What Is Recoverable Depreciation in a Home Insurance Policy?

12 Min Read | May 1, 2025

Imagine you’re trying to cook risotto on your fancy stove to impress your date. But you let it boil over while you try to convince your neighbor to turn down the reggae so you can hear Frank Sinatra. Your whole stove bursts into flames.

While insurance might not cover the loss of your date, it will pay you $1,000 for the stove. But wait, a new stove costs $1,900! Well, hopefully you have insurance with recoverable depreciation, and you’ll get a second check to make up the difference.

If that sounds confusing, don’t worry. Insurance can feel more complicated than a risotto recipe. But we’ll go over it step by step so you can feel confident you’ve got the right homeowners insurance coverage.

What Is Recoverable Depreciation?

If you’re already dozing off, we get it. Recoverable depreciation sounds about as exciting as a saltine cracker. But you’ll be glad you know once you know. So, what is recoverable depreciation? Recoverable depreciation is the difference between the value of your property when you bought it and its value when it got destroyed. The “recoverable” part of that term refers to whether your insurance will pay the difference or not. So basically, recoverable depreciation is the loss in your stuff’s value you can get back if you have the right insurance.

Understanding Recoverable Depreciation

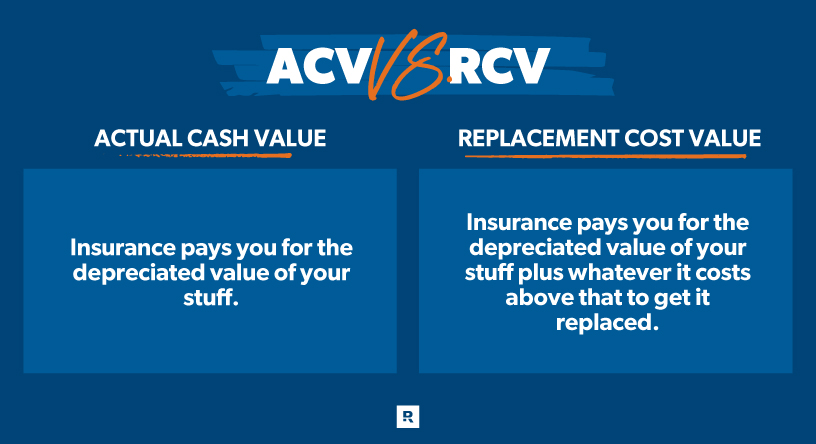

To understand recoverable depreciation, it helps to know what the different kinds of coverage are: replacement cost value (RCV) and actual cash value (ACV).

Home and auto insurance aren’t just about low rates—they’re about the right coverage level. Talk to a trusted pro who can help you get both.

If you have replacement cost value coverage (RCV), your insurance carrier will pay you enough to replace the loss—which means the depreciation is covered. You’ll get a check that equals what your damaged property was worth and then some more to cover what it costs to get a new one.

ACV coverage, on the other hand, only pays you what your property was worth right before it went kablooey.

Nonrecoverable Depreciation

If you have an ACV policy, your property will experience nonrecoverable depreciation. Like it sounds, this means when your property loses value, you won’t be able to get that value back through insurance if it gets destroyed. They’ll only pay you what your stove (or other property) was worth when it went up in smoke (aka the item’s loss in value over time is nonrecoverable).

How Is Recoverable Depreciation Calculated?

