In the fall of 2024, Ramsey Solutions conducted a nationally representative survey of over 1,000 U.S. adults (see full methodology below) to give insight into American behaviors and attitudes toward homeownership and the housing market.

As you might’ve guessed, most Americans aren’t too thrilled about high home prices and high mortgage rates. But that doesn’t mean people aren’t doing what they can to accomplish their buying or selling goals.

Whether you’re hoping to learn more about real estate, get the ball rolling on your own buying or selling plans, or grow your real estate business, this report will give you an idea of what to expect from buyers, sellers and homeowners in this housing market.

Real Estate Trends at a Glance

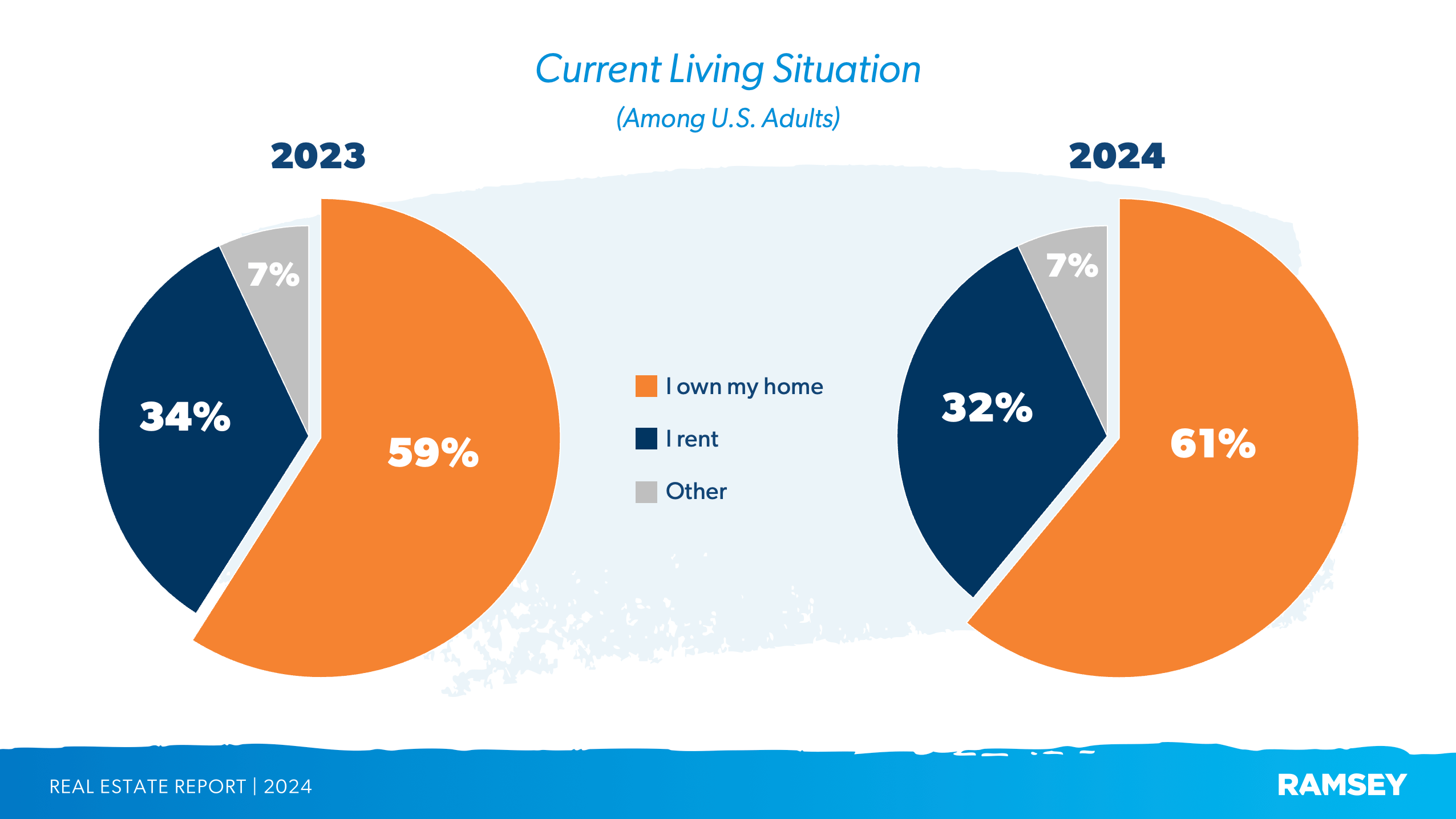

- Stable homeownership: 61% of U.S. adults own a home.

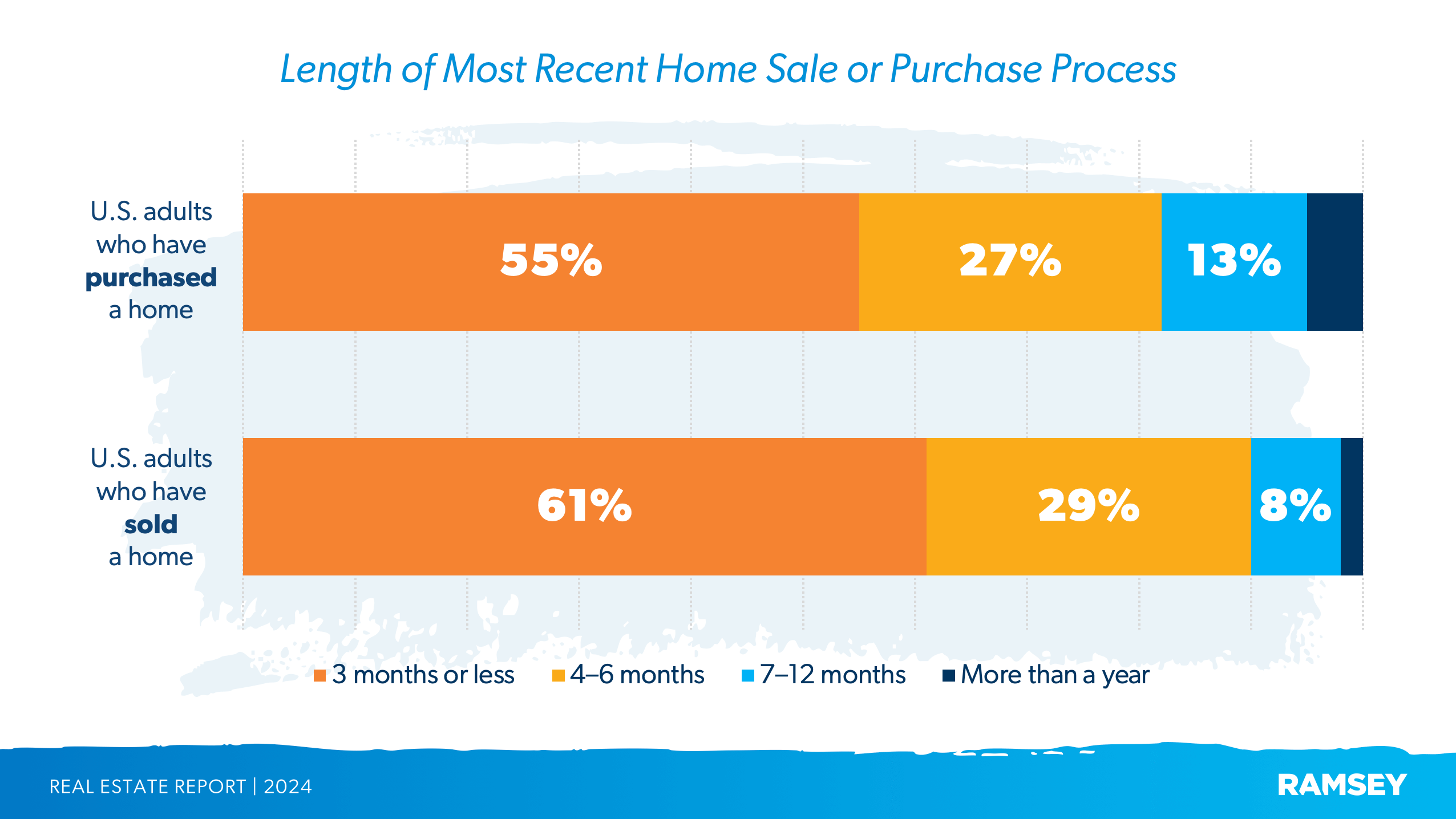

- Speedy transactions: For those who have ever bought or sold a home, most completed the process in under three months.

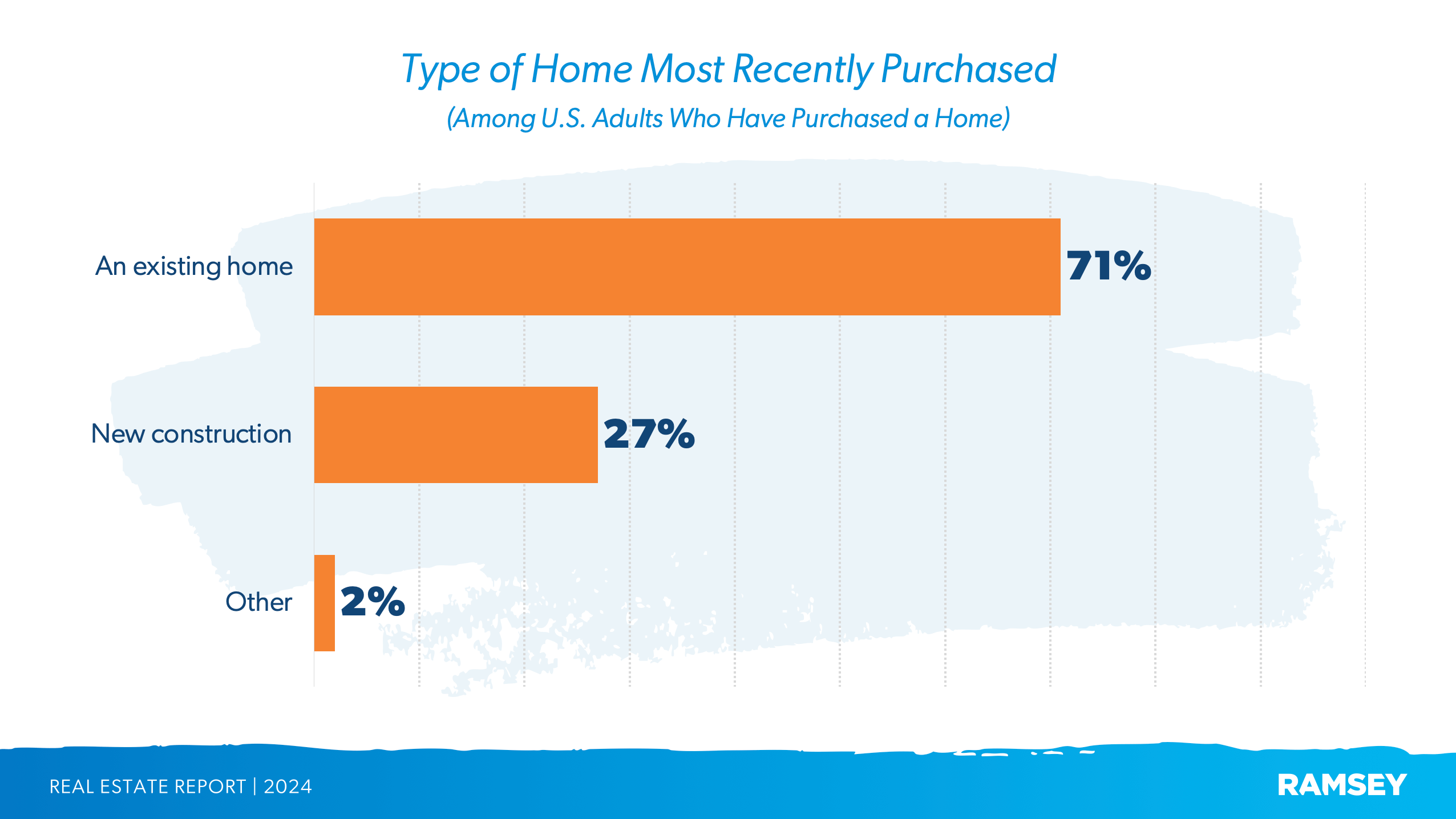

- Existing homes: Of those who have ever bought a home, 71% bought an existing home for their last purchase, compared to the 27% who bought a new build.

