"I paid off $121,000 in 28

months. I feel strong! The

burden is gone!"

You’ve busted your butt saving, paying off debt and saying no—so now you can say yes (and then some). You can relax, have some fun and let God use you to bless others. You’ve changed your family tree forever, and it’s time to live like it.

Your home is yours—free and clear. You don’t owe anyone anything! Your money is finally your own. So what should you do next? Literally anything you want! In Baby Step 7, money is for three things: giving, investing and having fun.

Giving is the most fun you can have with money. All those times you wanted to give but just couldn’t make it work are behind you. Now you can change lives with your margin. That old mortgage payment? You could buy a used car for a single mom or help someone else find their financial footing. Now’s the time to dream—and give like no one else.

You’ve been blessed with wealth. The next step is to steward it well. Dave recommends keeping your plan simple. Stick with mutual funds and debt-free real estate. Once you’ve built $10 million in net worth, you and your investing pro can talk about other options. And no matter what, you call the shots.

You’ve put in the work. You’ve said no a thousand times. It’s time to finally say yes for a change! Allow yourself to enjoy spending money on the things you never thought you’d be able to. Take your family on vacation. Grab the new clothes. Buy the boat. You’ve earned it! Now enjoy it.

You’re debt-free. Your house is paid off. Now it’s time to build some serious wealth.

Stick with simple.

Invest in good growth stock mutual funds balanced across four types: growth, growth and income, aggressive growth, and international. That’s the Ramsey recipe—and it works.

Use tax-advantaged accounts.

Roth IRAs and 401(k)s are still your best friends. Max them out—even after retirement’s covered.

Diversify with cash, not debt.

Want to add real estate investments? Awesome! Just pay cash, and set aside money for taxes, insurance and repairs so the costs don’t sneak up on you.

Work with a pro you trust.

Find someone who will empower you to call the shots. They’ll help you stay the course.

Play the long game.

The stock market will have its ups and downs. Stay calm and stay invested. Slow and steady wins the race.

Baby Step 7 is where your generosity shows up big. There’s no set percentage, but many people start with a tithe (10%) and give more as they feel led. It’s helpful to set a percentage at the beginning of the year. And if you stay open to giving more, opportunities will likely head your way. The point? Be a joyful and intentional giver.

Where to Start:

Some folks even create a giving plan with categories like:

Whatever your style, just stay intentional and prayerful. Giving should bring joy to you and to the people you’re helping.

In Baby Step 7, you finally get to enjoy the fruit of your hard work, but make sure you stick to the plan. Keep budgeting so travel, hobbies and the stuff you love have a place next to your giving, saving and investing.

It might be tempting, but this isn’t the time to be reckless. Stay disciplined!

Set a percentage of your income to spend on fun at the start of the year, and stick to it in your monthly budget. That gives you the freedom to spend without second-guessing. You’ve worked too hard just to lose focus now.

Want to stay grounded? Try matching what you spend on yourself with what you give. Or set limits that keep your heart and habits in check.

This isn’t about restriction. It’s about intentionality—which gives you the freedom to enjoy your money while building wealth and blessing others along the way.

Know where you stand. Add up your assets and liabilities to see your net worth.

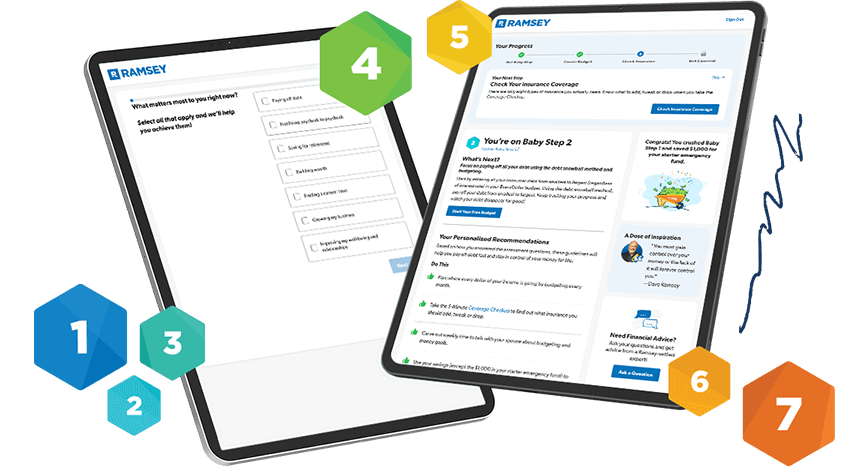

Not sure if you’re on Baby Step 7? Take the Get Started Assessment to find out—and get a custom money plan made just for you.

"I paid off $121,000 in 28

months. I feel strong! The

burden is gone!"

“Now, we talk more about our money, we make decisions together, and it’s not stressful anymore.”

“Budgeting gives you a true picture of your finances—of your life—so you can pick what you can do and plan all the good stuff.”

“I cried the first time we finished a month and actually had money left over. That had never happened before.”

“We're not stressed anymore. Our journey's in our hands now. We get to choose what we want to do."

"There’s freedom on the other side of debt. You don’t have to live like everyone else. I wanted something different for my family."

