The Average American’s Monthly Expenses

10 Min Read | Jan 30, 2026

Key Takeaways

- The average American household spends about $6,545 per month. Housing, transportation and food make up the biggest chunks of the budget.1

- Monthly expenses vary widely by household size and location, but the cost of most items has gone up due to inflation.

- Just because these numbers are “average” doesn’t mean they’re ideal. Staying below average in key categories can give you some breathing room in your budget.

- A zero-based budget is essential for tracking expenses, cutting costs, and avoiding the paycheck-to-paycheck lifestyle most Americans are stuck in.

Money’s tight for just about everybody right now (thanks, inflation). As you look for ways to cut costs, you’re probably wondering, Is everyone spending this much on food and housing? What are the average monthly expenses?

Get expert money advice to reach your money goals faster!

Well, here’s what we do know: The average monthly expenses for an American household total about $6,545.2 That adds up to about $78,540 per year. And these numbers come straight from the folks at the Bureau of Labor Statistics (BLS), who keep track of what Americans spend on everything from cereal to toilet paper to housing.

But everyone’s situation is different. So, let’s dig in to each monthly expense category a little more.

Average Monthly Expenses by Household Size

How much you spend on monthly expenses depends on several factors, including how many people you have living in your home. That said, here are the average monthly expenses by household size:3

- A single-person household spends an average of $4,716 on monthly expenses.

- Married couples without kids spend an average of $7,391 on monthly expenses.

- Married couples with kids spend an average of $8,809–9,780 on monthly expenses (depending on the kids’ ages).

Remember, these are averages, so they could vary a lot based on your family and the cost of living in your state.

Here's A Tip

Use our Cost of Living Calculator to see how expensive it is to live in your city versus somewhere else.

Average American Monthly Expenses

From basic living expenses (like food, housing and transportation) to other costs (like entertainment and giving), Americans spend their money on lots of different things. Let’s take a look at the 10 major categories of household living expenses.4

|

Monthly Expense |

Monthly Cost |

Percentage of Total |

|

$2,186 |

33.4% |

|

|

$1,113 |

17% |

|

|

$847 |

12.9% |

|

|

$818 |

12.5% |

|

|

$517 |

7.9% |

|

|

$301 |

4.6% |

|

|

$190 |

2.9% |

|

|

$163 |

2.5% |

|

|

$131 |

2% |

|

|

$275 |

4.2% |

Keep in mind, these are what the average American spends—not necessarily what you should spend each month. Your exact budget percentages need to make sense for your income, your lifestyle and your goals. And who wants to be average anyway, right?

Next, let’s break down what each category includes—and how you can come in below average by saving money on some of your living expenses.

Housing: $2,186 per Month

This probably isn’t news to you, but the biggest expense for everyone (singles, married couples and couples with kids) is housing, at $2,186 per month. Keeping a roof over your head costs a lot of dough—and the cost of housing went up 3.3% in 2024.5

And this category doesn’t just include rent and mortgage payments. It also covers property taxes, homeowners insurance, home repairs, gas and electric bills, and furniture.

To avoid being house poor (aka spending too much money on housing), try to keep your rent or mortgage (plus insurance, taxes and any HOA fees) at no more than 25% of your take-home pay.

We know, that’s below the average recommendation. But you want your house to be a blessing, not a burden. And if you save up a good down payment and choose a house you can afford, you’ll be able to actually enjoy your home—instead of stressing about how you’ll pay your mortgage.

There are also plenty of ways to save on home expenses, like being smart with the thermostat, sealing any air leaks, and using energy-efficient lightbulbs. And if you really want to offset your housing costs, you could always get a roommate or list your garage apartment on Airbnb.

“We have a programmable thermostat,” said Cortney, one of the members of the Ramsey Baby Steps Community on Facebook. “So I took our program up a degree, waited a few days, and took it up another degree. Now we are saving $1.40–2.25 per day on electricity! I know it’s small savings, but that $40–70 a month will help a lot!”

Transportation: $1,113 per Month

Airline tickets, gas, insurance, repairs and (here’s the big one) car payments—all that adds up to $1,113 a month. Yep, we sure do love our cars in the good ol’ U.S. of A. In fact, the average monthly payment for a new car is $748!6

A surefire way to cut your monthly transportation costs in half is to trade your car payment for a paid-for ride. We’re talking about paying cash for a car instead of taking out another car loan. You’ll spend less (and stress less) each month. Worth it!

Food: $847 per Month

It’s probably no surprise that food is number three on the list, at $847 per month. Americans love to eat. After all, we did invent the cheeseburger! Monthly food expenses are split between food at home ($519) and food away from home ($329). So on average, Americans spend about $190 more a month on groceries than they do eating out.

