Flood Insurance Guide: Everything You Need to Know

26 Min Read | Jul 24, 2025

Key Takeaways

- Flood insurance protects your home and belongings from flood damage and comes in two parts: building coverage for the structure and contents coverage for what's inside.

- Flooding occurs in nearly 90% of natural disasters in the U.S., and even just one inch of water can cause more than $25,000 in damage.

- Many homeowners mistakenly think their standard homeowners insurance covers flood damage—it doesn’t.

- You can buy flood insurance through the National Flood Insurance Program (federally backed) or a private insurer, each with different costs, coverages, and pros and cons.

- You can save on flood insurance by increasing your deductible, improving your home’s flood resistance, and transferring an existing policy when buying a home.

We’ve all seen footage of coastal areas devastated by hurricanes—maybe you’ve even experienced that personally. But the fact is, it doesn’t take a hurricane for your home to flood. Of all the natural disasters—including hurricanes—that the U.S. faces, 90% of them involve flooding.1

It doesn’t take a hurricane for your home to flood.

Natural disasters aren’t the only cause of a flood either—flooding can come from just about anywhere. So how do you protect your home? The simple answer is flood insurance. But flood insurance isn’t exactly simple! So let’s dig in and sort out the different kinds of flood insurance, how it works, and why it’s an important piece in your game plan to reduce your financial risk.

Related: If you’ve already been a flood victim, see: My House Flooded . . . Now What?

- Did You Know? Flood Facts

- How Do You Know if You’re at Risk for a Flood?

- How to Prepare for Flooding?

- Does Homeowners Insurance Cover Flooding?

- What Is Flood Insurance?

- What Does Flood Insurance Cover?

- What Doesn’t Flood Insurance Cover?

- How Flood Insurance Works

- How to File a Flood Insurance Claim

- When Is it Too Late to Buy Flood Insurance?

- How Much Does Flood Insurance Cost?

- Saving Money on Flood Insurance

- How to Get Flood Insurance

- Frequently Asked Questions

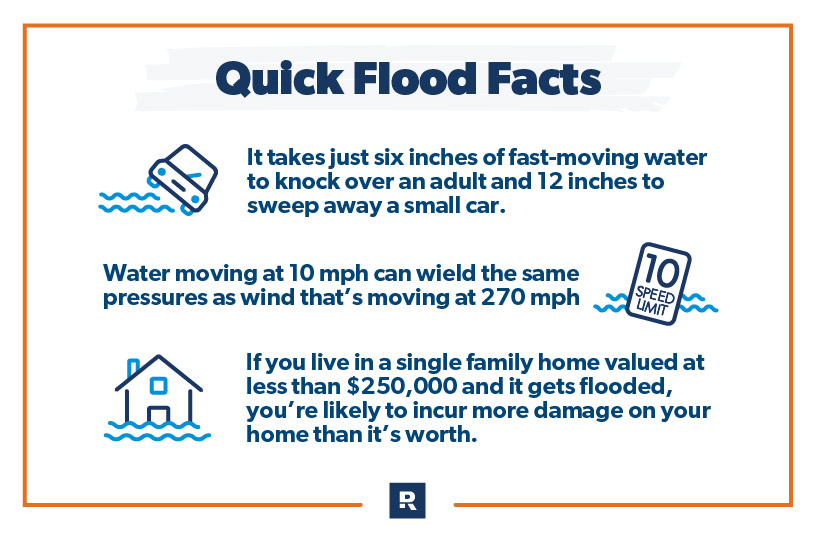

Did You Know? Flood Facts

Hurricanes can dump 10 inches or more of rain, but it only takes one inch of water to cause $25,000 in damage to your home.2

Here are a few more quick facts about floods you might find surprising.

- It takes just six inches of fast-moving water to knock over an adult and 12 inches to sweep away a small car.3

- Water moving at 25 mph can wield the same pressure as wind that’s moving at 790 mph—faster than the speed of sound.4

- If you live in a 100-year flood plain, your home has a 1% chance of flooding each year —that's 1 in 100. In a 500-year flood plain, the risk drops to 0.2%, or 1 in 500. But here's the kicker: In just three years, Houston experienced three separate 500-year floods.5

- If you live in a flood plain or a high-risk area, your lender will require flood insurance coverage to approve you for a federally backed mortgage.

