How Much Does Flood Insurance Cost? 2022 Average Rates

6 Min Read | Mar 11, 2025

We all do it. No matter what we’re shopping for, we look at the price first, and then look at the details. We’re looking for that sweet spot between a good price and good quality.

The same is true for flood insurance. You want the right coverage at the right price—because the last thing you want when you’re dealing with property damaged from a flood is to find out your coverage falls short. To help you find that sweet spot, we’ll go over the average cost of flood insurance in your state, how to understand the factors that affect your flood insurance premiums, and the cost differences between FEMA and private flood insurance.

- Average Cost of Flood Insurance by State

- Factors That Affect Flood Insurance Costs

- FEMA vs. Private Flood Insurance Costs

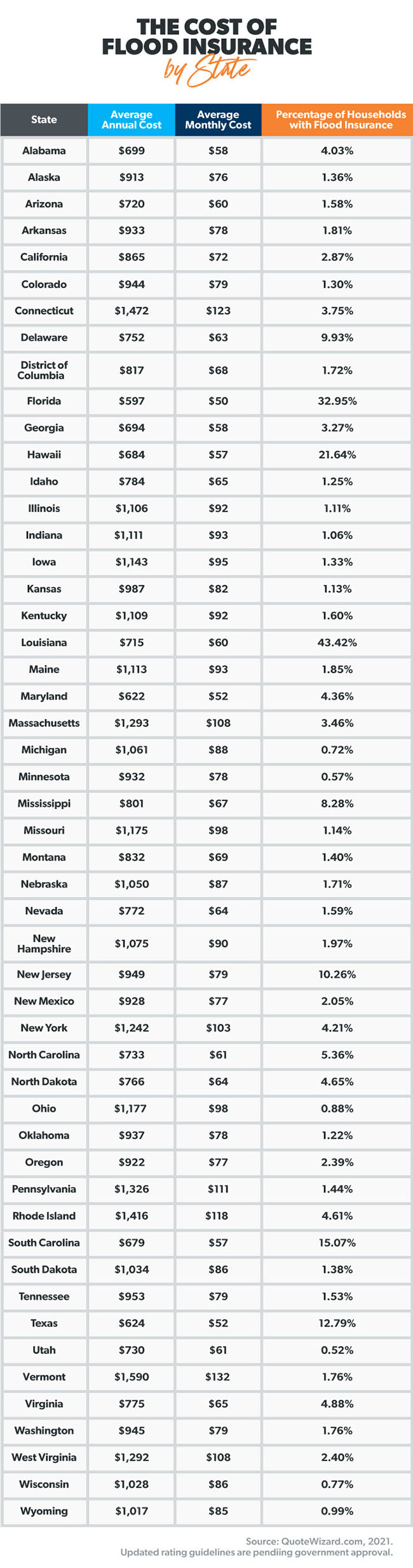

Average Cost of Flood Insurance by State

To add to everything else we have on our worry list these days, news footage of flood damage has become a regular part of newscasts across the country. Getting flood insurance isn’t just a low-priority task anymore that keeps sliding down to-do lists. It’s super important now for smart property owners (and renters) to do their homework on flood insurance, especially cost.

Home and auto insurance aren’t just about low rates—they’re about the right coverage level. Talk to a trusted pro who can help you get both.

Flood insurance rates vary widely from state to state. And several factors (some you can control) influence individual premiums. But before we get into the causes of price differences, let’s look at the average cost per state.

One of the most important things to remember about flood insurance is that homeowners and renters insurance do not cover flood damage. You must purchase flood insurance separately.

As we mentioned above, the price you pay might vary from your state’s average. Let’s go over the different causes that can affect your rate.

Factors That Affect Flood Insurance Costs

According to FEMA, government programs and private companies look at these critical factors to figure out their flood insurance rates:

- Flood risk

- Location

- Age

- Construction

- Coverage

- Flood Insurance Rate Maps (FIRMs)

- Risk Rating 2.0

- Deductible

We’ll go over each one.