If you want to lower your food budget—both at home and at restaurants—start meal planning! When you plan out your meals before you head to the grocery store, you’ll be more likely to buy only the stuff you need and skip the impulse buys. Having a plan will also keep you from making an expensive trip to a drive-thru because you didn’t know what to make for dinner.

Personal Insurance and Pensions: $818 per Month

At $818 per month, personal insurance and pensions increased 2.5% from 2023 to 2024.7 But what exactly does this category include? Well, personal insurance is basically another name for life insurance, which is about $48 a month for an average American.

Sidenote: We recommend term life insurance because all the other types of life insurance are rip-offs.

That leaves about $770 going toward retirement plans, pensions and your Social Security tax every month. But that’s because the Bureau of Labor Statistics lumps the Social Security tax into this category. That’s a 6.2% tax that comes directly out of your paycheck.

Health Care: $517 per Month

The $517 per month for health care includes the cost of health insurance premiums and out-of-pocket costs for medical services and prescriptions. It’s a pretty big line item for most Americans, especially if you have a family. And it went up by 0.6% in 2024.8

While you can’t always control your health care costs, there are some ways to save money on health insurance. For example, stay in-network when you can or take advantage of a Health Savings Account (HSA).

Entertainment: $301 per Month

The $301 that Americans spend on entertainment each month isn’t just buying tickets to see the latest Pedro Pascal movie (and there are lots of those lately). It also includes things like televisions, streaming services, countless hobbies (bird-watching, anyone?) and pets.

Yes, dogs are technically a form of entertainment (we always thought they were extra family members). FYI: The average American spends $73 a month on pets.9

Cash Contributions: $190 per Month

Charitable giving is a big part of the $190 spent in this category, but it also includes alimony and child support payments. In addition, cash contributions include any money you spend on room or board for a college student—whether they show up for their 8 a.m. chemistry class or not!

This category decreased by 3.6% in 2024. But charitable giving is one area where we actually recommend being above average.

Generosity shifts our focus off ourselves (our problems and our financial shortcomings) and reminds us of our blessings. We recommend tithing 10% of your income to a church, charity or other worthy cause.

