You just moved into your beautiful new house in a brand-new neighborhood. It’s on the perfect spot: nestled in the hills with a creek nearby. And of course, you got a homeowners insurance policy ASAP, so you're fully protected.

But are you? What about that creek? And those hills? You haven’t seen the rainy season yet . . . If you’re wondering, Do I need flood insurance? you’re asking the right questions.

How Do You Know if You’re at Risk for a Flood?

Who’s Required to Have Flood Insurance?

Does Homeowners Insurance Cover Flooding?

What Does Flood Insurance Cover?

What Doesn’t Flood Insurance Cover?

How Much Does Flood Insurance Cost?

How Do You Know if You’re at Risk for a Flood?

There are some obvious locations that immediately pop into our heads when we think of floods, like land right by the ocean or near the banks of the Mississippi River. But many other places could easily see rising waters that threaten nearby homes.

Free Flood Preparedness Checklist

If you're ready to be prepared in case of a flood, here's a free checklist to help you stay on track.

One of those places is New England. That’s right, New England—the region known for vivid, crisp falls, big cities and quaint countryside villages is also pretty prone to flooding. They’re not the only ones though. The Gulf Coast and Midwest see their fair share, along with the mid-Atlantic, South and . . . well, you get the picture. No matter where you live, you should be asking the question, Do I need flood insurance?

Home and auto insurance aren’t just about low rates—they’re about the right coverage level. Talk to a trusted pro who can help you get both.

In fact, about 20% of flood insurance claims come from areas that are considered low to moderate risk.1