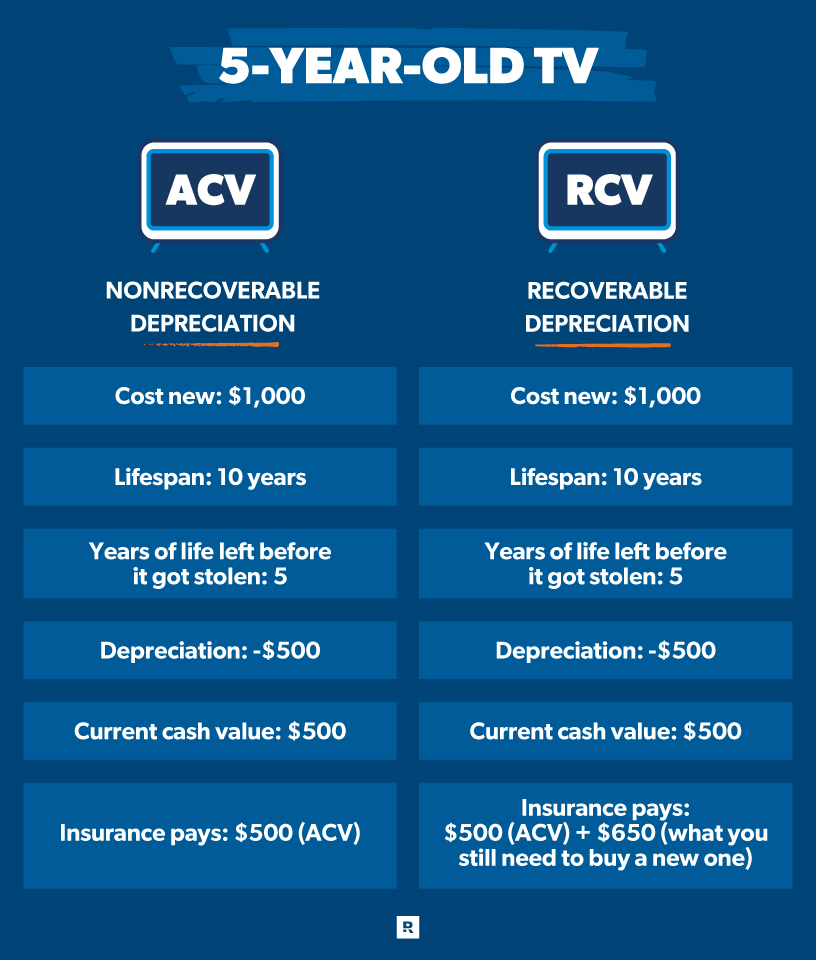

To figure out how much your stuff is worth after depreciation, insurance companies look at the lifespan of your item like the stove.

Say your stove is supposed to last 20 years and you’ve had it for five. The insurance company will take what it’s worth new ($1,900) and divide that by the years in its lifespan (20) to get a depreciation value for each year that passes ($95). So, if you’ve had the stove five years, it’s now worth $1,425, according to the insurance company. So much for “investing” in a quality stove!

Another factor insurance companies look at to determine depreciation is obsolescence. If better, badder models of your stove have been made since you bought yours, that’ll make your model worth less. But if no newer models have been released, that could make your stove’s value go up.

Actual Cash Value Repayment

That number ($1,425) we just calculated?—that’s the number you’ll see on your ACV check. Your insurance carrier will pay you out according to how much life is left in your item.

Recoverable Depreciation Payment

But if you have RCV, that means that depreciation is—recoverable! Which means you’ll be getting more moolah in the mail. Your carrier will cut you a check for $1,425 and for that $475 of depreciation your precious stove lost in the five years you used it. This is definitely a happier scenario!

How Insurance Pays for Recoverable Depreciation

Recoverable depreciation sounds like a fancy term—and it is—but it’s really just specific language used to talk about a particular part of RCV coverage—the part where you get paid for the replacement value rather than just the actual depreciated value.

Something you may not know about getting your stuff replaced through insurance is you’ll actually get two checks. Even though you have RCV, the first check will be the actual cash value of the thing (don’t panic—another one’s coming).

Generally, insurance companies pay out just enough to get you started replacing or repairing your stuff and wait for the final bill to come in so they don’t overpay (or underpay) you. So your second check will be the difference between the ACV of your stuff and what you paid to replace or repair it. This also helps prevent fraud when someone might bill insurance for the full cost then purchase a cheaper option to make a little money.

Recoverable Depreciation With a Deductible

If you have a deductible (you should!), that first check you get will actually be the ACV minus your deductible. So say your stove is worth $1,425 and your deductible is $500. That means your carrier will cut you a check for $925. Your second check will then be the difference between $1,425 and what you pay for a new stove. In other words, you’ll still be covering $500 worth of your new stove.

Insurance Can Be Confusing. We Have Someone Who Can Help.

RamseyTrusted® insurance pros are independent and vetted—and they help you fill the gaps in your policies. They make getting insurance (like home, auto and umbrella) one less thing to stress about. Plug in your zip code to connect with an agent who understands the coverage needs in your area.

How Recoverable Depreciation Affects a Home Insurance Claim

When it comes to your home insurance claim, recoverable depreciation won’t change too much. It’ll just involve a little more documentation on your part, and like we said above, you’ll get two checks instead of one.

How to File a Recoverable Depreciation Claim

Filing a claim if you have recoverable depreciation insurance involves an extra step to get your full payment. Let’s break it down:

After the kitchen fire, you’ll want to notify your insurance company and show them the stove damage. They’ll appraise what your stove (with depreciation) was worth before it went up in smoke and send you a check for that amount minus your deductible.

Next, you’ll go out and find a new stove. If you pick one that’s cheaper than the one you had, your insurance company will probably base your recoverable depreciation payment on that cheaper total rather than the value (when brand-new) of the original stove. So, if you want the most bang for your premium buck, go ahead and get a stove that’s as good as your original one.

Here's where the extra step comes in: Once you’ve bought your beautiful new stove (and before you get carried away making ratatouille), make sure to send invoices and receipts from the purchase to your insurance company to prove you bought it and how much you paid.

If everything checks out, your carrier will then send you a second check for the difference between the ACV (first check) and how much you paid for the new stove.

What Gets a Recoverable Depreciation Insurance Check?

