Key Takeaways

- Your tax returns are due on Tax Day, which falls on April 15, 2026. Make sure you gather all your tax forms and decide whether to self-file or work with a tax professional with plenty of time to spare.

- For tax year 2025, the standard deduction will lower your taxable income by $15,750 for single filers and $31,500 for married couples filing jointly. Unless your itemized deductions are greater than those amounts, you’re better off sticking with the standard deduction.

- The federal income tax brackets were slightly adjusted for inflation. Meanwhile, the lowest tax rate stayed put at 10% and the top tax rate remains at 37%.

- The One Big Beautiful Bill Act (OBBBA) makes many of the 2017 tax cuts permanent while introducing several new tax deductions, expanding some existing tax credits, and scrapping a few other credits altogether.

Well. It’s about that time of the year again—tax season. Groan. From standard deductions and adjusted tax brackets to figuring out which tax credits and deductions you qualify for, it can be a lot to figure out everything you need to know to file your taxes.

Get expert money advice to reach your money goals faster!

Don’t worry, we’re going to dive into all of that, plus a few more changes you need to be aware of. First, let’s kick things off with the main details you need to know for the 2026 tax season:

- Tax filing deadline: All tax returns must be filed by April 15, 2026. If you owe any taxes for tax year 2025, those also must be paid by this date.

- Extension deadline: If you request a tax filing extension, then your new tax filing deadline is October 15, 2026. However, if you owe taxes for tax year 2025, that payment is still due on April 15 regardless of the extension to file.

- Standard deduction increase: For tax year 2025, the standard deduction is $15,750 for single filers and $31,500 for married couples filing jointly.

- Tax brackets adjusted for inflation: Income tax brackets went up in 2025 to account for inflation. The tax rates all stay the same, with the lowest rate standing at 10% and the highest rate remaining at 37%.

But that’s just scratching the surface! For starters, the One Big Beautiful Bill Act (OBBBA) made many of the temporary tax cuts from the 2017 Tax Cuts and Jobs Act permanent. But that’s not all: The new law also included several tax changes that might affect your tax bill this year.

Let’s break down the details so you can file your taxes with confidence this year.

When Can I File My Taxes?

Tax season typically starts at the end of January, which means you should see a W-2 form from your employer in your mailbox by the end of the month.1 Since many employers use a digital payroll system for direct deposit, you might also find your W-2 online. Freelancers should also be on the lookout for a 1099 form from each of their clients.

Here are a few other tax forms you might need:

- Mortgage interest statements

- Investment income statements

- Charitable contribution statements

Now’s also a great time to gather your receipts (you kept those, right?) if you plan on itemizing your deductions so you’re not scrambling and pulling your hair out by the time April rolls around.

When Are Taxes Due?

Remember: Tax Day falls on April 15, 2026. That means you need to file your tax return and pay any taxes you owe by that date, or else you’ll be looking at failure-to-file and failure-to-pay penalties.2

If you need more time to do your taxes (maybe someone forgot to mail you a tax form or there was an error on one of them), make sure you file for a tax extension to avoid a failure-to-file penalty. If you request an extension, you’ll need to file your return by October 15, 2026.3

However, a tax filing extension does not extend the deadline to pay your tax bill. Any tax you owe is still due on April 15—with or without a tax filing extension.

Our advice? Don’t wait until the last minute to file your tax return or set up an appointment with a tax pro (good luck trying to get a meeting if you call them a week before the deadline). Once you have all your tax forms gathered and organized, you’ve got the green light to file your taxes. If you’re not sure you have everything you need, you’ll want to reach out to a tax pro—especially if you have a complicated tax situation.

And besides, wouldn’t it be nice to get your taxes done and over with in February or March so that April 15 is just another lovely spring day for you to enjoy?

Tax Year vs. Tax Season

Before we dive into tax brackets, let’s talk some lingo. You’ll often hear the phrases tax year and tax season. These are not the same thing.

The tax year is the actual year where you earn money, pay income taxes, make charitable contributions, work side gigs, etc. The tax season is when you file, report and pay any remaining taxes owed from the previous tax year.

So, during the 2026 tax season, you file taxes for the 2025 tax year. Got it? Keep that in mind whenever we’re talking about the tax season or tax year. It’s important!

Income Brackets and Tax Rates for the 2025 Tax Year

Here’s a refresher on how income brackets and tax rates work: Your tax rate (the percentage of your income you pay in taxes) is based on what tax bracket (income range) you’re in.

For the 2025 tax year, the tax brackets went up a few hundred dollars to account for inflation.

