Key Takeaways

- You can create a family budget in five simple steps. First, list all sources of income, including salaries, side jobs and any other earnings.

- Then, write down all monthly expenses—such as housing, utilities, groceries, transportation, insurance and entertainment.

- Next, subtract total expenses from total income to determine if adjustments are needed to stay within budget.

- Track expenses throughout the month to ensure you’re sticking to the budget and to identify areas for improvement.

- Finally, create a new budget before each month begins to adjust for changes in income or expenses.

Creating a family budget is the first step to managing your household finances. But budgeting can seem like a lot—especially when you’ve got kids. You’re busy, your money’s tight, and money talks are sometimes super awkward.

Hear this: You can create a successful family budget no matter your time, income or past. We’ve been teaching people how to do it for over 30 years and have seen it work again and again and again. Here’s some of our best guidance and tips on how to make a family budget work for you.

What Is a Family Budget?

A family budget is a plan for your household’s money—everything that comes in (income) and goes out (expenses). That means you’re planning ahead for all the giving, saving and spending each month, from groceries and rent to emergency savings and retirement.

How to Create a Family Budget in 5 Steps

Budget Step 1: List your income.

First, list your income—that’s any money you plan to get during that month.

Write down each normal paycheck for you and your spouse—and don’t forget any extra money coming your way through a side hustle, garage sale or anything like that. (If you’re a single mom, this includes child support or alimony.)

If you’ve got an irregular income, put the lowest estimate of what you normally make in this spot. You can adjust the number later in the month if you make more.

Budget Step 2: List your expenses.

Now that you’ve planned for the money coming in, you can plan for the money going out. It’s time to list your expenses. Check your online bank account or look at your bank statement to help you estimate your expenses.

We believe in starting your budget with a spirit of generosity by putting your tithe and other giving (such as charitable donations) right at the top. Also, if you don’t have an emergency fund yet, you need to make saving one of your priorities.

Then you’ll list what you spend money on. Start by covering your Four Walls—aka food, utilities, shelter and transportation.

Some of these are called fixed expenses, meaning they stay the same every month (like your mortgage or rent). Others change from month to month and are called variable expenses (like groceries).

Fixed expenses are way easier to nail down the first month. For variable expenses, look at your past spending and make your best estimate. It usually takes about three months to get the hang of this budgeting thing, so don’t worry if it’s hard to figure out your spending at first. You’ll get better at planning the more you budget.

Next, list all your other monthly expenses. We’re talking about insurance, debt, childcare, entertainment, restaurants, pet costs and any personal spending. And remember, needs come before wants. Always. So get those essentials in before the extras.

Budget Step 3: Subtract your expenses from your income.

When you subtract your expenses from your income, it should equal zero. We call this a zero-based budget. That doesn’t mean your bank account is at zero (keep a little buffer of $100–300 in there). But it does mean every bit of your income has a job.

If you end up with money left over after you’ve subtracted all your expenses, give those dollars a job too. Otherwise, you’ll end up mindlessly spending them on coffees and those one-click deals of the day. Put anything “extra” toward your current money goal—something we’ll talk about more in a bit.

What if you end up with a negative number? It happens. You just need to cut your planned spending until your income minus your expenses equals zero. (Hint: Start with extras like restaurants and entertainment.) You can’t spend more than you make. That math doesn’t add up. Literally.

Remember, you work hard for your money. It should work hard for you. Every single dollar. So make a zero-based budget. Every single month.

Budget Step 4: Track your expenses throughout the month.

Every time you spend or make money, you need to track it in the budget. That’s how you keep an eye on your spending—so you don’t risk overspending.

Also, tracking your spending creates accountability with your spouse. And yourself.

Yup. Sometimes you’re the exact person who needs to look at that restaurant budget line and see it’s just too low to hit up the Fry Guys food truck for lunch with your coworkers. (Did someone say “brown-bag your lunch” just then? We did. It was us.)

The first three steps are all about making your family budget. This step is the secret to keeping up with it. Don’t skip it. Track those expenses!

Budget Step 5: Make a new budget (before the month begins).

Your family budget won’t change a ton from month to month, but it will a little. You’ll have holidays, birthdays, annual subscriptions, babysitting and more. You’ll also have to cover marching band uniforms one month and buy new soccer cleats the next.

Don’t let any of it surprise you! Copy over last month’s budget and make the tweaks you need to get prepped for all the seasonal and month-specific spending coming your way. And do this before the month begins—because planning ahead is how you’ll get ahead with your money.

Budget Calculator

Enter your income and the calculator will show the national averages for most budget categories as a starting point. A few of these are recommendations (like giving). Most just reflect average spending (like debt). Don't have debt? Yay! Move that money to your current money goal.

Income

Expenses

Difference

Total Expenses

$0.00(P.S. This calculator is just the beginning. What you really need is a monthly budget. Check out EveryDollar. Today.)