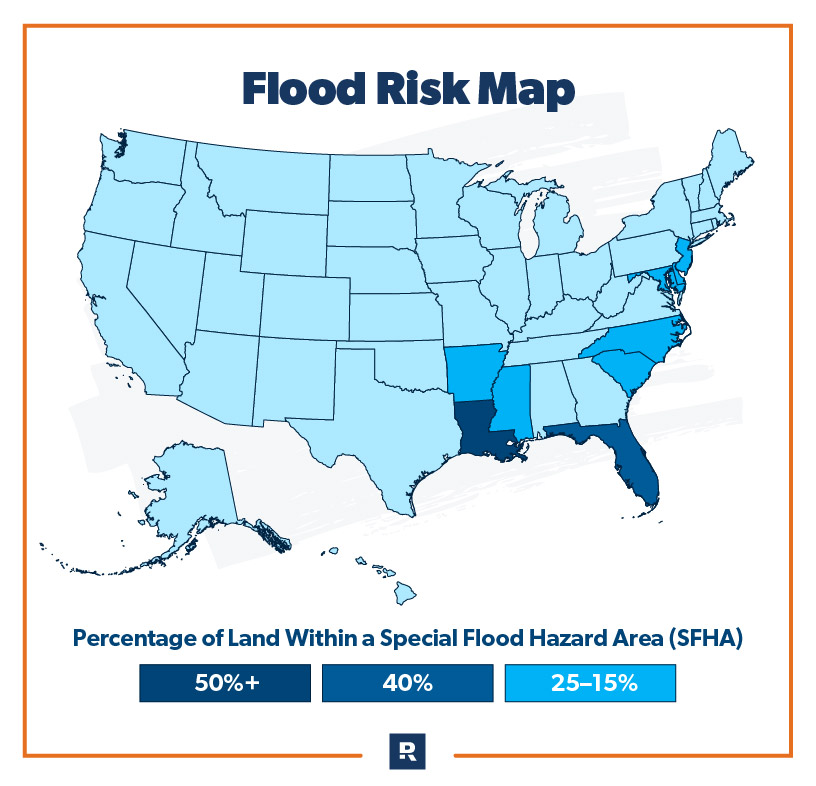

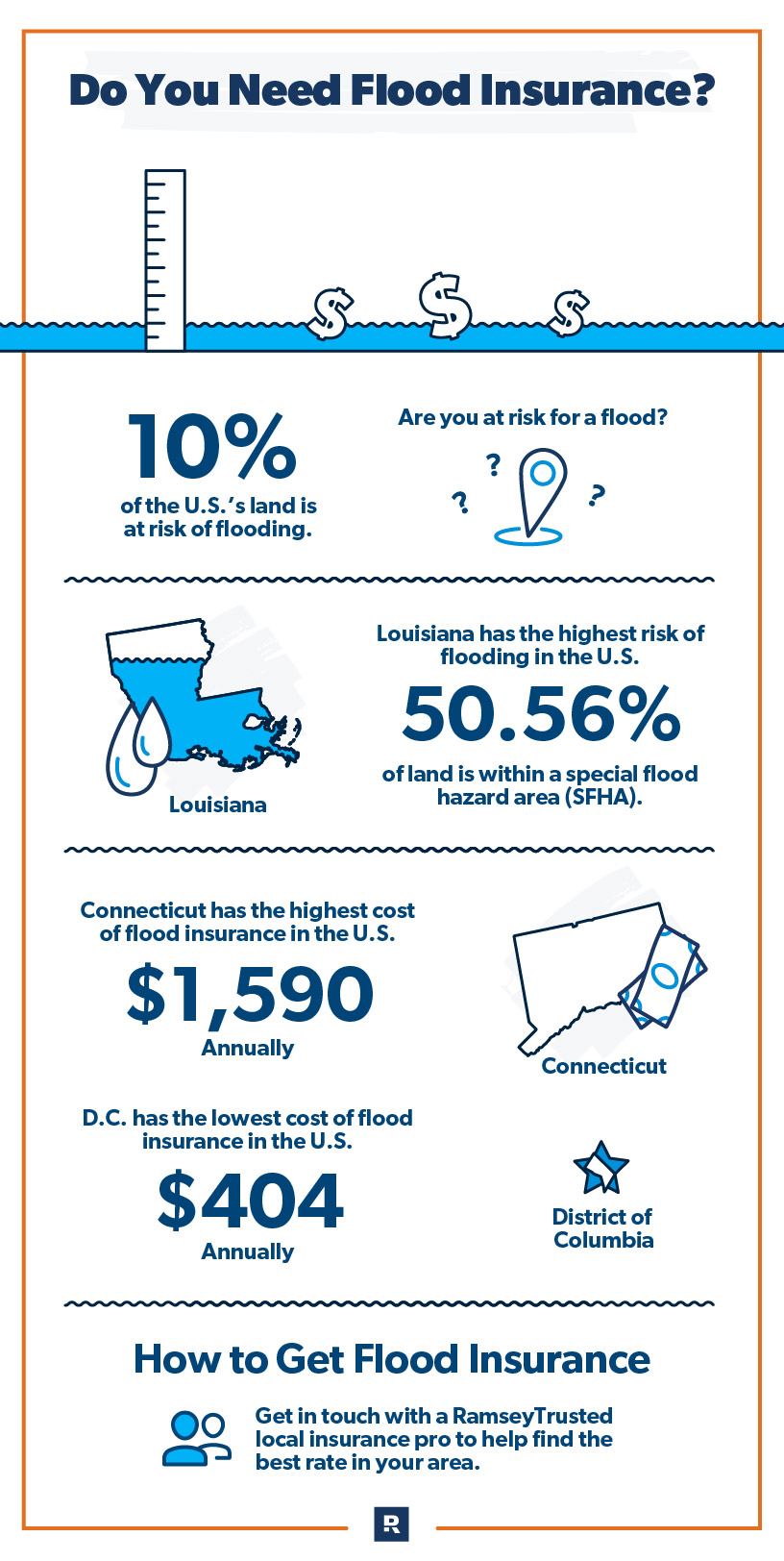

The Federal Emergency Management Agency (FEMA) estimates that 10% of the U.S. is at risk of flooding.2 That’s a lot.

So how do you know if you’re at risk for a flood? The easiest way is to take a look at a flood map like one of FEMA’s flood insurance rate maps (aka FIRMs). FEMA updates their flood maps yearly, giving each community a designated risk category. If you live in a high-risk zone, the question is no longer Do I need flood insurance? but How much flood insurance do I need?

But even if your house is in a low-risk zone, that’s a good sign you should look into flood insurance too. Low risk doesn’t mean no risk. Flooding can happen almost anywhere.

Plus, flood maps change over time. Factors like changing weather patterns, local dam improvements, and even new neighborhoods can cause the property your house sits on to go from a low-risk flood zone (special flood hazard area, or SFHA) to a high-risk flood zone (and vice versa) at any time.

