Key Takeaways

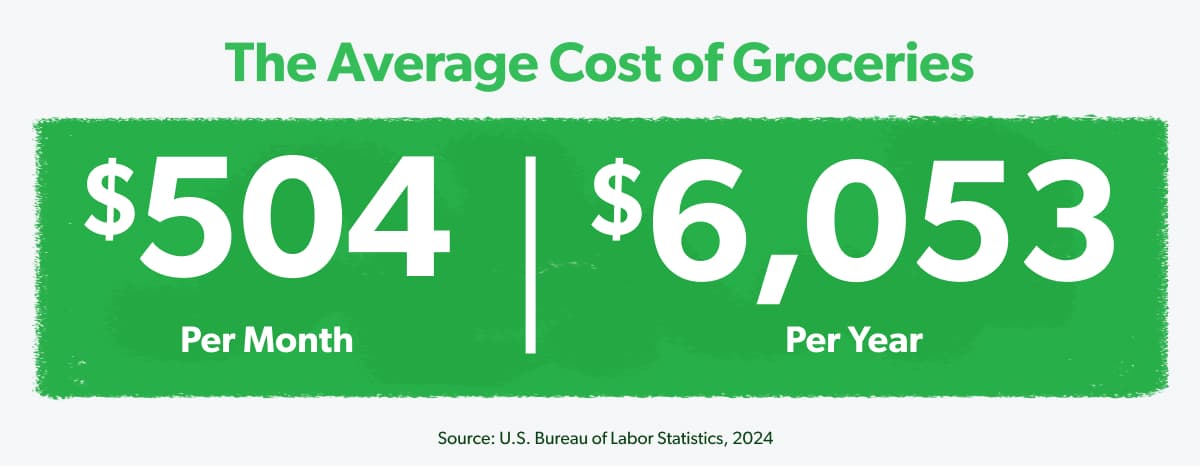

- The average grocery cost per month is $504.

- The USDA estimates $299–569 for a monthly food budget for one person, $617–981 for a couple, and $1,002–1,631 for a family of four.

- To figure out how much to spend on groceries each month, see what you already spend, budget for the rest of your expenses, adjust as needed, and consider your financial goals.

When setting up your budget, it’s hard to know how much money to set aside for the essentials—like food. Exactly how much should you spend on groceries each month?

Get expert money advice to reach your money goals faster!

The average household spends around $500 a month on groceries. But how much you should spend depends on your income, family size, dietary restrictions and lifestyle.

Average Grocery Cost per Month

The average grocery cost per month is $504—which totals to $6,053 a year.1

And that number is likely to increase as overall food prices continue to go up. In fact, Americans spent 2.7% more on food at home (aka groceries) from September 2024 to September 2025.2 And that doesn’t even include how much people also spend eating out each month!

But depending on where you live, what grocery store you shop at, and what you put in your cart, you could spend more or less than the average grocery cost. So, let’s talk about how to set a monthly grocery budget that makes sense for you.

How Much to Spend on Groceries Each Month

Unfortunately, there’s no magic number for how much each family should spend on groceries.

The USDA Food Plans and Cost of Food Reports give a rough estimate of what you could spend on groceries. These plans are based on current food prices and are broken down into four different budget levels: Thrifty, Low-Cost, Moderate-Cost and Liberal. (Keep in mind, these numbers don’t represent how much people are actually spending on groceries each month.)

Here are the estimated grocery costs per USDA Food Plan:3,4

Single-Person Household (1 Person)*

- Thrifty Plan: $299–375

- Low-Cost Plan: $323–372

- Moderate-Cost Plan: $394–467

- Liberal Plan: $501–569

Couple (2 People)

- Thrifty Plan: $617

- Low-Cost Plan: $638

- Moderate-Cost Plan: $788

- Liberal Plan: $981

Family of 4**

- Thrifty Plan: $1,002

- Low-Cost Plan: $1,097

- Moderate-Cost Plan: $1,351

- Liberal Plan: $1,631

*Adult age range is 20–50 for Thrifty plan and 19–50 for all other plans.

**Family includes two children, ages 6–8 and 9–11.

USDA Food Plans

Monthly Cost of Groceries by Family Size

|

Thrifty |

Low-Cost |

Moderate |

Liberal |

|

|

Single |

$299–375 |

$323–372 |

$394–467 |

$501–569 |

|

Couples |

$617 |

$638 |

$788 |

$981 |

|

Family |

$1,002 |

$1,097 |

$1,351 |

$1,631 |

Source: U.S. Department of Agriculture, 2025.

How to Lower Your Grocery Costs

As you can see, groceries can definitely take a big bite out of your monthly expenses. Thankfully, there are plenty of ways to save money on groceries—and here are a few ideas.

Raid your pantry and fridge first.

Before you rush off to the grocery store, take a good look through your pantry and fridge. Maybe you forgot you already have a jar of mayonnaise for that recipe. Or you could use those peppers that are about to go bad to make fajitas. Just take inventory and get creative with some pantry recipes. Waste not, want not, right?