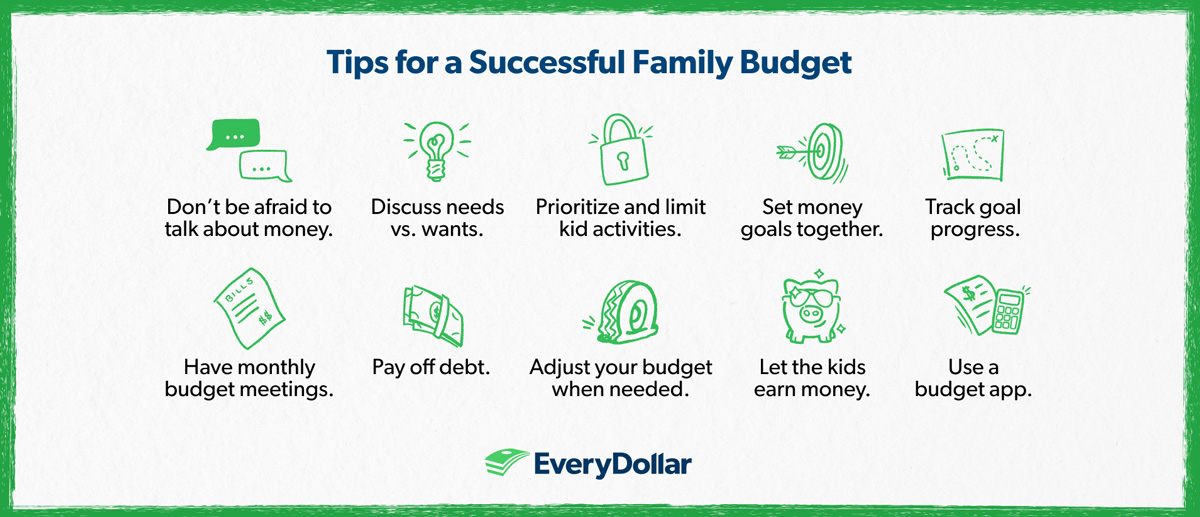

Tips for a Successful Family Budget

Now that you know how to create a household budget, let’s talk about how to make sure it works for you.

1. Don’t be afraid to talk about money.

Our research shows over half of Americans (53%) say they were never taught how to handle money growing up. So it’s super likely you won’t be used to having these conversations, and that can make things awkward at first.

But push past those feelings and talk about money together as a family. This builds a solid financial foundation for your kids now—and far into the future.

2. Discuss wants versus needs.

One of the first money topics to cover? The difference between wants and needs. And let’s be honest, even the adults in the room can use a refresher on this one.

Make sure everyone knows: Needs come first. This means you’re budgeting for essentials like the Four Walls before family memberships to the local wax museum or pricey baby clothes they’ll outgrow in a few weeks.

3. Prioritize and limit your kids’ activities.

You probably don’t have enough money in the budget for your kids to be involved in everything they’re interested in. And that’s okay.

The truth is, not everything comes with the low price tag of a good ole snow day. Between sports, clubs, lessons and more, one activity per kid per season is plenty for their time and your budget. Work together to choose that one extracurricular, and fill the rest of their time with free activities.

The Budgeting App That Finds Hidden Margin

You’ve got more margin than you think. EveryDollar helps you find it in minutes so you can start making real money progress, really fast.

4. Set money goals together.

Start making money goals together. That can be paying off debt or saving money for emergencies, a big purchase or a fun family experience. (If you don’t know where to start with setting money goals, check out the 7 Baby Steps.)

Talk through how everyone can be involved in making these goals happen. Speaking of which . . .

5. Track goal progress.

Goal tracking is so easy in EveryDollar (our budget app). You can set up a sinking fund for your goal and decide how much to save every month.

Then talk about ways to hit the goal faster, like:

- Cutting spending by skipping a few extras

- Trying a no-spend challenge for a month

- Having the kids earn extra money by mowing lawns or walking neighborhood dogs (or cats, if there’s a market for that)

- Doing the 100 Envelope Challenge to save up an extra $5,050 (yes, really!)

When you include the kids, they learn about money and the power of hard work—life lessons all around.

6. Have monthly budget meetings.

Monthly budget meetings help you all stay on the same page. Here’s what you should think about before and during these meetings.

- Make sure you’re covering common monthly expenses—as well as month-specific expenses.

- Talk about where you struggled last month.

- Celebrate your budgeting victories.

- Check in on your goals.

- Make sure the meetings don’t run too long.

- Have snacks. Always have snacks.

Need help? Download the EveryDollar Couples Budget Meeting Guide to make those monthly meetings focused—and fun.

7. Combine finances.

If you haven’t yet, you and your spouse should combine finances. That means combining bank accounts. For some people, that seems crazy. But if you want to get on the same page about money and truly work together as a team, you can’t skip this step. You’re not single anymore. You’ve become one—and your finances should too.

8. Pay off debt.

$18.39 trillion. That’s the total household debt in America as of June 2025.1 No. Joke.

Debt is constantly knocking on our front doors like a sneaky salesman with tempting “rewards” and the promise of instant gratification. But really, all debt does is hold this month’s income hostage to pay for your past.

Well, it’s time to slam the door in debt’s lying face. No more being a part of that $18.39 trillion statistic. Get everyone in your family on board to pay off your debt and take back your income. All of it!

9. Adjust your budget when needed.

Braces, bow ties and budgets. What do these three B-words have in common? They all need adjusting.

Yes, you’re supposed to adjust your budget during the month. Life happens! Sure, it’s easy to plan for the big things—like a new baby, an adoption or bringing home a family pet. But don’t forget the little stuff too. If the electricity bill comes in higher than you planned, take the extra money you need from a nonessential budget line and keep moving.

A budget isn’t a slow cooker. You can’t set it and forget it. You’ve got to get in there and make adjustments so your budget works for you and your family.

10. Let the kids earn money (aka work on commission).

Lots of us got an allowance growing up. But having your kids work on commission instead of handing them money for nothing teaches them how the world of work runs. They do chores—they get paid. They save their money—they pay for things.

Start kids out on commission-based earning so they learn the value of money, hard work and how those two things are directly connected.

11. Use a budget app.

Here’s a super practical tip on how to make a household budget that works: Use a budget app. It creates easy access to the budget at all times. And if it’s simple to make and keep up with a budget, that’s half the battle!

And don’t forget: We’ve got a budget app called EveryDollar. You and your spouse share one login. You can track spending from anywhere and everywhere. You can even pull up the budget on your desktop at your monthly budget meetings.

EveryDollar does more than just help you track your spending and manage your money—it actually helps you find more margin every month.