Key Takeaways

- Buy a house now only if you’re financially ready.

- Wait to buy until you’re debt-free and have a full emergency fund and a strong down payment saved.

- Mortgage rates may dip slightly through late 2025, but big drops aren’t expected.

Whether you got it from the news, your favorite social media platform, or that one friend who’s a self-proclaimed real estate expert, chances are you’ve heard that mortgage interest rates and home prices are pretty high these days—which is 100% true.

Find expert agents to help you buy or sell a home.

If you’ve been thinking about buying a house or working to save up a down payment, then that news has probably left you with an important question: Should I buy a house now or wait?

To answer that question—and so you can make the best decision for you and your family—let’s look at whether now is a good time for you to buy, or whether you should punt that decision down the road.

Is It a Good Time to Buy a House?

Yes, it is! (Technically.) But really, whether it’s a good time for you to buy a house depends more on your personal finances than on the housing market. Here’s a breakdown of when you should wait to buy a house and when you should pull the trigger:

When to Wait

You should wait to buy a house if you aren’t financially prepared for homeownership. No matter what the housing market is doing, buying a house is a bad idea if you don’t have your ducks in a row.

Specifically, you should wait on buying a house if . . .

- You have existing debt. Focus on paying off all your consumer debt before you buy a house. Getting rid of student loans, credit card payments and car notes will give you more margin in your budget—and that’s super important as a homeowner.

- You don’t have a full emergency fund. Saving up an emergency fund of 3–6 months of your typical expenses before you buy a house will make a broken HVAC unit, fridge or washing machine merely an inconvenience instead of a catastrophe.

- You haven’t saved a strong down payment. If you’re a first-time home buyer, you need a down payment of at least 5–10%. But if you can swing a 20% down payment, that’s even better. Why? Putting 20% down will keep you from having to pay for private mortgage insurance (PMI), an extra monthly fee that could add hundreds to your house payment.

- You can’t afford the house payment. Don’t buy a house if the monthly payment (including principal, interest, taxes, homeowners insurance and HOA fees) on a 15-year fixed-rate mortgage would be more than 25% of your take-home pay. Any more than that, and you run the risk of not having enough money left in your budget each month to put toward other important financial goals—in other words, you’ll be house poor.

We know how badly you want to be a homeowner and to start building equity. But if one or more of those statements apply to you, that’s where you should direct your focus for now. Every day, we talk to folks who bought a house before taking those steps and wound up regretting it because they got stuck with a giant, expensive burden.

We want your home to be a blessing.

When to Buy

If you have checked all those boxes, then you’re ready to hire a real estate agent and get to buying! You may be tempted to wait around for a better interest rate or more affordable home prices, but that’s not a good idea for a couple of reasons.

For starters, experts believe home prices will continue to rise for the next three years (at least).1 So, if you wait to buy when home prices go up, you’ll be stuck with higher prices. But if you buy now and interest rates happen to drop over the next year or two, you can still take advantage of the lower rates by refinancing your mortgage. Think of it this way: You date the interest rate but marry the house.

Overall, you never want to decide whether to buy a house purely based on what the market is doing. If you’re in good shape with your money, there’s no reason to wait.

Will Mortgage Rates Go Down in 2025?

Yes, it’s likely mortgage rates will dip a little more in 2025. But don’t expect a big drop. Why not? The Federal Reserve (aka the Fed) has projected only minor changes to the federal funds rate, which—while not directly tied to mortgage rates—still plays a big role in how they move.

In September, the Fed made its first cut of the year, lowering the federal funds target rate by a modest 0.25 percentage points to 4.00–4.25%.2 Their latest projections show the rate ending 2025 around 3.6%.3 Because the Fed typically cuts the rate by 0.25 percentage points at a time, that implies two more rate cuts could be coming. Keep in mind: 3.6% doesn’t mean mortgage rates will go that low. Mortgage rates are usually 1–3% above the federal funds rate.

Mortgage lenders had already begun trimming rates in anticipation of the September cut—so it’s likely that pattern will continue as we close out the year. Still, mortgage rates can rise or fall even if the Fed does nothing at all since other factors like the bond market also influence lenders. That’s why no one can predict what mortgage rates will do with 100% accuracy. So be careful not to base your home-buying decision only on rates.

