"I paid off $121,000 in 28

months. I feel strong! The

burden is gone!"

Close your eyes and breathe this in. You’re debt-free! And all that money you were throwing at your debt snowball will create the momentum you need to steamroller Baby Step 3. Now think about how it’ll feel to have 3–6 months of expenses in the bank, standing between you and life’s surprises. And the best part? You never have to reach for a credit card ever again.

Baby Step 3 is about building a rainy day fund—so tough times like a job loss won’t send you back into debt. A strong foundation in your financial house includes a big savings account just for emergencies. Once you lock this step in place, you’ll feel steady, confident and ready to start building wealth with real security behind you.

Murphy’s Law says anything that can go wrong will go wrong—and Murphy never shows up at a good time. But a fully funded emergency fund acts like Murphy repellent, taking the sting out of life’s surprises and turning crises into inconveniences. Like millions of others, you can crush Baby Step 3 in no time and never let Murphy catch you off guard.

Nothing fights fear or inflation like a plan, and your EveryDollar budget is the tool that helps you win. It kills excuses and frees up money for Baby Step 3. Track your savings, cut extras, and send every spare dollar to your 3–6-month fund. Soon enough, you’ll be looking at a growing stack of Benjamins in your high-yield savings account.

Your emergency fund covers essentials only—housing, utilities, groceries, insurance, transportation and any vital bills. Add up those monthly costs, then multiply by 3–6. If you have a steady job, aim for 3 months. Does your paycheck vary? Save a 6-month fund. Personalize it to fit your life’s needs. Don’t worry—we’ll help you get there!

The purpose of the emergency fund is to protect you against storms, give you peace of mind, and keep the next problem from becoming debt. Building a safety net isn’t complicated, but it can be tough. Your EveryDollar budget will help you stay intentional as you knock out this goal.

You’ve already proved you can do hard things. You beat debt by giving every dollar a job, and that same intentionality is what protects you in Baby Step 3. Keep your zero-based budget tight and stay intentional. Stick with it, and you’ll watch your 3–6-month fund grow with confidence.

Begin by looking at the last three months of your spending. Drop each transaction into categories—giving, rent or mortgage, groceries, gas—and total them up. Divide by three to find your monthly average. If the numbers feel overwhelming, the Budget Calculator can help.

We believe giving is a priority at every step. We recommend budgeting 10% of your gross income to give first—whether it’s to your local church or to a charity. Next, budget the amount you want to put toward your emergency fund. Then, budget your critical expenses (like rent, food or insurance). If there’s money left, pile it into your emergency fund!

Saving 3–6 months of expenses takes grit. It’s not always easy—and yeah, some days it’ll feel like you’re saying no more than you want. But the security waiting on the other side is game-changing! You’ll get there faster by being brutally honest about your habits. That late-night “just browsing” on Amazon? Yep, it adds up. This is a short season of sacrifice, and the cart can wait. You got this!

Now picture this: You hit a bump in the road and don’t break a sweat. No panic. No swiping a credit card. No “How am I going to cover this?” You’ve built a financial fortress—brick by brick—that protects your future and your peace. Stay focused. You’ve done harder things than this (remember the debt payoff grind?). Millions of families have reached Baby Step 3 using their budget and gazelle intensity. Roll up your sleeves one more time—you’ve got this!

In just 15 minutes, let the EveryDollar budget app help you . . .

Find hundreds of dollars of extra margin every month

Build a plan to make the most of each dollar every day

Get support from expert coaches right when you need it

You were already throwing that money at your debt payments with intensity. Now, redirect it to your emergency fund and watch your savings grow faster than you think.

Small cuts make a big difference. Reduce unnecessary spending for a season and move that money straight into your emergency fund. Just like when you were paying off debt, you’ll see how the fund really adds up faster after trimming back extra spending.

Drive for Uber, tutor online—there are hundreds of ways to earn more and speed up your Baby Steps. Get creative! What skills could you turn into extra cash? Photography, baking, playing guitar—all these could translate into extra money for your emergency fund.

Pause all investing (even up to the company match) until you complete Baby Step 3.

The truth? Netflix and Peacock can wait. Remember, this is a season. You’re saving and sacrificing now so that later, you can live like no one else.

Forget those off-site lunches. Pack your lunch and save serious money. Pro tip: Bring snacks too. You’ll skip overpriced vending machines and gas station snacks.

A no-spend challenge means no spending except on the essentials for a month—food, utilities, shelter and transportation. Think: rent, gas, groceries (not restaurants) and internet. No haircuts, treats, presents. You’ll be shocked at the money you’ll save.

Let’s face it—some of the things in your closet could be considered “vintage” by now. But you’re in luck! That’s what all the kids are into these days. Grab anything you haven’t worn in six months—minus seasonal stuff. Post it on Depop, Poshmark or ThredUp.

You could also start a side hustle of finding thrifted items and flipping them online. Every little bit helps.

Stop spending your whole paycheck at Whole Foods. Try ALDI, Trader Joe’s or Walmart instead. Again, this is just a season. You can come back to Publix for their delicious soup bar soon!