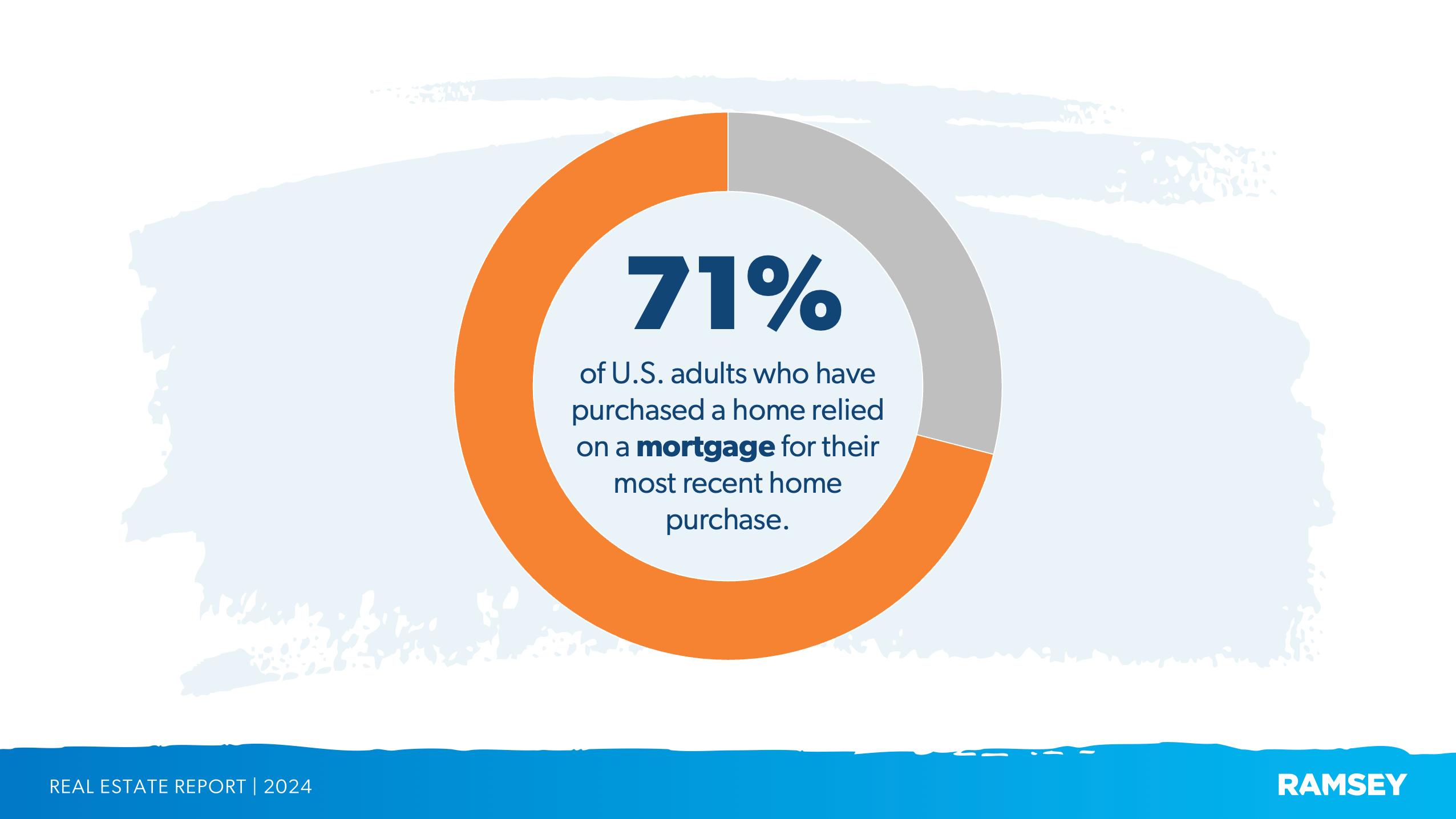

- Financing: 71% of those who have bought a home used a mortgage for their most recent purchase.

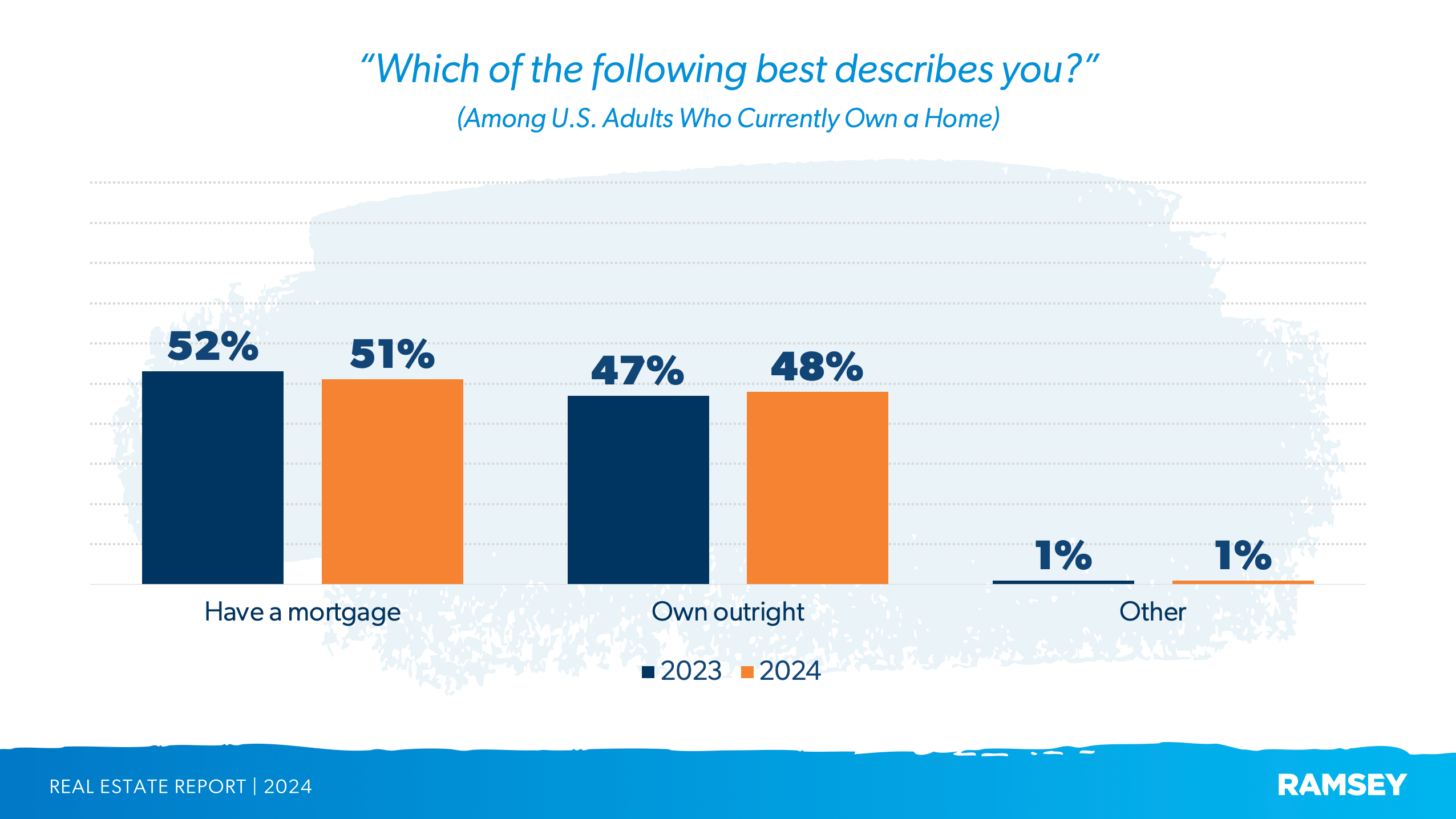

- Paid-off homes: 51% of homeowners have a mortgage, while 48% own their homes outright.

- Down payments: Historically, 20–29% of the home price is the most common range.

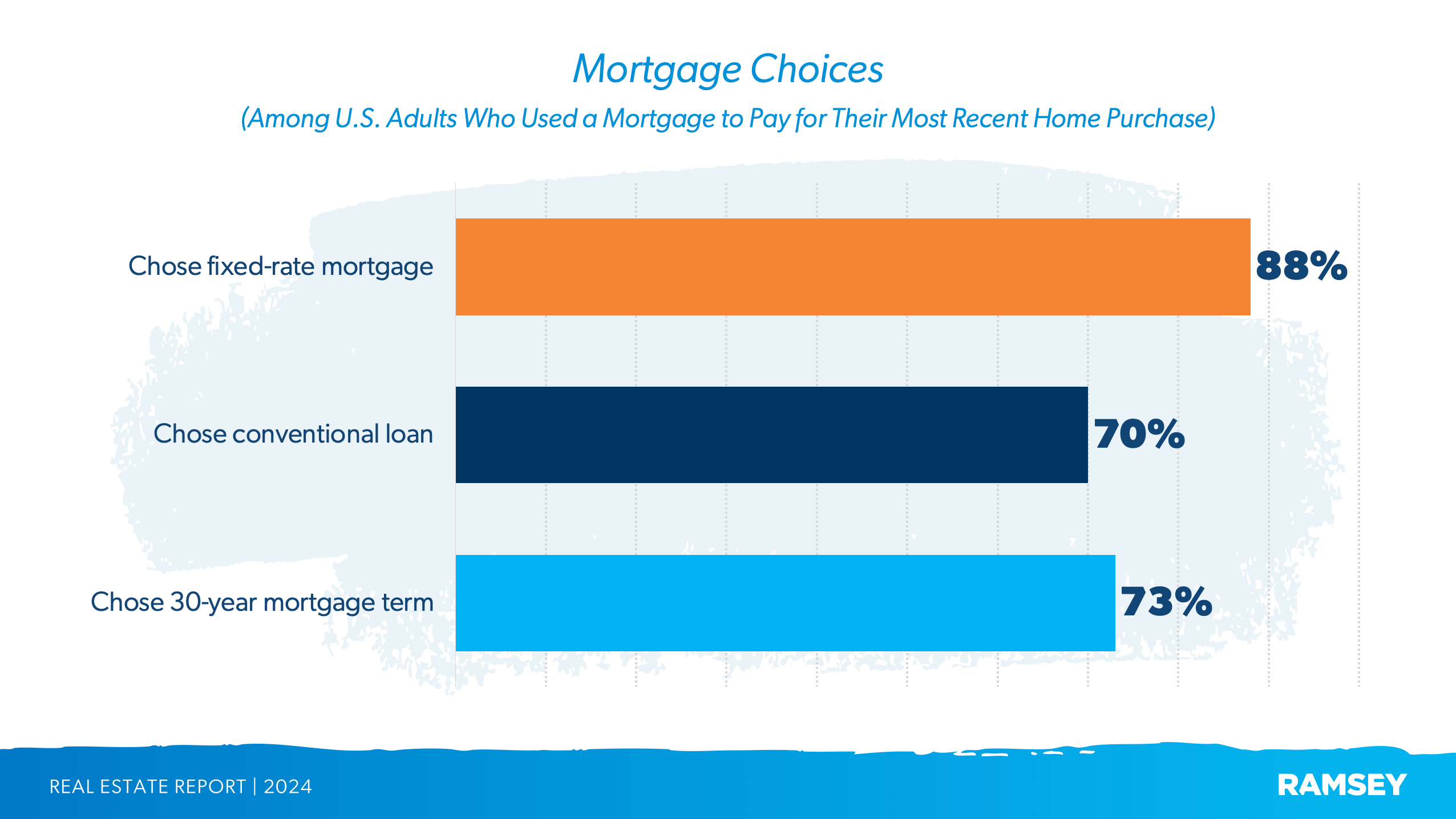

- Loan types: A 30-year fixed-rate conventional loan is the most common type of mortgage among those who have ever bought a home—but 15-year loans save far more in interest.

- Mortgage rates: Homeowners report being happy with rates under 5%—though new buyers will likely have to pay more.

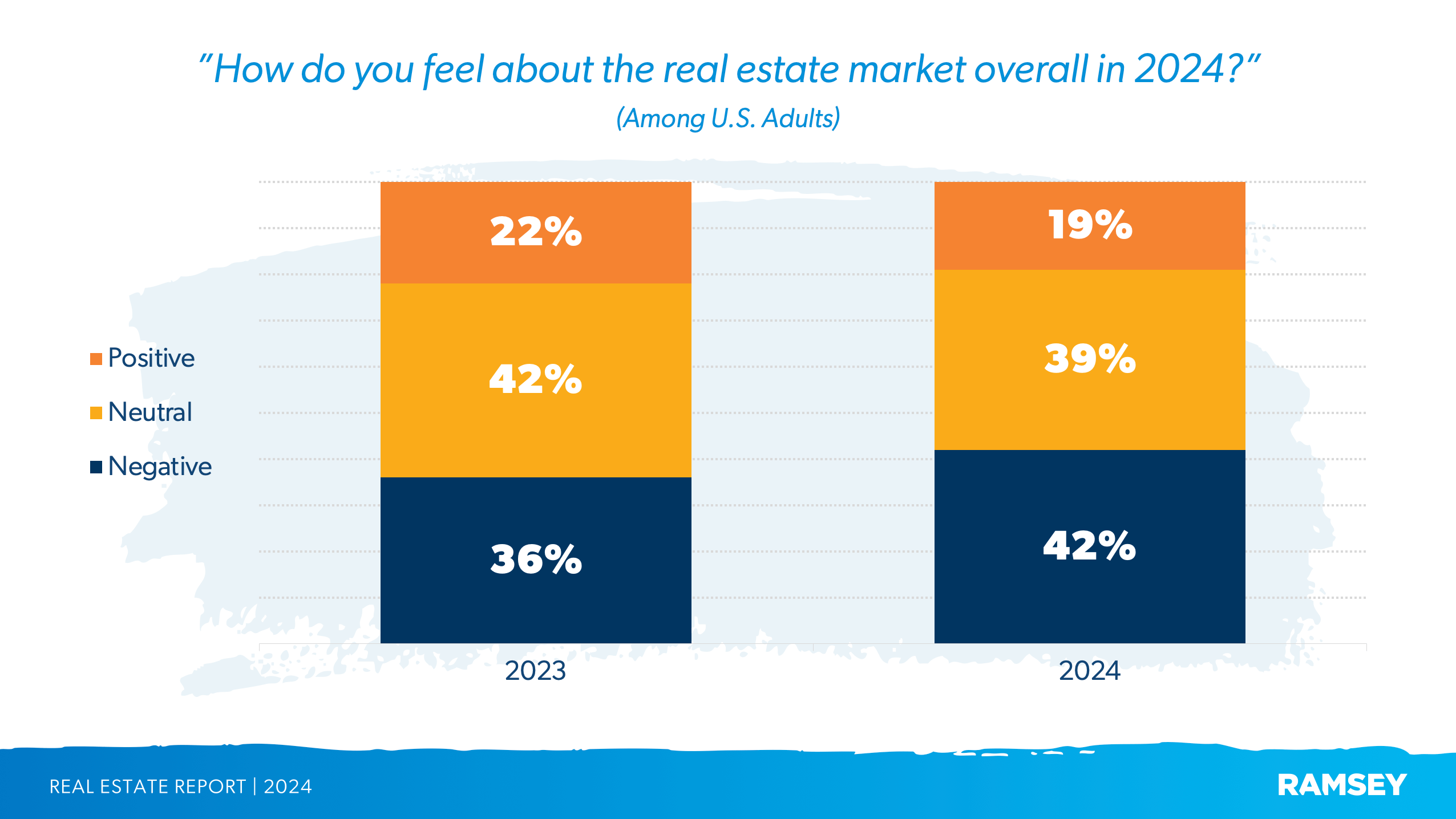

- Market sentiments: More people feel negative than positive about this market.

