"I paid off $121,000 in 28

months. I feel strong! The

burden is gone!"

Debt is gone, your emergency fund is stacked, and now it’s time to start building your future in Baby Step 4. Picture a quiet beach morning with no deadlines, no stress, just freedom. That future takes shape when you consistently invest 15% of your income—your most powerful wealth-building tool—and leave it to grow over time.

These days, a lot of people wonder if they’ll ever retire with dignity, but here’s the truth: Just $250 a month invested from age 30 to 65 can grow to $1,232,073. Anyone in America can retire a millionaire. To get there, invest 15% of your gross income in tax-advantaged accounts. Need a coach in your corner? An investment pro can guide you forward.

Retirement planning doesn’t have to be complicated. It’s a simple approach: Invest 15% every month on repeat. No guessing or chasing your golf buddy’s “hot tips.” Just consistent investments that grow over time so you can enjoy your golden years. Now that your money is in shape, the goal here isn’t gazelle intensity—it’s regular maintenance.

Putting all your money in one place is like having all your eggs in one basket: If that basket drops, so does your nest egg. Lower your investment risk by spreading your money across four types of growth stock mutual funds—growth, growth and income, aggressive growth, and international. If one area dips, the others help steady your growth.

The stock market will rise and fall in the short term—but over time, it’s had a proven track record of growth. Systematic, consistent investing is the tortoise that beats the hare in the race. Slow and steady wins every time. Month after month, you’re putting your future in a position to win—so you can build financial peace and retire with dignity.

This step is all about building lasting wealth for your retirement.

Wait to start Baby Step 4 until you’re debt-free (except your mortgage) and have a fully funded emergency fund of 3–6 months of expenses. That frees you up to invest your income for retirement. Once you’re ready, take your annual household income before taxes and multiply by 15%. That’s your yearly goal—then divide by 12 for your monthly target.

Now it’s time to put that 15% to work. Remember—your retirement accounts are just containers for the investments you choose. Think of them like buckets: The bucket itself isn’t what grows your money—the investments you put inside it do. The bucket simply gives you tax advantages and a place to hold those investments. Here’s the order we teach:

Need help navigating your retirement plan? Talk to an investing pro.

Inside your accounts, pick good growth stock mutual funds with a long, proven track record—think decades, not months. Look for funds that consistently beat the market and steer clear of anything trendy, complicated or hyped up as the “next big thing.” Like we said before, spread your investments across four categories—growth, growth and income, aggressive growth, and international—to stay diversified and give your money room to run. Avoid single stocks, crypto and anything that sounds like a get-rich-quick scheme. Never invest in something you don’t understand.

Retirement investing isn’t a “set it and forget it” deal—check in once or twice a year to rebalance your funds, update your contributions, and make sure you’re still hitting your 15%. These small tune-ups keep your plan moving forward. Check out the Investment Calculator below to see what the long-term payoff could look like.

Curious what your investments might look like down the road? Use this calculator to run the numbers. Building your retirement is 80% behavior and 20% head knowledge—and this quick check gives you the insight you need to get started.

In 0 years, your investment could be worth:

$0

$ 0

0% of Total

$ 0

0% of Total

$ 0

0% of Total

Adds $100 a month in contributions, but creates

$0

in additional growth

Adds $128 a month in contributions, but creates

$0

in additional growth

Adds $200 a month in contributions, but creates

$0

in additional growth

Budgeting matters just as much in Baby Step 4 as it did when you were paying off debt. It keeps you focused, gives every dollar its marching orders, and helps you stick with your investing plan month after month. A good budget also protects your progress. It creates margin, keeps lifestyle creep from sneaking in, and frees up extra money you can throw toward your other money goals.

No matter what Baby Step you’re on, giving the first 10% of your income shapes your heart. It loosens your tightfisted grip on control and reminds you to open your hand and trust God. When you give regularly, you’re believing God can do more with your 90% than you could with 100%. And the best part? Your giving fuels your church or organization’s mission and meets real needs in your community.

Getting back into debt in Baby Step 4 is like calling your toxic ex—you know it’s a bad idea, and it wrecks your peace every time. Every dollar you send to payments and interest is a dollar not building your future. Debt is dumb! When you stay debt-free in Baby Step 4 (and forever), your hard-earned money can go to work building the future you’ve been dreaming about and changing your family tree. See you never, debt!

When you pull money from your 401(k) or IRA early, you get hit with taxes and a 10% penalty, and you cut off the compound growth that makes your money work for you. That’s years of potential gains gone in an instant. Borrowing from your retirement accounts isn’t any better—lose your job or fall behind, and you’ll owe penalties and taxes on top of that loan. Either way, your future self pays the price.

It’s tempting to panic and stop investing when the market drops, but that’s the worst time to stop. Stay the course and keep investing for long-term growth. The market has always recovered over the long haul. Stay consistent and keep investing—this is how long-term growth happens.

