Key Takeaways

- A no-spend challenge is a money-saving method where you commit to stop spending money on nonessential expenses for a certain amount of time—usually a full month.

- A no-spend challenge can help you save money, spend more intentionally, avoid impulse buys, and reach your goals faster.

- Tips for winning a no-spend challenge include setting a savings goal, choosing the right time, getting your budget ready, and tracking your progress.

We could all use some extra cash right now—for the next vacation, the next grocery run, or the next car repair that’s bound to happen.

Get expert money advice to reach your money goals faster!

Well, good news! There’s a money trend that’ll help you save some bucks and create more breathing room in the budget—starting this month. It’s called the no-spend challenge!

Basically, the goal of a no-spend challenge is to go as many days as you can without spending money. And while the idea of a spending fast might not sound fun, it’s definitely worth the savings.

What Is a No-Spend Challenge?

A no-spend challenge is a money-saving method where you commit to stop spending money on nonessential expenses for a certain amount of time—usually a full month. You might also see people refer to this challenge as a no-spend month.

Now, we’re not talking about locking yourself in your home so you can’t go out and spend money. We’re all for saving money, but we also live in the real world.

During a no-spend challenge, you’re still covering your Four Walls (food, utilities, shelter and transportation) and other necessities. But you’re saying no to all the extras. Eating out at restaurants? Nope. Starting up polka-swing-fusion dance lessons? Not this month.

Think of it like a budget reset. You aren’t dropping all fun forever—you’re just pressing pause as you focus on saving money. It’s all about saying no to instant gratification and saying yes to intentional spending.

So, now that you know the basics of a no-spend challenge, let’s get into what the rules are and how to actually do the challenge for an entire month.

No-Spend Month Rules

The exact rules of your no-spend month are up to you. But here are some of the main guidelines to doing a no-spend challenge:

- Do spend money on things you need. We said this before, but necessary expenses are allowed—like food, your rent or mortgage, utilities, gas for your car, medical expenses, debt payments, insurance premiums and other regular bills.

- Don’t spend money on things you just want. Since the plan is to only spend money on what you need, you’ve got to get real clear on your needs vs. wants. This is where the self-control part of a no-spend challenge comes in.

- Do pause the challenge if you have an emergency. Unexpected expenses might come up—like a car repair or a medical emergency. If that happens, you have permission to stop the challenge and start again another month.

Again, you decide what rules you’ll follow, what exceptions you’ll make, and how intense you want to be with this no-buy challenge. Are you pausing or canceling subscriptions? Are you telling your BFF they don’t get a present because their birthday happens to be in your no-spend month?

Do what makes sense for you. But remember, the less you spend, the more you save!

The Benefits of a No-Spend Challenge

Doing this 30-day money challenge can help you:

- Save money (the main motivation here, right?)

- Examine your spending habits

- Spend more intentionally

- Avoid impulse buys

- Keep lifestyle creep from creeping in

- Cut out emotional spending (aka retail therapy)

- Make use of what you already have

- Be more eco-friendly

- Practice gratitude and contentment (and teach your kids to do the same)

- Reach your goals faster

- Take back control over your money

How to Do a No-Spend Challenge: 10 Tips for Success

We know 30 days (or longer) of no extra spending can be hard. But you can do it! We’ve got 10 tips to help you not just survive but thrive during your no-spend challenge.

1. Set a savings goal.

With any monthly savings challenge, you need a reason—a goal—to keep you disciplined. So, what’s your goal for your no-spend month? Maybe you want to pay down your debt or save up for a big purchase.

If you have a certain number you’re wanting to save, write it down. The more specific your goal, the better. That way, you’ll have a vision to help you stay the course when you’re tempted to just give up and drive to Target.

2. Choose the right time.

When you do a no-spend month is also super important. Lots of people do no-spend January to start the new year off on the right foot. Others prefer a no-spend November to save for Christmas gifts (also, it’s great alliteration).

