"I paid off $121,000 in 28

months. I feel strong! The

burden is gone!"

You’ve fought through the hardest parts of this journey—crushed your debts, built your emergency fund, and started investing and saving for your kids’ college. Baby Step 6 is where you wipe out your mortgage so you can build a lasting legacy. That’s living like no one else so later you can live and give like no one else.

Now that you’re walking Baby Steps 4 and 5—investing for your future and saving for your kids’ college—you can start making extra mortgage payments. Check your budget and throw any extra money toward the principal. Just don’t pause or lower your retirement or college savings to speed this up. You can do Baby Steps 4, 5 and 6 all at the same time. Keep moving forward. Intentionality will get you there in no time!

Your mortgage payment is likely your biggest bill—and the interest on that bad boy is hefty. Some people hang on to their mortgages just because the interest is tax deductible, but that math doesn’t hold up. Paying $10,000 in interest just to save $2,500 on taxes is a bad bargain. Your number one wealth building tool is your income, so don’t let a tax myth hold that income hostage.

Even on Baby Step 6, old habits can sneak back in. You’ve come too far to let that happen! Protect the progress you’ve made by saying no to new debt and by refilling your emergency fund if you ever have to use it. And take a fresh look at your numbers. Since your expenses and savings are shifting, you’ll want to keep your spending in check, your savings steady and your momentum strong.

Picture this: You’ve just hit Submit on that last mortgage payment, so you go outside and squish your toes into the grass. Suddenly, it feels different. Why? Because you own it free and clear! Baby Step 6 changes your entire future. Your biggest payment has become your biggest opportunity, allowing you to invest, save and be outrageously generous. This is how Baby Steps Millionaires are made.

Let’s get real for a second: Paying off a mortgage sounds like a big mountain to climb. Don't let that stop you! Baby Step 6 is the last mile in this money marathon—and financial peace is at the finish line. By making just one or two extra full payments a year, you’ll chip away at that timeline and save thousands in interest.

Let’s break down how that looks:

Say you have a $300,000 mortgage at a 5% interest rate with 15 years (180 months) to pay it off.

And that's if you make just one extra payment a year!

You don’t have to refinance to pay your home off faster.

If you already have a solid interest rate on your current mortgage, simply increase your payments to get it paid off sooner. Not sure how much is enough? Use our Mortgage Payoff Calculator below to find the payment amount that would achieve your desired payoff timeline.

Only refinance when it truly saves you money.

Refinancing is only worth doing when the lower interest rate will actually save you enough to cover the refinance costs and give you extra room to pay down your mortgage faster. And never choose a cash-out refinance. That option steals from the home equity you’ve built and will keep you from getting ahead.

If you do refinance, skip the points and origination fees.

Points and origination fees are basically prepaid interest—you’re paying the lender extra money up front in exchange for a slightly lower interest rate. The problem? It usually takes years to break even on what you paid. Most people move or refinance long before that, which means you never earn back the money you spent. In short: You pay more and the bank wins.

Use our Mortgage Payoff Calculator to see how extra payments can shorten your term.

Even in Baby Step 6, a budget stops your money from wandering off like a toddler in a department store. It keeps you on track, simplifies your investing, and protects the progress you’ve worked so hard for. It also stops lifestyle creep from sneaking in and helps you create more margin for achieving your money goals.

When you make an extra payment, mark it for principal only so you’re chipping away at the actual balance and not simply paying the interest.

A smaller home means a smaller mortgage, and a smaller mortgage means a faster path to living life debt-free. If the math checks out and the change works for your family, downsizing can be a powerful shortcut to freedom. And with contentment leading the way, a cozier space can feel surprisingly good.

Chances are that groceries are one of the biggest line items on your budget aside from housing—especially if you have a family. So think about some ways to cut back, like changing stores or shopping sales and in-season produce.

Okay, we’ll admit this is a tough one because we all love eating out from time to time. But restaurants will chew through your budget faster than you can grab the check. Cooking at home just two to three more times per week can save you a ton in the long run.

These days, it’s super easy to rack up more television subscription services than you actually use. Figure out which streaming services you can live without, cancel them, and put the extra cash toward your mortgage.

