Key Takeaways

- A tax extension gives you six extra months to file your tax return, but it does not give you extra time to pay your taxes.

- To file an extension, you’ll need to fill out Form 4868 and send it to the IRS by Tax Day (April 15 most years).

- If you owe taxes and don’t file your return on time, you’ll face failure-to-file penalties of 5% of what you owe per month, up to 25%—plus interest! So make sure you file an extension.

So . . . you got your W-2 early this year and thought, I’ll just do my taxes later—I’ve got plenty of time. After all, you still had a couple months until the tax filing deadline.

Get expert money advice to reach your money goals faster!

But February quickly turned into March, then March into April . . . and now Uncle Sam’s favorite day, Tax Day, is looming over you—and you’re not ready.

Whether you’re missing an important document or needing a little more time to get a better handle on your situation—or your dog ate your tax forms (ah, we love the classics)—you might have to file a tax extension.

Not sure what that means or even how it works? Don’t sweat it. We’ll walk you through the easiest way to file a tax extension.

What Is a Tax Extension?

A tax extension gives you six extra months to file your taxes. So instead of having your tax return due on Tax Day (that’s usually April 15), it’ll be due October 15.1 Just in time to order that pumpkin spice latte you secretly love but pretend not to because you’re too cool.

And there’s more good news: Filing a tax extension is free! All you need is a bit of time to fill out the tax extension request form.

Fair warning, though: While a tax extension does give you an extra six months to file your taxes, it does not buy you more time to pay your tax bill. Bummer.

We’ll dive deeper into this soon, but even if you can’t pay a dime of your taxes by Tax Day, you should still file an extension. The penalty for not filing at all is much harsher than the penalty for paying late after filing an extension.

So don’t get discouraged, don’t procrastinate, and definitely don’t ignore your taxes altogether. Pay as much of your bill as you can, and if you still can’t afford to pay your tax bill after six months, look into setting up a payment plan with the IRS.

How Do I File a Tax Extension?

All you have to do to file an extension on your tax return is fill out Form 4868 and file it by Tax Day.2

You can file it online or by good old snail mail.

And thankfully, Form 4868 is pretty simple to fill out, especially for a tax form. Here’s some of the information you’ll need:

- Your name, address and Social Security number.

- Your estimated tax liability (how much federal tax you owe).

- How much in federal taxes you’ve paid already (you can find that on your W-2). You need to report this info so you can make a tax payment to the IRS when you file your extension.

Okay, there are two ways you can file Form 4868:

You can file your tax extension online.

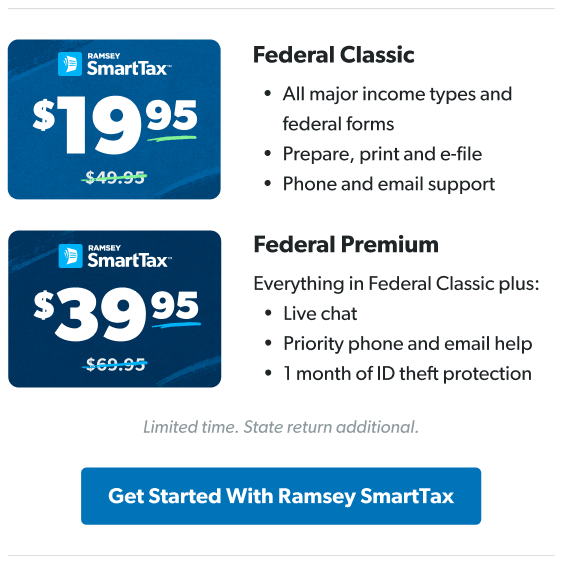

The IRS allows you to e-file an extension through the IRS website. Or you can file an extension with your tax software. If you want easy-to-use tax software with no hidden fees, check out Ramsey SmartTax.

If you owe taxes and make a full or partial payment online, you’ll get an automatic six-month extension without having to fill out Form 4868.3 But you still have to file your tax return eventually.

You can file your tax extension by mail.

Like the taste of licking stamps and envelopes? You can download Form 4868 from the IRS website, fill it out, and snail mail it to the IRS by Tax Day, along with a check or money order for your tax bill.

But snail is the key word to remember here. If you want even a reasonably fast response from the IRS, just go online for your extension request.

When Should I File a Tax Extension?

Now, let’s be clear. If your tax situation is pretty simple and you’re just feeling lazy, get your butt off the couch and do your taxes! Better yet—grab a laptop and do your taxes from your favorite spot on your couch. You can even sip on the pumpkin spice latte you love so much while you do it.

Otherwise, here are some situations where it’s okay to file an extension:

You don’t have the documents you need.

Are you missing your W-2, 1099 or other important documents? File for an extension, find and gather those documents, and do your taxes.

You go through an unexpected life event.

Life doesn’t stop for taxes. If you experience a traumatic life event like a death or illness, don’t push yourself to finish your taxes. File for an extension, focus on your life, and do your taxes later. Just don’t forget about them!

Your tax situation is really complicated, and you just need more time.

Itemizing tax deductions or owning a small business can make your tax filing really difficult. In that case, pushing the deadline to October can prevent you from rushing through your taxes and making dumb mistakes.

But listen: If your tax situation is that complicated, you should work with a tax pro. What may take you days or weeks to do can take a pro a fraction of the time.

What’s the Penalty for Not Filing My Taxes on Time?