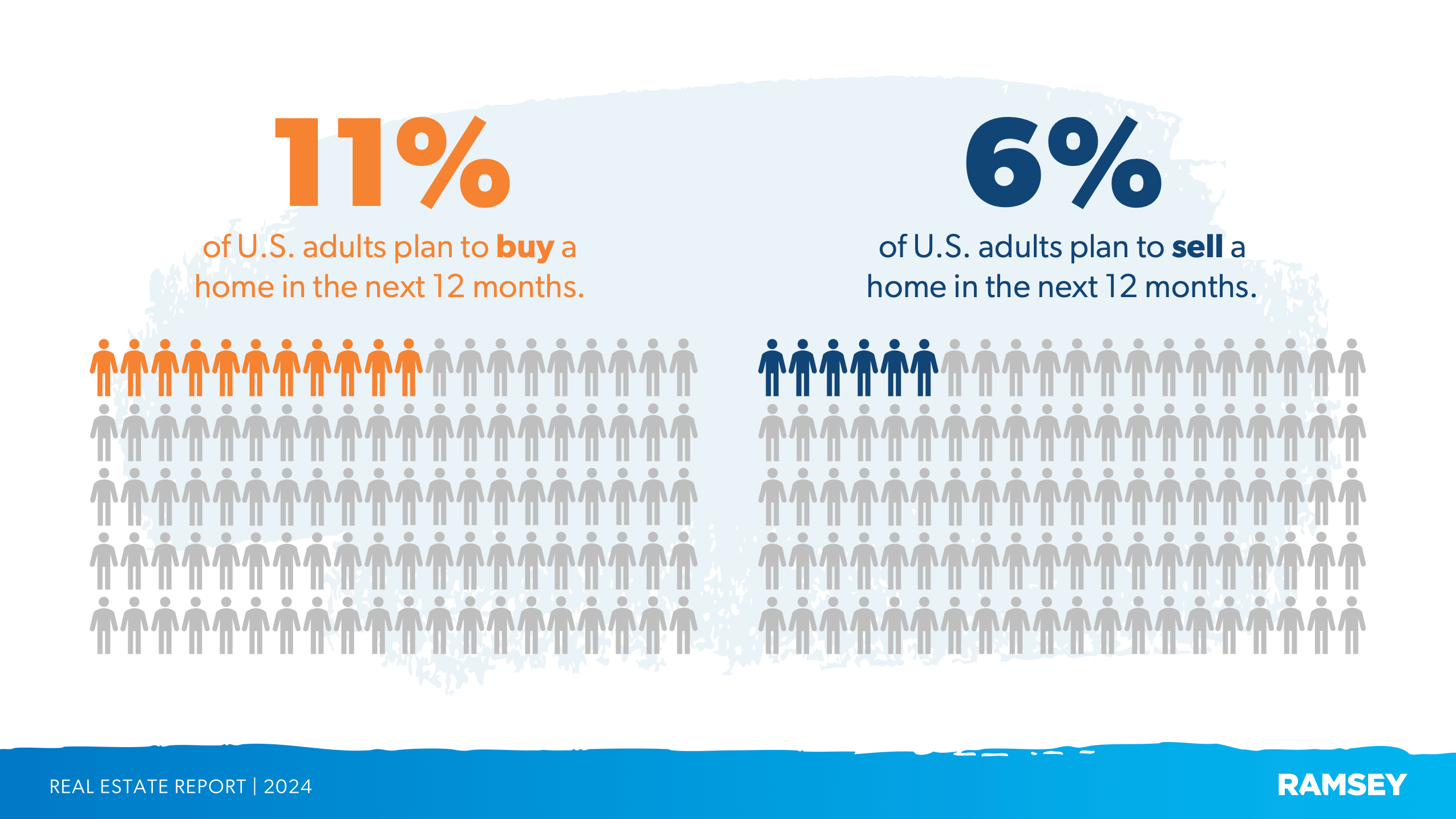

- Limited market activity: 11% plan to buy and 6% plan to sell in the next year.

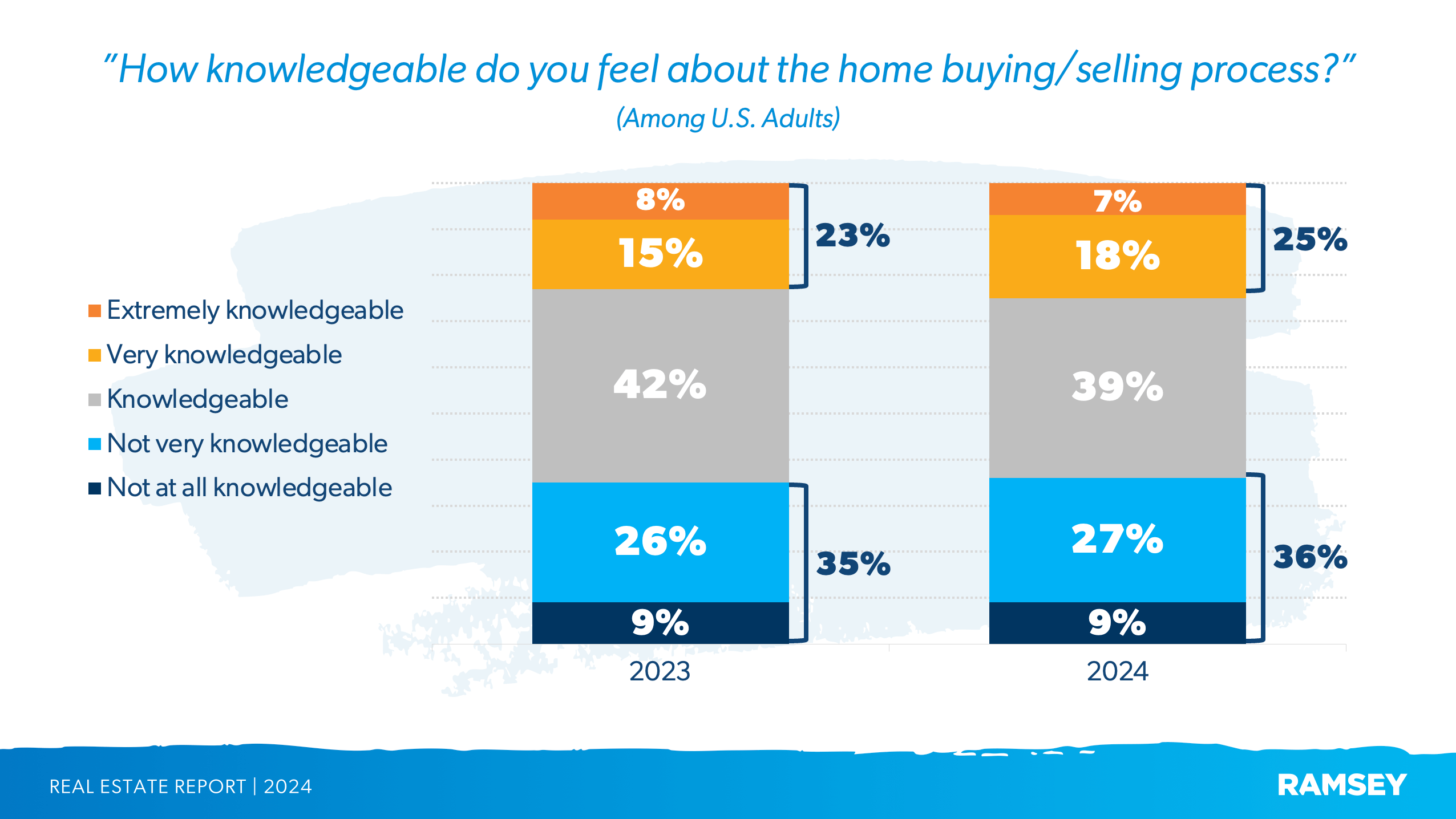

- Knowledge gap: A third of Americans don’t feel knowledgeable about the buying and selling process.

- Trusted agents: Trustworthiness is the top trait people look for in a real estate agent.

Here’s What to Expect When It Comes to Owning, Buying and Relocating

What percentage of Americans own homes vs. rent?

Six in 10 adults own a home (61%), while a third rent (32%). Compared to 2023, rates of homeownership have remained steady. Demographically, baby boomers (77%) and those with a household income of $100,000 or more (87%) are most likely to own a home.

How long does it take to buy or sell a house?

Of those who have ever bought a home, over half said the process took three months or less—from the moment they actively started searching to the day they closed.

Just like buying, most who have sold a home said it took three months or less—from listing to closing. If that feels too slow for your timeline, don’t worry. We’ve got tips you can use to sell your home faster.

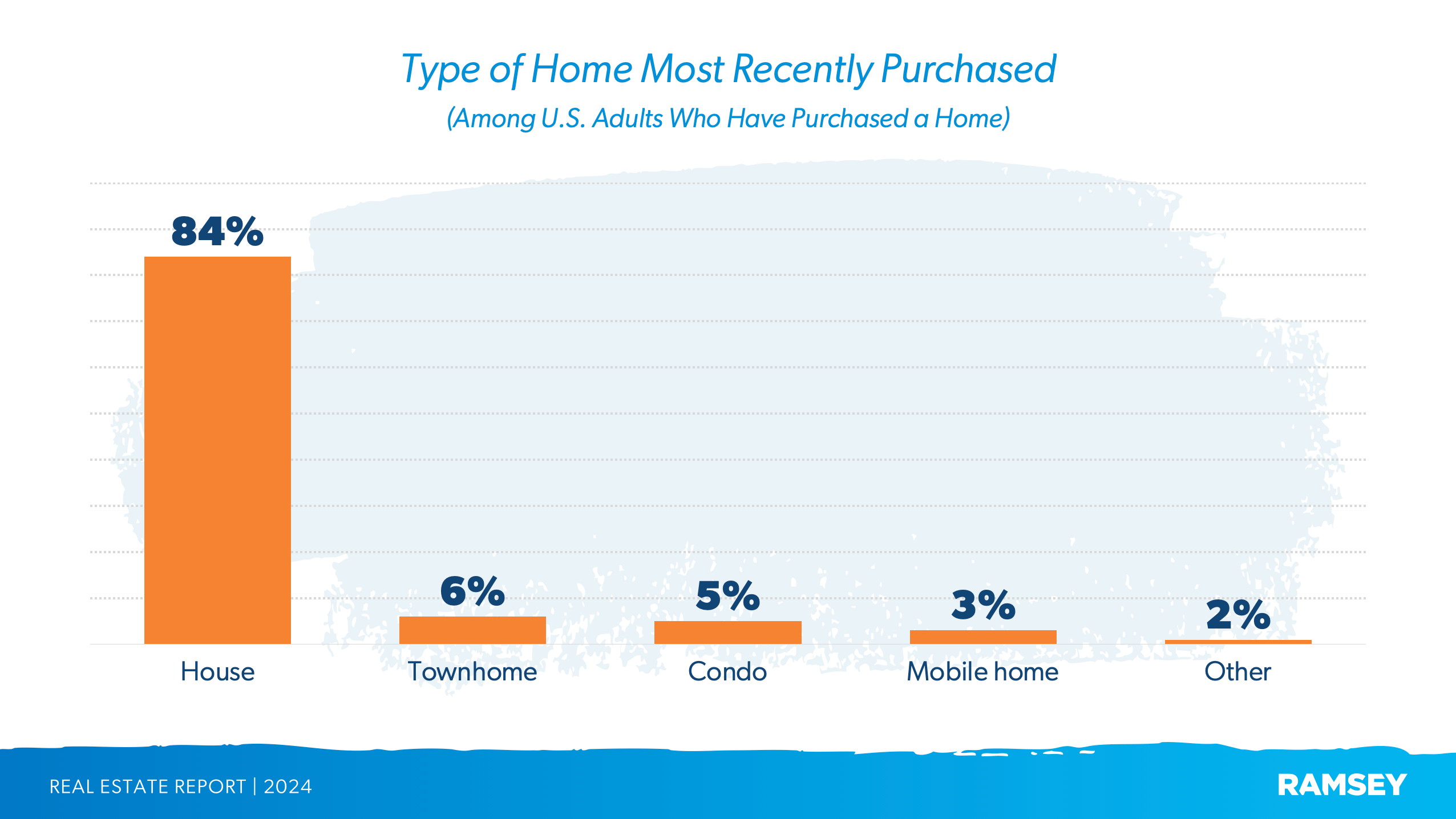

What’s the most popular type of home?