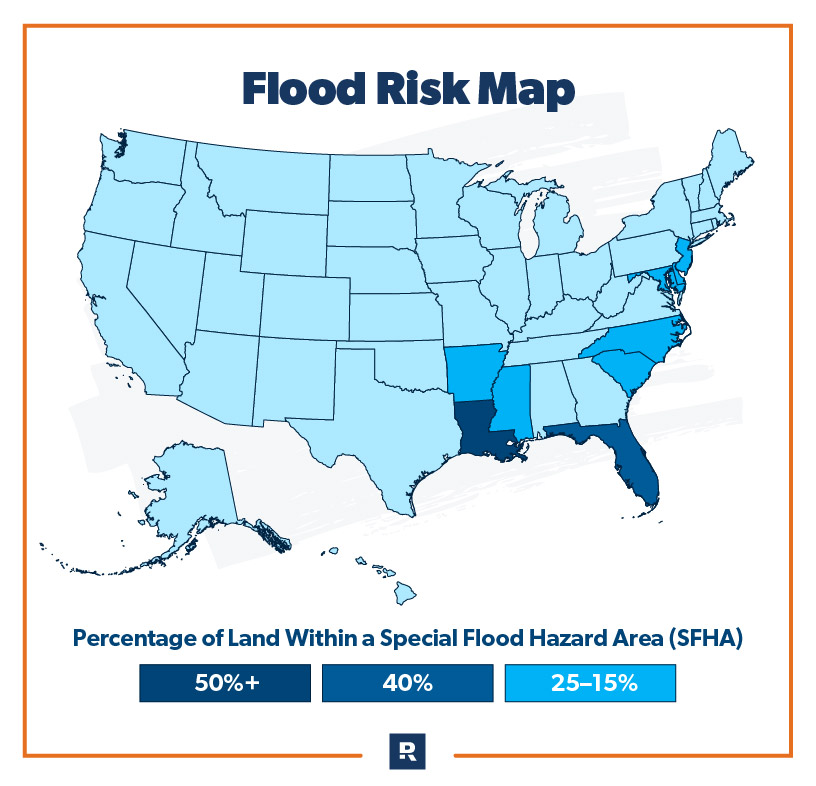

How Do You Know if You’re at Risk for a Flood?

Don’t get confused—a low-risk flood zone doesn’t mean no-risk flood zone. So even if you’re in a low-risk area, a flood could still happen to you. And keep in mind, flood zones aren’t fixed—risk levels can shift over time.

Many factors play a part in evaluating the flood risk for your home. For example, a change in weather patterns or the addition of a seawall or dam could cause the property your house sits on to go from a high-risk flood zone (special flood hazard area or SFHA) to a low-risk flood zone. And it works the other way too: A new neighborhood going in down the street could take your home from a low-risk zone to a high-risk zone because it’ll affect the way water absorbs and drains in that area.

If you’re not sure if your home is at high or low risk, check out a flood map. The Federal Emergency Management Agency (FEMA) updates their flood maps (called flood insurance rate maps or FIRMs) every year through in-house studies and community-initiated map revisions. The maps give each community an up-to-date risk category.

If you’re not sure if your home is at high or low risk, check out a flood map. The Federal Emergency Management Agency (FEMA) updates their flood maps (called flood insurance rate maps or FIRMs) every year through in-house studies and community-initiated map revisions. The maps give each community an up-to-date risk category.

These maps also help mortgage companies decide if they’ll require flood insurance for a home loan, and they tell your insurer what to charge you for flood insurance. And like we mentioned, FIRMs change over time to account for changes in land use, community development, weather patterns, wildfires and other factors.

Ask your local insurance agent where your community ranks for flood risk or go to FEMA’s Flood Map Service Center and put in your address to view it yourself.

The damage from just one inch of water can cost a homeowner more than $20,000.

Insurance Can Be Confusing. We Have Someone Who Can Help.

RamseyTrusted® insurance pros are independent and vetted—and they help you fill the gaps in your policies. They make getting insurance (like home, auto and umbrella) one less thing to stress about. Plug in your zip code to connect with an agent who understands the coverage needs in your area.

How to Prepare for Flooding

Maybe you live in a flood-prone area or maybe a freak storm is headed your way. Either way, you can take steps to prepare your home before the waters rise.

Get Flood Insurance

That’s right. Once the dirty, debris-churned water is lapping at your door, it'll be too late. Stay on top of your flooding risk by doing a yearly checkup with your independent insurance agent or on your own.

Inventory Your House

You should do this anyway for your regular homeowners insurance policy, but before a flood is an excellent time to reevaluate what you own (you got that new TV after you inventoried, remember?). Pictures or even video are an easy way to catalog everything. Grab the price tag, serial number or other identifying marker if you can.

Flood-Proof Important Documents and Items

The weatherman may be notorious for getting it wrong, but he usually can predict a flood a few days in advance (unless it’s a flash flood). If you know a big weather event is headed your way, put your important documents (think birth certificates, Social Security cards, passports, medical records, and insurance papers and records) and any portable valuables in a waterproof, secure location.

Elevate Utilities

If you live in a flood-prone area, putting your utilities (think HVAC air handlers, electrical panels, propane tanks, etc.) on a second floor or on stilts can prevent a lot of expensive damage.

