weeks later you start smelling something funky. You file a claim with your carrier, but they deny it saying your wood floors are old and already had mold in them from wear and tear.

This is a case where you should keep fighting to get the insurance company to live up to their end of the bargain. Bottom line: If you think you should be covered, keep calling and emailing.

Prevent further damage. Don’t start any remediation or repairs but do make sure to stop any further damage by fixing water leaks and protecting surfaces from exposure to more moisture.

Provide evidence. Take photos and document what you found, where, and what it looks like caused it. You also can try bringing in an independent expert to verify the cause of the mold.

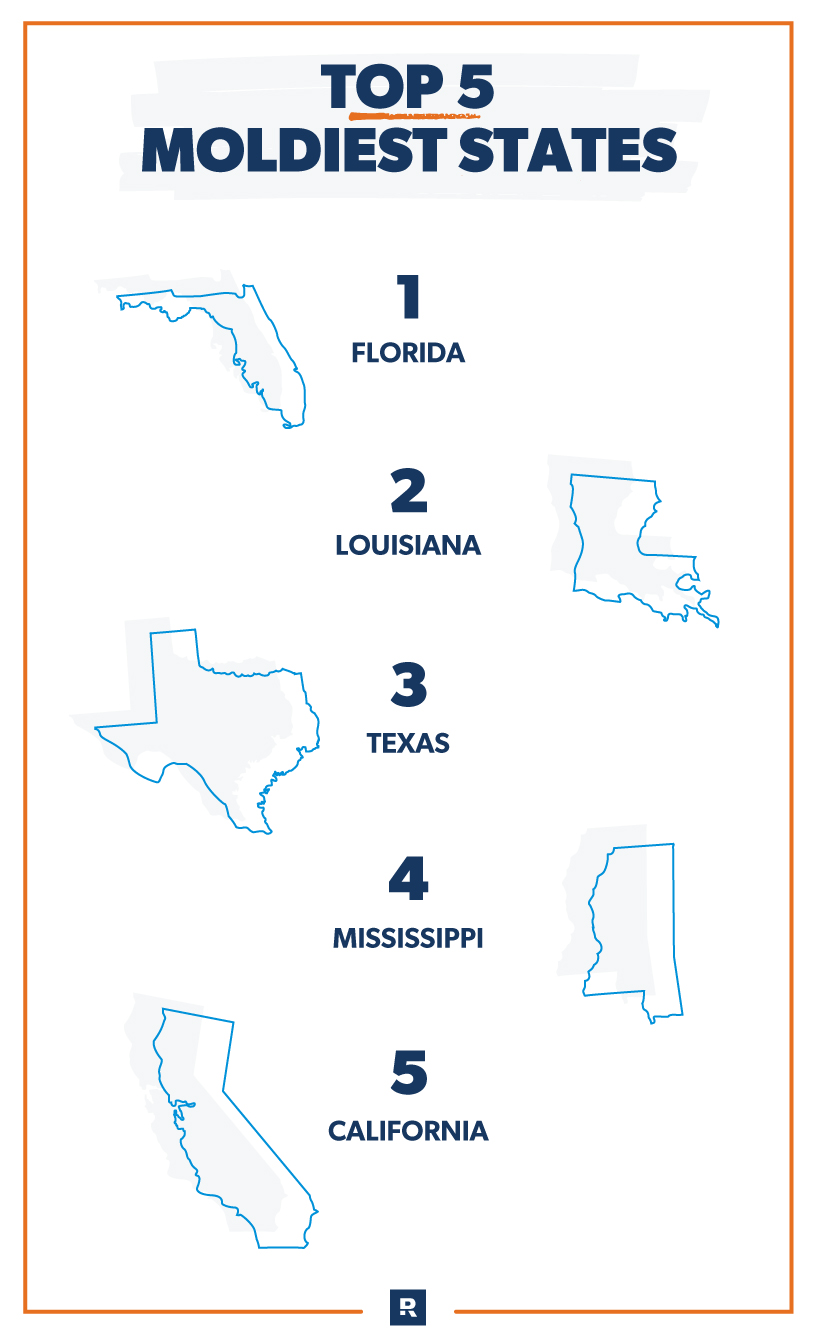

Moldiest States to Live In

It’s probably not surprising to find out some states have more mold problems than others. Wondering where your state falls? Let’s find out. 2

Florida

Today’s forecast is hot and muggy with a 100% chance of afternoon thunderstorms. Yeah, it’s not a big surprise that Florida tops the list. With relative humidity rising above 90% in the summer and frequent tropical storms, Florida is a great place for mold to live.