For two decades, Dave Ramsey and his team have connected millions of people with the SmartVestor program—a referral network of financial advisors who value serving over selling. Get custom advice from pros who lead with the heart of a teacher.

Ramsey Solutions is a paid, non-client promoter of participating pros.

Here’s how to approach real estate investing the Ramsey way:

Maxing out your Roth IRA and 401(k) every year puts you in the top tier of retirement savers. So what’s next? Here’s how to keep building wealth—the Ramsey way:

You’ve done the hard work. Now keep building—and use your wealth to change lives.

Your kids are learning about money—even when you’re not teaching it. And our toxic money culture teaches debt.

From cereal boxes to toys with mini credit cards, companies are targeting your kids early. If they win your child’s money habits now, they win for life. But not on your watch.

You’re the parent. Your home is the training ground for truth. So be hands on and intentional.

Here’s how:

Start with work.

No free money. Commission beats allowance—every time. Work, get paid. Don’t work, don’t get paid. That’s real life.

Teach the basics early.

Financial Peace Jr. helps you teach kids (ages 3–12) how to save, spend and give on purpose.

Let them see you budget.

They’re watching. When they see you build and stick to a plan with EveryDollar, they’ll learn that money follows a plan, not feelings.

Talk money with teens.

At this point, it’s time to prepare your kids to manage funds well as they start their first jobs and get ready for college. Help them set up an EveryDollar budget and take them through Foundations in Personal Finance if their high school doesn’t offer it.

You’re shaping how your kids handle money for the rest of their lives. Teach it on purpose. Don’t let America’s toxic money culture do the job for you.

Yes. Baby Step 7 is one of the best times to keep a financial advisor in your corner.

You’re building wealth on purpose now. And a great pro helps you stay focused, calm and intentional.

But choose wisely.

You want someone who will equip you to win. Someone who explains your options clearly and celebrates your wins. Not someone pushing products you don’t need.

As your wealth grows, so does the complexity: bigger investment moves, tax strategy, real estate decisions and giving plans. A solid advisor helps you navigate all of it with wisdom—not hype.

This isn’t about being told what to do. It’s about having a guide who helps you change your family tree and leave a lasting legacy.

Need a coach in your corner? An investment pro can guide you forward.

Baby Step 7 is the time to get intentional about legacy. You’ve worked hard to build wealth. Now make sure it’s protected and passed on with clarity.

Start with the basics:

Once you have more than $1 million in assets, a trust may help simplify things for your family and stretch your generosity further. That’s a conversation worth having.

Legacy planning isn’t just paperwork—it’s stewardship. You’re deciding how your money will keep making an impact when you’re not around. So don’t wing it. Work with a pro who shares your values, explains things in plain English, and helps you make decisions that reflect your heart.

Generosity is one of the best parts of Baby Step 7, but you need to have boundaries.

You can help someone you love without becoming their safety net. Start by offering guidance. Share the Baby Steps, and help them set up an EveryDollar budget. That kind of help empowers them to make a change and keep moving forward.

If you do give money, make it a gift—aka not a loan. And only if the gift won’t wreck your own progress.

Be clear about your expectations, and don’t budge. You’re helping them move forward—which is a good thing—but they have to learn from their mistakes. Enabling simply keeps people stuck, while healthy generosity brings hope, dignity and direction.

In Baby Step 7, your goal is to lift people up and point them toward freedom.

Yes, but don’t drop your guard just because you’ve built wealth. You’ll need to protect what you’ve worked so hard to create.

Here’s what to keep (and when):

Heads up—you might eventually become self-insured but only when you can absorb a major hit without wiping out your net worth. Until then, review your insurance yearly so your coverage grows with your wealth.

Absolutely. Baby Step 7 brings freedom—but it also brings new risks if you’re not careful.

The biggest threats to your wealth now are subtle but can add up big time:

Don’t worry—you can prevent these from happening. Just stay grounded with a written budget. Stick to simple, proven investments. And don’t get cute or chase trends.

Wealth needs protection too. Make sure your insurance keeps up—home, auto, umbrella, identity theft, health and long-term care (after age 60).

And remember: When people know you’ve got money, you become a target for scams, lawsuits and high-pressure salespeople, so stay wise and intentional. That’s how you protect your progress—and your peace—for the long haul.

“Here is what I have seen: It is good and fitting for one to eat and drink, and to enjoy the good of all his labor in which he toils under the sun all the days of his life which God gives him; for it is his heritage. As for every man to whom God has given riches and wealth, and given him power to eat of it, to receive his heritage and rejoice in his labor—this is the gift of God.” (Ecclesiastes 5:18–19 NKJV)

That means building wealth isn’t wrong. And enjoying it isn’t either—as long as your heart is in the right place.

The Bible is clear: God is the owner. You’re the manager. When you hold your wealth with open hands, you’re free to enjoy what God has given you and use it to bless others.

Wealth isn’t the problem. The problem is when it becomes your purpose. So stay grateful. Stay generous. And never forget who it all belongs to.

If you’ve got a unique question about Baby Step 7, try our Ask Ramsey tool, powered by Ramsey AI.

The content on this page provides general guidelines about investing topics. Your situation may be unique. To discuss a plan for your situation, connect with an investment professional.