Prepare Your Basement

If your house has a basement, buy a sump pump and install a water alarm to keep it from becoming an underground swimming pool. Consider getting a battery-operated pump in case the power goes out.

Prepare Your House

Sandbags can make the difference between catastrophic damage and an annoying repair. They won’t keep all the water out, but they can keep most of it out by redirecting it. Sandbags are especially helpful at blocking water from garage doors, basement windows, sliding doors, gaps in walls, a shallow trench or a door that’s lower than the others.

Keep your gutter and downspouts clean so they can do their job of directing water away from your home’s foundation. Move your furniture and anything else you can up to higher ground, like your second floor.

To prevent any electrical shorts, unplug your appliances and devices. Also shut off any propane tanks.

Secure any outdoor furniture or equipment, and don’t forget the trash cans and tool shed.

Make a Plan to Get to Safety

Figure out where and how to get to higher ground if needed and think about what you’ll leave behind and what you’ll take with you.

Free Flood Preparedness Checklist

If you're ready to be prepared in case of a flood, here's a free checklist to help you stay on track.

Floods After Fires

Fire and water? Those don’t mix! You probably wouldn’t think it, but wildfires can make flooding more severe. Flash floods and mudflows spike after fires because scorched earth can’t absorb water very well. Fires also change the landscape, removing forests and ground cover that would normally direct water elsewhere or absorb it.

A wildfire can increase a region’s risk of flooding for up to five years—until plants and trees have a chance to grow back.

Does Homeowners Insurance Cover Flooding?

If you think you’re covered for flooding by your homeowners insurance policy, think again.

The National Flood Insurance Program (the federal government’s public insurance) estimates that far fewer people actually have flood insurance policies than those who think they do. According to the Insurance Information Institute, many homeowners mistakenly believe they’re covered when they’re not. In fact, only about 30% of homes in the highest-risk areas have flood insurance.6 (Hopefully after reading this article, that won’t be you!)

One of the biggest misconceptions is thinking a standard homeowners insurance policy takes care of flood damage. It doesn’t—at least not in the way you might expect. Your home insurance will only cover flooding that comes from inside your house—like a burst washing machine hose. If water comes into your house from the outside, that’s a whole different ball game and you’ll need flood insurance to cover damage from that.

What Is Flood Insurance?

Flood insurance will pay to repair or rebuild your home and replace your stuff if you get hit by a flood. FEMA defines flooding as “an excess of water on land that is normally dry, affecting two or more acres of land or two or more properties.”7 If you live under the threat of water coming into your house from a storm or overflowing river, you should get flood insurance.

You can buy flood insurance from the federal government or through a private flood insurance carrier.

The Two Types of Flood Insurance

There are two types of flood insurance. That’s right—it couldn’t be easy and just be one. But this is good news for you because two types means there are options—options that could save you money!

One kind is available through FEMA and the other is available through private insurers. Both types have different coverage options and costs. But what’s the difference between the two, which one is best for you, and what do they each cover? Let’s break them down so you can understand your options.

National Flood Insurance Program (NFIP)

The National Flood Insurance Program, or NFIP, offers flood insurance through FEMA. As long as your community is in one of the nearly 21,000 communities that participate in the program, you should be able to get NFIP coverage.

Pros:

- Easy to get: NFIP insurance is sold through nonfederal, independent insurance agents who can write up flood insurance directly from the government or from private insurance companies. (Not all insurance companies offer NFIP.) Contact your local insurance agent to see if they offer it or can recommend someone who does.

- Lower premiums: Typically, NFIP is cheaper than private flood insurance, but not always. Premiums vary depending on a ton of factors, but median costs range anywhere from $689–8,245.9 If you can’t afford your annual premium up front, you can also pay for it in monthly installments.

- Can’t be canceled: You won’t lose your coverage because your risk rises and your insurer thinks it’s now too high.

- Federally backed: With an NFIP policy, you’re covered by the federal government, so you know you’ll get your money.

Cons:

- Takes longer to kick in: It takes 30 days for NFIP coverage to go into effect. Although there are a few exceptions, don’t wait until the last minute to get coverage if you need it!

- Lower coverage limits: NFIP will cover up to $250,000 for damage to your home (building coverage) and up to $100,000 for your belongings (personal property coverage).

- Takes longer to get paid: Depending on the kind of claim you’re making and how quickly your insurance company responds to it, getting the full payout may take up to a year—so be prepared to be patient. In some cases, you might have to make repairs before your insurance company pays you, or they may ask for a quote first. They also may have your contractor bill them directly for any repairs. Once an adjuster has evaluated the damage, you can request an advance or partial payment to get started on repairs that can’t wait.

