Link copied!

Unable to copy link. Please try again.

Spring is in the air! That means warm days are ahead—and these common spring expenses are on the horizon. Are you budget-ready for the changing of seasons? With this list in hand, you can be.

Common Spring Expenses

1. Spring Break

A quick weekend trip, a staycation in your own town, or a weeklong vacay with the family—it’s your choice . . . if it’s in the budget. No matter what you plan on doing during spring break, budget ahead for it.

Think about the expenses for travel, hotels, food and entertainment. Then you can relax and soak up the sun without worrying about your vacation soaking up all your money.

Pro tip: Even if you don’t plan on traveling, those school-aged kids who’ll be home all week might need supervision. Budget for extra childcare costs those days or plan to take time off from work.

2. St. Patrick’s Day

This year, Americans are expected to spend around $6.9 billion on St. Patrick’s Day, including festive clothes, drinks, food and parties.1 That’s. So. Much. Just remember our favorite Irish proverb: Luck doesn’t make your money goals happen. Budgets and hard work do.

Get expert money advice to reach your money goals faster!

Okay, we made that one up. But they’re still wise words to live by. So, set those holiday spending limits ahead of time, and then enjoy the celebrations without wondering if you can afford it.

3. Easter

You know you’ll fill baskets, find matching outfits for the whole family, and plan a wonderful Sunday dinner. Those chocolate bunnies, pastel vests and glazed hams won’t pay for themselves. So, when you make your budget for April, get it all in there!

4. Mother’s Day

Mom works hard all year round—it’s about time she had a day off! Ask how she wants to celebrate Mother’s Day and then add your own special touches to surprise her. Plan a weekend full of her favorite things—just be sure to budget before you buy.

5. Memorial Day

If your family or friends want to celebrate Memorial Day with party food and fun at a backyard barbecue, decide ahead of time who’s bringing what. The more you can split up the cost, the more you can enjoy your long weekend without worrying about overspending on burgers or all the glorious red, white and blue decor.

6. Taxes

Taxes. Can’t live with them. Can’t live (in America) without them. Some people don’t think about filing taxes as an expense to prep for. But you’re not some people. You think and budget ahead!

And here’s why you need to think about taxes when you make your spring budgets: If your return is a bit complicated, it’s worth the money to hire a tax pro. They’ll take away your stress and make sure everything is done the exact right way.

And if your return is simple enough to do on your own, you need to pay for a dependable tax program like Ramsey SmartTax that will walk you through the process with confidence.

Pro tip: Don’t wait until the last minute to file your taxes. If you find out you owe money, you want to make sure you have time to save up. That way you don’t even think about going into debt to pay off Uncle Sam.

7. End-of-Year School Expenses

If you’ve got school-aged kids, you know they love to celebrate the end of the school year—and that means there might be expenses here you need to budget for.

Depending on the age of your kids, that may mean teacher gifts, class parties, yearbooks, prom and maybe even senior trips. All the pre-vacation celebrations can really start costing you, so be ready!

8. Landscaping

Mulch, pruning shears, fresh flowers—there’s a long list of supplies you may need to give your yard a magazine-cover-worthy look (or even to get it to an acceptable state after ignoring it all winter).

Find budget-friendly ways to do this, like buying your mulch in bulk. And don’t be afraid of doing the hard work yourself! Make a weekend of it with the whole family—or offer to take turns with friends and get together to knock out each other’s landscaping needs one yard at a time.

9. Gardening

The danger of frost is officially over, so you’re probably itching to get your tomatoes, squashes, bell peppers and herbs in the ground. Those seeds or plants can really add up depending on the size of your garden.

If you can’t afford to plant everything right now, no worries. Buy what’s best to plant this time of year, and then continue planting new veggies when you save up more money in a couple months.

10. Graduation Gifts

Between nieces, nephews and neighbors’ kids, you’re bound to know a graduate or three. Be ready for the invitations that’ll fill your mailbox by budgeting for gifts.