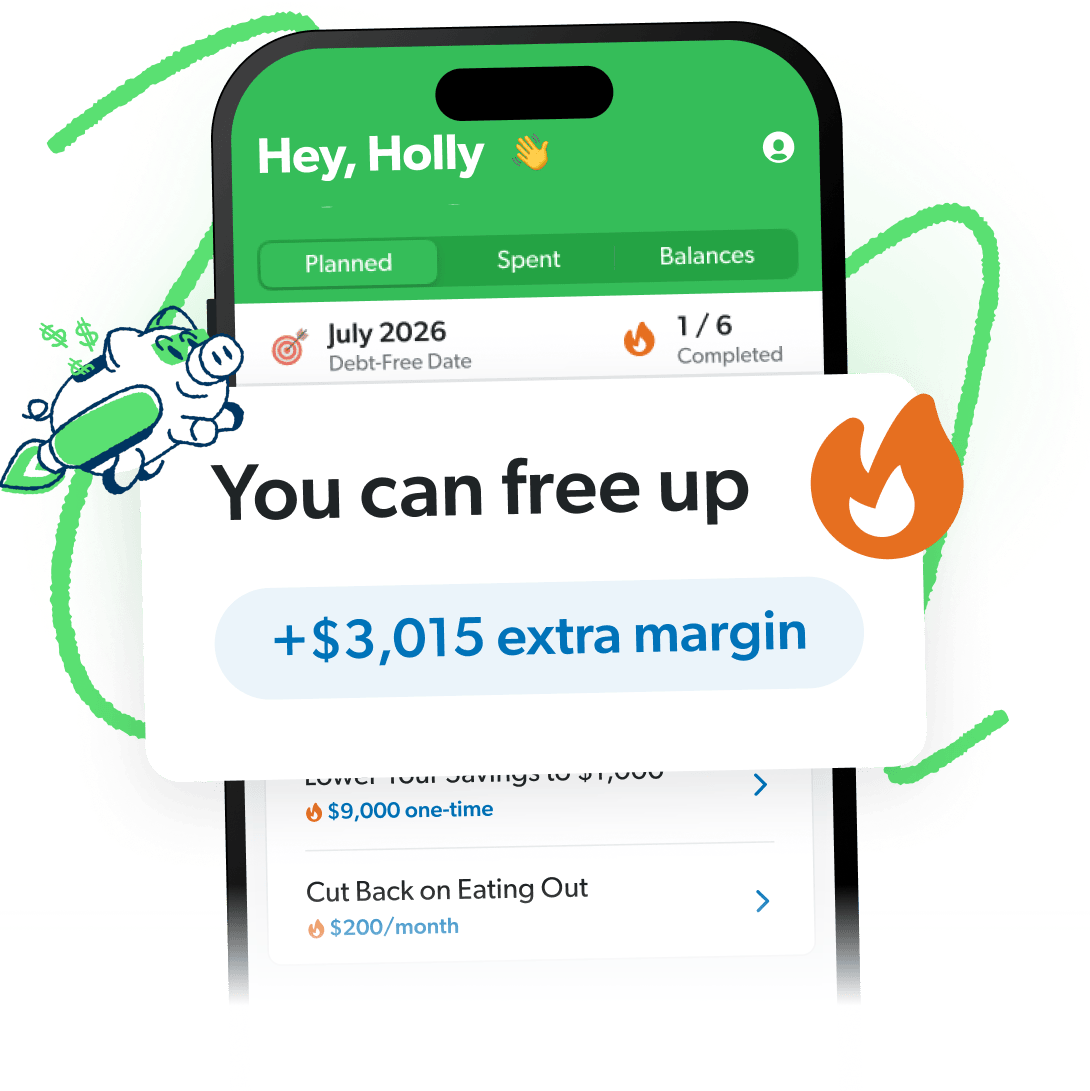

Put More Breathing Room in Your Budget

Money feeling tight? Not anymore. The EveryDollar budgeting app helps you free up thousands of dollars you didn’t know you had—in minutes.

Apparel and Services: $164 per Month

The average spent on clothes and other services per month is $164. But this could vary a ton based on the size of your family and whether or not you have a Carrie Bradshaw-level shoe addiction (choosing shoes over rent is never a good idea, by the way). And since we’re on the topic of shoes, the average monthly amount for footwear is $38.10

Besides clothing, this category includes dry cleaning, alterations and jewelry.

Education: $131 per Month

Remember, $131 a month for education is an average of all Americans. So if you’re paying for a kid (or kids) to go to college or private school, this expense is going to be way higher.

The average cost of college tuition for an in-state school is $11,950 a year ($996 per month).11 Yikes! That’s more than the average cost of food.

Other Expenses: $275 per Month

This category is a catchall for lots of different expenses: personal care products and services, books, alcohol, tobacco and miscellaneous items.

It’s like that drawer in your house that collects scissors, loose change, gum wrappers and a pile of stuff you probably don’t need. While toothpaste is essential (please brush your teeth), you can probably cut back on some of these expenses. (Hint: One of them rhymes with schlottery stickets)

And even though the Bureau of Labor Statistics doesn’t list debt as its own category, it’s definitely a monthly expense you need to account for. In fact, the average American has around $69,000 of debt!12,13 That’s a huge chunk of people’s paychecks going to debt payments every single month.

How Has Inflation Impacted Living Expenses?

Prices on just about everything have gone up in the last couple years thanks to inflation. And that means monthly living expenses for most Americans have gone up.

The annual inflation rate for all items was 2.7% as of December 2025. The cost of food was up 3.1%. Shelter (aka housing) was up 3.2%. Some good news, though: The price of gasoline decreased by 3.4% year over year.14

The moral of the story? For most things, you have to spend more money just to keep your same standard of living. And that’s why having a budget is key to keeping up with (and covering) all your monthly expenses. (More on that in a second.)

Jessica, another member of our Ramsey Baby Steps Community, listed all the ways that you can save money despite rising costs: “Buy less, buy used, find stuff for free, reuse, recycle, buy store brands, make do without, fix it, save up, stay on budget, find cheaper housing if you can, use the library, find deals, trade/barter. Use your money on costs you can’t reduce. Find ways to create more income. Inflation is nothing new and it’s not going to stop. Learn how to beat it.”

Keep Track of All Your Expenses With a Budget

So, now you know all the numbers for average monthly expenses. How do your living expenses stack up?

Maybe you spend more or less than the average person. But in this case, you want to be below average. Why? Because the average, normal American lives paycheck to paycheck. No, thank you. Don’t settle for normal when normal is broke.

If you can’t afford your current living expenses or if you have no idea what your actual expenses are, you need a monthly budget. Heck, if you're doing totally fine with money, you still need a monthly budget!

A budget helps you make a plan for every monthly expense. It also shows you where you can cut back spending to give yourself more margin (aka breathing room).

That’s why we made the EveryDollar budgeting app! EveryDollar helps you find extra margin every month so you can start making real money progress, really fast.

Just download the app, answer a few questions, and we’ll build you a personalized plan based on your situation to free up margin and make the most of every dollar, every day. (See where we got the name?)

Next Steps

- Write down every expense you had in the last 30 days to see where your money is actually going.

- Pick one major category—housing, transportation or food—and choose one change you can make this week to lower that cost.

- Use EveryDollar to create a zero-based budget, track spending daily, and find extra margin without the guesswork—so every dollar has a job before the month begins.

Get started with EveryDollar for free right now!