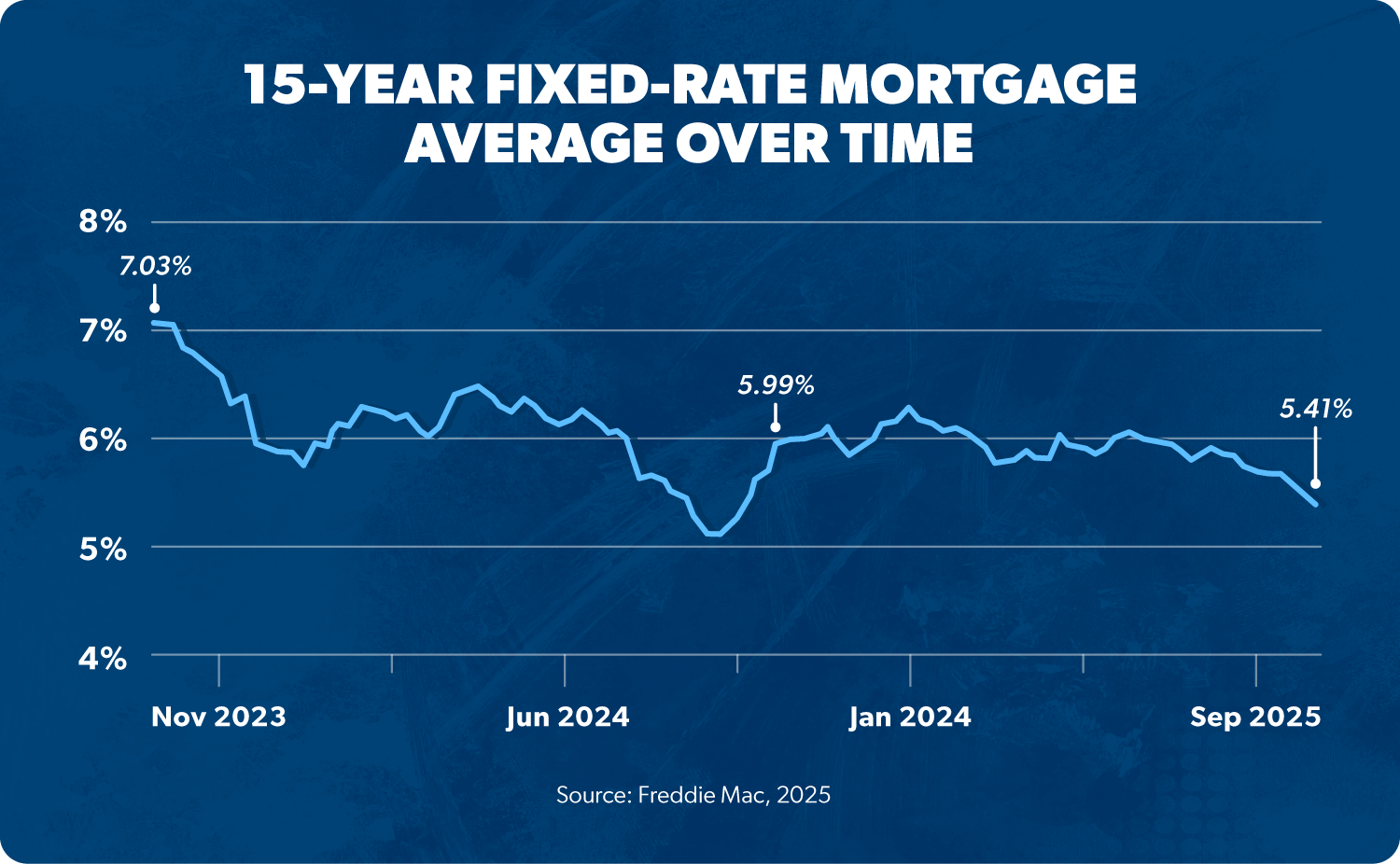

Even a small dip is a welcome change from the highs of 2023. Back then, the typical 15-year fixed-rate mortgage dropped from 7.03% in October 2023 to 5.99% in October 2024—a sweet relief for buyers.4

Want to see how a lower rate could benefit your home-buying budget? Try our free Mortgage Calculator.

What Is the Federal Reserve?

The Federal Reserve is the U.S. central bank that creates money and sets interest rates. Its main goal is to keep the economy running smoothly by having low unemployment and low inflation.

Think of a mechanic who tinkers around with a car to make it purr like a kitten—that’s what the Fed is like. And one of its favorite tools is interest rates.

Why Does the Fed Raise Interest Rates?

The Fed raises interest rates to encourage people to borrow less, spend less and save more—which should slow down inflation. But remember, the Fed doesn’t directly set mortgage rates. They control only the federal funds target rate (the interest rate banks charge each other for overnight loans), which then indirectly influences most other interest rates, including those on loans and mortgages.

The Bottom Line

No one likes high interest rates, but they’re not the end of the world. This is still a great time to buy a house. It’s also a good time to sell a house.

While it’s always great to have a lower interest rate on your mortgage, that doesn’t mean you have to wait years to buy or sell a house—or to refinance if your current loan just isn’t working for you. You get to decide when to buy a house based on what’s right for you and your family—not the Fed.

Next Steps

1. Take our free quiz to see whether you’re ready to buy a house.

2. Follow the advice from your quiz results to get organized and prepared to buy.

3. Connect with our friends at Churchill Mortgage to get a mortgage that fits your budget.

Frequently Asked Questions

-

Is 2025 a good time to buy a house?

-

Even though interest rates are still high, it’s a great time to buy a house. The higher interest rates have priced some buyers out of the market, which means you could face less competition when you make offers. Plus, if interest rates do eventually go down significantly, you can always refinance to get the lower rate.

-

Will my mortgage payment go up if rates increase?

-

Mortgage rate increases will only affect your mortgage payment if you have a HELOC or an adjustable-rate mortgage. The payment on a fixed-rate mortgage won’t change.

-

Should I lock in my mortgage now?

-

If you’re debt-free, have a fully funded emergency fund with 3–6 months of your typical expenses, and can put at least 20% down on a home (or 5–10% if you’re a first-time home buyer), you should lock in your mortgage rate now. One reason not to wait is because, in an average market, home prices increase year over year. And you can always refinance your mortgage down the road if rates drop.

Did you find this article helpful? Share it!

We Hear You!

We’re considering adding the ability to save articles to your Ramsey account.