"I paid off $121,000 in 28

months. I feel strong! The

burden is gone!"

If you've decided you're sick and tired of constant money stress, you’re in the right place. Baby Step 1 is where that all changes. How? Baby Step 1 requires you to break old money habits and build new ones so you can finally take control of your money—for good. We’ll show you how.

You need breathing room to stop the cycle of debt and paycheck-to-paycheck living. Saving that kind of money can feel impossible when you’re just trying to stay above water—but you’ve got this. (If you’ve already got your $1,000 saved, move right along to Baby Step 2!)

This step isn’t about being ready for any possible emergency—it’s about breaking the old habit of relying on debt in an emergency. Your starter emergency fund turns what used to be a financial crisis into a minor inconvenience.

A budget isn’t optional for Baby Step 1. Trying to get ahead without one is like building a house with no foundation. It ain’t happenin’. Tracking your spending throughout the month is key so you can spot areas to cut back and save more.

Imagine how you’ll feel when a flat tire doesn’t destroy your bank account or pile on to your credit card balance. You’ll be able to replace it—in cash—and get back on your way. And you’ll ride that momentum into Baby Step 2.

The key to this Baby Step? Speed. Don’t let this be another thing you start and don’t finish. We know you can do it. Millions of people just like you have. The first step to saving up $1,000? You’ve got to look at what’s already happening with your money. And you do that by making a budget.

Again, this is the number one tool to get started. It’s simply a plan for your money. You’ll want what’s called a zero-based budget. That means every dollar you earn has a job—whether it’s for rent, groceries, debt or even fun. And once your budget is complete, there’s zero money left over. It’s all been put into a category and there’s a plan for it.

Write down all the income you have coming in monthly (paychecks, side hustles, babysitting, everything) and add it up. This is what you have to work with to cover your expenses for the month.

This might take some time, but log into your bank account and take a look at the past three months. Group each transaction into categories like giving, rent/mortgage, groceries and gas. Then add up each category and divide by three so you have a rough average of your spending each month. Need help? Use the Budget Calculator.

We believe giving is a priority, even at this step. We recommend budgeting 10% of your gross income to give first—whether it’s to your local church or to a charity. Next, budget the amount you want to save toward your emergency fund. Then, budget your critical expenses (rent, food, minimum payments on debt). If there’s money left, pile it into your emergency fund!

Once you see where your money’s going—like $55 a week on Dunkin’—you’ve got to be honest with yourself. You can’t keep living like this.

Relief will come from the little choices. It means brewing coffee at home for 25 cents a cup. Sure—it’s not fancy. But financial peace is a high no pumpkin-spice cold brew can top.

You’re building a future you can look forward to. This is your moment to change. You’ve got to do this—for you.

No need to reinvent the wheel—here’s a simple budget calculator to get you started fast!

Enter your income and the calculator will show the national averages for most budget categories as a starting point. A few of these are recommendations (like giving). Most just reflect average spending (like debt). Don't have debt? Yay! Move that money to your current money goal.

Drive for Uber, tutor online—there are hundreds of ways to earn more and speed up your Baby Steps. Get creative! What skills could you turn into extra cash? Photography, baking, playing guitar—all these could translate into extra money for your emergency fund.

Pause all investing (even up to the company match) until you complete Baby Steps 1–3.

The truth? People who are broke don’t have time for Netflix. You’ve got time for work, work, family and more work. Remember, this is a season. You’re saving and sacrificing now so that later, you can live like no one else.

Forget those off-site lunches. Pack your lunch and save serious money. Pro tip: Bring snacks too. You’ll skip overpriced vending machines and gas station snacks.

A no-spend challenge means no spending except on the essentials for a month—food, utilities, shelter and transportation. Think: rent, gas, groceries (not restaurants), and internet. No haircuts, treats, presents. You’ll be shocked at the money you’ll save.

Let’s face it—some of the things in your closet could be considered “vintage” by now. But you’re in luck! That’s what all the kids are into these days. Grab anything you haven’t worn in six months—minus seasonal stuff. Post it on Depop, Poshmark or ThredUp.

You could also start a side hustle of finding thrifted items and flipping them online. Every little bit helps.

Stop spending your whole paycheck at Whole Foods. Try Aldi, Trader Joe’s or Walmart instead. Again, this is just a season. You can come back to Publix for their delicious soup bar soon!

This is the time to pull out all the stops—and do it fast. Trim your grocery shopping down to rice and beans if you have to and sell so many things the kids think they’re next. Deliver food or groceries, pet-sit, whatever it takes to start stockpiling money into your emergency fund.

Check your calendar for birthdays, weddings and renewals. Decide how much to set aside each month so nothing sneaks up on you. But keep in mind—this is a new season. Holidays may look different for now.

"I paid off $121,000 in 28

months. I feel strong! The

burden is gone!"

“Now, we talk more about our money, we make decisions together, and it’s not stressful anymore.”

“Budgeting gives you a true picture of your finances—of your life—so you can pick what you can do and plan all the good stuff.”

“I cried the first time we finished a month and actually had money left over. That had never happened before.”

“We're not stressed anymore. Our journey's in our hands now. We get to choose what we want to do."

"There’s freedom on the other side of debt. You don’t have to live like everyone else. I wanted something different for my family."

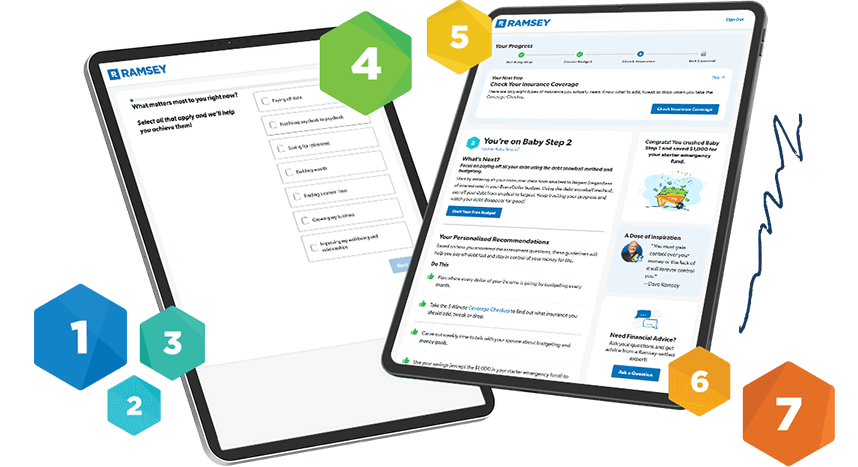

We’re hoping it’s Baby Step 1—otherwise, you just got an earful. Take the Get Started Assessment to find out—and get a free custom money plan built just for you.

Start by dialing in your budget. Cut anything you don’t need right now, pick up a side hustle, and sell what you can to build momentum.

Just pay the minimums on your debt for now. You’ll attack your debt with full force in Baby Step 2—promise.

Usually about a month. Push hard, no excuses—you got this!

Keep it somewhere safe and easy to access—like a savings account connected to your checking.

First, see if you can cover the cost in your budget. If not, ask:

If you answer yes to all three, it's an emergency.

(No, Black Friday shopping doesn’t count. But an emergency dentist visit? Yep.)

Three words: the Four Walls. That means food, utilities, shelter and transportation. And keep up the minimum payments on your debts. Pause everything else until you hit your $1,000 goal.

If you’ve got a unique question, try our Ask Ramsey tool, powered by Ramsey AI. And to boost your emergency fund savings even more, create your budget in EveryDollar and get personalized recommendations to speed up your progress!