Change up where you shop.

One of the biggest factors in how much you spend on groceries is where you shop. Seriously, have you seen the price differences out there? Check out some cheaper grocery stores in your area—like Costco or ALDI. Yeah, you may have to bag your own groceries at some of these places, but that little bit of inconvenience means huge savings for you.

Choose generic.

According to a Consumer Reports study, store brands cost anywhere from 5–72% less than name brands—and most of them taste just as good.5 Even if you aren’t willing to trade in your Cheerios for Honey Nut Hoops just yet, start by opting for the generic brand of basics like condiments, bread, yogurt, nuts or soup.

You probably won’t notice the taste difference, but you’ll definitely notice the price difference on your receipt!

Shop sales.

Another way to save money on your next grocery store run is to pay attention to sales and specials. Do your research beforehand to scout out any weekly specials and try to plan your meals around those items. Shopping produce that’s in season can also save you some bucks.

And if you’ve got the time and patience, you can always try couponing. Just don’t forget to do the math and make sure you’re actually saving money—especially before you buy in bulk. Stocking up on a year’s supply of applesauce just because it’s on sale isn’t always worth it.

Want more grocery savings tips?

Download our Meal Planner & Grocery Savings Guide for free. You’ll learn how to schedule your meals with confidence and shop the grocery store aisles like a pro. Plus, you’ll get downloadable meal planning and grocery list templates to help you save time and stick to your food budget each month!

Put More Breathing Room in Your Budget

Money feeling tight? Not anymore. The EveryDollar budgeting app helps you free up thousands of dollars you didn’t know you had—in minutes.

How to Budget for Groceries

All the above ideas are a great start, but actually setting a grocery budget for the month is the best way to spend less. Because when you give yourself a limit before you head into the store, you’re more likely to shop responsibly (instead of just throwing things in a cart and saying a quick prayer at checkout).

Keep in mind that everyone’s grocery budget will be different, so we’ve got four steps to help you figure out how much you should spend each month.

1. See what you already spend.

Start by opening up your bank account. Then, go through your spending history and add up how much you spent on groceries each month for the last several months. Use the monthly average as your baseline grocery budget amount. You may cringe when you see the total, but knowing how much you actually spend each month will help you create a budget that makes sense for you and your family.

2. Budget for other expenses.

Once you decide on a number for your grocery budget, finish setting up the rest of your budget. After food, make sure you cover the other Four Walls: utilities, shelter and transportation. Then add in any other monthly expenses. Do you pay for day care? What about subscriptions? Oh, and don’t forget any debt you may have—like car payments, credit card bills or student loans.

3. Adjust as needed.

Once you’ve included all your expenses in your budget, you might need to do some adjusting. Your goal is to give every dollar a job—whether you’re giving it, saving it, using it to pay off debt, or spending it. That’s what we call a zero-based budget.

You also want to make sure you’re not spending more than you make each month. So, go back through your budget and see which areas you can cut back on (maybe food) and where you can put more money (toward savings, for example).

And listen, you probably won’t get your grocery budget right for the first few months. If you keep going over because you can’t feed your family with the amount you originally set, it’s okay to bump that number up. (You’ll just need to adjust other areas of your budget to find that extra money.)

But if you keep going over budget because you can’t get your spending under control, you need to make some different choices or find ways to save money (more on that in a minute).

4. Consider your financial goals.

According to Ramsey Solutions’ quarterly State of Personal Finance study, food is usually one of the biggest areas we overspend on. But it can also be one of the biggest opportunities to help you save money and hit your goals!

For example, if you’re paying off debt, focus on throwing as much money as you can toward your payments. So, you might prioritize shopping for cheaper meals that require fewer ingredients to help you cut costs. Or maybe you decide to stop eating out entirely. In that case, your grocery budget probably needs to be a little bigger because you’ll be cooking at home more.

If you’re trying to rebuild your emergency fund, your grocery budget will probably look a little lean for a couple of months while you stockpile some savings. Or maybe you’ve got the room in your budget to add those expensive cheeses to your cart without it derailing your progress. Whatever your goal, your grocery budget can play a huge part in how fast you get there.

Get Budgeting With EveryDollar

So, we all now know that a budget is the best way to save money buying groceries. But what’s the best way to budget? Well, that’s easy—it’s with EveryDollar, Ramsey’s all-in-one budgeting app.

But EveryDollar is so much more than just a budgeting app. It's built to help you find margin and put it to work toward your long-term money goals—like building an emergency fund, paying off debt, saving for retirement, and more!

Next Steps

- Do a quick pantry and fridge inventory and plan your next few meals around what you already have.

- Download the free Meal Planner & Grocery Savings Guide to start organizing your meals and shopping list for the week.

- Review your last two or three months of bank statements and calculate your real average grocery spending—and be honest!

- Download EveryDollar and set a zero-based budget that will help you plan out exactly how much you have for groceries every month—and stick to it!