Related: Saving money shouldn’t mean sacrificing coverage. RamseyTrusted® insurance pros know how to help you get the right coverage at the right price. They get it—they follow Ramsey principles and want you to win with money, without cutting corners on protection. Connect with an insurance pro.

Private Flood Insurance

Only a few insurers offer private flood insurance—flood insurance not funded through the federal government. Recent data found that about 35% of flood policies are through a private company.10

Because private flood insurance policies vary (a lot!) by the insurance companies that offer them, you’ll want to ask your local insurance agent to give you flood insurance quotes on both NFIP and private flood policies to see what each will cover for you.

Below are some pros and cons of private flood insurance to help you get a feel for whether private flood insurance could work for you.

Pros:

- Higher coverage: Private flood insurance typically offers a higher level of coverage than NFIP’s $250,000 limit on your home and $100,000 limit on your belongings.

- Shorter wait: With some private insurers, your coverage could go into effect in less than a week, while NFIP often takes 30 days to kick in.

- Additional benefits: If you have to temporarily relocate, private insurance may provide for short-term housing. Depending on the policy, you could also potentially buy coverage for items or areas not covered through NFIP.

- Backed by the state: Depending on the insurer and state, your policy may be backed by something called a guaranty fund. This means the state will pay the coverage if the insurer folds.

- Real-time risk assessment: A private insurer may have a more up-to-date risk analysis on your property than the NFIP’s, which could help you better understand and prepare for any flood-related hazards.

- Costs less: Because their risk analysis is more accurate, a private insurer may determine your property is in a lower risk area than FEMA’s flood maps currently indicate, saving you a ton of money on your premium!

Cons:

- Higher premiums: With private insurance, you’re likely to pay a heftier premium, especially if you live in a high-risk area.

- Not backed by all banks: Because banks tend to view private insurance companies as a higher risk than insurance through FEMA, they may not accept private flood insurance if you carry a mortgage with them.

- Not available in all areas: If you live in a high-risk area, a private insurer may deny you coverage if they deem you too high of a risk.

- Coverage can be canceled: Private insurers can cancel your policy or choose not to renew it if your risk rating goes up or they decide you’re too high of a risk.

Do I Need Both Types?

If your home is worth more than $250,000 and you’re in a high-risk area, you may actually need both types of coverage. Since NFIP policies are typically (but not always) less expensive, consider carrying the maximum amount of coverage through NFIP combined with coverage through a private insurer. That way, damages that exceed the limits of your NFIP policy will still be covered.

On the other hand, if your property is considered low risk and NFIP doesn’t offer the coverage you need, you can streamline your coverage with a policy through a private insurer that’s backed by a guaranty fund. This could potentially give you a faster turnaround with the processing and payment of your claim. Ask your insurance agent if either or both is the right fit for you!

Flash floods typically carry water between 10 and 20 feet high.

Check on your coverage before it becomes an emergency by taking our Coverage Checkup for a personalized action plan that shows what coverages you need and what you don’t.

|

NFIP vs. Private Flood Insurance |

||

|

NFIP Policy |

Private Policy |

|

|

Coverage Limit |

$250,000 building $100,000 contents |

$1 million+ |

|

Waiting Period |

30 days |

7+ days |

|

Financial Backing |

Federally backed |

State backed (sometimes) |

|

Premiums |

Tend to be lower |

Tend to be higher |

|

Availability |

Everywhere |

Limited |

|

Replacement Cost Building Coverage |

Yes |

Yes |

|

Replacement Cost Contents Coverage |

No |

Yes |

|

Additional Living Expenses (ALE) |

No |

Yes |

What Does Flood Insurance Cover?

If you’ve been reading up on insurance at all, you’ve probably learned that it’s never straightforward. There are always exceptions and hoops to jump through. For example, many folks assume their homeowners policy will cover damage caused by hazards like floods—but as we’ve already discussed, that’s not the case. So, what does flood insurance cover?

Well, there are two different kinds of flood coverage you can buy: building and contents. Just like it sounds, building coverage covers the structure of your house (or business) while contents coverage covers what’s inside. Keep in mind that both building coverage and personal property coverage have their own deductibles.

Let’s take a look at what they cover:

Building Coverage

- Insured building and foundation

- Electrical and plumbing systems

- Furnaces and water heaters

- Refrigerators, cooking stoves and built-in appliances

- Permanently installed carpeting

- Permanently installed cabinets, paneling and bookcases

- Window blinds

- Foundation walls, anchoring systems and staircases

- Detached garages

- Fuel tanks, well water tanks and pumps, and solar energy equipment

- Debris removal

Contents Coverage

- Personal belongings, like clothing, furniture and electronic equipment

- Curtains

- Washer and dryer

- Portable and window air conditioners

- Microwave ovens

- Food freezers (and the food inside)

- Carpets not included in building coverage (aka carpet installed over wood floors)

- Valuable items, such as original artwork and furs (With an NFIP policy, the limit is up to $2,500. With a private carrier, it’ll vary.)