Look, you can’t play hooky on Tax Day. The IRS will catch you, and they’ll toss a flag on the field if you do. But the size of the penalty depends on you.

What’s the failure-to-file penalty?

You really want to avoid this. You’ll be charged a failure-to-file penalty if you don’t file your tax return by Tax Day and you didn’t ask for an extension. Here’s how it adds up: You’ll be charged late fees and interest starting at 5% of your unpaid tax bill every month, up to a max of 25%.4

Ghosting Uncle Sam? Not a good idea.

For example, let’s say you owe $1,000, miss the April 15 deadline, and don’t file an extension. You finally get around to filing your taxes on June 15. Your failure-to-file penalty would be $100 ($1,000 x 5% per month). You’ll also owe interest (currently 8% per year!) on your bill.5

What’s the failure-to-pay penalty?

Let’s say you filed your tax return and requested an extension on time, but you couldn’t pay your full tax bill. In this case, you’ll face a failure-to-pay penalty instead. The penalty is smaller, starting at only 0.5% of your unpaid tax bill each month (also capped at 25% max).6

Is it ideal? Not really. But it’s far better than a hefty failure-to-file penalty. Also, as much as we like to poke fun at the IRS, they’ll work with you in this situation to set up a payment plan that fits your budget.

What if I don’t owe taxes?

So, what happens if you’re getting a refund? If you’re expecting a refund, you won’t get a penalty for filing late. You just won’t get your tax refund until you file. The IRS will hold on to your money for up to three years.7

What happens after those three years? The IRS pockets the cash. Yeah, they take your money! So just file your tax return. Even if you don’t think you owe.

Here’s the deal, folks—if you’re filling out Form 4868, you’re already going through the hassle of trying to figure out your tax liability and how much you’ve paid. You might as well just go ahead and file your tax return. It probably won’t take as long as you think, and then you won’t have to worry about it anymore.

Having Trouble Doing Your Taxes?

Here’s the thing: Getting a tax extension doesn’t solve your initial problem—getting your taxes filed.

If you don’t think you’ll be able to get your taxes together in time, talk with a RamseyTrusted® tax pro. These tax experts have years of experience, and believe it or not, they love this stuff. They can help you file an extension or go ahead and file your tax return.

If your taxes are pretty straightforward and you want an easy-to-use tax software that can give you some peace of mind, check out Ramsey SmartTax. No hidden fees, no advertisements, no games. That’s how it should be!

Next Steps

- One way to file an extension is to do it through the IRS website. You can also file an extension using tax software. Want an easy-to-use software with no hidden fees? We’ve got you covered! Check out Ramsey SmartTax.

- Once you’ve filed your extension, don’t put off filing your tax return. Here’s how to file your return in six simple steps.

- Still have questions? Get connected with a RamseyTrusted tax pro. They can make sure you meet all of the IRS deadlines and avoid those pesky late fees and penalties.

Frequently Asked Questions

-

Does a tax extension give me more time to pay my taxes?

-

We said it earlier, but it’s worth repeating: A tax extension doesn’t give you more time to pay your taxes. If you owe taxes, you must pay them by Tax Day. Otherwise, you’ll have to pay interest and late penalties.

Figuring out how much you owe without actually filling out your tax return can be tricky. The IRS offers online tools to figure out your tax bill so you can send in a payment with your extension form.

-

How long is a tax extension?

-

A tax extension lasts for six months. But you don’t want to push the deadline because the IRS only gives one extension. Miss the second deadline, and you’ll be hit with failure-to-file penalties, and those are 5% a month up to a max of 25%.

-

How do I know my tax extension has been approved?

-

Extensions are pretty much automatically approved. It’s super rare for the IRS to reject a tax extension. In fact, Form 4868 doesn’t even ask for a reason for your extension.

When you file your extension electronically, you’ll receive an electronic confirmation. Hang on to that!

If you filed by mail, you probably won’t receive a confirmation from the IRS. You can just assume your request was accepted. Or, if you don’t mind waiting on hold for hours, you could try calling the IRS to see if they received your form.

-

What if I'm out of the country for the tax deadline?

-

If you’re on a trip for work or on vacation and you miss Tax Day, the IRS doesn’t want to hear your excuses. You’re still expected to file your taxes (or an extension) before the April deadline. The IRS does offer a little bit of grace if you’re living outside the country on Tax Day.

Out of Country

U.S. citizens living outside the country for work or military service receive an automatic two-month extension to file their taxes.9 That means you’ll have until June to file your return without penalties. However, interest will be added to your bill starting on Tax Day.

Combat Zone Extension

Service members who are deployed overseas in a combat zone or as part of an operation protecting national interests don’t have to file a tax return or pay their tax bill until 180 days after the deployment has ended.10 This also applies if you were injured and hospitalized while serving.

-

When is the deadline for filing a tax extension?

-

The tax extension deadline is always the same as Tax Day, which is April 15 most years. And it’s a full-stop deadline. If you don’t file for an extension by Tax Day, the failure-to-file penalties will start, so don’t procrastinate!

Federal Classic Includes:

-

All major income types and federal forms

-

Prepare, print and e-file

-

Phone and email support

-

1 year of audit assistance

Federal Premium Includes:

Everything in Federal Classic plus:

- Live chat

- Priority phone and email help

- Free financial coaching session

- 3 years of audit assistance

- 1 month of ID theft protection