Tax Year 2025 Marginal Income Tax Rates and Brackets

|

Tax Rate |

Single Filer |

Married Filing Jointly |

Head of Household |

Married Filing Separately |

|

10% |

$0–11,925 |

$0–23,850 |

$0–17,000 |

$0–11,925 |

|

12% |

$11,925–48,475 |

$23,850–96,950 |

$17,000 –64,850 |

$11,925–48,475 |

|

22% |

$48,475–103,350 |

$96,950–206,700 |

$64,850–103,350 |

$48,475–103,350 |

|

24% |

$103,350–197,300 |

$206,700–394,600 |

$103,350–197,300 |

$103,350–197,300 |

|

32% |

$197,300–250,525 |

$394,600–501,050 |

$197,300–250,500 |

$197,300–250,525 |

|

35% |

$250,525–626,350 |

$501,050–751,600 |

$250,500–626,350 |

$250,525–375,800 |

|

37% |

Over $626,350 |

Over $751,600 |

Over $626,350 |

Over $375,8004 |

For example, if you’re single and your taxable income is $75,000, then you’re in the 22% tax bracket. But that doesn’t mean your tax rate is a flat 22%. Instead, part of your income is taxed at 10%, another part at 12%, and the last part at 22%.

Standard Deduction for the 2025 Tax Year

When you pay taxes, you have the option of taking the standard deduction or itemizing your deductions (calculating your deductions one by one). Itemizing is more of a hassle, but it’s worth it if your itemized deductions add up to more than the standard deduction.

For the 2025 tax year, the standard deduction went up to adjust for inflation. Here’s the 2025 standard deduction:

Standard Deduction for Tax Year 2025

|

Filing Status |

Standard Deduction |

|

Single |

$15,750 |

|

Married Filing Jointly |

$31,500 |

|

Married Filing Separately |

$15,750 |

|

Head of Household |

$23,6255 |

Here's A Tip

Not sure whether you want to take the standard deduction or itemize? Everyone’s situation is different, so there’s no one-size-fits-all answer. You might want to talk to a tax pro if you’ve got a complicated situation with lots of possible deductions. And they can help you navigate more year-end tax-saving tips too.

Not sure whether you want to take the standard deduction or itemize? Everyone’s situation is different, so there’s no one-size-fits-all answer. You might want to talk to a tax pro if you’ve got a complicated situation with lots of possible deductions. And they can help you navigate more year-end tax-saving tips too.

Tax Deductions and Credits to Consider This Tax Season

The closest things to magic words when it comes to taxes are deductions and credits. Both help you keep more money in your pocket instead of Uncle Sam’s, but in slightly different ways.

- Tax deductions help lower the amount of your income that can actually be taxed. Some deductions are only available if you itemize, while others are still available even if you decide to take the standard deduction.

- Tax credits, on the other hand, are dollar amounts actually subtracted from your tax bill, and there are two types: refundable and nonrefundable. If a credit is greater than the amount you owe and it’s a refundable credit, the difference is paid to you as a refund. Score! If it’s a nonrefundable credit, your tax bill will be reduced to zero, but you won’t get a refund. Still a win!

Here are some potential deductions and credits you might be able to claim on your tax return this year. But while it’s never too early to start planning for taxes, the IRS doesn’t always follow our schedule. So keep in mind that the details below could change as tax season approaches.

1. Charitable Deductions

You can deduct charitable contributions you made during tax year 2025 as long as you itemize your deductions and donate to qualified organizations. The limit for charitable deductions is 60% of your adjusted gross income (AGI).6 (By the way, AGI is your total income minus other deductions you’ve already taken.)

2. Medical Deductions

If you found yourself with hefty medical bills in tax year 2025, you might be able to find at least some tax relief.

You can deduct any medical expenses above 7.5% of your adjusted gross income (AGI).7 For example, if your AGI was $100,000, you can deduct out-of-pocket medical expenses above $7,500 in tax year 2025. But you have to itemize your deductions in order to write off those expenses on your tax return.

3. Business Deductions

If you’re self-employed, there are a bunch of deductions you can claim on your tax return—including travel expenses and the home office deduction if you use part of your home for business purposes.8

But if you’re one of the millions of people who work remotely, you won’t be able to claim the home office deduction since it’s reserved for self-employed people only. Sorry!

4. Retirement Account Deductions

If you’re an employee who contributed to a traditional 401(k) throughout the year, you don’t need claim those contributions as tax deductible when you fill out your tax return. That’s because the money was taken out of your paycheck before federal taxes on your income are figured. That’s one less thing you have worry about!

For traditional IRA contributions, you can take a full deduction up to the limit ($7,000 for most folks and $8,000 if you’re 50 or older) if neither you nor your spouse participate in an employer-sponsored plan like a 401(k). Cha-ching!