Flood Risk. First, the biggest factor that determines flood insurance cost is the historical risk of flooding in your area. If your home is in an area that has experienced flooding in the past, the more your flood insurance is likely to cost. That’s because premiums are primarily based on risk, and insurance companies charge higher premiums to compensate for risk. To learn more about flood risk in your area, you can check out FEMA’s flood maps.

Location. The specific location of your home within a floodplain also plays an important role in determining cost. Floodplains are in areas next to rivers and creeks that overflow because of heavy rain. Unless your home is built on a hill or other elevation, the closer you are to a floodplain, the higher your flood insurance premium will be.

Age. Flood insurance providers also base your premium on the age of your home. Older homes can be more prone to flood damage because of their structure or building materials. Insurance companies consider this a big risk and—no surprise—they raise premium costs accordingly.

Construction. Some modern construction materials like bricks and concrete are more flood-resistant and help protect newer homes from damage caused by floods. Also, new construction in flood zones often includes a floodwall (permanent barrier) around the structure to prevent floodwaters from reaching it. Flood insurance providers pay close attention to features like this when they’re determining your policy premium.

Coverage. Here’s the truth. The more flood damage coverage you request, the higher your premium will be. If your home is worth more than $500,000, is filled with expensive antique furniture and you’re in a high-risk area, your premium will likely be on the high side. But if your home is new construction and is valued at $250,000, your premium cost could be minimal.

FIRMs. FEMA creates Flood Insurance Rate Maps (FIRMs) for each community across the United States. FIRMs are used by government programs and private insurance brokers to determine flood insurance rates. Every FIRM shows the zones FEMA has designated as an official flood area, including the potential severity of the type of flooding in that area.

Risk Rating 2.0. FEMA is updating the National Flood Insurance Program (NFIP) with rates that are more in line with current trends. One of the goals of Risk Rating 2.0 is to reduce the difference between flood-insurance costs for lower- and higher-valued homes. Starting in October 2021, new policies and policies that are eligible for renewal will be based on the new rating guidelines.

Deductible. A deductible is the amount you must pay when you file a claim before your insurance coverages kicks in. The same math applies to a flood insurance deductible as it does to all insurance deductibles. The higher your deductible, the lower your premium.

Are You Protected With the Right Insurance?

Take the Coverage Checkup to get a personalized action plan that breaks down what to keep, add or nix so you can take control of your insurance with confidence.

FEMA vs. Private Flood Insurance Costs

Don’t assume that FEMA is your only choice for flood insurance. You have options! You can either get flood insurance through FEMA’s National Flood Insurance Program (NFIP) if your community participates in the program, or you can get flood insurance through a private insurer. Or both. We’ll break down what you need to know about the different costs between the two providers.

Typically, it’s cheaper to get private flood insurance than it is through the NFIP, but not always. One of the reasons private flood insurance tends to be cheaper is because their risk analysis is more sophisticated.

For example, a private insurer can potentially determine that your property is in a lower risk area—and therefore doesn’t require as much coverage—more quickly and more accurately than FEMA’s NFIP can.

Another reason private insurance can be cheaper than your NFIP options is the way its coverage is structured. Private flood insurance companies provide coverage for your building property and your personal property, while NFIP flood insurance requires you to buy these two coverages separately.

This difference affects cost because NFIP insurance requires you to pay your deductible twice—once for building coverage and once for personal property coverage when you file a claim. Paying two deductibles can add up quickly, especially if your policy carries the recommended high deductible.

Ask your local insurance agent to clarify the policy cost options of NFIP vs. private flood insurance.

Free Flood Preparedness Checklist

If you're ready to be prepared in case of a flood, here's a free checklist to help you stay on track.

Get the Best Flood Insurance Price

Anytime you make an investment as large as the one you’ve made in your home, it just makes sense to protect it. Flood damage can happen fast—and it’s expensive to repair. Before it creates a perfect storm in your life, be prepared with the right flood insurance.

We recommend talking to one of our RamseyTrusted pros who knows about flood insurance costs in your area. Be sure to ask about FEMA vs. private flood insurance rates. Find out how much you can save.