Louisiana

Another swampy, sticky state, the Bayou State also sees its fair share of tropical storms (and mold).

Texas

If you think you’re seeing a pattern here—you are. Situated on the gulf, the Lone Star State is also another hot ’n’ humid one.

Mississippi

Again, moist and warm (yes, we went there). Mississippi has America’s mightiest river, moss-drenched estates, Elvis’s birthplace and lots of mold.

California

One of these five is not like the others. That’s right. Sunny, dry Cali is number five. While it’s known for an arid climate, the Golden State does get a lot of precipitation, and homes there are often built without a central HVAC system.

One of the reasons California’s problem is so bad is because people don’t expect mold to grow in their homes. They’re not on the lookout for it, and don’t always take steps to prevent it.

How Do You Prevent Mold Growth?

Maybe your house just flooded and now you’re worried it’ll soon be moldier than two-week-old bread. Or maybe you just haven’t ever thought about the threat mold poses before. Either way, there are some solid things you can do to help keep mold growth at bay.

Manage Humidity

Flooding and water damage are obvious mold concerns. But certain molds thrive when the humidity in a house is simply above 50%. Here are some ways you can keep your house dry so mold is less likely to set up shop.

If you’re dealing with a critical moisture issue like a flood, you need to dry the area thoroughly as quickly as possible. Here are a few ways to do that:

- Use fans.

- Turn the AC down or the heat up depending on the amount of moisture in the air.

- Call in a professional water drying service.

Mold can start growing within 24–48 hours of water exposure.3 If you experience flooding or a burst pipe or any incident that causes water damage and moisture, it’s a good idea to get your home tested for mold within six months after the incident. Many insurance carriers only allow you to file a claim within that six-month window.

If you have a chronic or ongoing moisture issue, you’ve got a few options for dealing with it:

- Increase ventilation by installing exhaust fans in bathrooms and in the kitchen.

- Turn the AC down to remove moisture from the air.

- Use a dehumidifier and make sure you clean it regularly or it will become the mold problem.

- Buy an inexpensive indoor humidity reader.

- Keep the windows closed when it’s humid outside.

- In winter, check windowsills and sashes for condensation that could lead to mold.

Kill Spores

Install an ultraviolet light (aka blue light) inside your HVAC system to kill mold spores as well as germs and other bacteria.

Stay on Top of Maintenance

Keep a close eye on anything that could leak, like your washing machine, dishwasher, refrigerator (ice maker line), plumbing under the sinks, the AC, etc. Water damage happens quickly and mold loves to grow in dark, unventilated areas, which, hey, most of these spaces are.

Outside, add drainage in any areas near the house that tend to stay wet—and especially any areas of standing water against the house.

What to Do if Insurance Won’t Cover It

If you’ve given it your best shot and your insurance carrier won’t budge on your claim, you’ll have to take care of the mold yourself.

If you can afford it, a mold remediation specialist is the easiest and safest way to go. But they’re usually very expensive—we’ll get into the details in a minute.

If your budget can’t handle a mold specialist and the problem area is less than 10 square feet, you might be able to take care of it yourself.4

Here are some guidelines from the Environmental Protection Agency (EPA) for cleaning up mold:

Protect yourself. Wear a properly fitted mask that filters out mold spores and wear gloves that reach your elbows. Also, evacuate the space until the mold is removed.5

Stop the moisture. You’ll never get rid of the mold if you don’t fix the moisture problem. Fix the leak, bring the humidity down with a dehumidifier or the AC—whatever you need to do to dry things out.6

Remove all the mold. Getting most of it isn’t enough—it’ll just grow back. If mold is growing on a porous surface (like drywall or wood) you’ll need to remove all the damaged material. If it’s a hard surface, like tile, you can probably clean it with a mold-killing solution. (Be wary of bleach—it removes the mold’s color, but doesn’t always kill it or remove it.)7

Don’t paint over mold. Painting over mold doesn’t get rid of it—and your paint will probably peel in a little while.8

Research. Mold as a serious issue in homes is still a fairly new thing. More and better ways of dealing with it pop up online all the time. Dig a little if you need help with a particular situation.

