Key Takeaways

- The first step is figuring out whether or not you need to file a tax return. Most people do have to file, but depending on your gross income for last year and whether you can be claimed as a dependent by someone else, you may not have to.

- Before you begin, get your tax documents organized (like your W-2 and 1099 forms) and pick a filing status (like single or married filing jointly).

- Then, you’ll need to choose whether to take the standard deduction or itemize your deductions. You’ll want to pick the option that gives you the lowest taxable income depending on your tax situation.

- Finally, you’ll need to decide whether to file with tax software or with a tax pro based on the complexity of your tax situation (we can help with both).

Too many people dread filing taxes because of all that paperwork and all those rules (and let’s be honest—all the math). But filing your taxes doesn’t have to come with a side order of stress and anxiety.

Nope! It can actually be pretty simple and easy with a little time and organization. So, let’s walk step by step through how to file taxes—with zero worry.

Step 1: Check Whether You Need to File

First things first: Do you even have to file taxes? Great question! It depends on a few factors:

- Income: If your gross income is below a certain amount, you don’t have to file taxes. It depends on your age and filing status (we’ll go over those numbers in the charts below).

- Age and blindness: If you’re blind and/or over 65, your income can be even higher before you’re required to file.

- Filing status: Do you plan to file as single, head of household, married filing jointly, married filing separately or qualifying surviving spouse? The minimum income requirements are all different depending on your filing status. We can help you decide which filing status you should choose later.

- Dependent status: Can someone claim you as a dependent? If so, that might also affect how much gross income you can make before you’re required to file a tax return.

Yeah, because it’s the IRS, things are a bit complicated. Here’s a breakdown of the income amounts, by filing status, that trigger a requirement for you to file a 2025 tax return (due April 15, 2026):

|

Filing Status |

Under 65 |

65 or Older |

|

Single |

$15,750 |

$17,750 |

|

Married Filing Jointly |

Both spouses are under 65: $31,500 One spouse is under 65 and one spouse is 65 or older: $33,100 |

Both spouses are 65 or older: $34,700 |

|

Married Filing Separately |

$5 |

$5 |

|

Head of Household |

$23,625 |

$25,625 |

|

Qualifying Surviving Spouse |

$31,500 |

$33,1001 |

As you can see, the minimum income requirements for filing vary according to your age and filing status. This amount is based on your gross income, which means the total taxable income you get—whether it’s money, goods, services or properties. That includes income you’ve made from sources outside the U.S.

What If Someone Else Claims You as a Dependent?

If someone else claims you as a dependent on their tax return, the rules change. Your age and filing status are still factored in, but the IRS also considers the type of income you receive—earned or unearned.

- Earned income is exactly what it sounds like—it’s money you earned working your J-O-B. It includes things like salaries, tips and wages.

- Unearned income is different, but still potentially taxable. It’s income you brought in from investments, unemployment compensation, Social Security benefits, or interest from a savings account.

Here’s how those minimum gross income amounts break down for those who are being claimed as a dependent on someone else’s tax return (note that earned and unearned amounts vary):

|

Marital Status |

Age as of December 31, 2025 |

You Must File a Return If Any of These Apply: |

|

Single |

Under 65 |

|

|

Single |

Over 65 or blind |

|

|

Single |

Over 65 and blind |

|

|

Married |

Under 65 |

|

|

Married |

Over 65 or blind |

|

|

Married |

Over 65 and blind |

|

If your gross income is taxable according to the above tables, then you’re one of the lucky millions who must file their taxes with the IRS.

The next step is to see just how organized you’ve been throughout the tax year. Bring on that paperwork! (This is our happy face.)

Step 2: Gather Your Tax Documents

First, gather all the tax documents you need to complete your return. If it makes things a little more fun, think of this as a scavenger hunt (as long as scavenger hunts are actually fun for you). What forms will you need? Here are a few to keep in mind:

- W-2s

- 1099s

- Mortgage interest statements

- Investment income statements

- Charitable contribution statements and receipts

- Retirement account contributions

- Last year’s federal and state (if applicable) tax returns

Life-Change

If you’ve gone through any major life changes in the past year—maybe you got married or moved to a new address—you might need to do some extra paperwork. Now, you won’t submit these with your tax return, but here are some government forms you may want to take a look at:

- Form 8822 (to change your address if you moved)3

- SS-5 (if you changed your name)4

- W-4 (to adjust tax withholdings based on your new household income)5

Investments and Interest

Income and investment interest forms are usually mailed or sent electronically to you by the end of January, so keep an eye out for them. You can also find and download many of these documents yourself through your bank, mortgage provider or payroll company.

Side Hustles

If you started a new side gig or small business last year to help pay off debt or save for a down payment on a mortgage, congrats—you’re crushing it! Also, here’s your reward for working so hard: That income is taxable too (whomp whomp), so be on the lookout for your 1099 forms from those jobs.

A 1099 form records any payments you receive throughout the year from a person or entity other than your employer. They can also report other types of earnings, like royalties, prizes, awards, rental income and lottery winnings. Here are three of the most common 1099 forms you might get if you’re working a side gig:

- 1099-K: This form shows all the payments you received for your small business or side hustle through a debit or credit card or some other electronic payments system (think Venmo or PayPal).

