Key Takeaways

- Tax Day is April 15, 2026. This is the big federal deadline for filing your individual tax return, requesting an extension, or making tax payments.

- An extension means more time to file, not pay. If you need extra time, file Form 4868 by Tax Day—but remember to pay what you owe by April 15, or you’ll have to pay fees and interests.

- Estimated self-employment tax payments are due on January 15, April 15, June 15 and September 15.

Look, we get it—taxes are the worst. Just hearing the words “Tax Day” is enough to make you reach for a bottle of aspirin . . . or maybe a stiff drink. But here’s the thing: April always rolls around, and taxes aren’t going anywhere.

Get expert money advice to reach your money goals faster!

So, why not ditch the stress as soon as possible this year? Mark these key dates, stay ahead of the game, and file early like a pro this tax season.

When Is Tax Day?

Tax Day is Tuesday, April 15, 2026—all individual federal income tax returns are due on this day.1 This deadline is for federal returns, not state taxes (if you live somewhere with a state income tax). Note: When April 15 falls on Saturday, Sunday or a legal holiday, tax deadlines and payments are due the next business day.

For those planning to file online, the date and time in your time zone when you click “submit” determines if your return is filed on time. Don’t worry—you’ll receive an electronic confirmation that the IRS has accepted your return.

Need to snail mail your return? The IRS considers a mailed return on time if the envelope is addressed correctly, has plenty of postage, and is postmarked by April 15.2

What if I’m overseas or on military deployment?

For very special cases, like if you live overseas or if you’re deployed on military duty outside the U.S., you have an automatic two-month extension to file your taxes without needing to request one.

This means you have until June 15 to file and send in payment without being hit with a penalty. But, of course, there’s a catch—you still have to pay interest on any owed taxes not paid by the original due date.3 (Whomp, whomp.)

We recommend sticking with the regular deadline to stay ahead of the game. That way, you don’t wind up paying Uncle Sam more than you have to.

What if I live in a state impacted by a natural disaster?

If you live somewhere affected by a natural disaster—like a hurricane, wildfire or earthquake—the IRS usually postpones various tax filing and payment deadlines to give those folks more time to get their taxes in order.

But keep in mind that not everyone living in these states automatically qualifies for these extended tax deadlines. The IRS only grants extensions to individuals and businesses in federally designated disaster areas, usually specific counties identified by the Federal Emergency Management Agency (FEMA).

Make sure you check with your state’s government and keep up with IRS announcements for any updates on disaster-related extensions for your area. If you’re still not able to file your tax return by these new deadlines, you should file a tax extension with the IRS.

When Is the Deadline to Pay My Taxes?

Your tax payment deadline depends on your filing status. For most individuals, it’s simple: Your deadline to file and pay is Tax Day—which is also the worst day to find out you have an unexpected tax bill to deal with.

If you can file early, go ahead and do it to save yourself a headache or two down the line.

If you can’t pay your bill on time, the IRS does offer payment plans (with interest, mind you).4 But it’s always easier to handle a tax bill when you know about it ahead of time. Then you can come up with your own payment plan by Tax Day.

What If I Can’t File by the Tax Deadline?

If you can’t file your taxes by Tax Day, don’t panic—you can get a six-month extension by filling out Form 4868. Just be sure to submit it by Tax Day.

If you zoom past April 15 without an extension, you’ll pay a failure-to-file penalty, which is 5% of your unpaid taxes each month up to a maximum penalty of 25%.5 For returns over 60 days late, the minimum penalty is either $510 or 100% of the tax owed (whichever amount is less).6 Ouch!

Keep in mind—and this is really important: Even if you’ve requested an extension to file, that doesn’t mean you have an extension to pay. (Bummer, right?)

You still need to send in your tax payment to the IRS on your filing due date. The last thing you want is to get hit with a penalty for paying late, which could be anywhere from 0.5% to 25% of those unpaid taxes.7

When is my tax return due after filing an extension?

For most people, you have until October 15 (six months after April 15) to file your tax return after an extension—a pretty solid amount of time.8 But if you’re one of the few with a different filing due date, your extension due date will be different too.

What happens if I don’t file by the extension due date?

You’re going to have to pay that failure-to-file penalty we told you about—and that’s just flushing cash down the toilet. We want you to conquer Tax Day, not the other way around.

Whatever your situation, we recommend that you file your taxes sooner rather than later. It can make all the difference in how much you’ll end up having to shell out to good ol’ Uncle Sam.