Write a check in the amount of their graduation year (like $20.23) or snag a great read like The Proximity Principle, which helps people walk the path toward a career they’ll truly love. That way they’ll be thinking way ahead when they step on campus. (P.S. You can totally buy a copy for yourself too if you’re needing the same inspiration!)

11. Weddings

Flowers are blooming, and so is love! Spring can feel like a marathon of marriages. You’ve probably already sent in a couple RSVPs or put some Save the Dates on your fridge.

And being a wedding guest can mean paying for travel, fancy clothes and gifts. Think of clever ways to save as you attend weddings this season—like going in on one big gift to split the cost with friends, or reminding yourself you don’t need a completely new outfit for someone else’s big day. Then, prep your budget for those upcoming costs—so it doesn’t say, “You can’t!” when they say, “I do.”

12. Spring Activities and Entertainment

One of the best parts of spring is being able to get outside again. Finally! That means dancing at outdoor concerts, riding on roller coasters, and exploring street festivals.

Keep your budget in mind as you create your event calendar. And don’t forget to throw in some free activities to lower costs without cutting the fun.

13. Student Loan Payments

If you’ve got student loans—and you’ve been pausing your payments because of the CARES Act student loan payment relief—it’s time to start prepping your budget for that relief to end.

Listen: This “student loans will all be forgiven” song and dance has gone on far too long. It’s time to stop the waiting and worrying. Pay. Them. Off. Put that line item back in your budget this spring and plan to pay off those student loans quickly so you never have to think about them again!

Does it sound a little crazy? Maybe. Will it feel crazy good to finally be rid of the weight of your student loans? Definitely.

14. Organization and Spring-Cleaning Supplies

This weather might have you itching to clean out and clean up. Those storage bins and bleach-alternative cleaners aren’t free. But here’s a thought: While you’re clearing out, what if you sell some stuff? List stuff to sell online or host an old-fashioned garage sale to help cover the costs of this expense (and maybe make a little extra something something to cover other stuff on this list!).

15. Summer Camps and Sports

If you’ve got kids at home, it’s almost time for summer camps and sports. Don’t forget to get your budget ready to pay for those deposits and save up for the full payment when it’s due.

Add a line to start budgeting now for this large expense so your kids can do all the back handsprings and camp crafts their hearts desire.

16. Summer Vacation Sinking Fund

The warmer it gets outside, the stronger our dreams become of escaping the everyday on a dreamy summer getaway. But big city sites and blissful beaches cost money.

Don’t stress if your summer vacation fund is low. You have time to stash some cash—as long as you work it into your monthly budget by setting up a sinking fund.

We’ll talk more about sinking funds in a minute, but this is the basic idea:

- Check how many paydays you have until your trip.

- Put some money aside each time you get paid.

Then you can save up enough cash to make that dream vacation a reality. Because vacations should be about making memories—not debt.

17. Your Debt Payoff Goal

Okay, here’s another crazy-radical idea. (But the good kind of crazy-radical. Trust us.)

What if you made this the season you buckled down and got intense about paying off your debt? When would you be debt-free if you leaned into this goal all throughout spring?

Could you finally have a Christmas where you aren’t holding a weight of credit cards, student loans and car payments that’s heavier than Santa’s sack of gifts? You know, the one with presents for every single kid in the whole wide world. Yeah. That’s heavy. And debt is too.

Maybe it’ll take longer than a few months. But it’s going to be so worth it. Every season you step into with debt, you’re stuck in the cycle of paying off the past—which will always keep you from truly leaping into the future!

Play around with our debt payoff calculator. Adjust your budget. And do this!