The overwhelming majority of Americans who have bought a home purchased a single-family house for their most recent buy, compared to a small percentage who purchased condos, townhomes and mobile homes.

Along the same topic, when it comes to what kinds of homes people have purchased, existing homes were more common than new construction (71% vs. 27%). This is probably less about choice and more about the availability of existing homes compared to new builds.

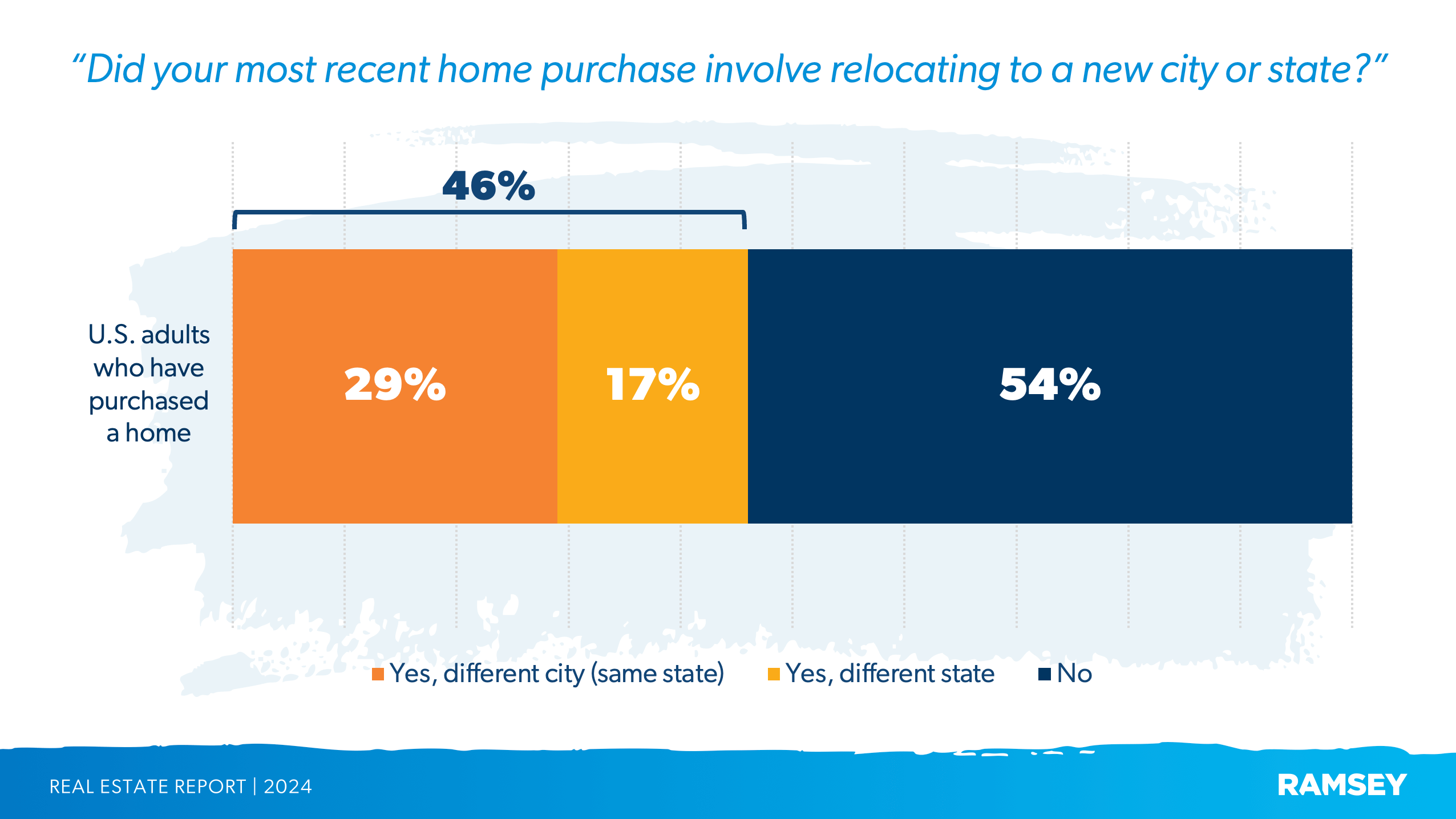

How many people move to a new city or state when buying a home?

Almost half of home buyers relocated to a different city or state when they bought their most recent home. Demographically, baby boomers (43%) and those with a household income of $100,000 or more (43%) were most likely to have relocated. If moving to a new area is part of your home-buying plans, make sure you check out our Cost of Living Calculator and get yourself fully prepared for the move with our Relocation Guide.

What to Know About Mortgages, Down Payments and Interest Rates

What percentage of Americans have a paid-off house?

Believe it or not, 48% of current homeowners own their home outright—so don’t let anyone tell you it isn’t possible. Meanwhile, a little more than half of homeowners (51%) have a mortgage. That’s not a big change compared to 2023. It also makes sense that younger people—Gen X (63%) and Gen Z/millennials (58%)—are more likely to have a mortgage compared to baby boomers and the Silent Generation (37%).

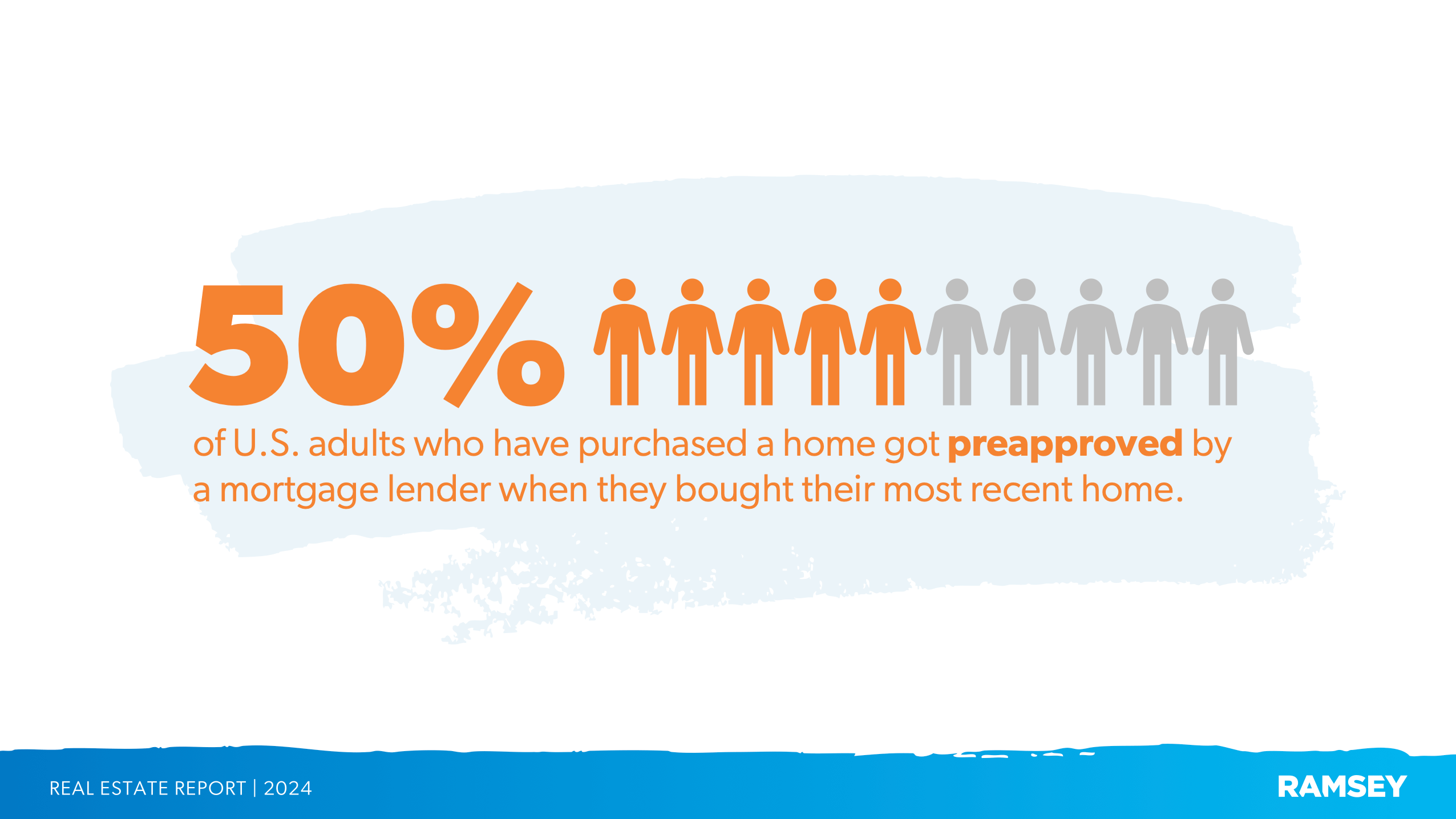

Is a mortgage preapproval common?

Among those who have ever purchased a home, 50% got preapproved for their most recent mortgage. Many sellers won’t take your offer seriously unless you have that preapproval in hand—especially when you’re competing with other buyers who already do.

How common are home inspections and moving services?

Most buyers (60%) had a home inspection done before finalizing their most recent purchase. Don’t skip this step—it's essential for avoiding unexpected, costly repairs with your new home.

Saving for a house isn’t only about the down payment and closing costs. About 36% of buyers used moving services—and relocation costs like that can add up quickly. Be sure to budget for moving expenses.

What percentage of home buyers use a mortgage?

Historically, over 70% of buyers have relied on a mortgage to purchase their home. Keep in mind, the best way to buy a home is still putting 100% down—pay for your home in cash.

What’s the typical down payment amount on a house?

Historically, the most common down payment on a house is 20–29% of the purchase price, with the median coming in at 20%. (Remember, median means half of all buyers paid less and half paid more.) That’s awesome news because any down payment that’s 20% or more allows buyers to skip private mortgage insurance (PMI).

A third of buyers who report they’re struggling or in crisis with their finances had a down payment less than 10%. If you’re a first-time home buyer, don’t buy a home if you can’t put down at least 5–10%. And make sure your mortgage payment (including principal, interest, taxes, insurance, HOA fees and PMI) is no more than 25% of your monthly take-home pay—otherwise, you could be house poor.

Listen, we want you to own a home—we just don’t want your home to own you. For help saving up a big down payment fast, check out our free Down Payment Guide.

What’s the most common type of mortgage?

Historically, most people choose a 30-year fixed-rate conventional loan. It’s great that they’re avoiding risky types of mortgages and sticking to a fixed-rate loan. But make sure you understand the cost differences between a 15-year and 30-year mortgage before locking yourself into significantly higher interest payments over three decades. (Hint: Choosing a 15-year term will save you hundreds of thousands of dollars compared to a 30-year term.)

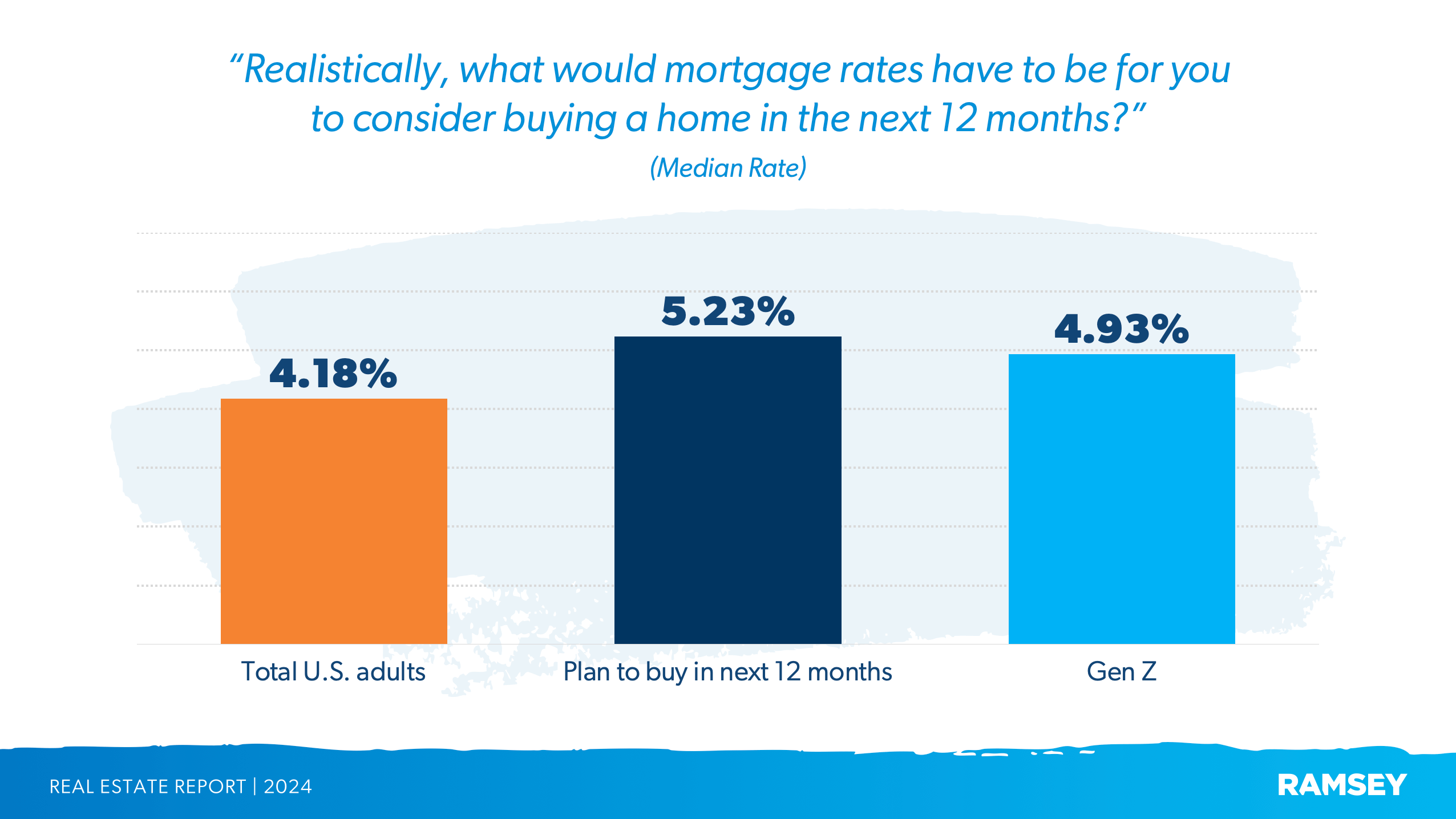

What would mortgage rates have to be for someone to consider buying?