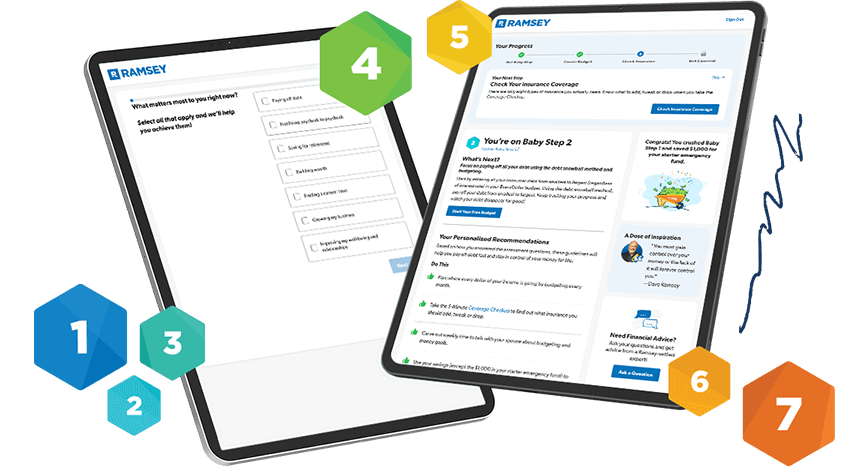

Not sure if Baby Step 4 is your step? Take the Get Started Assessment to find out exactly where you are—and receive your free custom money plan built just for you.

"I paid off $121,000 in 28

months. I feel strong! The

burden is gone!"

“Now, we talk more about our money, we make decisions together, and it’s not stressful anymore.”

“Budgeting gives you a true picture of your finances—of your life—so you can pick what you can do and plan all the good stuff.”

“I cried the first time we finished a month and actually had money left over. That had never happened before.”

“We're not stressed anymore. Our journey's in our hands now. We get to choose what we want to do."

"There’s freedom on the other side of debt. You don’t have to live like everyone else. I wanted something different for my family."

For two decades, Dave Ramsey and his team have connected millions of people with the SmartVestor program—a referral network of financial advisors who value serving over selling. Get custom advice from pros who lead with the heart of a teacher.

Ramsey Solutions is a paid, non-client promoter of participating pros.

Retirement isn’t about running away from a job you hate. If you’re miserable, the solution isn’t to dream about quitting someday—it’s to change the work you’re doing now.

Retirement also isn’t a life of sitting still. Dave tells the story of Harold Fisher, a 100-year-old architect who kept working because he loved it, not because he needed the money. That’s the real picture: reaching the point where your money works harder than you do and work becomes something you choose, not something you’re chained to.

Retirement also isn’t automatic or guaranteed. Most Americans aren’t prepared, and many don’t believe a secure retirement is even possible. But it is—if you have a plan and take action. Retirement is not an age; it’s a financial number. When you have enough money to live and give like no one else, you’re ready.

If you have access to an employer-sponsored retirement account like a 401(k), it can be as simple as setting up automatic contributions. You can choose to have a portion of each paycheck automatically invested in the funds of your choice.

Otherwise, you can set up an Individual Retirement Account (IRA). These are available at a variety of financial institutions and take about as long to set up as a bank account. You simply transfer money into your IRA and use it to invest in mutual funds from right inside your account.

Ramsey’s path to financial peace follows the 7 Baby Steps. We always recommend waiting to start investing until you’ve paid off all debt (except your mortgage) and have a fully funded emergency fund with 3–6 months of living expenses.

The sooner you can start investing, the more time your money will have to grow. But it’s never too late to start! We’ve seen plenty of people become successful investors later in life.

Let’s get one thing straight: The only “good debt” is paid-off debt. Your most powerful wealth-building tool is your income. And when you spend your whole paycheck sending loan payments to banks and credit card companies, you end up with less money to save and invest for your future. It’s time to break the cycle!

Trying to save and invest while you’re still in debt is like running a marathon with your feet chained together. Get debt out of your life first and build your 3–6-month emergency fund. This frees up your income to focus on your future—not your past.

Your emergency fund (3–6 months of expenses) is your safety net. If you have to spend some of it on an emergency, your top priority is to restore it. So yes, you should pause all investing temporarily until your emergency fund is back to fully funded status. This isn’t forever—just long enough to get that cushion back in place. Once you’re fully funded again, jump right back into investing 15% of your income for retirement.

This protects you from having to go back into debt if another emergency hits. It’s all about financial security first, then building wealth.

We recommend investing 15% of your gross annual income (not your take-home pay) each year. For example, if you and your spouse bring in $100,000 annually, the goal would be to invest $15,000 a year.

If your employer offers a match, that’s awesome! But no, the money they put into your account doesn’t count toward your 15%.

When you invest 15% of your income, you’re investing enough to make good progress toward your retirement goals and still have money left for other money goals like saving for your kid's college (Baby Step 5) and paying off your home (Baby Step 6).

Depending on your situation, you may want to use more than one type! As a general guideline, we recommend using the following formula to help you figure out which accounts to use:

Match beats Roth beats traditional.

If your employer offers a Roth 401(k) with a match of 4%, for example:

If your employer only offers a traditional 401(k) with a 4% match, for example:

If you don’t have access to an employer-sponsored retirement account:

It depends on the type of account! For instance, if you want to set up an employer-sponsored account like a 401(k), your human resources (HR) department should be able to walk you through the process.

These days, you can open a Roth IRA or traditional IRA on the website of any major investment firm. As a general rule, we recommend working with an investment pro, who will be able to help you explore mutual funds and understand how different accounts could fit your needs.

We recommend investing evenly across four different categories of growth stock mutual funds:

Instead, focus on time-tested investments—like good growth stock mutual funds—that have a long history of building wealth for investors. That’s how you minimize risk and grow your money for the long haul.

If you’ve got a unique question about saving for retirement or working the Baby Steps, try our Ask Ramsey tool, powered by Ramsey AI. And to keep your momentum during Baby Step 4, stay on track with your EveryDollar budget every month.

The content on this page provides general guidelines about investing topics. Your situation may be unique. To discuss a plan for your situation, connect with an investment professional.