How to Budget for Seasonal Items or Events

So, now you know all the events and expenses you’ve got to be budget-ready for this spring. But how the heck do you do that anyway? This is a great question! Just follow these two simple steps to make it happen:

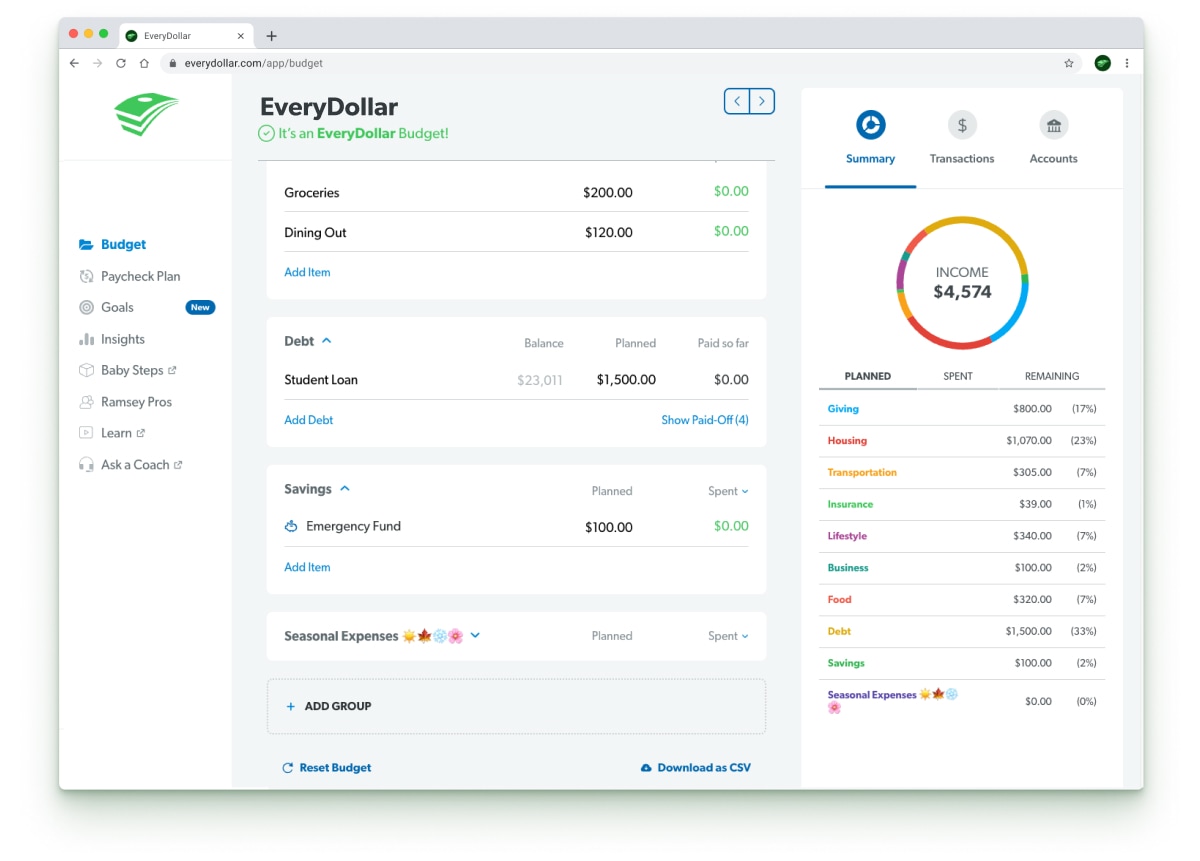

1. Add a seasonal budget category.

To do this, hop on the desktop view of your EveryDollar budget. Scroll to the bottom and select + Add Group. Then name the group whatever you like. We went with Seasonal Expenses for our example. And we added some emojis. Just because.

2. Add budget line items.

See that + Add Item prompt that popped up under your new budget category? Click there and add in as many lines as you want or need. (You can do this step from your phone or desktop.)