- 1099-NEC: This shows how much money you made as an independent contractor. Independent contractors work for one or more companies and don’t receive benefits or have payroll taxes withheld from their checks.

- 1099-MISC: This form is the catchall for most of the miscellaneous income you earned outside of what’s documented on a W-2, 1099-NEC or a 1099-K.

If Tax Day is getting closer and you still haven’t received your tax statements or can’t find them online, you’ll want to reach out to whoever you worked for and let them know you need your paperwork as soon as possible so you can get your taxes done. You may need to file an extension.

Step 3: Pick a Filing Status

Your filing status is important. It helps you figure out what documents you’ll need to file your taxes, along with any exemptions you qualify for, your standard deduction, your eligibility for certain credits, and how much you’ll owe in taxes.

There are times when picking your filing status is pretty straightforward—like if you’re single—and other times when it’s not so clear because you might qualify for more than one filing status.

So, how do you figure out which filing status to pick? There are five different statuses to choose from:

- Single: If you have gone through a divorce, are legally separated, or aren’t married, you’ll file as a single taxpayer. You’ll probably file as single if you were widowed before the tax year, but you may want to talk to a tax pro just to make sure.

- Married filing jointly: File under this status if you’re married and both of you agree to file a joint return. In most cases, married couples save a lot by filing jointly.

- Married filing separately: If you’re married and for some reason don’t agree to file jointly—maybe you want to be responsible for your individual taxes only or filing separately results in a lower tax bill—you can use this filing status.

- Head of household: This one’s a little tricky. To qualify, you must meet these three criteria: You’re unmarried, you have a qualifying child or dependent, and you paid for more than half the household expenses for the year. If you’re a single parent or taking care of an ailing family member, you might qualify to file as head of household.

- Qualifying Surviving Spouse: If your spouse passed away and you didn’t remarry in the same tax year, you can file jointly with your deceased spouse. For up to two years after your spouse’s death, you can use the qualifying surviving spouse filing status if you’re still unmarried and live with a qualifying dependent.6

Most people either file as single or married filing jointly. But always do the math—there are rare instances when there might be an advantage to filing separately or under another filing status if it applies.

Step 4: Take Advantage of Deductions and Credits

When you file your taxes, you have two choices when it comes to deductions: Take the standard deduction or itemize. This is a pretty big deal because tax deductions lower your taxable income—and the lower your taxable income is, the smaller your tax bill will be!

Choosing Between the Standard Deduction and Itemized Deductions

How do you decide? The standard deduction for the 2025 tax year (the taxes you’ll file in 2026) is $15,750 for individuals, $23,625 for head of household, and $31,500 for married filing jointly.7

If your itemized deductions add up to more than the standard deduction, you’re better off itemizing. If not, save yourself the hassle of digging through filing cabinets for old receipts and just take the standard deduction. (For most taxpayers, taking the standard deduction is a no-brainer. But it doesn’t hurt to do the math if you think it’s close . . . just in case.)

Getting your deductions right can have a big impact on how much you may owe Uncle Sam (or how much he owes you). But if you’re still unsure about which route to take, don’t worry! A tax pro will be able to answer your questions about standard versus itemized and guide you through your decision.

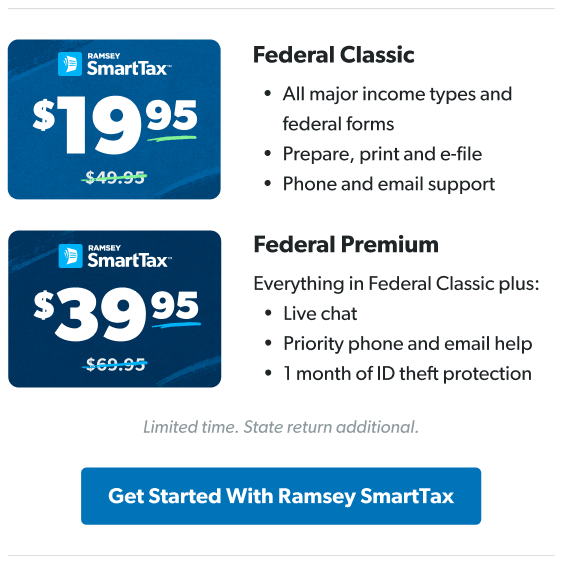

Online tax software can also walk you through deciding between the standard deduction and itemizing. We recommend Ramsey SmartTax—it’s affordable, easy to navigate, and there are no hidden fees to worry about.

Tax Credits

You’ll want to use either online tax software or a tax pro to help you take advantage of tax credits too—because they cut your tax bill on a dollar-for-dollar basis. Let’s say you have a tax bill of $2,000, for example. A $400 tax credit would lower your bill to $1,600. Not too shabby!