Policy limits will vary with a private provider, but NFIP has very specific limits. As with every insurance policy, check out the declarations page of your insurance policy or talk to your local insurance agent to find out what your coverage includes.

What Doesn’t Flood Insurance Cover?

Like we mentioned earlier, insurance is never straightforward. Here’s where we get into the exclusions.

Some common things not covered by NFIP flood insurance are:

- Water damage or moisture resulting in mold growth (and more damage) that the homeowner could have prevented

- ALE (additional living expenses), as in the costs to cover a hotel or food while your home is being repaired

- Most vehicles like cars, boats, etc.

- Stuff stored in a basement or finishings (like carpeting, drywall, etc.)

- Anything outside the building that’s insured (think landscaping, pools, patios, fencing, septic systems, etc.)

- Lost income or other financial losses from having to close your business or not being able to use your insured property (think farms or rental properties)

- Damage from water flowing under the ground

- Any extra expense that comes from having to comply with new laws, regulations or code as you rebuild or repair from flood damage

When it comes to private flood insurance, the exclusions will be similar but can vary. Keep in mind, flood policies can differ a lot, so make sure you know what’s in yours.

How Flood Insurance Works

Flood insurance covers you financially in case a flood event damages your home. Your house getting flooded is devastating, but if a hurricane is headed to your hometown and you have flood insurance, you can have peace of mind knowing your finances won’t be swept away too.

Depending on what kind you get, your flood insurance will pay you some or all of the cost to replace your home and possessions. Just like with homeowners insurance, flood insurance policies come in two kinds of coverages: replacement cost value (RCV) and actual cash value (ACV).

Replacement Cost Value Flood Insurance

With RCV coverage, the insurance company will give you enough money to repair or replace your building and stuff at what it costs in the current market. So, if it cost $300,000 to build your home seven years ago but it would cost $415,000 now, you’ll get $415,000. Same goes for your stuff inside.

With NFIP policies, building property coverage is always RCV coverage. This means it covers what it would cost to repair or replace your home up to $250,000 (as long as your policy covers at least 80% of the full replacement cost of your house and you carry the max amount of coverage).

Actual Cash Value Flood Insurance

A lot of people choose ACV coverage because it comes with a cheaper premium. But it only pays out what your structure or personal property is worth minus depreciation. In other words, you’ll be paid for the value of your stuff today—not what it would cost to replace it with new stuff. So, a lot of what’s used to finish out your house—like carpeting—wouldn’t get fully paid for by insurance with ACV. Same thing goes for your stuff—you’d get the used price (not the new price) for your TVs, fridge, dishwasher, clothes, devices and so on.

With an NFIP policy, ACV is the only kind of coverage you can get for your personal property. Personal property (contents) coverage replaces up to $100,000 in items and includes depreciation value. So, if you paid $2,000 for that TV three years ago, personal property coverage would pay what it’d be worth today instead of what you paid for it originally or what it would cost to replace it.

With a private flood insurance provider, you have more options when it comes to the kind of personal property coverage you can get.

How to File a Flood Insurance Claim

If your house has turned into a retention pond, you’ll need to contact your private insurer or an agent with the NFIP immediately to help you start your claim. Pro tip: Ask for an advance payment to help you get started with cleanup. This’ll be deducted from your final coverage total.

It might take a while for an agent to make it out to inspect your house. Meanwhile, you’ll need to start cleaning up the mess, and that can affect how visible the damage is. So, whenever it’s safe to do so, document all the damage to your home. Use video and pictures to record everywhere the water went, including floodwater lines on walls.

Next comes cleanup. It’s important to do this ASAP because when it comes to mold damage from a flood, if you haven’t done all you can to prevent mold growth, insurance may not cover it.

When you meet with your insurance adjuster, they’ll help you submit an estimate of your losses and answer any questions. Remember to double-check the adjuster’s written report to make sure they got everything.

Next up, you should get payment. How much you get will depend on your policy type, the adjuster’s evaluation, and how well you documented and represented the damage your home suffered.

When Is It Too Late to Buy Flood Insurance?

Typically, a flood insurance policy takes 7–30 days from purchase to kick in. So . . . waiting until after the water is in your home to purchase a policy is definitely too late. When the storm is brewing off the coast, that’s also too late. When your home is smack in the middle of the cone of uncertainty, that is—you guessed it—too late. And when the river is rising an inch an hour, that’s way past too late.

If you’re planning on getting a policy with the NFIP, there’s usually a waiting period of 30 days before it goes into effect. With private flood insurance, your waiting period could be much shorter—somewhere between 7–17 days. But that means you still have to plan ahead.

