Key Takeaways

- It’s important to budget for all of your monthly expenses in each category. For example, monthly expenses for the Housing category could include mortgage or rent, home maintenance, lawn care, pest control and household items.

- When creating a budget, start with giving and saving. Then budget for your Four Walls: food, utilities, housing and transportation.

- Having a miscellaneous budget line will help you cover those unexpected expenses that pop up throughout the month.

If you regularly make a monthly budget (or you’re ready to start), that’s awesome. I mean it! Budgeting is the first step to taking control of your money, and you’re taking that step.

But maybe you’re wondering if you’ve got everything you need in your budget. Here’s something that will help: a list of budget categories and monthly expenses to include every month. Plus, I’ll show you how to budget for your monthly expenses, step by step.

Let’s jump right in!

Budget Categories for Every Month

Giving

Saving

Food

Utilities

Housing

Transportation

Insurance

Health

Kids

Debt

Pets

Lifestyle and Entertainment

Personal

Month Specific

Examples of Monthly Expenses to Include in Your Budget

What you budget for each month depends on your family and your lifestyle. You’ve also got both fixed expenses and variable expenses that change month to month.

Here are 51 examples of monthly expenses to include in your budget, organized by budget category. You may not need every single one of these budget lines, but this list will help you get started!

Giving

I always start my family’s budget with giving (including tithing 10% of our income). It’s the best way to get my head (and heart) straight before I start working through the rest of my budget. Generosity takes the focus off me and shifts it onto thinking about others. And honestly, it helps me start each month feeling way more grateful for what I have.

1. Tithing

2. Charitable giving

Saving

You need to make saving a priority in your budget. That includes building an emergency fund—$1,000 if you have debt and 3–6 months of expenses once you’re debt-free. You also want to make sure you’re investing 15% of your income for retirement. And if you’ve got a big purchase coming up (like a car or a vacation), use a sinking fund to save up for it every month.

3. Emergency fund

4. Retirement savings

5. Large purchases

Food

Now that we’ve got giving and saving taken care of, we need to cover your monthly bills. Let’s start with what I call the Four Walls: food, utilities, housing and transportation. For food, make sure groceries and restaurants each have their own budget lines. Because you have to eat—but you don’t have to eat out.

That’s right: Restaurants fit nicely under your food budget category, but they aren’t an essential expense, and they aren’t one of the Four Walls. If you need to free up cash for one of the Baby Steps or get more margin in your budget, this is a great place to cut spending and save money!

6. Groceries

7. Eating out

Here's A Tip

If you’re having trouble taming your food budget, check out my free meal planner to help you get that number down.

Utilities

In this monthly budget category, include all the services that keep your house running. Remember, these utility bills might change from month to month, so think about that as you plan.

To be safe, budget on the higher side in each of these budget lines—and if you don’t end up needing the money, throw the extra at your current money goal!

8. Electricity

9. Water and sewer

10. Natural gas or propane

11. Trash services

12. Internet

13. Phone bill

Housing

Just including your rent or mortgage payment isn’t enough when you budget for your housing costs. Don’t forget property taxes and HOA fees (if those things apply to you), as well as lawn care, gutter cleaning and HVAC inspections.

You can also include household items like laundry detergent, toilet paper, paper towels and light bulbs in this category. Household items are a part of life—and they need to be in the budget.

14. Mortgage or rent

15. Property taxes and HOA fees

16. Home maintenance

17. Household items

18. Lawn care

19. Pest control

Transportation

This budget category might include gas, public transportation costs (including Uber or Lyft rides), oil changes or other routine car maintenance—really just anything you pay to get where you need to go.

Of course, the amount you budget each month for transportation costs might change. Think about any special occasions like a trip to Grandma’s or an out-of-town soccer tournament for the kids. You’ll need to budget more for gas in a month that has more driving!