How Much Does Professional Mold Remediation and Removal Cost?

So you’ve peeled back the layers and you definitely have a mold problem. Or maybe you haven’t pulled anything apart, you just smell it and need someone to assess it. How much is this going to cost you?

Professional mold remediation is expensive for several reasons. The pros use specialized equipment to first, figure out how far the mold problem has spread, and then contain any airborne spores to keep the problem from spreading even more as it’s cleaned up.

If the surfaces can’t be cleaned, the remediation team will remove and replace those materials—again, focusing on keeping the air clean. That takes skilled and experienced pros to make sure the job is done right.

Let’s take a look at the process.

Assessing the Problem

Professionals will come evaluate your problem, sometimes testing and pulling apart areas that need further investigation.

Some companies combine the assessment and cleanup job into one price package. Others charge for those separately. If you’re just getting an assessment done, it could run anywhere from $450 to $800.

Size

Per square foot, the national average price for professional mold remediation is somewhere between $10–30. The total average range is $1,500–9,000.9 About 60% of the cost goes toward labor while the remaining 40% is materials.

Keep in mind though, when you’re trying to figure out how much your remediation might cost, you can’t base it on the square footage of your home. Mold often lives in the walls and ceilings too, so you have to count those square feet as well. For really big jobs, some companies charge a per room rate.

Location

You could end up paying more depending on where in your house the mold has decided to set up shop (like underneath your shower or on your vinyl siding). For instance, mold cleanup on a vent is pretty cheap. But if the black stuff has settled in the walls, it’s a lot more.

Material

Material

The material mold is growing on is another cost factor. Scrubbing mold off of tile is fairly easy because the tile won’t need to be torn out and replaced. If you’ve got mold growing under your bathtub though, that’s a much bigger project, and often involves replacing drywall and other porous materials.

Type of Mold

Bet you didn’t see that coming. But yep, even the type of mold you have growing impacts the price tag. Some molds are easier to remove and less toxic than others. Chaetomium is one of the cheapest molds to remove, while black mold is pricier.

If you’re paying on your own, always get estimates from multiple companies. And make sure you’re clear about their procedures because they can vary from company to company. If your insurance company is footing all or part of the bill, they may have specific companies you’ll have to work with.

How Do You File a Homeowners Insurance Claim for Mold?

Filing an insurance claim for mold damage is the same process as any other insurance claim. But because it’s mold, you’ll need to keep a few extra things in mind:

- Double-check your insurance policy to make sure you have direct mold coverage or your mold issue was caused by a covered incident (fire, storm, etc.).

- Get ready for pushback (insurers don’t like paying out for mold).

- Let your insurer know immediately if you find mold after a covered incident.

- Document and take photos of everything.

It’s worth mentioning again: For those without mold-specific insurance, some companies won’t cover a claim on mold after six months of the covered incident that caused it. So, if you have a covered, water-related incident, get your home tested for mold within six months.

Insurance Can Be Confusing. We Have Someone Who Can Help.

RamseyTrusted® insurance pros are independent and vetted—and they help you fill the gaps in your policies. They make getting insurance (like home, auto and umbrella) one less thing to stress about. Plug in your zip code to connect with an agent who understands the coverage needs in your area.

How Much Will Insurance Cover for Mold?

Even if your claim is successful and your carrier agrees to pay for remediation, you still may have to pay some out of your own pocket in addition to your deductible. Most insurers cap how much they’ll pay for mold damage in a standard policy. If you have mold-specific insurance, the cap will probably be higher.

Caps vary between companies, but range somewhere between $1,000–10,000. As we saw above, a big remediation job can come in as high as $30,000, so you could easily be footing a hefty bill even if you have insurance coverage.

It’s important to remember, though, that a half-baked remediation job won’t get you anywhere. If you leave any mold, it will just grow and spread and ruin what you did fix. So only fixing the problem as far as insurance will cover it isn’t a good idea.

Additional Coverage for Mold Damage

If you’re worried about mold issues in your home down the road, the good news is you can buy mold-specific coverage, making the question, Does homeowners insurance cover mold? a nonissue. Insurance for expensive homes sometimes comes with mold coverage automatically. If you don’t own a luxury home but still want mold insurance coverage, you can often purchase it through a rider.

Do I need mold insurance coverage?