If you do contribute to an employer-sponsored plan, the deduction phases out as your income increases depending on your filing status:

- Single: You get a full deduction if your income is less than $79,000. You can take a partial deduction if your income is between $79,000 and $89,000. If you make more than $89,000, you don’t get any deduction.

- Married filing jointly: You get a full deduction if you make less than $126,000. If your income is between $126,000 and $146,000, the deduction is only partial. Couples making more than $146,000 get no deduction.

- Married filing separately: You get a partial deduction if you make less than $10,000. There’s no deduction if you make more than $10,000.9

If you’re not covered by an employer-sponsored plan at work but your spouse is, you’ll need to file jointly to get the deduction. You can take a full deduction if you make less than $236,000, a partial deduction if you make between $236,000 and $246,000, and no deduction if you make more than $246,000.10

What if you’re the proud owner of a Roth IRA or Roth 401(k)? The bad news is, your contributions to Roth accounts are not tax-deductible. But the good news (and it’s very good news) is that you won’t have to pay taxes when you take the money out of your account in retirement. (That’s why we recommend investing with Roth IRAs and Roth 401(k)s whenever possible.)

Need help navigating retirement plans? It’s probably a good idea to reach out to an investment professional who can walk you through the process.

5. Earned Income Tax Credit (EITC)

This one’s a biggie. The EITC is a refundable credit designed to help out low- and middle-income households.11 To qualify for the credit, a single filer with no children must have an AGI below $19,104, while the cap for a married couple with three or more children is $68,675.12

Maximum Adjusted Gross Income Limits

|

Dependents Claimed |

Single, Head of Household, Married Filing Separately or Widowed |

Married Filing Jointly |

|

0 |

$19,104 |

$26,214 |

|

1 |

$50,434 |

$57,554 |

|

2 |

$57,310 |

$64,430 |

|

3 or more |

$61,555 |

$68,67513 |

And here’s the maximum EITC credit amounts you can get based on your number of qualifying children:

Maximum EITC Credit Amounts

|

Qualifying Children |

Maximum Credit Amounts |

|

0 |

$649 |

|

1 |

$4,328 |

|

2 |

$7,152 |

|

3 or more |

$8,04614 |

You cannot claim the EITC if you have investment income over $11,950 or if you’re married filing separately.15

Depending on your income, your filing status and number of dependents, the credit could save you anywhere from a few hundred to a few thousand dollars on your taxes.

Here's A Tip

But here’s a crazy stat: About 5 million taxpayers who are eligible for the EITC do not claim the credit each year, leaving about $7 billion in unclaimed benefits on the table every year.16 Don’t let that be you if you qualify!

6. Child Tax Credit (CTC)

Got kids? Well, here’s a tax credit just for you! The child tax credit lets you credit up to $2,200 per dependent child under the age of 17. The income limit is $400,000 for married filing jointly and $200,000 for all the other filing statuses. The CTC is also partially refundable up to $1,700.17

7. Child and Dependent Care Credit

This is another great credit parents and guardians should know about. The child and dependent care credit is a nonrefundable credit that allows taxpayers to offset some of the costs for care provided while you’re working, things like child care facilities and in-home caregivers for older dependents.

Here’s how it works: You can claim 20–35% of up to $3,000 ($6,000 for two or more dependents) for the cost of care. The percentage of the credit depends on your AGI. Families with an AGI of $15,000 or less can claim the full 35%. As you earn more income, the credit is reduced. But a family with an AGI of over $43,000 can still claim the minimum credit rate of 20%.18

Let’s break it down. You pay $250 a week for Junior to go to day care. That’s about $13,000 a year (ouch). If you qualify to credit 20% of $3,000 in care costs, you get $600 knocked off your tax bill. Not too shabby!

8. Education Credits

Bettering yourself or your children through education is a good thing, and it’s even better when you get a tax break.

The American opportunity tax credit (AOTC) is a partially refundable credit that pays for education expenses for students during their first four years of college. You can claim up to $2,500 per student—and if the credit brings your tax bill to zero, you could receive up to $1,000 (that’s 40% of the credit) as a refund.19

Another education credit is the lifetime learning credit (LLC). This one isn’t refundable, but it covers up to $2,000 in qualified educational expenses per return.20 While you can only take advantage of the AOTC for undergrad expenses, you can reap the benefits of the LLC for expenses related to all kinds of educational opportunities—from degree programs to technical classes to courses for improving job skills.