20. Gas or public transportation

21. Car maintenance

Put More Breathing Room in Your Budget

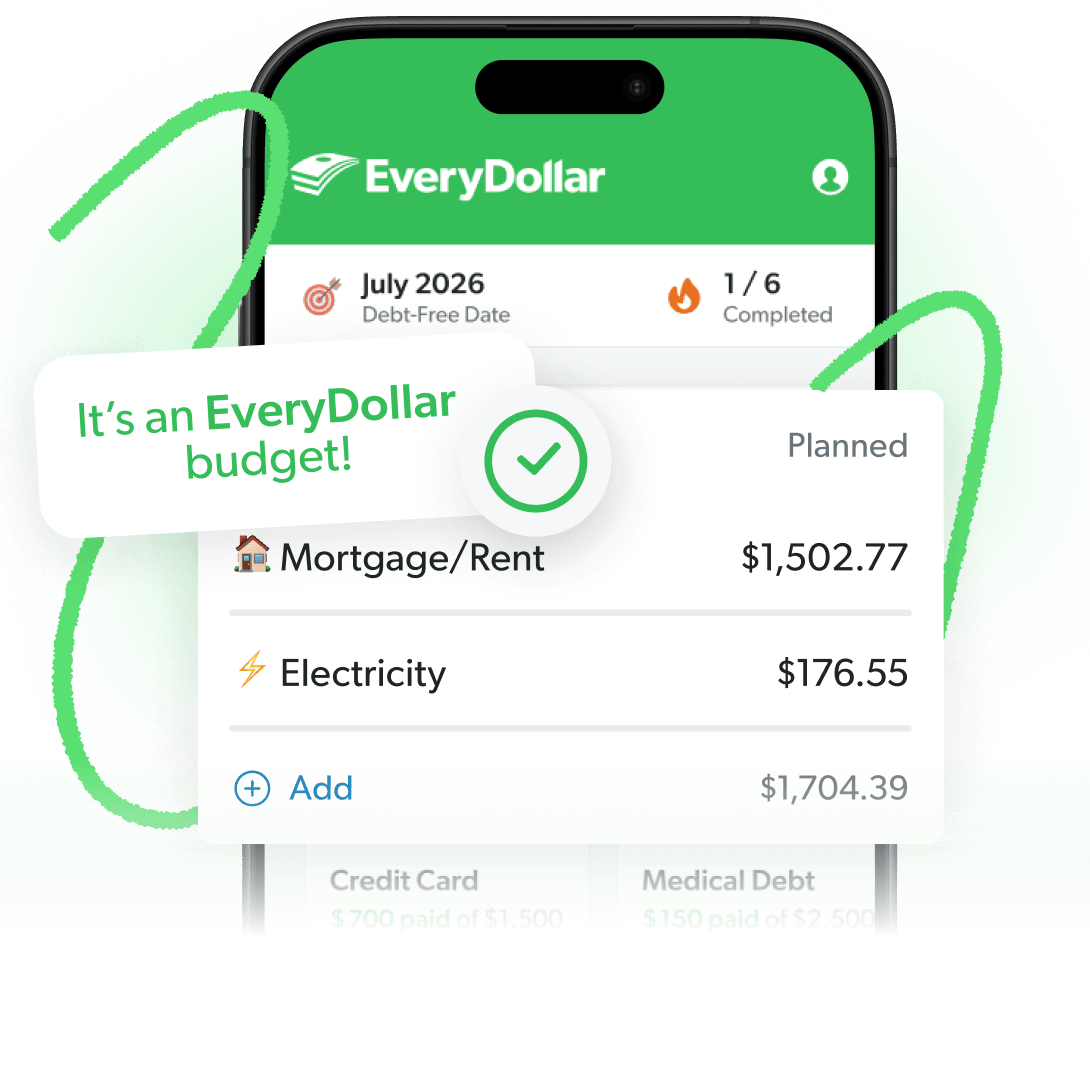

Money feeling tight? Not anymore. The EveryDollar budgeting app helps you free up thousands of dollars you didn’t know you had—in minutes.

Insurance

Yeah, I know insurance isn’t the most fun thing to spend your money on, but don’t skip this. Insurance helps protect the people and the things you love. When you’re budgeting for monthly expenses, don’t forget to include monthly premiums for the types of insurance you can’t do without, including:

22. Health insurance

23. Auto insurance

24. Homeowners or renters insurance

25. Term life insurance

26. Identity theft protection

Health

Medicine, vitamins, supplements, gym memberships, workout apps, therapy—it all counts here. Make sure you’re taking care of yourself. But at the same time, remember: You can be fit and healthy on a budget.

27. Gym memberships and fitness classes

28. Therapy appointments

29. Copays for doctor visits

30. Medication

Kids

For those of you with children, you know costs can add up quick. Childcare, school tuition, supplies, field trips, dance or karate classes, the group snack you forgot you signed up to bring. Including as many of these expenses as you can in your budget will keep you from stressing as much.