So make sure you check an up-to-date FIRM—and keep checking every so often.

To find out your community’s risk category, you can ask your local insurance agent or go to FEMA’s Flood Map Service Center and put in your address to view it yourself.

Why You Need to Know Your Flood Risk

If you’re still wondering, Do I need flood insurance? take a look at how much damage a flood can cause—and how fast.

- The damage from just one inch of water can cost a homeowner more than $25,000.3

- It takes just six inches of fast-moving water to knock over an adult and 12 inches to sweep away a small car.5

- Water moving at 25 mph can wield the same pressures as wind that’s moving at 790 mph—faster than the speed of sound.6

- If you live in a 100-year flood plain, your home has a 1% chance of flooding every year. In the last several years, Houston alone has seen at least three 500-year floods.7

- If you live in a flood plain or a high-risk area, you’re required to have flood insurance if your home has a federally backed mortgage.

The damage from just one inch of water can cost a homeowner more than $20,000.

Who’s Required to Have Flood Insurance?

While it might be a good idea for most people to have flood insurance, there are some who are required by law to have it. For example, if you have a home or business with a government-backed mortgage and it’s located in a high-risk area, you need flood insurance.

Like we mentioned earlier, you can find out whether you’re in a flood zone by looking at FEMA’s maps. If you do live in a high-risk zone, check with your lender to find out if you have to carry a flood policy—sometimes, they’ll require you to even if the government doesn’t.

Does Homeowners Insurance Cover Flooding?

Only 27% of homeowners have flood insurance according to a survey by the Insurance Information Institute. But the actual number could be much lower.8 Many people mistakenly believe they have flood insurance because they think their homeowners insurance covers it. But it doesn’t.

Whether you have flood coverage or not with a standard homeowners policy depends on what type of flooding you’re talking about. If you’re hoping it covers a spontaneous pond in the laundry room from a burst washing machine hose, you’re in luck. But if you’re holding out for coverage on a hurricane, monsoon or even rainwater from a bad thunderstorm getting inside, you need to think again.

If you only have a standard homeowners insurance policy, you can pretty much bet you’re not covered for flooding from any kind of storm or event outside your house that brings water in. To get flood coverage, you have to buy it separately or pay extra to have it included in your policy as a rider.

What Does Flood Insurance Cover?

There are two kinds of flood insurance you can buy, and each one covers something different. If you’re at any risk of flooding, you should probably have both.

You can get building coverage and contents coverage, and most people buy theirs through the government’s National Flood Insurance Program (NFIP), although you can get them through a private carrier as well. Like it sounds, these policies cover your house structure and what’s inside your building.

Let’s take a look at what they cover:

Building Coverage

- Insured building and foundation

- Electrical and plumbing systems

- Furnaces and water heaters

- Refrigerators, cooking stoves and built-in appliances

- Permanently installed carpeting

- Permanently installed cabinets, paneling and bookcases

- Window blinds

- Foundation walls, anchorage systems and staircases

- Detached garages

- Fuel tanks, well water tanks and pumps, and solar energy equipment

- Debris removal

Contents Coverage

- Personal belongings, like clothing, furniture and electronic equipment

- Curtains

- Washer and dryer

- Portable and window air conditioners

- Microwave oven

- Food freezers (and the food inside)

- Carpets not included in building coverage (aka carpet installed over wood floors)

- Valuable items such as original artwork and furs (up to $2,500)

Keep in mind, what caused the flooding is important in figuring out if these things are really covered. Just like damage caused by a storm flood isn’t covered under a standard homeowners policy, damage caused by some types of flooding isn’t covered by some flood policies. (Yeah, there are lots of rules.)

FEMA defines flooding as “an excess of water on land that is normally dry, affecting two or more acres of land or two or more properties.”9 So if your sewer backs up into your house (if this has happened to you, we’re very sorry) because of flooding outside, you’re covered. But if the backup wasn’t caused directly by flooding, you’ll have to rely on any sewer backup rider you (hopefully) added.

What Doesn’t Flood Insurance Cover?

Like with all types of insurance, there are some things flood insurance doesn’t cover—like pretty much anything in a basement.