No matter what Baby Step you’re on, giving the first 10% of your income shapes your heart, helps you live with an open hand, and reminds you to trust God. And the best part is you get to support organizations you believe in like your church, local animal shelter or food kitchen.

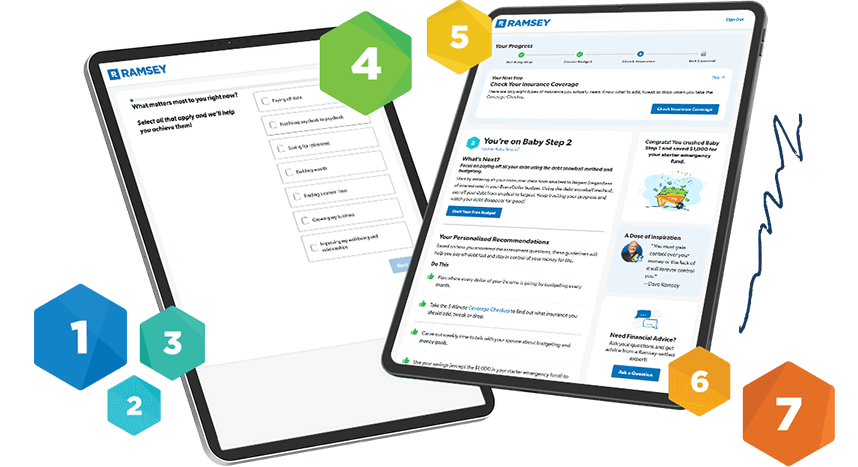

Not sure if Baby Step 6 is your step? Take the Get Started Assessment to find out exactly where you are—and receive your free custom money plan built just for you.

"I paid off $121,000 in 28

months. I feel strong! The

burden is gone!"

“Now, we talk more about our money, we make decisions together, and it’s not stressful anymore.”

“Budgeting gives you a true picture of your finances—of your life—so you can pick what you can do and plan all the good stuff.”

“I cried the first time we finished a month and actually had money left over. That had never happened before.”

“We're not stressed anymore. Our journey's in our hands now. We get to choose what we want to do."

"There’s freedom on the other side of debt. You don’t have to live like everyone else. I wanted something different for my family."

Our EveryDollar app helps you plan, track and budget smarter—so you can pay off your mortgage faster.

Whether you’re in a starter home or your dream home, refinancing could be the right move to help you knock out that mortgage.

Wait to start paying down your mortgage until you’ve done these four things:

Once you’ve accomplished these steps, you’re ready to start paying off your house early.

If you claim the mortgage interest tax deduction, you could end up with a higher tax bill once you pay off your mortgage. But keeping your mortgage just for the tax deduction doesn’t make sense. Take a look at the math:

Let’s say you pay $10,000 a year in interest and you fall into the 25% tax bracket. Well, you’d only get a $2,500 tax deduction. It’s a nice perk while you’re paying off your mortgage, but it’s a terrible reason to intentionally keep it. That’s like trading a dollar for a quarter.

Whether your home is paid off or you owe money on it, your homeowners insurance policy will cost the same. You aren’t required to have homeowners insurance if your home is paid off, but not having insurance is a horrible idea. Your home is your largest asset, and you want to make sure you’re financially protected if something happens to it.

You might have a pile of cash sitting in your 401(k), but it’s a terrible idea to use your retirement money to pay off your house. First off, you’ll need that money if you ever plan to retire. And second, you’ll get hit with income taxes plus a 10% early withdrawal penalty. So you’ll lose 30% or more of your money before you can even put it toward your mortgage. Bad plan!

A biweekly payment plan can be a good idea—but never pay extra fees to sign up for one. There’s nothing magical about it. The real reason it helps pay off your mortgage faster is that the smaller biweekly payments add up to 13 full-size payments over the year instead of the standard 12.

If you’ve got a unique question about working the Baby Steps, try our Ask Ramsey tool, powered by Ramsey AI. And to boost your debt payoff journey even more, create your budget in EveryDollar and get personalized recommendations to speed up your progress!