A lot of tax credits are linked to your age, filing status, income, or whether you can claim any dependents. Here are a few common credits geared toward people with dependents (whether those dependents are children or adults):

- Earned income tax credit (EITC): This is a refundable credit designed to give you a break if your income is low to moderate, especially if you have children. Depending on your income, how many children you have, and your filing status, the EITC could save you anywhere from $649 to more than $8,000.8

- Child tax credit: If you have a child you’re claiming as a dependent, you may qualify for this credit. For 2025, you can get a maximum tax credit of $2,200 for each qualifying child under age 17—with an income limit of $400,000 for married couples and $200,000 for individuals.9 Nice!

- Child and dependent care credit: Let’s face it—childcare can be crazy expensive. Uncle Sam offers this credit to try to offset some of those costs. If you have to pay for care for your child, elderly parents or other dependents who can’t care for themselves, you might qualify for the child and dependent care credit.10

If you have a child or adult dependents, there’s no reason you shouldn’t take advantage of these credits. If you don’t have dependents to claim on your taxes, don’t sweat it—we still recommend you check with a tax pro to see if you qualify for any other credits.

Step 5: File Your Taxes

According to the IRS, about 52% of Americans hired a professional to help them file their tax returns in 2025, and 45% self-filed using tax software. A tiny minority went with an old-school paper return (which generally makes the process a lot slower).11

So, which filing option should you choose? Our free tax quiz can help you decide. For now, let’s compare using online tax software with using a tax pro.

File Your Taxes With Online Tax Software

If you’re going to use online tax software, we recommend Ramsey SmartTax because it’s easy to use, always up to date, and offers built-in support if you need a little extra help during the process.

Whichever tax software you choose, filing your taxes usually follows these steps:

- Choose a filing plan. Any tax software you choose will offer different filing plans with different features (for example, Ramsey SmartTax offers two plans: Federal Classic and Federal Premium), so take a minute to see which plan’s features best fit your tax situation.

- Answer questions about yourself and your tax situation. Once you choose a plan, your software will walk you through some basic questions about yourself and your financial situation, starting with your name, address, date of birth and occupation. You’ll need to pick a filing status (single or married filing jointly are most common). Then, you’ll answer questions like whether you moved to a different state last year or have any dependents.

- Fill out your federal tax return. This is when you’ll want to have all your tax forms handy (like your W-2, 1099 and Schedule C). You’ll use these forms to answer questions about your income throughout the year. The software should also walk you through any deductions and credits you can claim—and hopefully lower your tax bill!

- Fill out your state income tax return. When your federal taxes are finished, the tax software should transfer that information to your state return automatically. If you live in a state that doesn’t charge income tax—hooray! You get to skip this step.

- Review your info and print your return. Before you send your return to the IRS, make sure you take a few minutes to review everything. We recommend printing a copy (or securely saving an electronic version in the cloud) each year for your records.

- E-file your return and choose a payment method. Finally, e-file your return. If you owe Uncle Sam, choose how to make your payments (or if he owes you a refund, choose how you’d like to get it). Don’t worry! Your tax software will guide you through all those options.

If this sounds a bit overwhelming, you can hit the brakes at any point in the process—remember, you won’t pay for anything until you’re ready to e-file.

Now, what if you’d rather talk to a tax pro?

File Your Taxes With a Tax Professional

Working with a tax pro can save you the hassle of dealing with all that paperwork—and can probably save you some time too!

Here are some things to keep in mind if you’re filing with a tax pro:

- Pick a tax pro who’s qualified. What should you look for in a tax pro? Start with the obvious: Are they qualified as an Enrolled Agent (EA) or Certified Public Accountant (CPA)? Both EAs and CPAs go through training, testing and continuing education to maintain their credentials and stay up to date on tax laws and regulations.

- Pick a tax pro who looks out for your best interests. They should ask you questions about your financial goals and make time to answer your questions—and you should feel you can trust them with your information. Your tax pro will be able to meet with you either in person or online to get a grasp on your tax situation.

- Provide your tax pro with your paperwork and tax forms. To speed up the process, make sure you have all your paperwork in order. Use this checklist to be sure you bring everything you need.

- Your tax pro will prepare and file your return. This is one of the best parts about going with a tax pro: They’ll plug in all your numbers and information and complete your tax return so you don’t have to. And they’ll be able to answer your questions about how much you owe (or how much you’re getting back). Plus, they can look for ways for you to save money on next year’s taxes!

Get Started Filing Your Taxes Today

See? It’s not so bad. If you spend a little time and energy focused on these five steps, you’ll be fine. And the earlier you can get your documents organized, the less stressed you’ll be once you sit down to file your taxes.

If you decide your tax process is complex and needs a little help, our nationwide network of RamseyTrusted® tax pros can help. Once you get connected with a tax pro, they’ll prepare your taxes and get them ready for filing so that you can rest easy on Tax Day.

Find a tax professional today!

If you’re comfortable flying solo, check out Ramsey SmartTax. Our simple, no-nonsense tax software has everything you need to file your return with confidence—and no hidden fees.

Next Steps

- Get all your tax stuff together: W-2s, 1099s, interest statements and expense receipts.

- Get all the information you need to make an informed decision about which option is best for you. File with tax software (if things feel pretty simple) or talk to a tax pro (if things feel more complicated).

- Remember, the earlier you file, the better—so don’t put it off! Get started on your taxes now.