If you wait until danger is looming to think about flood insurance, you’ll have to rely on sandbags and prayer. It might be sunny and dry outside, but now is the time to figure out if you need financial protection against a flood.

Are You Protected With the Right Insurance?

Take the Coverage Checkup to get a personalized action plan that breaks down what to keep, add or nix so you can take control of your insurance with confidence.

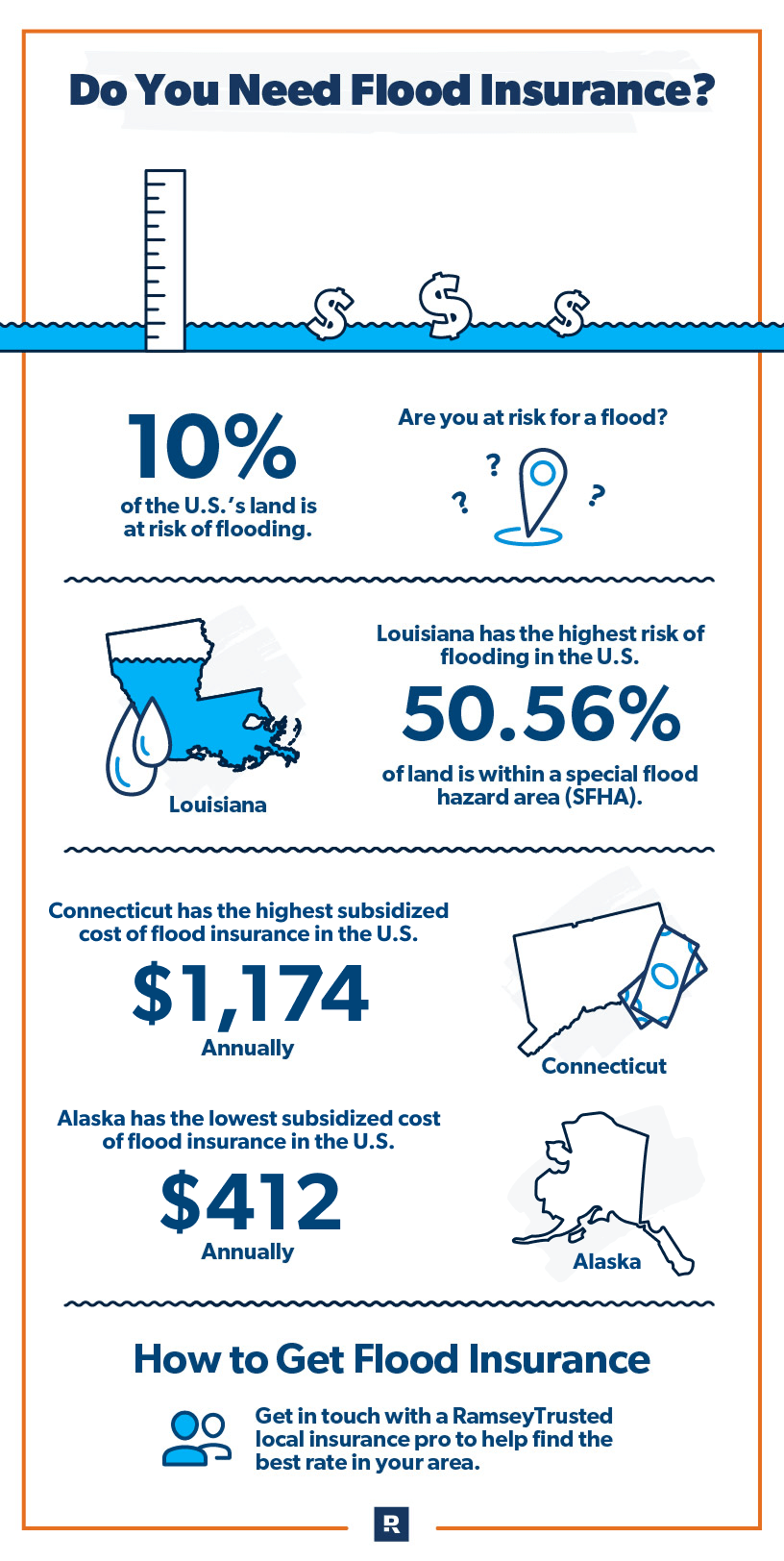

How Much Does Flood Insurance Cost?

Like with other types of insurance, how much flood insurance costs hinges on your situation. While the median flood insurance rate from NFIP is about $1,290 a year, many factors go into your specific rate, including your home’s location, your community’s flood risk, and whether you’ve done any flood-proofing.

Your rate will change depending on:

- Whether you’re buying building or contents coverage (or both)

- How big of a deductible you choose and the limits on your coverage

- Where your structure is located on your property (Is it downhill or in an area where water would collect?)

