"I paid off $121,000 in 28

months. I feel strong! The

burden is gone!"

You’re already investing 15% for retirement in Baby Step 4. Now it’s time to save for your kids’ college—so they can say no to student loans. Baby Step 5 is all about setting your kids up to graduate debt-free. And you’re doing it the right way: retirement first, then college. Why? Because your kids may not even go to college, but you’re definitely going to want to retire, and no one else is going to pay for that!

Whether they’re still in diapers or already getting their learner’s permit, it’s never too late to start. The last thing you want after fighting through Baby Step 2 is to watch your kids repeat the cycle of debt. Baby Step 5 gives them a shot at a life free of student loans—and that’s worth every dollar you set aside.

There are a bunch of ways to save for college, but we’ll highlight two: Educational Savings Accounts (ESAs) and 529 plans. Both let you grow and spend your money tax-free when it’s used for qualified education expenses. Each has its own rules and quirks, and we’ll get into the nitty-gritty below.

Planning ahead keeps you from buying the lie that everybody takes out student loans. According to the National Center for Education Statistics, in 2020–2021, 62% of undergraduates didn’t take any federal loans for school. However, a 2025 congressional report found that 43 million Americans have student loan debt. Baby Step 5 helps your kid avoid that trap—and start life with options, not payments.

Imagine your son or daughter graduating with no debt—ready to enter the workforce without the stress of a looming student loan payment. You’ve given them one of the greatest gifts for their future: the gift of starting out on solid financial ground.

First things first: Set a savings goal. If your kid’s already in high school, you’ll need to save more—and save faster—than if they’re still learning to walk. And don’t ignore the cost difference between all your options. Look at the costs of community colleges, in-state vs. out-of-state tuition, and public vs. private schools.

The number one mistake students make? Choosing a school they can’t afford. That's why so many people end up calling The Ramsey Show buried under six figures of student loan debt and desperate to escape.

But here’s the truth: Your kid’s college choice matters way more to your wallet than to their future employer. Your kid has a better shot at success entering adulthood debt-free than with “Ivy League” printed on a pricey diploma.

That said—if you’ve got the funds and want to save extra for a more expensive school, go for it. Just don’t do it at the expense of other goals like saving for retirement or paying off your home.

As you’re thinking about your savings goal, take a look at the average cost of attendance so you can get an idea of how much you need. These numbers are another example of how school choice impacts the cost of a college education.

Here are the average costs of attendance for the 2023–2024 school year, according to College Board:

Now it’s time to decide if you want to go with an ESA, a 529 plan or both. These accounts let you grow and spend your savings tax-free, as long as you use the money for qualified education expenses.

An ESA is kind of like an education IRA. You can invest up to $2,000 a year in stocks, bonds or (our recommendation) mutual funds. If you start saving when your child is born and earn an average return of 11%, you could have over $110,000 saved by the time they’re 18. Bonus: ESA funds can also be used for K-12 expenses.

With a 529 plan, there’s no contribution limit—but if you go too big, you could run into gift taxes. We recommend avoiding prepaid 529 plans (they come with too many restrictions) and choosing a 529 savings plan (they’re more common and more flexible).

The most important thing? Choose a plan that keeps you in control of the money. Shop around. Read the fine print. Feeling overwhelmed? That’s normal. Reach out to an investment pro to talk through your options.

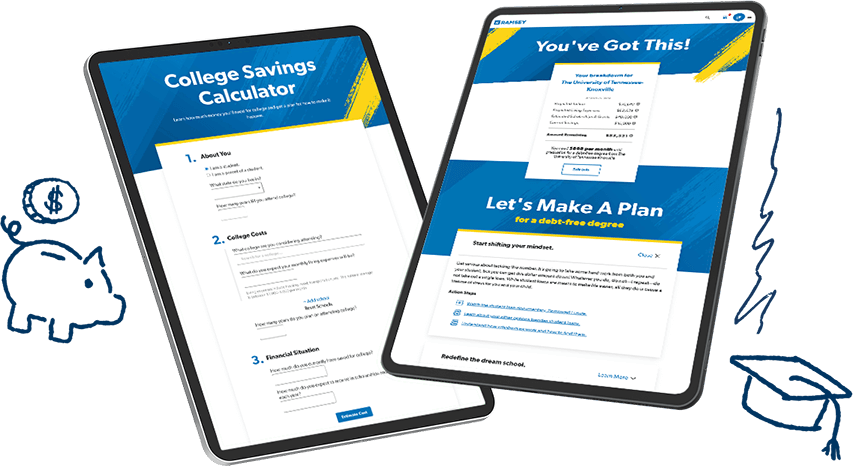

Use our College Savings Calculator to see how much you’ll need to save—based on school type, location and your kid’s age.

When your high schooler’s rounding the corner toward graduation, help them get serious about free money. That means grants, scholarships and student aid.

The FAFSA is how you get access to grants, financial aid, work study programs and some scholarships. According to a recent report by the National College Attainment Network, the class of 2024 left about $4.4 billion in Pell Grant funds unclaimed because they didn’t complete the FAFSA form.

Don’t be like those jokers. Submit your FAFSA as soon as it opens—typically on October 1 for the next school year. The earlier you apply, the more aid your kid may qualify for. The sooner you get your results, the sooner you can build a budget around what’s left to pay for. Pro tip: State deadlines vary, so check your local rules.

Scholarships are free money for college—no payback required. If your kid shines in sports, academics or extracurriculars, have them use those strengths to score some scholarship cash. Encourage them to apply for every scholarship they qualify for—seriously, make it feel like a part-time job. And don’t ignore the small awards. Those little wins add up fast and can make a big dent in tuition.