But maybe those months don’t work for you because you’ve got a birthday, anniversary or other big event. That’s okay! Just look at your calendar and decide on a timeframe you know you’ll be able to commit to not spending money.

3. Get your budget ready.

A budget is simply a plan for your money. And you definitely need a plan when doing a no-spend challenge. Start by budgeting for all your essentials. Then, see the areas where you can cut spending.

Any subscriptions you don’t use? What services can you skip this month (nails, haircuts, massages)? A budget is how you tell your money where to go—and that’s the key to winning a no-spend challenge.

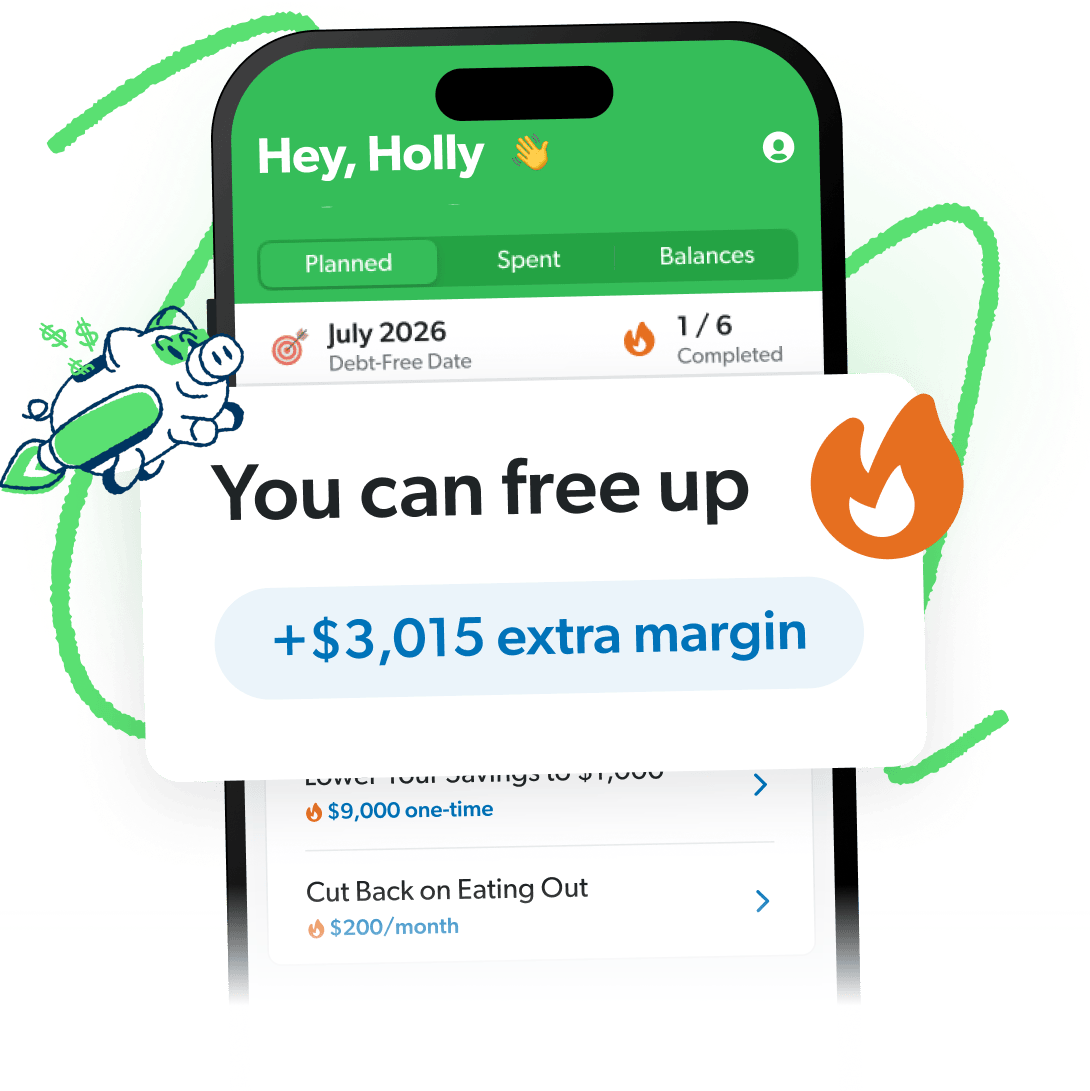

Find Margin You Didn’t Know You Had With EveryDollar

Money feeling tight? Not anymore. The EveryDollar budgeting app helps you free up thousands of dollars you didn’t know you had—in minutes.

4. Track your no-spend progress.

A great way to stay motivated during 30 days of no spending is to track your progress throughout the month. That said, check out our no-spend challenge printable PDF!

All you have to do is check off every day you don’t spend money. Or you can use some stickers you already have to fill in the bubbles along the way.

5. Plan your meals.

Meal planning can help you save more and waste less on groceries every month—but especially during a no-spend month. You can choose to plan your meals each week or make a bunch of meals at once to freeze for later.

Start by taking a good look through your pantry and fridge. Next, pick recipes around what you already have or what’s on sale at the store that week. Be sure to plan for breakfasts, lunches, dinners and even snacks. Then, make a list and stick to it when you go to the store—you can’t afford to go off script here!

6. Avoid spending temptations.

Maybe your weakness is Target, HomeGoods, Golf Galaxy. Nothing wrong with these stores. But during a no-spend month, avoiding places where you’re most tempted to spend is half the battle!

For many of us, the devices in our pockets are our biggest vices. Between retailer apps, Instagram ads, and stylized posts from influencers, it’s hard to spend even five minutes on our phones without being lured into making a purchase.

So, ditch the FOMO and overspending by removing your card info from retailer apps and websites or deleting shopping apps completely from your phone. Even better: Limit your social media use!