This is the time to pull out all the stops—and do it fast. Trim your grocery shopping down to rice and beans if you have to, and sell so many things the kids think they’re next. Deliver food or groceries, pet-sit, whatever it takes to start stockpiling money into your emergency fund.

Check your calendar for birthdays, weddings and renewals. Decide how much to set aside each month so nothing sneaks up on you.

"I paid off $121,000 in 28

months. I feel strong! The

burden is gone!"

“Now, we talk more about our money, we make decisions together, and it’s not stressful anymore.”

“Budgeting gives you a true picture of your finances—of your life—so you can pick what you can do and plan all the good stuff.”

“I cried the first time we finished a month and actually had money left over. That had never happened before.”

“We're not stressed anymore. Our journey's in our hands now. We get to choose what we want to do."

"There’s freedom on the other side of debt. You don’t have to live like everyone else. I wanted something different for my family."

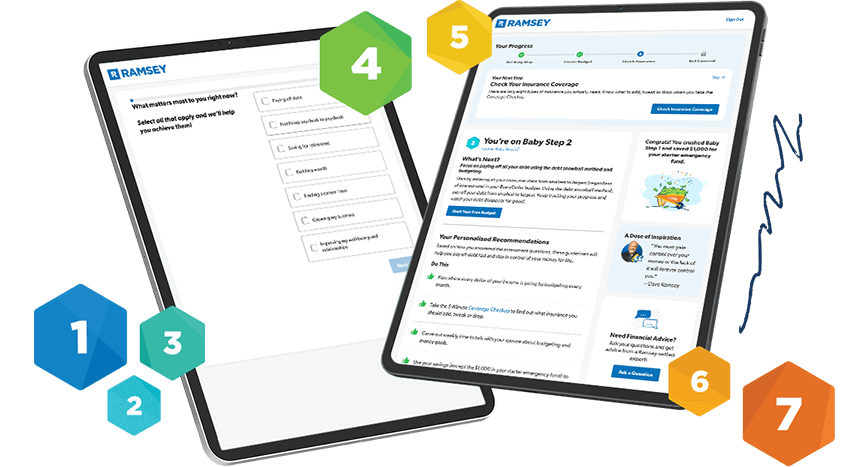

Not sure if Baby Step 3 is your step? Take the Get Started Assessment to find out exactly where you are—and receive your free custom money plan built just for you.

How long it takes depends on your monthly expenses and how much margin you can save each month after the budget is balanced. Most people finish Baby Step 3 in about 6–12 months, but it can be faster or slower based on your situation. The key is to keep up that same gazelle intensity you had in Baby Step 2—budget hard, cut extra spending, and throw every extra dollar into savings until you reach your goal.

And one of the best ways to stay focused and move faster is to use tools that bring instant clarity to your money. The Budget Calculator gives you a fast overview of where your money is going so you can see what’s possible each month. Then the EveryDollar budget app takes it further, giving you a personalized plan that shows every dollar’s job and helps you budget with confidence as you build your fully funded emergency fund.

The most important thing is to make sure your emergency fund is liquid—meaning you can get to it easily and quickly. That said, the best places to put your emergency fund are:

And remember, this money is not here to make you rich—so don’t invest it in mutual funds or anything else. It’s for emergencies only.

Before you dip into your savings, see if you can simply adjust your budget for the month to cash flow the expense. If you don’t have enough wiggle room to cover it, ask yourself these three questions:

If the answer is yes to all three, you’ve got a real emergency—and a real need to use your emergency fund. If not, then it can wait.

What we sometimes label as “emergencies” aren’t really emergencies at all. Wants, upgrades, sales, takeout, vacations or running out of fun money don’t qualify. And anything you can plan for—like birthdays, holidays, routine bills or regular car maintenance—should stay out of your emergency fund too. Save this money for the big surprises you truly didn’t see coming, not for convenience or poor planning.

Nope. Keep your fully funded emergency fund right where it is. It’s your safety net for life’s surprises. Once you finish Baby Step 3, then you start saving separately for a down payment. We call this Baby Step 3b—it’s not an official Baby Step, just the smart bridge between your emergency fund and the wealth-building steps.

Here’s how to do it: Keep your 3–6 months of expenses untouched, then open a separate savings account just for your down payment. Ideally, you’ll save 20% of the home’s price so you can avoid private mortgage insurance (PMI)—a monthly fee that can cost you thousands over time. If you’re a first-time buyer, 5–10% down is okay but expect to pay PMI until you build more equity.

So when Murphy shows up with a blown water heater or a dead HVAC right after you move in, you’ll take it in stride. That emergency fund shields you from the surprise repairs insurance won’t touch.

If you’ve got a unique question about saving for your fully funded emergency fund or working the Baby Steps, try our Ask Ramsey tool, powered by Ramsey AI. And to keep your momentum during Baby Step 3, build your budget in EveryDollar. You’ll get personalized recommendations that’ll help you keep moving forward.