- How your building is designed (Is it on stilts?)

- How old your house is

- Where your biggest (aka most expensive) stuff is stored (Are your utilities on the second floor or on stilts?)

Because location plays such a big role in rates, you can imagine they vary a bit from state to state.

Flood Insurance Rates by State

Wondering where your state sits in the lineup? In general, Northeastern states tend to see the highest rates for flood insurance. Many are close to the ocean and have a network of waterways that are prone to flooding from snowmelt and heavy rain.

But it’s not just the Northeast—Hawaii tops the list because of frequent hurricanes, while West Virginia deals with a constant flood risk thanks to all those mountains and rivers.

As you look through the rates, keep in mind that residents in many flood-prone areas don’t actually pay a flood insurance premium that reflects the risk of living where they do. For those with NFIP policies, the federal government subsidizes some rates so homeowners don’t get priced out by updated flood zones (and skyrocketing rates). But each year, their premium increases until they eventually reach the risk-based rate. If you purchase a flood policy now though, you’ll pay the full risk-based rate.

|

Top 10 States for Highest Risk-Based Annual Premium From NFIP vs. Annual Subsidized Rate |

||

|

State |

Median Annual Risk-Based Rate |

Median Annual Subsidized Rate |

|

Hawaii |

$3,258 |

$1,023 |

|

West Virginia |

$2,683 |

$972 |

|

Connecticut |

$2,514 |

$1,174 |

|

New Hampshire |

$2,248 |

$972 |

|

New Jersey |

$1,943 |

$953 |

|

Vermont |

$1,896 |

$985 |

|

New York |

$1,834 |

$943 |

|

Massachusetts |

$1,762 |

$1,106 |

|

Alabama |

$1,703 |

$825 |

|

Kentucky |

$1,673 |

$886 |

Data From FEMA11

Now let’s take a look at the ten states with the lowest premiums . . .

|

Top 10 States for Lowest Risk-Based Annual Premium From NFIP vs. Annual Subsidized Rate |

||

|

State |

Median Annual Risk-Based Rate |

Median Annual Subsidized Rate |

|

Alaska |

$413 |

$412 |

|

Utah |

$612 |

$602 |

|

Maryland |

$647 |

$629 |

|

Virginia |

$800 |

$708 |

|

Michigan |

$832 |

$756 |

|

Nevada |

$869 |

$689 |

|

North Dakota |

$890 |

$761 |

|

Nebraska |

$967 |

$795 |

|

Ohio |

$970 |

$787 |

|

Colorado |

$979 |

$786 |

Data From FEMA12

While most people get their flood insurance through the NFIP, private insurers can sometimes be cheaper (oh yeah!). A local independent insurance agent can compare flood insurance quotes for you and find you the best option. But there are other ways to save money too.

Saving Money on Flood Insurance

What’s more of a bummer than finding out you have to buy something that’s really expensive? Not much. But don’t get too bummed out—there are ways to save on this pricey necessity.

As with most insurance policies, whether you need flood insurance—and what you’ll pay for it—is based on the degree of risk you currently face. So, how can you decrease your risk and lower your premium?

Compare Rates

When deciding on flood insurance, don’t assume one source will be more cost-effective than the other. Be sure to get flood insurance quotes from your agent for both private and NFIP policies to find out which one will work best for you.

Increase Your Deductible

As of 2022, a $10,000 deductible would result in up to a 40% discount in your base premium.13 Don’t forget—you'll likely have two deductibles, one on the building and one on the contents.

Maintain Your Coverage

Whether it’s your own home or a house you’re looking to buy, do your best to avoid any lapses in coverage. If your property happens to be grandfathered (see below) into a lower risk category than FEMA’s latest flood maps reflect, that’ll help your premium stay at the lower rate.

Reduce Your Possible Damage

According to FEMA, homes built in compliance with NFIP standards experience about 80% less damage than homes that aren’t.14 Take a look at these strategies to protect your home:

- Wet flood-proofing: This may sound a little crazy. Is this like fighting fire with fire—only it’s water with water? Kind of! If the bottom part of your home sits below base flood elevation—the height floodwater has at least a 1% chance of reaching during the year—wet flood-proofing may be the fix for you.

To meet NFIP standards, the part of your home that’s under the base flood elevation would need to be a space you’re not living in, like a basement, garage or even a crawl space. To flood-proof the space, you’d need to construct or rebuild it with materials that are resistant to floodwaters. You’d also want to make sure to put in flood openings—small openings built into the base of the walls—to allow the floodwaters that come in to also flow out without a pump.

- Dry flood-proofing: This one makes more sense right off the bat. Dry flood-proofing keeps floodwaters from getting into the home with flood-proof sealants and barriers. You can also add a drainage system to divert water away from the house.