7. Make a wish list for later.

See something you want—but don’t need—during your no-spend month? Add it to a wish list! Then, after your no-spend challenge is over, you can come back to that list to see what you still want and can afford.

Putting some time between you and a possible impulse buy is a good habit to start—even when you’re not in the middle of a no-spend month. Plus, who knows? You may change your mind about that special blender you thought you just “had to have” last week.

8. Use old gift cards.

If you’ve got some gift cards in your wallet or dresser drawer that still haven’t been used, this is the time to use them. After all, that’s free money! But the trick is to spend no more than the amount on the gift card. So, if that card only gets you a tall black coffee at Starbucks, then that’s it. Again, this challenge is all about practicing gratitude.

9. Find free things to do.

Just because you’re skipping paid entertainment and activities during your no-spend month, doesn’t mean you have to sit at home and stare at the wall. You can find tons of free ways to keep yourself (and your kids) entertained.

Borrow books and movies from the library. Sign up for free streaming services and get access to tons of movies and TV shows. Look for free community events in your area. Dust off that deck of cards you found in the junk drawer and search for fun card games on Google. Take a hike (literally). There is plenty of free fun out there to enjoy!

10. Let others know you’re doing a no-spend challenge.

You don’t have to go through your no-spend month alone. In fact, it’s better if you don’t! Telling your friends and family about your challenge can help you stick with it. And they’ll know not to tempt you with a trip to the mall or a night out at a restaurant (unless they’re paying!).

You can also post about your challenge on social media for added accountability. You may even inspire others to take on the challenge and save money as well. Spread the hope far and wide!

The Key to Winning a No-Spend Challenge: A Budget

No-spend challenges are great! But it’s hard to stay on track without knowing where your money is going. That’s why you need to budget.

The EveryDollar app does more than just help you track your spending and manage your money—it actually helps you find more margin every month!

Just download the app, answer a few questions, and we’ll build you a plan to free up thousands in margin to put toward your goals.