Impact on Organizational Health

Awareness of Employee Financial Health

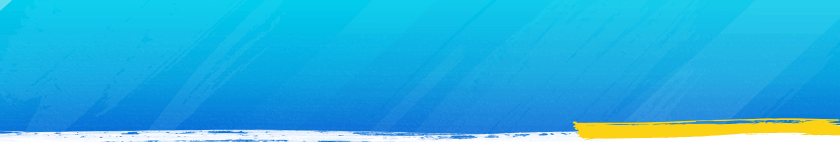

Are benefits decision-makers aware of the financial stress their employees are dealing with? It depends on who you ask. Overall, only 28% of employers say they have a great deal of awareness about their employees’ financial health. But companies that offer financial wellness as a benefit are twice as likely to say they have a great deal of awareness than companies that don’t offer financial wellness.

GREAT DEAL OF AWARENESS OF EMPLOYEE FINANCIAL HEALTH

Responsibility for Employee Financial Health

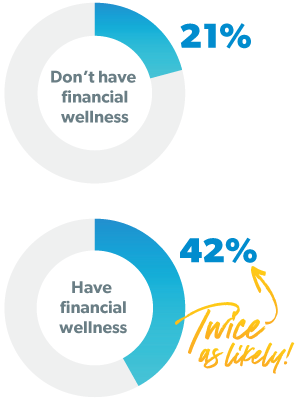

As we saw above, employers who offer financial wellness as a benefit are also twice as likely as those who don’t to feel extremely responsible for their employees’ financial well-being.

FEEL EXTREME RESPONSIBILITY FOR EMPLOYEE FINANCIAL HEALTH

Impact of Employee Financial Stress

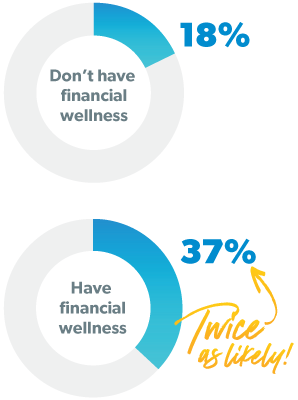

Employers may not have a great deal of awareness about their employees’ specific money problems, but they do recognize that their employees are dealing with financial stress. Nearly one-third of employers say their employees’ level of financial stress is too high. Not only that, nearly half said stress has a significant impact on their employees.

of employers say their employees’ level of financial stress is too high.

of employers say their employees’ level of financial stress is too high.

Which Employees Are Struggling?

The reality is, financial stress affects all types of workers. No industry, type of work, or level of payroll is immune to employee financial stress. It’s a pervasive problem for all companies whether they know it or not.

TYPES OF WORKERS SIGNIFICANTLY IMPACTED BY FINANCIAL STRESS

The Perceived Impact of Employee Financial Stress on Businesses

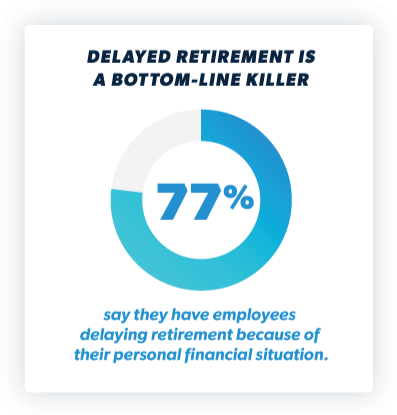

Companies are also feeling the effects of their employees’ financial issues on their bottom line. Many said they had significant concerns about high/increasing health care costs for employees, high employee turnover, low productivity and distracted workers—all symptoms of a team dealing with big financial problems.

FEEL EXTREME RESPONSIBILITY FOR EMPLOYEE FINANCIAL HEALTH

- High/increasing health care cost for employees

- Employees delaying retirement for financial reasons

- High turnover of employees

- Low productivity from employees

- Distracted employees

- Low participation in company-sponsored retirement savings

It's Worth Repeating . . .

Have control over their day-to-day finances.

Have enough cushion to handle most financial emergencies.

Are out of debt and able to manage their expenses without swiping a credit card.

Are on track to meet their savings and retirement goals.

Financial wellness is a lot like fitness. Sure, there’s a bit of technique involved, but for both, being successful means focusing on the right exercises, keeping up the commitment, and getting some encouragement along the way.

But the lack of awareness and sense of responsibility we saw in the data is clearly holding employers back from offering their employees what they truly need. To put it simply, employees are taking a beating when it comes to their money. You just read it above: There’s no industry, type of work or level of payroll that’s immune from employee financial stress—it’s everywhere. And it’s hurting your bottom line in the form of turnover, delayed retirements and lost productivity.

Want to read this later?

Enter your email and we'll send you a link so you can read the study later and learn more about SmartDollar, Dave Ramsey's financial wellness benefit.