But beware: You can claim both the AOTC and the LLC on your tax return—but not for the same student or the same expenses.21 And both credits have income limits: You cannot claim either credit if your modified adjusted gross income (MAGI) is more than $90,000 ($180,000 for those who are married filing jointly).22

In addition to these credits, you could be eligible for a tax deduction (up to $2,500) for interest you’ve paid on student loans. Now, the student loan interest deduction is definitely not a reason to keep student loans around if you currently have them since the deduction is basically a small refund of what you’ve already paid—it’s not free money.

So you should still pay off your student loans as soon as possible. But if you do still have student loans and you’re working hard to pay them off, this deduction could be a nice bonus.

How the One Big Beautiful Bill Impacts Your 2025 Taxes

The OBBBA covers a lot of ground when it comes to taxes. For now, let’s go over some of the major headlines that might impact your tax bill (for better or worse) when you sit down to file your return this spring.

1. No taxes on tips or overtime pay (for the most part).

If you’re a tipped worker, you can deduct up to $25,000 of tips from your income—which means you’ll be able to keep more money in your pocket this year. The deduction starts to phase out for anyone making more than $150,000 per year ($300,000 for couples).23

For overtime workers, the new law adds a tax deduction of up to $12,500 ($25,000 for couples) for overtime wages from 2025 through 2028. And just like with tipped workers, the deduction phases out for those making more than $150,000 per year.24

There’s a big caveat here: This tax cut for overtime pay is mostly available to hourly—not salaried—workers.

2. Seniors get a new tax deduction.

The OBBBA gives seniors (ages 65 and older) a temporary tax deduction of $6,000, and it’s available whether you take the standard deduction or itemize.

The deduction begins to phase out for seniors who earn more than $75,000 a year ($150,000 for couples), so you’ll have to settle for a reduced deduction if you’re above that income threshold. This deduction is available from 2025 through 2028, so enjoy it while you can.25

3. The SALT deduction gets a huge bump.

If you live in a state with high state and local taxes (we see you, California and New York), you’re probably over the moon about the beefed-up state and local tax (SALT) deduction. The new law raises the cap on the amount of state and local taxes (which also includes property taxes) you can write off your tax return to $40,000 (up from $10,000).

However, if you make more than $500,000 per year, you’ll get a reduced deduction. And the deduction drops back down to $10,000 if your income is $600,000 or more. This is also a temporary deduction, with the cap set to return to the $10,000 mark starting in 2030.26

4. This is your last chance to enjoy tax breaks for clean energy home improvements and electric vehicles.

The bill ends tax credits for rooftop solar, geothermal heat pumps and other energy-efficient home devices at the end of 2025. The bill also axed the $7,500 tax credit that reduced the cost of electric vehicles—that one expired on September 30, 2025.27

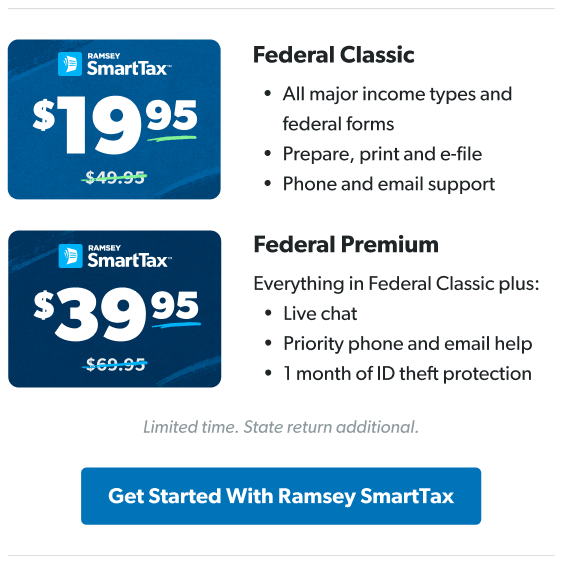

File Your Taxes With Confidence in 2026

Win with taxes (and avoid costly mistakes) when you do your taxes the Ramsey way. Ramsey SmartTax is the no-nonsense tax software you can trust. It’s simple to use with no hidden fees and no hidden agenda. It’ll even teach you along the way so you’ll feel empowered to do your own taxes with confidence.

And unlike the folks at the IRS, our product specialists will answer your calls and serve you with excellence if you need any help along the way. You definitely won’t get that with IRS Free File!

File your taxes with Ramsey SmartTax!

But what if you have a more complicated tax situation or had a wild year in 2025? In that case, working with a tax pro is a smart move. And if you’re looking for a trustworthy tax professional who serves your area, try one of our RamseyTrusted® tax pros. They know the tax code inside and out so you don’t have to.

Find a tax pro who serves your area today.