Whether you need mold coverage or not depends a lot on where you live and what your house is made of.

If you live in a damp place like Quillayute, Washington, where it rains an average of 207 days per year, you might be thinking, I need insurance that covers mold no matter what caused it. And you’d probably be right.

Keep in mind, adding a rider to your existing policy will increase your premiums, but it might be worth it for you folks in the Gulf Coast and other damp regions.

On the other hand, if you live in the Mojave Desert in Nevada, you probably would be just fine with whatever mold coverage your homeowners insurance already offers.

If your house is made of wood, is a split-level house, has a basement, is situated in a dense forest or has poor ventilation, you might check into getting a mold rider. Wood is prone to rot and easily grows mold with just a little moisture. Walls against the ground often remain wet. If your house never sees the sun, it will tend to grow mold on the outside and possibly the inside too. Without proper ventilation or climate control like an HVAC system, moisture will build up inside and make the perfect environment for mold to grow in.

It can be tricky figuring out how much homeowners insurance coverage you need, but the independent agents at Zander Insurance can help you figure it out—just like they did for Lorraine W. from the Ramsey Baby Steps Community on Facebook.

“Zander took all my info and gave me three different options,” she said. “We went over the differences (it was the first time I was doing this solo). I ended up with a better rate than previously and couldn’t be happier. I didn’t go with the cheapest option they offered but have been very happy with the coverage I got and the price I’m paying.”

If you think you need a mold rider, check with your insurance company to see if they offer it. If you’re not sure you need mold coverage, try talking to an independent insurance agent. They can help you figure it out. And because they work for you rather than a specific insurance company, they can find you the best mold coverage insurance for the best price.

Talk to a RamseyTrusted insurance pro today!

Interested in learning more about homeowners insurance?

Sign up to receive helpful guidance and tools.

Frequently Asked Questions

-

How fast can mold grow?

-

According to the Federal Emergency Management Agency (FEMA), mold can start growing within 24–48 hours of water damage.10 That’s why it’s super important to dry out any part of your home that’s been exposed to water ASAP.

-

Does bleach kill mold?

-

Bleach is not reliable as an effective mold killer. For decades, bleach manufacturers claimed bleach killed mold, but many experts agree now it’s not a good choice.11 The reality is bleach is only somewhat effective if the mold is on a hard surface like tile. For mold on porous surfaces like wood, bleach does nothing because it can’t penetrate and kill the mold roots deep inside.12 Instead, it will simply make the appearance of mold fade because it’s, well, bleach.

-

Can you clean mold damage yourself?

-

It’s possible to clean up mold yourself, but the EPA recommends only attempting this if the damaged area is less than 10 square feet. Anything bigger requires the resources and expertise of a professional.

If you attempt a cleanup yourself, make sure you protect yourself by wearing gloves and a respirator mask, containing the site so mold spores don’t spread to other parts of the house, and being very thorough in your removal.

-

Is it okay to paint over mold?

-

No! It’s never okay to paint over mold. Covering mold growth with a coat of Yarmouth Blue won’t solve anything. The toxins are still there (and still growing) and your expensive paint will just peel right off in a few months.

Some mold, like black mold, stains whatever it’s been on. In this case, you may paint over the remaining stain, but only after you’ve killed the mold and cleaned the surface as well as you can.

-

What should I do if my landlord won’t take care of mold?

-

Maybe you live in a rental house, and you’ve discovered mold. You’ve notified your landlord, but they’re unresponsive or said it’s not a real problem. What you can expect depends on the laws in your state, but here are a few things to try:

- Write a letter requesting the repairs and keep records.

- If your state offers protection for renters in moldy living conditions, reach out to your state and show them your records.

- If your state doesn’t offer any protection, look at your local codes and ordinances to see if you can force the landlord to take action through those. Some local rules require landlords to fix things like sagging roofs and ceilings, leaking pipes, etc. This will at least fix the problem causing mold. Then you can clean it up and know it won’t come back.

- If none of these things work, try filing a complaint with your state’s consumer affairs division.

- Hire a lawyer and file a lawsuit. This is a last resort, but sometimes it’s the only way to hold a landlord accountable in a state with few laws.

- Move out. If you can’t resolve the mold problem, you should find a new place to live. Constant exposure to mold can lead to serious health issues! If you need help finding a safe place to live, a RamseyTrusted real estate pro can help you find a new home.