- Repositioning appliances: One option to help prevent flood damage is to move any heating or cooling systems, as well as electrical panels, as far away from the base flood elevation as possible.

- Elevating your home: For maximum protection, some homeowners choose to either relocate their home to an area of their property that’s higher or elevate their home on stilts so it’s above the base flood elevation.

Transfer Over the Previous Owner’s Flood Policy

If you’re purchasing a home in a flood zone and the seller has a flood policy, they can transfer that existing policy to you—helping you to avoid the headaches of trying to get a new policy. This also allows you to avoid the 30-day waiting period with NFIP for new policies.

Ask About Grandfathering

As FEMA updates its flood maps, your home could go from a low-risk zone to a high-risk zone, raising your premium (no thanks). If that happens, look into getting grandfathered in at your previous flood zone rating. As long as your home was built to code with its flood zone at that time, you could qualify for the lower rate—and this could save you a ton of money!15 Keep in mind, if the new maps put your property in a lower risk flood zone, this probably isn’t a cost-effective solution for you.

Correct the Map

If the current flood maps show you in a high-risk area but you’re in a low-risk flood zone, you can apply for a Letter of Map Change (LOMC)—an official revision to FEMA’s flood map—and not have to wait for the map to be physically changed by FEMA.

How to Get Flood Insurance

It pays to check out your flood risk and look into insurance because, as we’ve seen, it doesn’t take Noah’s flood to wipe out your home and finances. By understanding the hazards you may face and what your coverage options are, you can sleep tight at night knowing you made the best possible decision for you and your home.

But if the idea of figuring all this out on your own has you feeling like you’re Noah without an ark, here’s a lifeline: Get in touch with a RamseyTrusted local insurance pro.

These folks are experts in their field and can help you figure out your home’s risk level, how much flood insurance you may need, and whether an NFIP or private policy would best fit your situation. On top of that, they’ll shop around to make sure you’re getting the best deal!

Don’t wait until the water is at your door. Reach out to a RamseyTrusted insurance pro today!

Next Steps

- Check your flood risk by reviewing FEMA’s flood maps or asking your insurance agent for guidance.

- Compare quotes from both NFIP and private insurers to find the best fit for your home and budget.

- Take steps to protect your home from future flood damage—like elevating utilities or adding sump pumps.

- Connect with a RamseyTrusted insurance agent to make sure you have the right flood coverage in place.

-

How much is flood insurance?

-

On average, people pay about $1,290 annually for an NFIP policy, which are the vast majority of policies out there. It’s always a good idea to check with a private insurer to see if they can offer a better price.

-

When is flood insurance required?

-

You’ll be required to get a flood insurance policy if you have a federally backed mortgage for your home and live in a location with high flood risk. Even if your mortgage isn’t backed by the government, your lender may still require you to hold a flood policy. Check with your lender to be sure.

-

Is all flood insurance through FEMA?

-

Around 90% of all flood insurance policies are issued through the National Flood Insurance Program, which is administered by FEMA. The remaining 10% of policies are purchased through the private insurance market. While that’s still a small number of policies, private flood insurance is slowly gaining ground as prices across the board increase and more private insurers enter the market.

-

What does flood insurance cover in a basement?

-

If your basement fills up like an underground pool, any stuff you store down there is toast as far as insurance coverage goes. If you finished your basement with flooring and nice drywall (and it becomes wetwall), that’s also not covered.

What is covered are utilities for running the house, like air conditioner units, furnaces and water heaters, foundation elements and staircases.

-

How does insurance differ with wind damage versus water damage?

-

Homeowners insurance will sometimes cover damage by wind-driven rain (aka the wind blows rain into your house and ruins the floor), but it won’t cover water rising and entering your home from outside (aka storm surge, river overflow, or flash flooding).

-

Does flood insurance cover hurricanes?

-

Some damage from hurricanes (storm surge and flooding from rain accumulation and river overflow) is covered. But wind damage is not.

-

How do I start recovery after a flood?

-

If you’ve had to abandon your home for high ground, make sure it’s safe to return before starting the recovery process.

-

-

- The first thing you need to do is document the damage. Take photos and videos to show your insurance provider what happened. Make sure to include floodwater lines on walls.

- Once the waters have receded, start drying out your home ASAP. It’s your responsibility to keep mold from growing wherever possible.

- Contact your insurance provider and get your claim started.

- Work on restoring your utilities next. As you clean up, electricity and water will make it much easier. If you think your utilities are damaged, you’ll probably want to contact a professional to get them inspected before trying to turn them on.

- Now the fun part: cleaning up. Anything in your home that came in contact with floodwater should be completely cleaned and disinfected (floodwater often has sewage and other waste in it).

-

-