I’m Self-Employed. What Are the Deadlines for Estimated Taxes?

If you’re self-employed (a freelancer, independent contractor, small-business owner, etc.), you’ll most likely have to pay estimated taxes four times a year (these are also known as quarterly taxes).

For 2026, the quarterly tax due dates are:

|

When You Got Paid |

Tax Due Date |

|

Sept. 1 to Dec. 31 |

Jan. 15, 2026 |

|

Jan. 1 to March 31 |

April 15, 2026 |

|

April 1 to May 31 |

June 15, 2026 |

|

June 1 to Aug. 31 |

Sept. 15, 2026 |

|

Sept. 1 to Dec. 31 |

Jan. 15, 20279 |

Not sure whether or not you need to pay estimated taxes? Reach out to a tax professional who can help you figure it out. If you wind up owing a significant amount and waiting until Tax Day to make your payment, you’ll also have to shell out extra for an underpayment penalty. Gross!

When Are State Income Taxes Due?

Do you live in a state without an income tax? Lucky you—you could be off the hook! But if your state does require a return, deadlines often mirror the federal deadline (Tax Day), though some states do set their own schedules.

And here’s a heads-up: Federal extensions for natural disasters don’t always apply at the state level. So double-check local tax rules and deadlines to keep yourself on track—your state’s government website is a good place to start.

Key Tax Deadlines in 2026

Staying ahead of tax deadlines can save you a ton of time, money and stress. Here’s a quick roundup of the important dates most people need to keep in mind for this tax year.

- January 15, 2026: Estimated tax payments for Q4 2025 are due.

- Late January 2026: The IRS starts accepting federal tax returns for the 2025 tax year.

- April 15, 2026 (Tax Day): This is the big one! Deadlines include:

- Filing your individual federal tax return for the 2025 tax year

- Requesting an extension with Form 4868

- Paying any federal taxes owed for the 2025 tax year

- Paying Q1 2026 estimated tax payments

- Making any additional IRA or HSA contributions for the 2025 tax year

- June 15, 2026: Estimated tax payments for Q2 2026 are due. This is also the filing deadline for those living or working overseas and deployed military personnel.

- September 15, 2026: Estimated tax payments for Q3 2026 are due.

- October 15, 2026: If you filed a tax extension, this is the last day to file your tax return for tax year 2025.

- January 15, 2027: Estimated tax payments for Q4 2026 are due.

Mark these dates, set your reminders, and plan ahead to stay on top of all your tax obligations and keep Uncle Sam off your back. And remember, if you have a complicated situation, you might have some key deadlines not listed here. Not sure what those deadlines might be? A RamseyTrusted® tax pro can help clear things up.

File Your Taxes (Right) Early

Do yourself a favor and don’t mess around with these deadlines. Life gets chaotic, and it’s easy for taxes to slip through the cracks. But when you tackle this stuff early—even by just prepping ahead of time—you’ll free up mental calories for everything else life throws your way.

Next Steps

- Don’t put off filing your tax return! Not sure where to start? Here’s how to file your return in six simple steps.

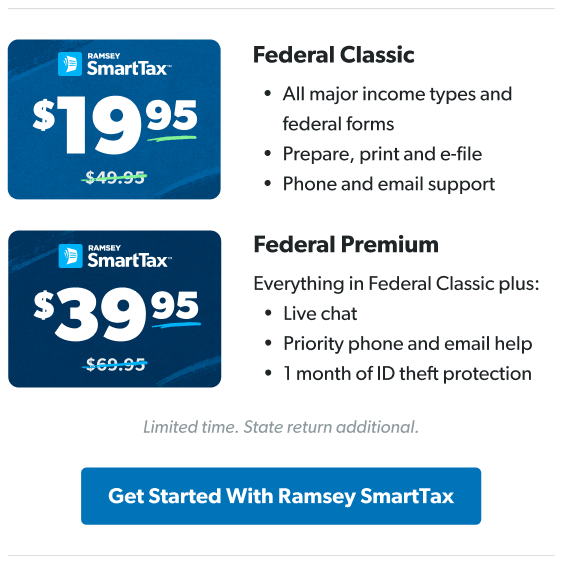

- Got simple taxes? Check out Ramsey SmartTax. It’s quick, easy and comes with everything you need from the start to knock out your return.

- Still have questions about tax season due dates or a tricky tax situation? A RamseyTrusted tax pro will help you hit every deadline on time and avoid pesky late penalties and interest.