Rates would need to be less than 5% for most U.S. adults to consider purchasing a home in the next 12 months, but those actively looking to buy in the next year would accept higher rates.

Gen Z and those who haven’t ever bought a home are among the most willing to accept a higher interest rate.

What mortgage rate do the majority of current homeowners have?

The median mortgage rate for Americans still paying off a mortgage is just under 4%, and most homeowners with rates under 5% report being happy. But here’s the reality: It’s highly unlikely we’ll ever see rates as low as 2–3% again. That’s why we say, “Date the rate, marry the house.” You can always refinance later if rates drop, but home prices are likely to keep rising. So if you’re financially ready, don’t wait—buy the house now and lock in today’s prices before they climb.

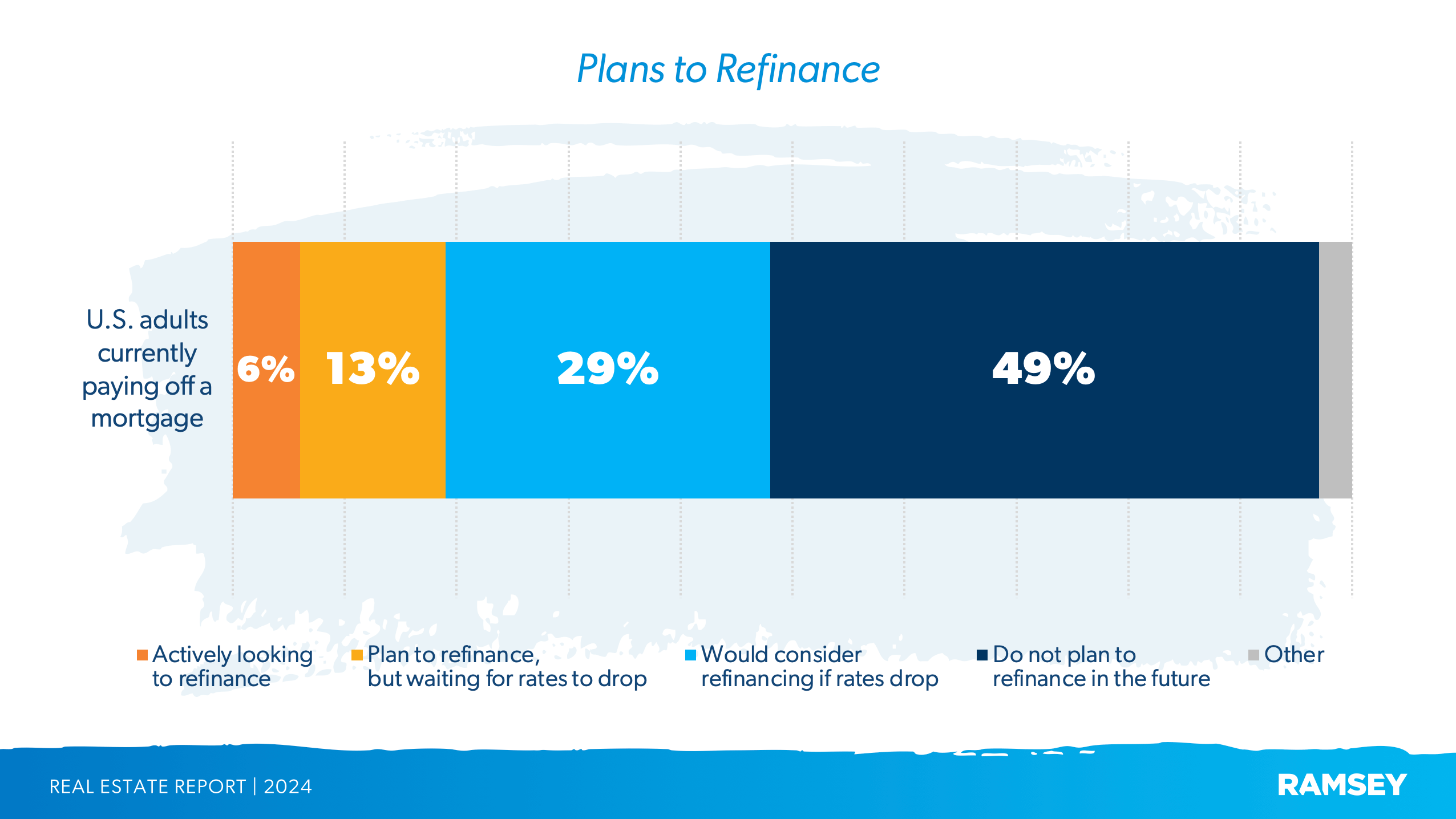

How many people are considering refinancing their mortgage?

Half of those who are still paying off a mortgage would consider refinancing. Keep in mind, deciding to refinance depends on whether the math works in your favor. Connect with a trusted mortgage lender, like our friends at Churchill Mortgage, to see if refinancing will help you reach your financial goals.

While Most Are Staying Put, Millions Still Plan to Enter the Housing Market

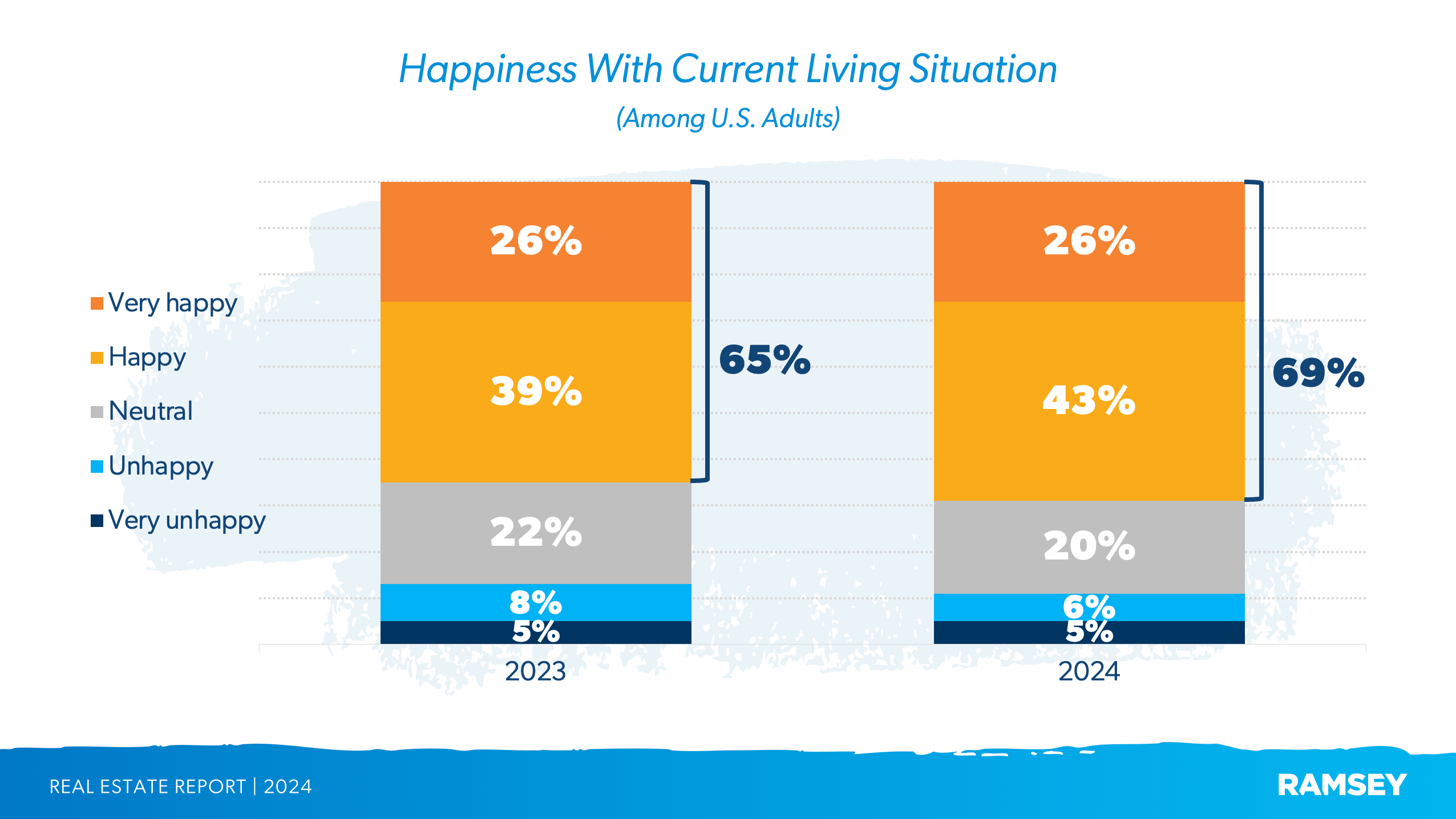

How do Americans feel about their current living situation?

Most people continue to be happy with their current living situation, with happiness being higher among homeowners (80%) compared to renters (53%).

What percentage of Americans have never owned a home?

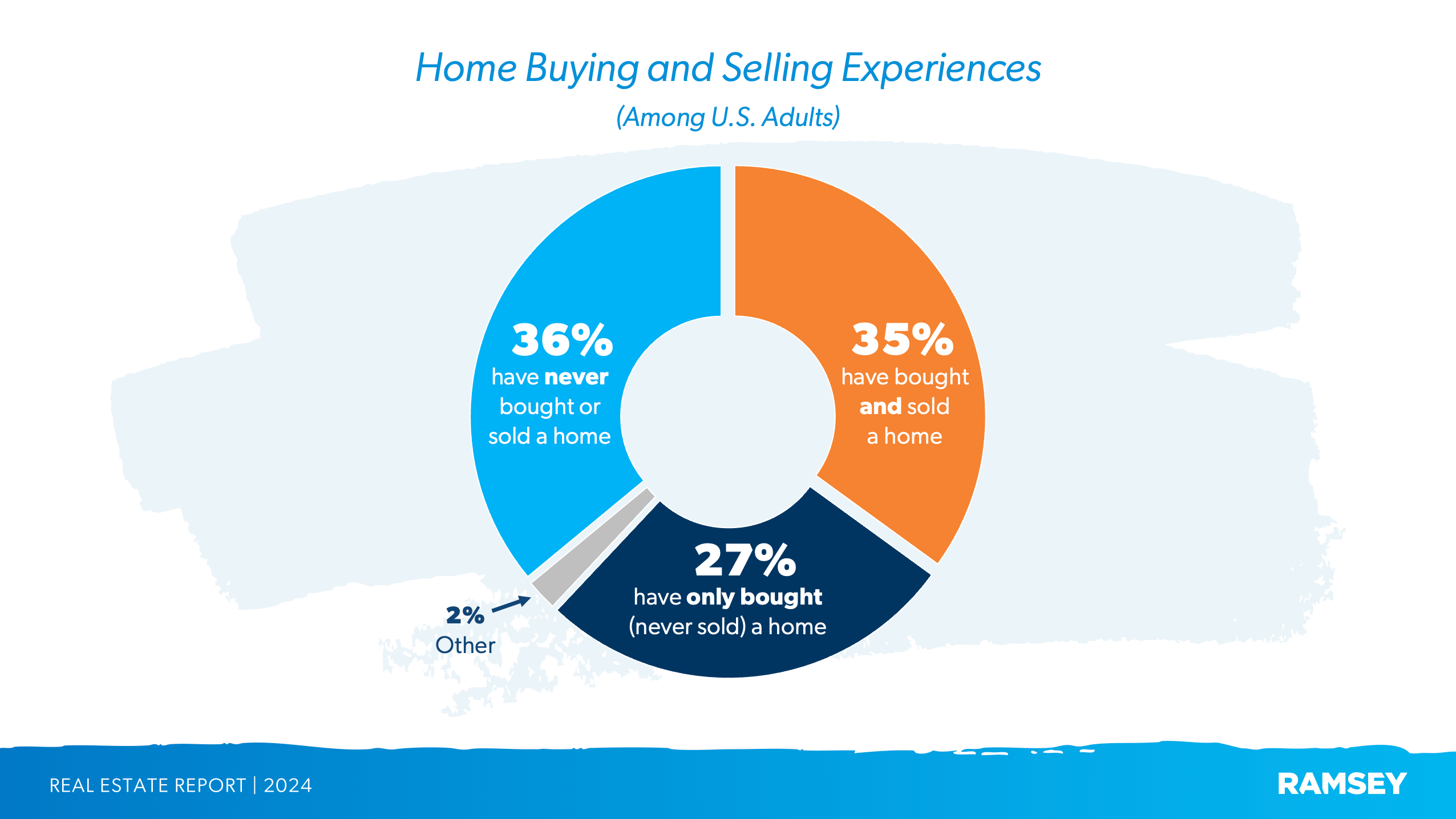

More than a third of U.S. adults (36%) have never bought or sold a home. It’s not surprising that Gen Z (the youngest group in this study) falls into this category—with 73% having never bought or sold. On the flip side, 27% of adults have only bought (never sold), and 35% have both bought and sold a home in their lifetime.