31. Childcare

32. School expenses

33. Sports and extracurriculars

Debt

If you’ve got debt, you need to include it in your budget. Start by listing the minimum monthly payments for all your debts—your car payment, student loans, credit cards, etc. Then, use any extra money you can squeeze out of your budget and throw it at your smallest debt. Having your debts listed in your budget every month will help you pay them off faster!

34. Car payment

35. Student loans

36. Credit cards

Pets

We love our furry friends, but it takes money to keep them happy and healthy. Don’t forget to budget for pet costs like food, vet visits, flea and tick medication, heartworm prevention, grooming, boarding, toys, treats and other supplies.

37. Pet food and treats

38. Pet medication

39. Vet visits

40. Grooming and boarding

Lifestyle and Entertainment

Tickets to a concert. A ball game with your kids. Bowling with friends. It’s great to spend money on things you enjoy—if it’s in the budget! (You can also have plenty of fun without spending a single dollar, you know.)

And if you pay for any TV or music streaming services to avoid the ads, be sure to put those in the budget too! Some of them are regular monthly expenses, so they need a budget line every month. Others you pay for once a year, so you’ll need to know which month to expect the charge.

41. Streaming services or cable

42. Subscriptions (monthly and yearly)

43. Event tickets

44. Travel expenses

Personal

For this category, you can include expenses like clothing, personal care items (toothpaste, makeup, beard oil, etc.), and getting your hair or nails done. This is also where you put aside some money each month to spend on whatever you want. Planning this amount ahead of time helps you spend guilt-free and avoid overspending on impulse buys.

My husband, Winston, and I each have our own fun money lines—and you should too if you’re married. I don’t have to check in when I see something I want in the $5 Target bin, as long as there’s still $5 left in my line! It keeps us accountable to our budget and to each other—but it also gives us freedom to spend. And really, that’s what budgeting is all about!

Now, if you’re trying to build up your savings or pay off debt, you’ll want to trim this category down to help you reach your goal faster. But it’s okay to reward yourself in little ways along the journey!

45. Clothing

46. Personal care

47. Fun money

Month Specific

Most of the expenses I’ve listed will show up in your budget every month. But there are also irregular expenses you only have to worry about for that specific month. Trips, birthday parties, Thanksgiving—the Month Specific category is a great place to include these. (Oh, and don’t forget to budget for taxes if those don’t automatically come out of your paycheck.)

Take some time to update your calendar with any renewal or appointment dates. Then look at your calendar when you make your budget! This will help you make sure you’re not forgetting any annual expenses—like car tag renewals or your Amazon Prime membership. (If you’ve got a budgeting app, like EveryDollar, you can always peek back at last year before you make each monthly budget!)

And let’s face it, things will pop up throughout the month that you didn’t think to budget for. That’s why you need a miscellaneous budget line! It’ll keep those unexpected expenses from sending you into panic mode. But if a certain expense keeps falling here, it’s time to give it a special budget line all its own.

48. Taxes

49. Holidays and special occasions

50. Gifts

51. Miscellaneous

How to Budget for Your Monthly Expenses

Okay, so you know what budget categories to include and what monthly expenses to expect. Now you need to know how to create your monthly budget!

Step 1: Write down all your income in a typical month. (If you have an irregular income, put in your lowest estimate. You can bump it up later if you make more!)

Step 2: Make a list of all your monthly expenses. (You can always pull up your bank account and take a look at last month’s transactions to get a better idea of what you usually spend.)

Step 3: Subtract your expenses from your income—and that number should equal zero. This method is called zero-based budgeting.

Now, a zero-based budget doesn’t mean you have zero dollars in your bank account. (Keep a little buffer of $100–300 in there.) It also doesn’t mean you spend everything you make.

Nope. It simply means you’re giving all your money a job to do. It means you plan how you give, save, spend and invest all of your income. This way you never get to the end of the month and wonder where all your money went—because you told it exactly where to go.

When you budget, you are in control of where every single dollar goes. This gives you confidence that you’re spending and saving well.

That’s why we made the EveryDollar budgeting app! EveryDollar helps you find extra margin every month so you can start making real money progress, really fast.

Just download the app, answer a few questions, and we’ll build you a personalized plan, based on your situation, to free up margin and make the most of every dollar. Every day. (See where we got the name?)