Here are some of the common things not covered by flood insurance:

- Water damage or moisture resulting in mold growth (and more damage) that the homeowner could have prevented

- ALE (additional living expenses), like the cost to pay for a hotel room and food while your home is being repaired.

- Most vehicles, like cars, boats, etc.

- Stuff stored in a basement or finishings (like carpeting, drywall, etc.)

- Anything outside the building that’s insured (think landscaping, pools, patios, fencing, septic systems, etc.)

- Lost income or other financial losses from having to close your business or not being able to use your insured property (think farms or rental properties)

- Damage from water flowing under the ground

- Any extra expense that comes from having to comply with new laws, regulations or code as you rebuild or repair from flood damage

Policies can be different, though, so make sure you check yours for a full list.

How Much Does Flood Insurance Cost?

On average, a flood insurance policy from NFIP costs around $900 a year.10 How much flood insurance will cost you depends on how high your risk of flooding is.

Besides location in a flood zone, there are a lot of other factors that impact your flood insurance rate.

These include:

- How far your property is from the water’s edge (aka ocean, lake or river)

- Whether you’re buying building or contents coverage (or both)

- How big of a deductible you choose and the limits on your coverage

- Where your structure is located on your property (Is it downhill or in a bowl?)

- How your building is designed (Is it on stilts?)

- How old your house is

- Where your biggest (aka most expensive) stuff is stored (Are your utilities on the second floor or on stilts?)

In the end, how much it’ll cost to cover your particular house will depend on where you fall on all of these points.

That being said, states still differ a lot in how much flood insurance costs within their borders. Seven out of the top 10 most expensive states are in New England.

Flood Insurance Costs by State

Like we mentioned, where you live definitely impacts your risk for flooding and how much you’ll pay. Here are the 10 states where residents pay the most:

|

Top 10 States Where Residents Pay the Most for Flood Insurance |

|

|

State |

Annual Rate |

|

Connecticut |

$1,590 |

|

Hawaii |

$1,437 |

|

Massachusetts |

$1,269 |

|

New Hampshire |

$1,216 |

|

Vermont |

$1,197 |

|

New York |

$1,184 |

|

West Virginia |

$1,133 |

|

New Jersey |

$1,081 |

|

Pennsylvania |

$1,075 |

|

Rhode Island |

$1,062 |

Data From FEMA11

There are plenty of states where flood insurance isn’t as high as, well, the floodwaters. These are the states where you’ll likely pay the least for flood insurance:

|

Top 10 States Where Residents Pay the Least for Flood Insurance |

|

|

State |

Annual Rate |

|

District of Columbia |

$404 |

|

Alaska |

$454 |

|

Maryland |

$608 |

|

Utah |

$645 |

|

Nevada |

$715 |

|

Virginia |

$743 |

|

Texas |

$776 |

|

Georgia |

$791 |

|

North Carolina |

$791 |

|

North Dakota |

$798 |

Data From FEMA12

Keep in mind though, these numbers are what people are actually, currently paying. Some homeowners have subsidized rates (aka the government is paying part of their premium). This is because a few years ago, the way rates were calculated changed drastically and some people suddenly ended up with much higher premiums. The government stepped in and subsidized their rates so they didn’t get priced out of the market.

The actual risk-based costs are often much higher. For those paying subsidized rates, each year their rate increases a little until they reach the risk-based rate. If you buy a policy now, you’ll be paying the risk-based rate.

How to Get Flood Insurance

If figuring out whether you need flood insurance and how much you need feels like a massive task, don’t worry—you don’t have to do it alone! An independent insurance agent is super helpful when it comes to sorting out your insurance and finding the best rate.

Don’t wait to find out if flood insurance is right for you. Get in touch with a RamseyTrusted local insurance pro. These independent agents have the heart of a teacher and will help you understand your coverage options and risks, plus they’ll make sure you get the best deal to boot.

Contact a local independent insurance agent today!

Insurance Can Be Confusing. We Have Someone Who Can Help.

RamseyTrusted® insurance pros are independent and vetted—and they help you fill the gaps in your policies. They make getting insurance (like home, auto and umbrella) one less thing to stress about. Plug in your zip code to connect with an agent who understands the coverage needs in your area.