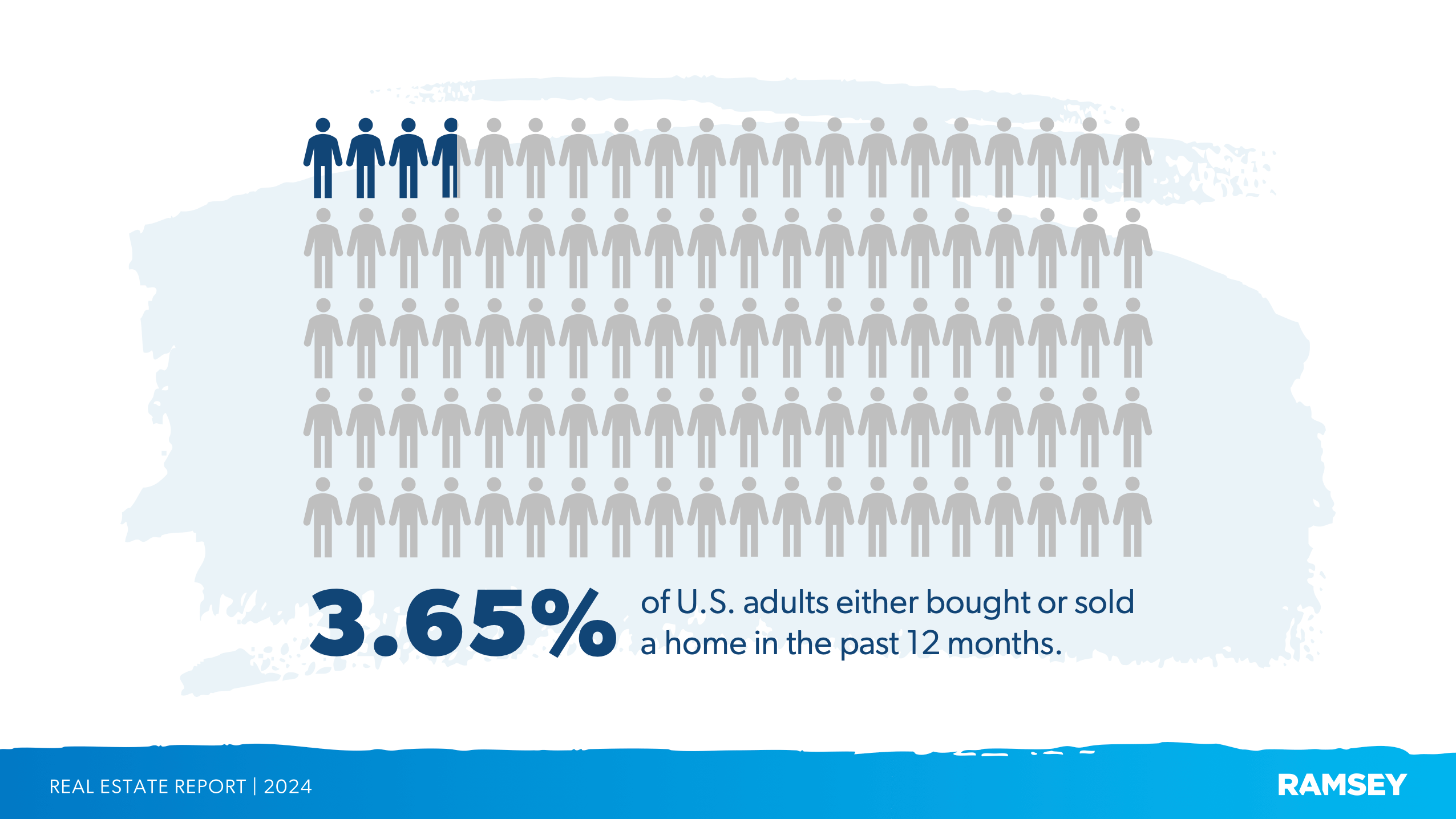

What percentage of Americans buy or sell homes in a year?

Less than 4% of U.S. adults bought or sold a home in the previous 12 months. While that percentage may sound small, it represents millions of buyers and sellers.

How many Americans plan to buy or sell a home in the next 12 months?

About 1 in 10 adults plans to buy in the next year, while 6% plan to sell. And more than half plan to work with a real estate agent, whether they’re buying (57%) or selling (52%).

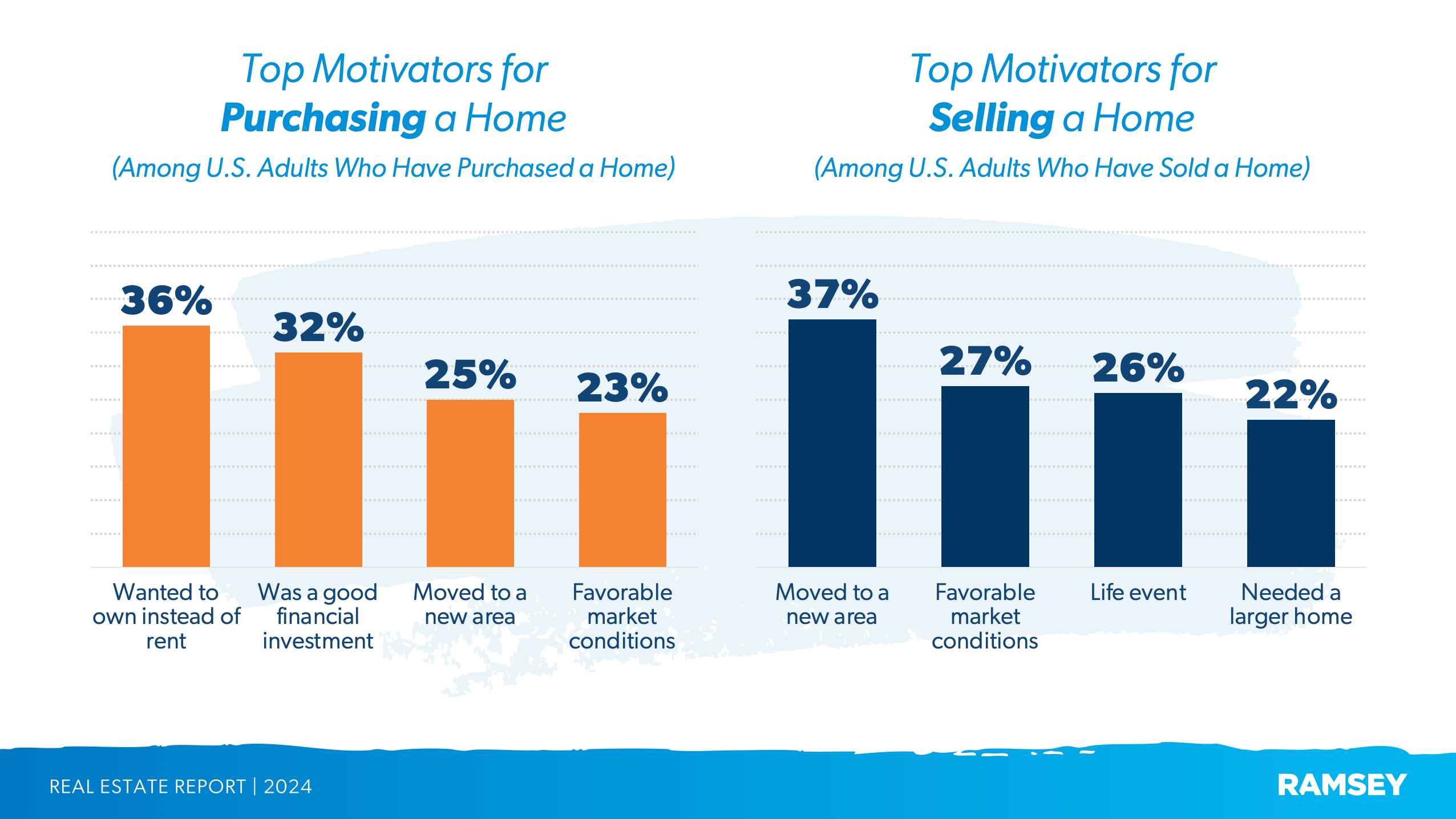

What motivated people to buy or sell a house?

Of those who have ever bought or sold a home, buyers were motivated by the financial stability and investment opportunities of homeownership, while sellers more often sold because they were moving to a new area.

Most People Have a Negative View of the Housing Market

Unfortunately, U.S. adults continue to feel more negative than positive about the real estate market. But even though the outlook feels tough, there are still smart ways to win. We’ve helped thousands of buyers and sellers make confident moves—and we can help you too. Check out our free Home Buyers Guide, a step-by-step plan that’ll give you confidence about the buying process in any market.

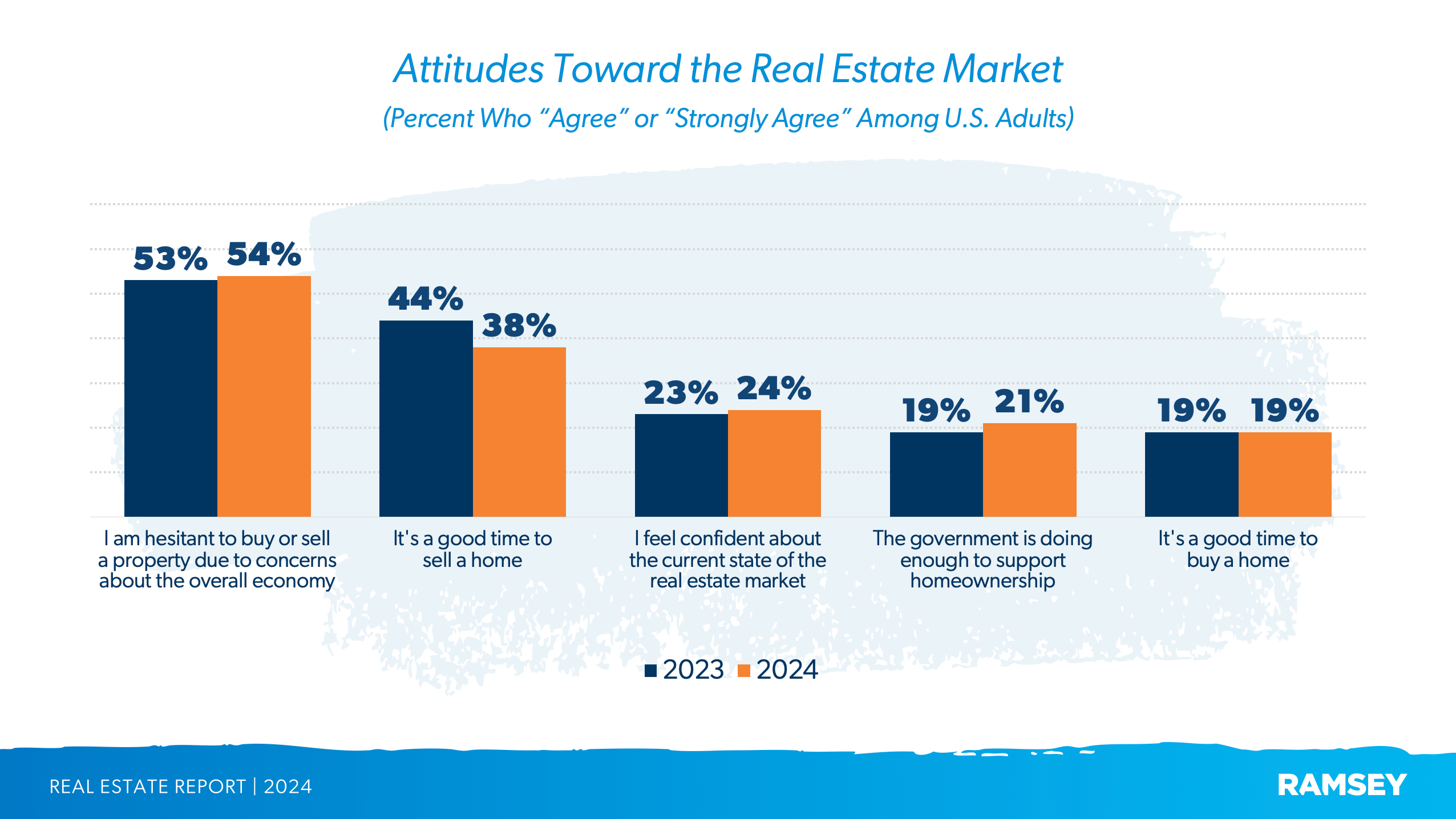

Most people remain hesitant to buy or sell.

