Learn how to pay off debt and start living on your terms again.

How the Debt Snowball Method Works

The debt snowball method is the fastest way to pay off your debt. You'll pay off the smallest debt while making the minimum payment on all your other debts, and gain momentum as each one gets paid off.

How to Pay Off Debt

If you’re ready to get out of debt for good, check out this simple guide on how to pay off debt. The fastest and most effective way is the debt snowball method, where you knock out your smallest debts first to build momentum. You’ll also learn which debt to pay off first—because not all debt is the same. And even if money feels tight, there are smart strategies for paying off debt with a low income. Once you’ve got the plan, all that’s left is to take the first step.

What Is Debt?

Before you can pay it off, you need to know exactly what debt is. It’s not just a number. Debt is anything you owe that’s standing between you and your goals. But not all debt looks the same. From credit cards to student loans, there are different types of debt that hold you back in different ways. And watch out for phantom debt—aka old debts that can come back to haunt you. Knowing what debt really is and where it’s hiding is the first step to getting rid of it for good.

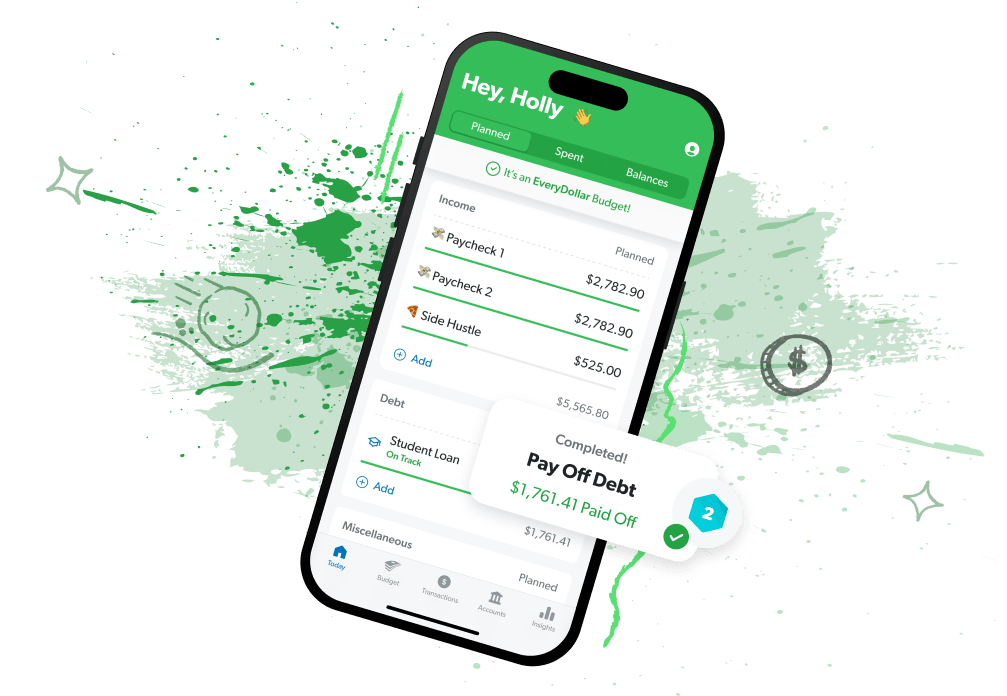

Get Your Debt Snowball Rolling

And that starts by getting on a budget. With EveryDollar, you can make sure you’re covering the basics every month and free up more money to throw at your debt. In fact, most people find $332 in their first EveryDollar budget (now that will get things rolling!).

More Debt Resources

Trending Debt Articles

Foreclosure: What It Is and How to Avoid It

What's the Catch With Zero Interest Loans?

What Does It Mean to Finance a Car?

How to Rent a Car Without a Credit Card

What Happens to Credit Card Debt When You Die

How Long Does It Take to Pay Off Student Loans?

What Is a Financial Coach?

How the Debt Snowball Method Works