There are two different ways you can go about making these seasonal budget lines:

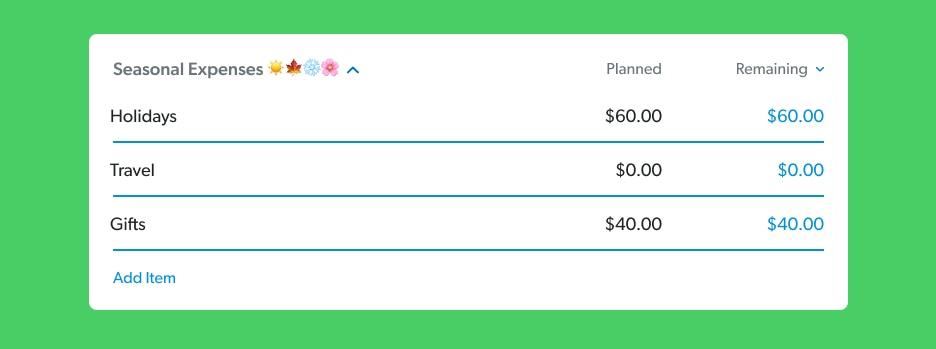

First way: Make budget lines with general names and change the dollar amount each month, but not the budget line name.

- For example: You can call a budget line Holidays. Every month, make sure you think of what holiday is coming and put in the dollar amount you need to cover it.

- Name another one Travel and maybe have a Gifts line too. If you don’t need to use one of the lines that month, just leave the dollar amount at zero.

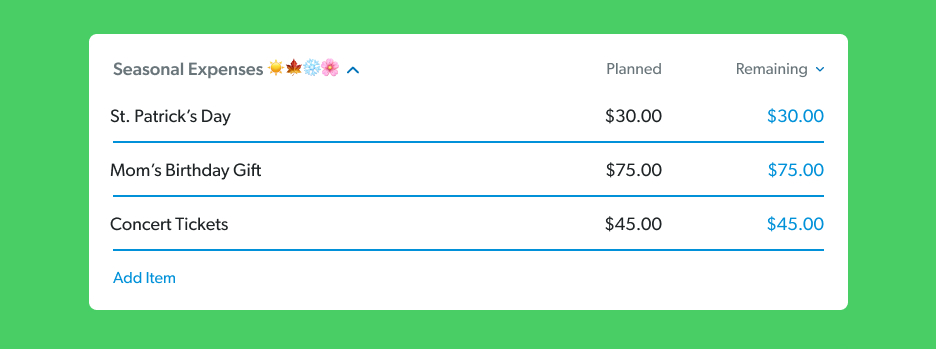

Second way: You can also choose to make every budget line very specific and change the line names and dollar amounts each month.

- For example: You can call a budget line St. Patrick’s Day in the month of March. Then delete that line after you copy your budget over to April.

- Add a line called Mother’s Day for the month of May. Then when June comes along, change it to Father’s Day.

The first method is best for people who think deleting a whole budget line sounds crazy. The second is best for people who want their budget lines to say exactly what they’re going to cover.

Neither is wrong. Pick whichever way is best for you. Just make sure you’re ready for every expense this spring—and all year long.

A Note on Sinking Funds for Seasonal Expenses

We told you we’d come back to talking about this! Hey—never forget the power of the sinking fund when you’re budgeting for a more expensive seasonal expense—like those summer camps we mentioned. Maybe you can’t move enough money around to pay cash for the deposit in May. You need a sinking fund!

What’s a sinking fund? It’s a simple way to save up cash for a bigger expense. And it’s super easy. All you have to do is divide the total amount of money you need for the expense by the number of months you have to save. That’ll tell you how much money to put into your sinking fund each month!

To make something a sinking fund in EveryDollar, just tap on the budget line and then click Fund by the piggy bank icon. Follow the easy steps from there.

And hey, if you haven’t already, download EveryDollar and start budgeting! If you already have EveryDollar, get in there and prep for spring.

All this talk of spring makes us think of that age-old saying: April showers bring May flowers. In other words, sometimes we have to push through something that’s messy or uncomfortable before we can get the reward.

Let’s be honest—sometimes budgeting is like that. It’s messy at first while we’re figuring out how to budget. And it can be a little uncomfortable saying no to buying something you want now so you can crush your money goals sooner. But when you budget every month—no matter the season—it makes for a brighter and better future.

Worth. It.