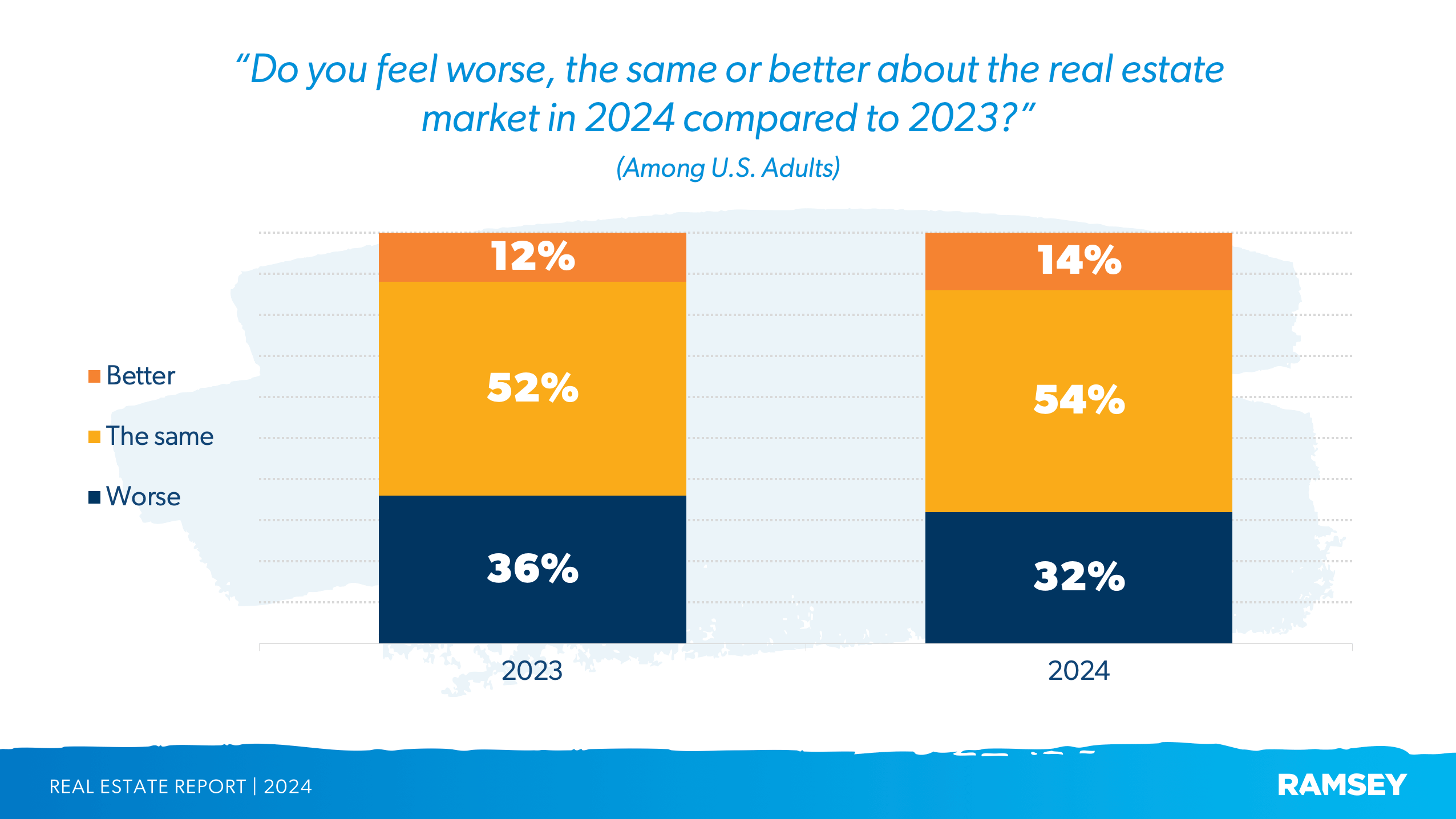

A third of people feel worse about the market in 2024 than they did in 2023.

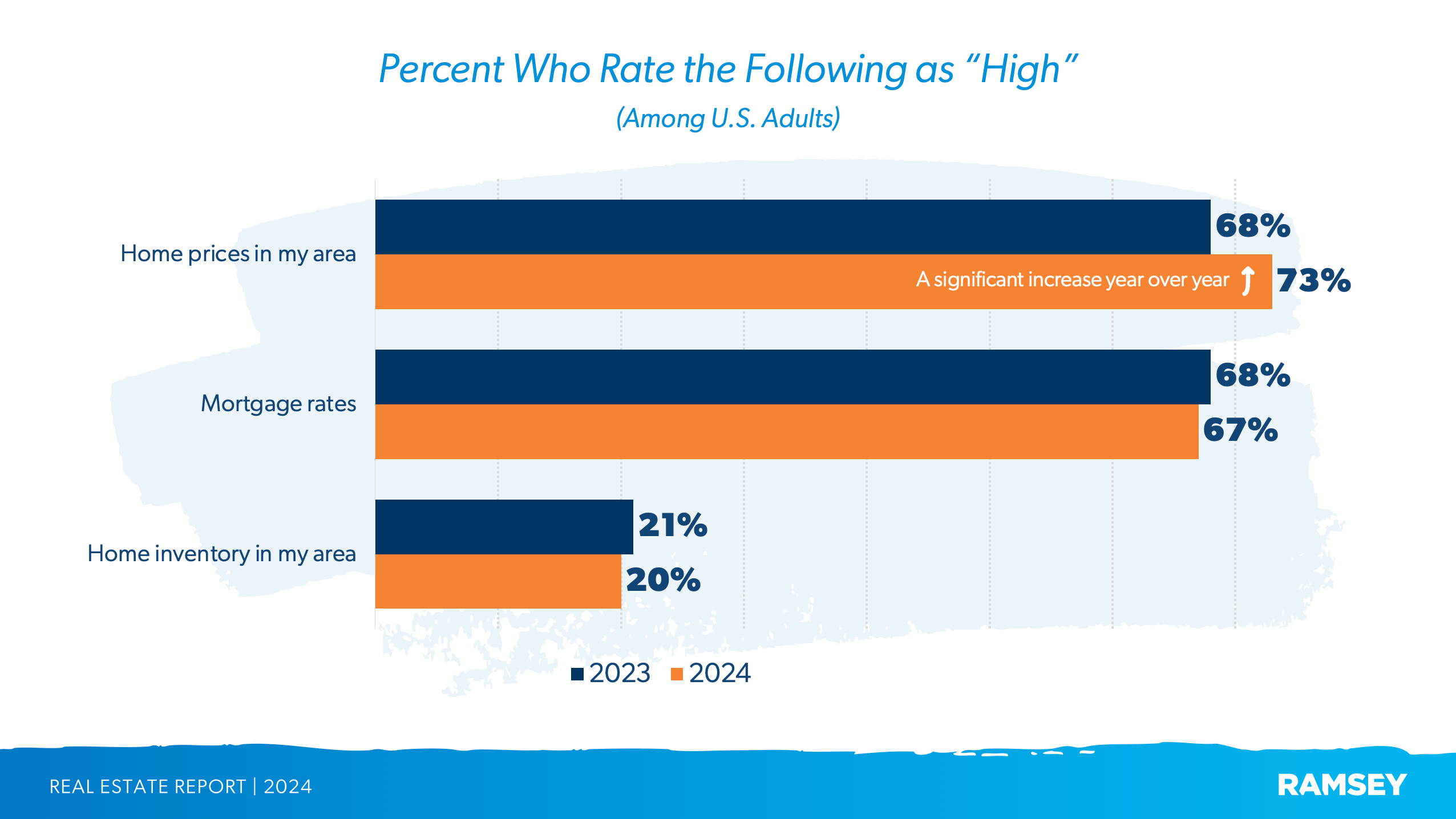

More people rate home prices as “high” in 2024 than in 2023.

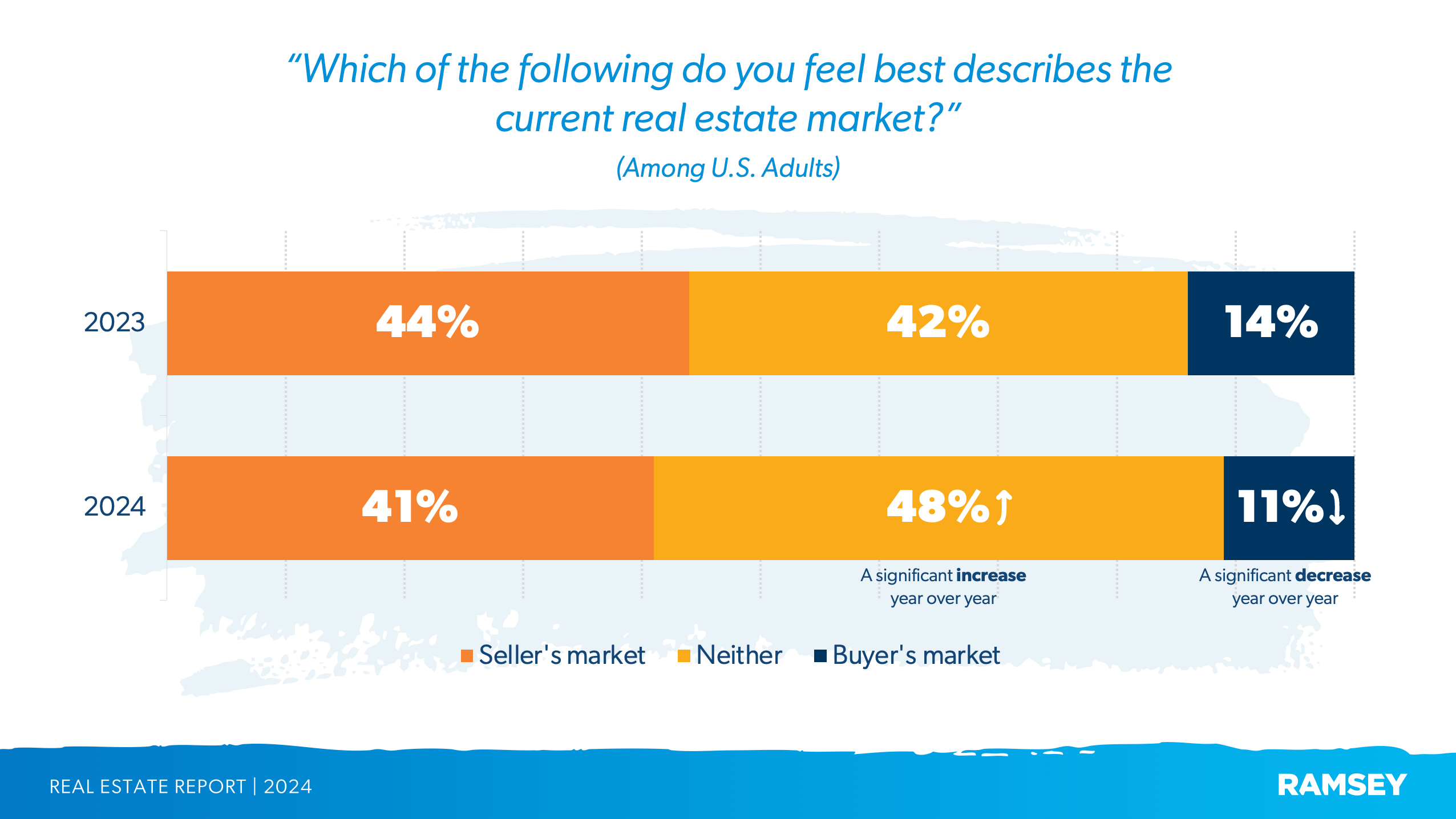

Is it a buyer’s or seller’s market right now?

People most often report seeing the market as neutral—favoring neither buyers nor sellers. But when it comes to different age groups, Gen Z (20%) are among the most likely to think it’s a buyer’s market.