If your child qualifies, they can take AP classes to earn college credit in high school. There’s usually a small exam fee—but that’s nothing compared to the cost of a college course.

Most U.S. states now have some kind of dual enrollment program. If your student is accepted into the program, they’ll attend college classes while still in high school and spend their junior and senior years stacking up college credits. Cost varies state-to-state, but in some cases, dual enrollment is free—so students can get as much as two years of college paid for!

Some companies help cover college costs through tuition reimbursement. If your kid’s applying for part-time jobs (which is also a great way for them to contribute to the costs of college), help them look for employers who offer this benefit. It’s extra money for school—and real experience for their resumé.

If your kid lives at home and commutes to college, they’ll avoid pricey room and board—and save serious money. They can also ditch the campus meal plan and eat at home instead (bonus: family dinners). And yes, they can still get the full campus experience as a commuter—clubs, friends, all of it.

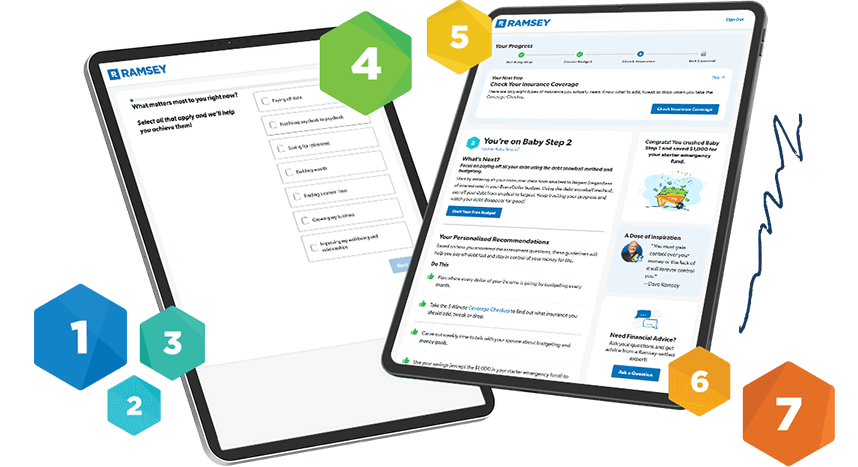

Not sure if you’re actually on Baby Step 5? Take the Get Started Assessment to find out exactly where you are—and receive your free custom money plan built just for you.

"I paid off $121,000 in 28

months. I feel strong! The

burden is gone!"

“Now, we talk more about our money, we make decisions together, and it’s not stressful anymore.”

“Budgeting gives you a true picture of your finances—of your life—so you can pick what you can do and plan all the good stuff.”

“I cried the first time we finished a month and actually had money left over. That had never happened before.”

“We're not stressed anymore. Our journey's in our hands now. We get to choose what we want to do."

"There’s freedom on the other side of debt. You don’t have to live like everyone else. I wanted something different for my family."

For two decades, Dave Ramsey and his team have connected millions of people with the SmartVestor program—a referral network of financial advisors who value serving over selling. Get custom advice from pros who lead with the heart of a teacher.

Ramsey Solutions is a paid, non-client promoter of participating pros.

Yes! You’ve heard the phrase “student loan crisis”—and it’s no exaggeration. Here are the stats:

• Borrowers owe about $1.65 trillion just in student loans!

• Total student loan debt has grown by about $100 billion since 2020.

• There are currently about 43 million student loan borrowers in the U.S.

• According to U.S. News, 56% of 2024 college graduates used student loans.

• Experian reports that the average amount of student loan debt per borrower is about $38,000.

But beyond the stats, we hear stories every day about people who are crushed by their student loan payments. There’s a special kind of stress that comes with owing thousands—especially if the career you trained for doesn’t pay what you expected.

Yes, you can send your kid to college without loans. You know how to do this. You’ve already done the hard stuff—you’ve made it through Baby Steps 1–4. Don’t hand your kid a debt burden. Hand them a bright future, free from student loans.

That really depends on the age of your child and where they could potentially go to school. Check out our College Savings Calculator to get an idea of current college costs.

Both an ESA and a 529 plan can be used for:

You can also use an ESA for K-12 expenses like books, tutoring, technology and even uniforms. If your student doesn’t use the funds, you can change the beneficiary to their sibling—or, for a 529, to a parent, grandparent or yourself (think grad school). Worst case? You can withdraw the funds, but you’ll pay a 10% penalty and income tax on the gains.

You’re working Baby Steps 4, 5 and 6 at the same time—but there’s a reason they go in that order. At some point, you’ll want to retire, and you’ll want to do that with dignity. But your kid? They might go to college—or they might not. That’s why Baby Step 4 (investing 15% of your gross income for retirement) comes first. It’s all about putting on your own oxygen mask before you help those around you. Secure your future. Then help launch theirs.

Always follow the Baby Steps in order—so you don’t get stretched too thin or lose momentum.

As a reminder, here they are:

So yes—buy the house before you save for college. The order matters because it helps you focus your money and energy on one big goal at a time. That’s how you build wealth faster and with less stress.

Don’t stress, you’ve got this. When you reach Baby Step 5, you’ll simply divide the amount you’re able to save for college among your children. That might mean starting with a set monthly amount per child or prioritizing the oldest first. Just remember, something is better than nothing, and your retirement comes before college savings.

If you’ve got a unique question about working the Baby Steps, try our Ask Ramsey tool, powered by Ramsey AI. And to boost your college savings journey even more, create your budget in EveryDollar and get personalized recommendations to speed up your progress!

The content on this page provides general guidelines about investing topics. Your situation may be unique. To discuss a plan for your situation, connect with an investment professional.