Are you one of the 70 million freelance workers in the U.S.?1 Congratulations! Technically that means you are self-employed. Whether you’re designing websites or mowing lawns as a side hustle, you are your own business—the CEO of “You Inc.” At least that’s how Uncle Sam sees you.

Working for yourself has its perks, but it also comes with challenges—especially when tax season rolls around. One of the challenges is figuring out what to do with those 1099 tax forms. They always show up uninvited after you provide outstanding service or products to your small-business customers!

Don’t worry, we’ll walk you through the different types of 1099 tax forms, why you got one (or five or 10), and what you’re supposed to do with them.

What Is an IRS 1099 Tax Form?

A 1099 form records any payments you receive throughout the year from a person or entity other than your employer. For example, if you write ads for your local goat yoga studio (apparently that’s a real thing!) as your side hustle, you can expect to receive a 1099 form recording how much income you made from your writing. The yoga studio isn’t your full-time employer, but you still have to report that income to the IRS, and the 1099 form records exactly how much you should report.

Get expert money advice to reach your money goals faster!

There are several different types of 1099 forms, so we’ll break them down for you below, but first let’s talk about the basics.

What Is a 1099 Form Used For?

If you’re a freelancer or independent contractor, chances are you’re going to be paid by many different individuals or companies for your services or products. Well, the 1099 tax form tells you how much you’re paid throughout the year. It provides info for three parties:

- You as the income earner

- The payer who fills out the 1099 form

- The IRS

Who Gets a 1099 Form?

Anyone who has a side hustle or works as an independent contractor can expect a 1099 form in the mail by January 31 each year. Again, a 1099 reports income you’ve earned from your side gig. But a 1099 could report a variety of other earnings, including:

- Royalties

- Prizes or awards

- Rent

- Lottery winnings (won’t happen, but if it does, it’s going to be taxed)

- Medical and health care payments

So be sure to keep records and receipts for any transactions—Uncle Sam will want his share, even for your $12.50 lotto win!

Who Sends a 1099 Form?

Any of your small-business clients who have paid you during the year may fill out a 1099 form to report that payment, whether they paid you via cash, check, debit or credit card, or a third-party payment platform like PayPal or Venmo.

As a side hustler, would you ever be required to fill out a 1099 form? Unlikely. But let’s say you hire an independent contractor to build a website for your side gig. Then you would need to report the payment you make to them on a 1099 form.

When Should You Expect to Send or Receive a 1099 Form?

You know those lovely W-2 forms your main employer sends every year? They have to mail them early enough in the tax season to give you time to prepare your tax return.

Well, the same is true with payers who aren’t your main employer and any 1099s they may have to send. The majority of 1099 forms are due to you, the payee, by January 31. That should give you plenty of time to make sure those 1099 forms are accurate in reporting your earnings.

But suppose you think one of your payers incorrectly reported a transaction on your 1099 form. Just contact them and, as always, keep records of your communication.

What Does Being a 1099 Employee Mean?

If you’re self-employed, a company might call you a 1099 employee because at the end of the year they’ll send you a 1099-NEC form. That doc lists your income instead of the W-2s companies send to their employees. Getting one just means the IRS classifies you as a nonemployee because you don’t receive the same benefits and payroll deductions as an employee of a company. (But working in your pj’s has benefits all its own right?)

We’ve covered the basics about 1099s—who would receive them, who would send them, and what they are used for. Now let’s look at the different kinds of 1099 forms you might receive and how they differ from one another.

Types of 1099 Forms

The IRS has over twenty kinds of 1099 forms for taxpayers. That’s a lot of paperwork! But chances are you’ll only receive one or two of these before April, if any. Here’s the details on the most common types of 1099s.

What Is an IRS 1099-NEC Form?

The 1099-NEC tax form helps freelancers and independent contractors report income they earned from different sources throughout the year to the IRS. NEC stands for nonemployee compensation. Basically, Uncle Sam wants to make sure all that hard-earned money is on the grid.

The 1099-NEC will include the name, address and tax identification number of the business or client who paid you and your name, address and Social Security number. When you receive the form, the type and amount of payments you received from the business you freelanced for will already be filled out.

Before the IRS created the 1099-NEC form in 2020, nonemployee compensation was reported on the 1099-MISC form, which is still around (minus the nonemployee compensation box). We’ll talk about the 1099-MISC a little later (assuming you can handle the anticipation).

1099-NEC vs. W-2 Form

Both the 1099-NEC and W-2 forms basically serve the same purpose: to report your income to the IRS. But the difference is that W-2 forms go out to employees while 1099s are sent to nonemployees, including freelancers and contract workers. And it’s very possible you’ll receive both forms during tax season!