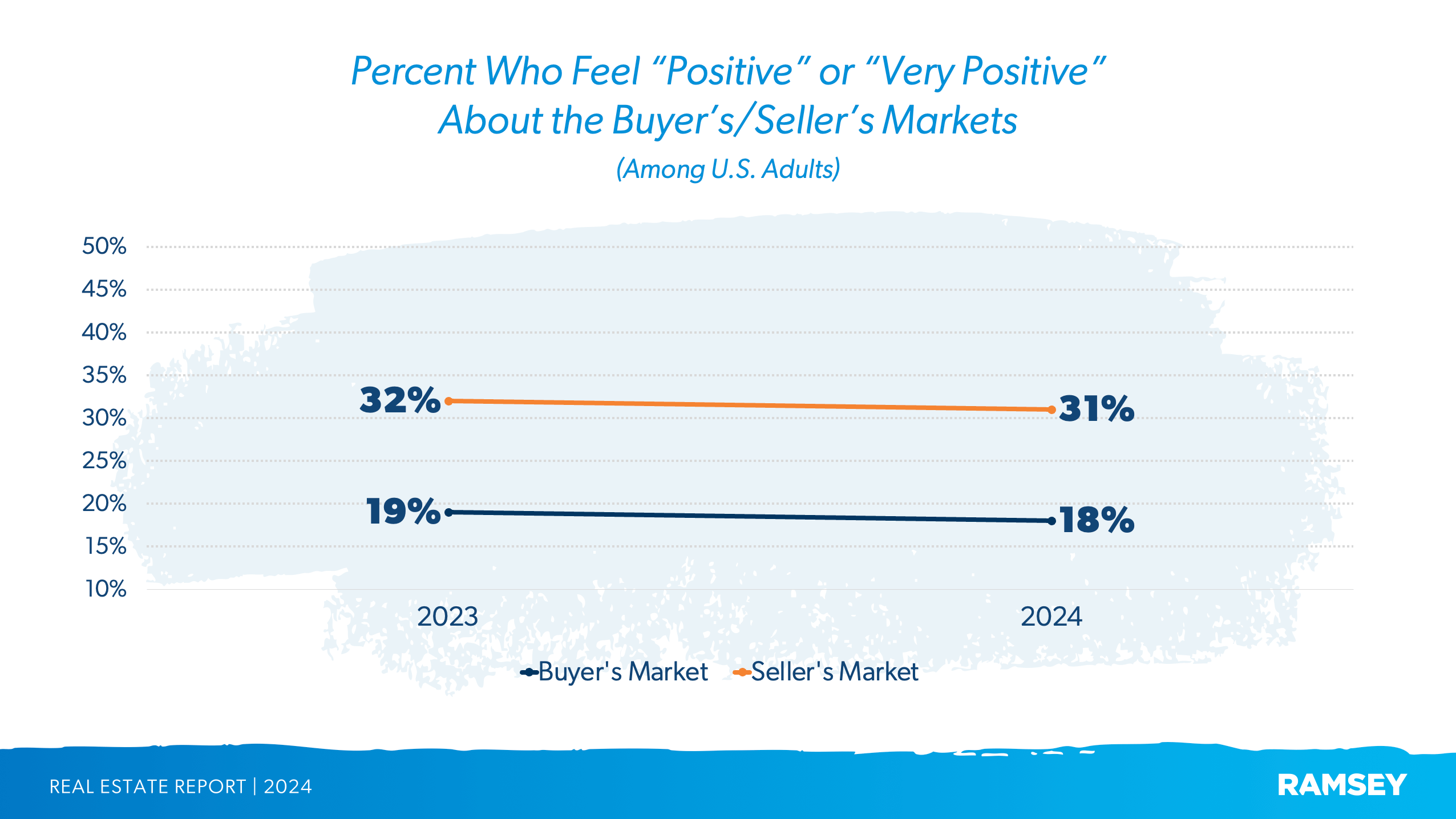

Still, people feel more positive about the seller’s market than the buyer’s.

Check out what Dave Ramsey and Rachel Cruze say about the challenges of the current housing market and the advice they give to buyers:

Check out what Dave Ramsey and Rachel Cruze say about the challenges of the current housing market and the advice they give to buyers:

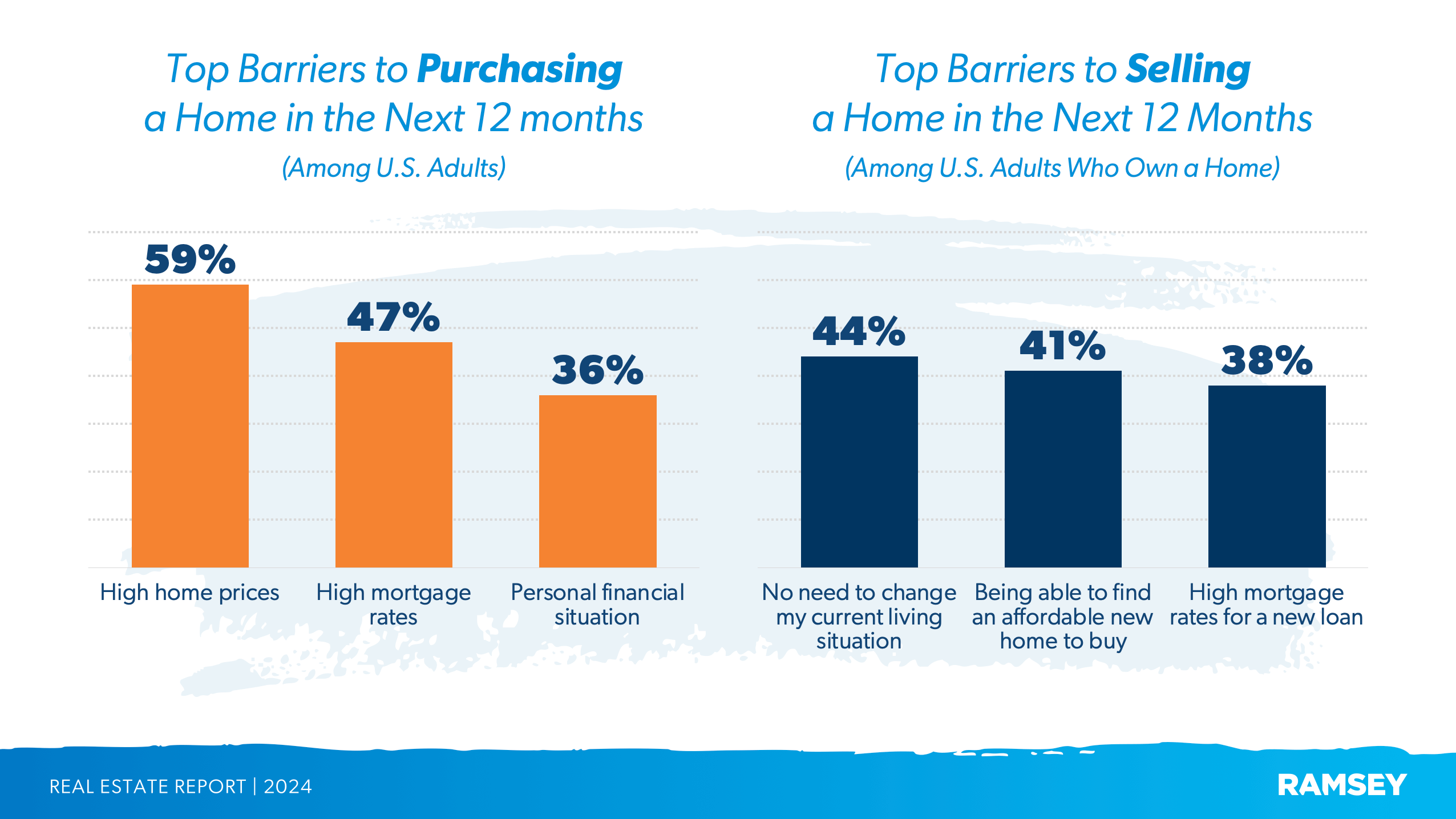

What’s the biggest barrier to buying or selling a house?

High prices and mortgage rates are a barrier to both buyers and sellers entering the market in the next 12 months, although some have managed to buy a home despite crazy housing market conditions.

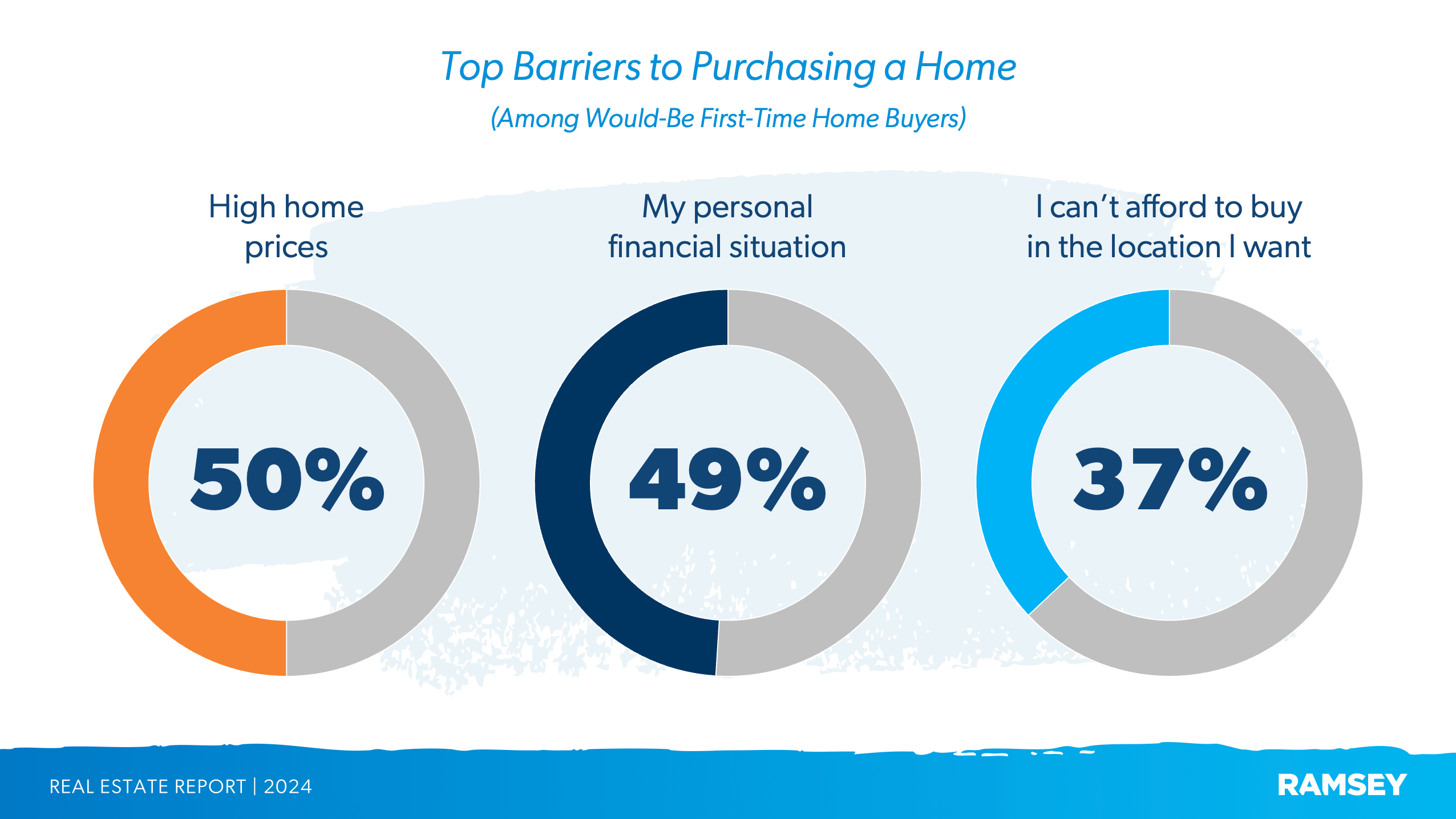

High home prices are a top barrier for those who have never bought a home—in addition to financial constraints, which could include debt and lack of savings.

With the financial odds stacked up against most buyers, it makes sense why many have a negative view toward this housing market. One of the best ways you can overcome that challenge is by freeing up your income. We teach people to pay off their debt and build a full emergency fund before stepping into homeownership. We know it isn’t easy. If you’ve had a student loan around for so long you think it’s a pet, it’s hard to see debt as catastrophic to your ability to save for a house. So use the debt snowball method for the fastest way to pay off debt.

People Want to Learn More About Real Estate

How knowledgeable do buyers and sellers feel about the real estate process?

More than 1 in 3 U.S. adults say they don’t feel knowledgeable about buying or selling a home. That number jumps to 56% among those who say they’re in crisis or struggling with their finances. If that sounds like you, don’t worry—you’re not alone. Get instant access to our free real estate resources or tune into our real estate podcast to grow your confidence and knowledge today.

What real estate topics are people most interested in learning about?

When asked, the top two real estate topics people want more information about are interest rates and home prices. To stay up to date about market conditions like those, visit our U.S. Housing Market Trends page and get the latest data from well-known, reputable sources like Freddie Mac and the National Association of REALTORS®. We break it down into easier-to-understand language (no highbrow gibberish) so you know what it means for you.

Trustworthy Real Estate Agents Are in High Demand

What percentage of buyers and sellers work with a real estate agent?

At least 80% of those who have bought or sold a home chose to work with a real estate agent—and it’s easy to see why. The value agents bring to the table is worth every penny. Buyers gain access to far more home listings than they’d find on their own, opening up better options and faster results. For sellers, the payoff is even bigger: Year after year, data shows an agent’s help can add tens of thousands more to a home sale compared to those who go it alone. And when it’s time to negotiate, nothing beats having a pro in your corner—someone who eats, sleeps and breathes real estate.

What do people want most from real estate agents?

When choosing a real estate agent, character matters most. U.S. adults consistently prioritize trustworthiness over sales stats or flashy performance metrics. That’s why it’s key to ask the right questions up front—to make sure you’re choosing the agent who’s the best fit for you.

Get Help Buying or Selling a Home With Our Free Resources

Rising home prices and mortgage rates might make the housing market feel out of reach—but there’s still hope. And we’re here to help. Whether you’re buying or selling, visit our Real Estate Home Base for all the tools and resources you need to prepare with confidence. Or jump-start the process by connecting with a RamseyTrusted® agent who can help you reach your real estate goals.

If you’re a top real estate agent in your market and want to join our mission by serving buyers and sellers with the financial principles we teach, apply to our RamseyTrusted program.

About the Study: Methodology

The Real Estate Report is an annual research study conducted by Ramsey Solutions with 1,014 U.S. adults to gain an understanding of the personal behaviors and attitudes of Americans toward real estate. The nationally representative sample was fielded from September 26 to October 8, 2024, using a third-party research panel. Margin of error was ±3.08%. For reference, the age ranges in 2024 for each generation group were as follows: Gen Z is age 18–26, millennials are 27–42, Gen X is age 43–58, and baby boomers/the Silent Generation are 59+. Since August 2023, the Real Estate Report has surveyed 2,016 U.S. adults.

Did you find this article helpful? Share it!

We Hear You!

We’re considering adding the ability to save articles to your Ramsey account.