You will be able to recover depreciation on anything that’s covered in an RCV policy. This means if your house is destroyed in a storm and you have replacement cost coverage, you’ll get a second check covering depreciation for everything.

This could include:

- Appliances (washer/dryer, fridge, the three toasters you got for your wedding, etc.)

- Electronics (TV, computers, cameras, etc.)

- Furniture (we don’t need to list these)

- Clothes (some of you may be hoping your husband’s clothes blow away)

- House structure

Recoverable Depreciation for Roof Replacements

So far, we’ve been talking about recoverable depreciation in reference to stoves because it’s a fun story. But the most common big-ticket item you’ll run into this issue with is your roof.

For most people, their roof is the single biggest item they own that depreciates when it comes to home insurance. While a lot of factors change the price, on average, a whole new roof in the U.S. costs $10,000.1

If the heavens open and bestow the gift of hail upon your 15-year-old average roof, pummeling it unto destruction, you’ll be getting comfy cozy with recoverable depreciation—or not, depending on whether you have RCV or ACV coverage.

But let’s say you do have RCV coverage. First, your insurer will calculate the depreciation on your roof. Most asphalt shingle roofs last 20 years. You’ve had yours for 15, which means it had five years of life left in it. So, according to your carrier, your roof was worth $2,500. That means your carrier will send you a check for two and a half grand to start with.

After you’ve paid for the new roof, you’ll send them all the invoices and receipts and they’ll pay you the difference ($7,500). Now you’re cooking with gas!—oh wait, this is a roof not a stove. . . . Now you’re covered!

It’s probably pretty obvious by now what will happen if you don’t have RCV coverage and only ACV. You’ll get $2,500 and a sayonara.

Recoverable Depreciation Time Limit

Stuck between the matte graphite or blue finish for your stove? Just know you can’t wait forever to make your claim on recovering depreciation. Don’t get bogged down while trying to find the perfect replacement or figuring out repairs for so long that you go past your insurance company’s time limit. That’s right, there’s a time limit on how long you can wait before claiming recoverable depreciation.

While it differs by state, the window is generally 180 days or six months but can be up to two years from the date your stuff got destroyed.

How Do You Fight Insurance Depreciation?

Sometimes what an insurer pays out just doesn’t seem fair. Maybe you think they depreciated your stuff too much. If that’s the case, you can fight it—just be prepared to offer evidence for why your stuff is worth more than they say it is.

Before you kick up any fuss though, make sure you read through your insurance policy carefully. It could be that you missed something in there that means the insurance company is actually right—like maybe you only have ACV coverage when you thought you had RCV, or there’s a deadline for filing that you missed, or something else.

If after reading your policy you still think your carrier is underpaying you, talk with the insurance adjuster who valued your stuff. Make sure they (and you) understand the situation and have all the details.

Your next step if that doesn’t work is to file a complaint with the insurance company and ask for a review. Finally, if all else fails, you can file a complaint against your insurance company with your state’s insurance department.

How Do You Negotiate a Diminished Value Claim?

So far, we’ve been talking about recoverable depreciation in terms of home insurance. But there’s a similar issue called diminished value with cars and your auto insurance.

If your car gets smashed up in an accident, even after you get the repairs done, it’s worth less. You’ve probably seen this in real life when you went to buy a car (you see a car going for a great price and find out it’s been in two accidents).

Insurance will of course pay for your car repairs, but sometimes they’ll also pay for the diminished value of your car. So if your car was worth $10,000 before the accident and now is worth $8,000, they’ll pay you $2,000!

How this works is different in every state, but usually you can’t have been at fault and you have to provide proof your car lost value.2 One way to do this is to get an appraisal from a certified vehicle appraiser.

Do I Need Recoverable Depreciation Insurance?

Yes, it’s more expensive, but if you can afford it, buying recoverable depreciation insurance or RCV coverage is a really good idea. Think about it: If your home went up in flames and your insurance provider only paid you the ACV of what it and everything inside is worth, would you have enough to cover the rest and put your life back together?

In most cases, the answer is no. And that’s okay. That’s the reason you should get insurance that will cover the cost to replace everything, including depreciation.

How to Find Home Insurance With Recoverable Depreciation

You now know you need it, but how do you get? Well, many insurance companies offer coverage for depreciation or RCV as an option. It’s going to be more expensive, but like we said before, it’s worth it. (It’s a verifiable fact that fancy stoves are the only way to impress a date.)

Just because it costs more, though, doesn’t mean you have to pay through the nose! Going through an independent insurance agent to get a recoverable depreciation policy can save you a stockpot-load of cash. Because they work for you rather than a particular insurance company, they’re motivated to get you the best deal around.

Don’t let a home calamity go from bad to worse. Protect your wallet from disasters like storms, floods and cooking.

Talk to a RamseyTrusted insurance pro about recoverable deprecation coverage. Connect with a RamseyTrusted pro today!

Interested in learning more about homeowners insurance?

Sign up to receive helpful guidance and tools.