For example, let’s say you’re a full-time middle school teacher, but you also freelance as a photographer for a local newspaper.

As an employee at the middle school, you’ll get a W-2 form. But as a freelancer, you’ll receive a 1099-NEC from the newspaper you shoot for.

Remember, taxes have usually been taken out of your W-2 income, but not your 1099 income. If you’re juggling a bunch of tax forms and not sure where to start, it’s probably a good idea to connect with a tax pro who can sit down with you and help you understand your tax situation.

Who Gets a 1099-NEC Form?

If you received $600 or more in payments from a particular business or client, they’re required to send you a 1099-NEC form by January 31, as well as a copy to the IRS. So, if five companies paid you more than $600 last year, you should get five 1099 forms—one from each company.

What if that January 31 deadline comes and goes and you still haven’t gotten your 1099 form? You should reach out to the company or client to get it straightened out.

But if you were working as a contractor for a company, such as a rideshare business like Uber, where you collect electronic payments from customers, you’ll receive a 1099-K form from the company.

What Is a 1099-K Form?

The 1099-K is a tax form that shows all the payments you received for goods or services through a credit or debit card or some other electronic payment system—like PayPal. Most businesses won’t send you a 1099-K unless you collected more than $20,000 or had more than 200 transactions during the year.2

If you didn’t get a 1099-NEC or 1099-K from a client you worked for, does that mean you don’t have to report that income? Not so fast! Even if you earned, say, $400 for some freelance work and didn’t receive a 1099 from the company you freelanced for, you’re still required to report that income when you file your taxes. This leads us to yet another 1099 form—the 1099-MISC.

What Is an IRS 1099-MISC Form?

The 1099-MISC is the catch-all for most of the miscellaneous income (that’s what the MISC in 1099-MISC stands for) you earned outside of what’s documented on a W-2, a 1099-NEC or a 1099-K (but did you earn enough to buy a vowel?).

The money you make with your side hustle isn’t the only type of income that has to be reported to the IRS, and all those other types of income are covered by the 1099-MISC form. The 1099-MISC includes boxes for:

- Rents

- Royalties

- Fishing boat proceeds

- Crop insurance proceeds

- Several other types of income

1099-MISC Instructions

A 1099-MISC form includes a bunch of boxes that can be kind of confusing at first glance. Some are very specific, like fish purchased for resale. Any fishmongers out there? But here are some of the highlights of the types of income covered by the 1099-MISC:

- Rents: If you own property that you rent to a business, the business will send you a 1099-MISC that includes the amount of rent they paid you. (If you rent residential property, you probably won’t receive a 1099-MISC.)

- Royalties: These are payments made to you for the use of property that you own, from oil and mineral properties to copyrights and patents. Whoever pays you royalties should also send you a 1099-MISC if you earned over $10.

- Other income payments: This includes things like certain types of legal damages, jury duty pay, and pay for being part of a medical study. It also includes prizes and awards. Did you win that sweepstakes for an all-inclusive cruise vacation? While you’re sipping piña coladas in the Bahamas, remember that you’re required to pay taxes on any prizes and awards worth more than $600.

- Medical and health care payments: If a business makes payments of $600 or more to physicians and other health providers for medical services, they’re required to send out a 1099-MISC to the providers.

- Payments to an attorney: Lawyers also get a 1099-MISC when they get paid $600 or more by a business for their services.3

People use the 1099-MISC to report several other types of miscellaneous income, including substitute payments to brokers that take the place of stock dividends and fishing boat or crop insurance profits. But for most folks those boxes will remain blank on the form.

How Is a 1099-NEC Different From a 1099-K or 1099-MISC?

The 1099-NEC and 1099-K forms do the same thing: report how much business income you generated during the year from your side gigs or independent contractor work. The difference is that each form reports income you received from specific payment methods. The 1099-MISC reports specific kinds of business income regardless of the payment method.

The 1099-NEC form records payments from:

- Cash

- Checks

- Direct deposits

- ACH (Automated Clearing House)

- EFT (Electronic Funds Transfer)

The 1099-K form reports payments from:

- Debit cards

- Credit cards

- Third-party payment platforms like Venmo or PayPal

What about a 1099-MISC form? This bit of red tape reports miscellaneous business compensation over $600 such as:

- Payments to an attorney

- Prizes and awards

- Rent paid for your small business’s office space

- Royalties

Other Types of 1099 Forms

We’ve defined and discussed the differences among three common types of 1099 forms—the 1099-K, the 1099-MISC and the 1099-NEC. But get this: There are over 20 different 1099 forms! So here’s a rundown on several other 1099s you may receive:

- 1099-A: A is for Acquisition or Abandonment of Secured Property. Clear as mud, right? You’ll receive a 1099-A if you owned property that went into foreclosure and the bank canceled a portion of your debt or sold your property.4

- 1099-B: B is for . . . ball. No, not really. It stands for broker and barter. The IRS description for the 1099-B form is Proceeds From Broker and Barter Exchange Transactions. You’ll receive a 1099-B if you sell stocks, bonds, commodities and other types of investments through a broker.5 The second part of the 1099-B is barter exchange transactions.6 A bartering exchange is a marketplace (usually online) where people or companies can exchange products and services. But before you freak out and think trading baseball cards or clothes with a buddy is going to get you in trouble with the IRS, the 1099-B does not cover informal trades, just ones done through a bartering exchange.Some types of bartering should be reported as income even if you don’t receive a 1099-B. For example, an HVAC guy might install a new furnace for an accounting firm in exchange for them handling his books. The HVAC guy will have to count the value of that service as income—and hopefully the accounting firm will help him figure that out on his taxes!

- 1099-C: C is for cancel, as in Cancellation of Debt.7 Having a debt canceled is a time to celebrate, but the IRS is going to rain on your parade a little bit because it considers canceled debt as income. If you negotiated with a collections agency to cancel more than $600 of your credit card debt, you’ll receive a 1099-C to let you know you have to pay taxes on that canceled debt.

- 1099-DIV: This form is for Dividends and Distributions.8 Dividends are payments companies make to their stockholders to share their profits, and, yes, they’re subject to taxes. A distribution is what a mutual fund pays to shareholders based on how much money it made—and Uncle Sam wants a piece of that too!

- 1099-G: G is for government, as in Certain Government Payments. A 1099-G lists unemployment compensation, state or local income tax refunds, reemployment trade adjustment assistance (RTAA) payments, taxable grants, and agricultural payments.9 Most of that seems pretty clear. But what in the world is RTAA? We’ll save you some time googling it. RTAA is a federal program that provides extra money to make up the difference in pay for workers over age 50 who had to take lower-paying jobs after losing their jobs due to the effects of foreign trade.

- 1099-INT: INT stands for interest income.10 If a bank or other institution has paid you more than $10 in interest in a year, you’ll receive a 1099-INT. Unless you keep your life savings stuffed under your mattress earning zero interest, you’ve probably received a 1099-INT at some point.

- 1099-Q: Q stands for qualified, as in Payments From Qualified Education Programs.11 If you withdraw money from an Education Savings Account (ESA) or a 529 plan, you’ll receive a 1099-Q. But you’ll only be taxed on the amount of the withdrawal if you spent the money on something besides school expenses.

- 1099-R: R is for retirement. The 1099-R is for Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.12 Wow, the IRS included everything but the kitchen sink in that title! If you received money from any of these sources, expect to get a 1099-R (even if you aren’t retired). Here again, most of these sources of income are self-explanatory, except maybe insurance contracts. This refers to permanent or total disability payments made by insurance companies.

What to Do When You Receive a 1099 Form

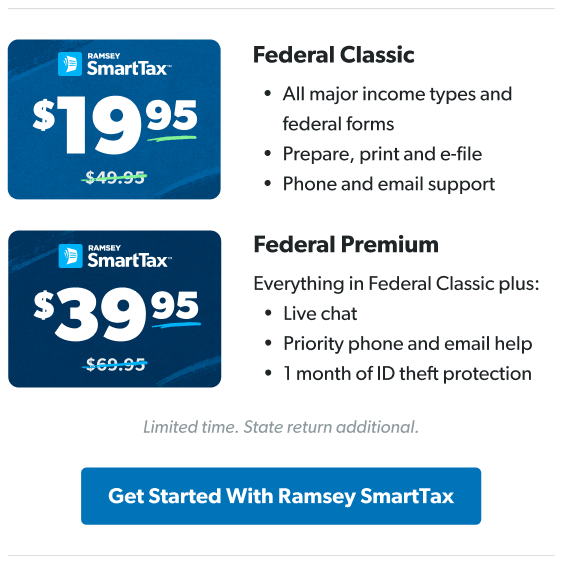

OK, so you’ve gathered your 1099 forms . . . now what? You can plug all of that info into tax-filing software, like Ramsey SmartTax. It’s tax software you can trust with no hidden fees.

Or if doing your own taxes gives you the sweats or you think your tax situation is too complicated, a RamseyTrusted tax pro can help. They’re the only tax advisors trusted by our team, and they’re part of our nationwide network of Endorsed Local Providers (ELPs).