If you want to save more money, maybe to invest in retirement or add some cushion to your budget each month, one surefire way to do that is to cut spending. Okay, okay—that’s not rocket science. But you might need some inspiration for where to start.

Here you go: 24 ways to cut spending and save more money!

How to Cut Spending on Home Expenses

Saving on home expenses can mean changing up small habits for bigger savings over time, or in some cases, making a pretty big change for an instant win. Let’s look at examples of both.

1. Go green(er).

The first way to cut spending in your home is to make more energy-efficient life choices. Some of these are financial investments up front. But they all pay off in the end.

Get expert money advice to reach your money goals faster!

For example, you can save on home expenses by turning off the lights when you leave a room, buying lightbulbs that have earned the Energy Star, buying a programmable thermostat, or washing your laundry in cold water instead of hot. Green changes like these can keep more green in your wallet.

2. Don’t become house poor.

You’re house poor when too much of your income goes toward your mortgage or rent, leaving you feeling poor in all other areas. Yes, you need shelter. Yes, you want a nice place to live. But you don’t want to spend so much on your house that you can’t afford to make other money goals happen.

Don’t be house poor—be house wise by making sure you’re not spending more than 25% of your take-home pay on housing. (That includes your rent or mortgage plus HOA fees, taxes, insurance and PMI). This makes your home a blessing instead of a financial curse.

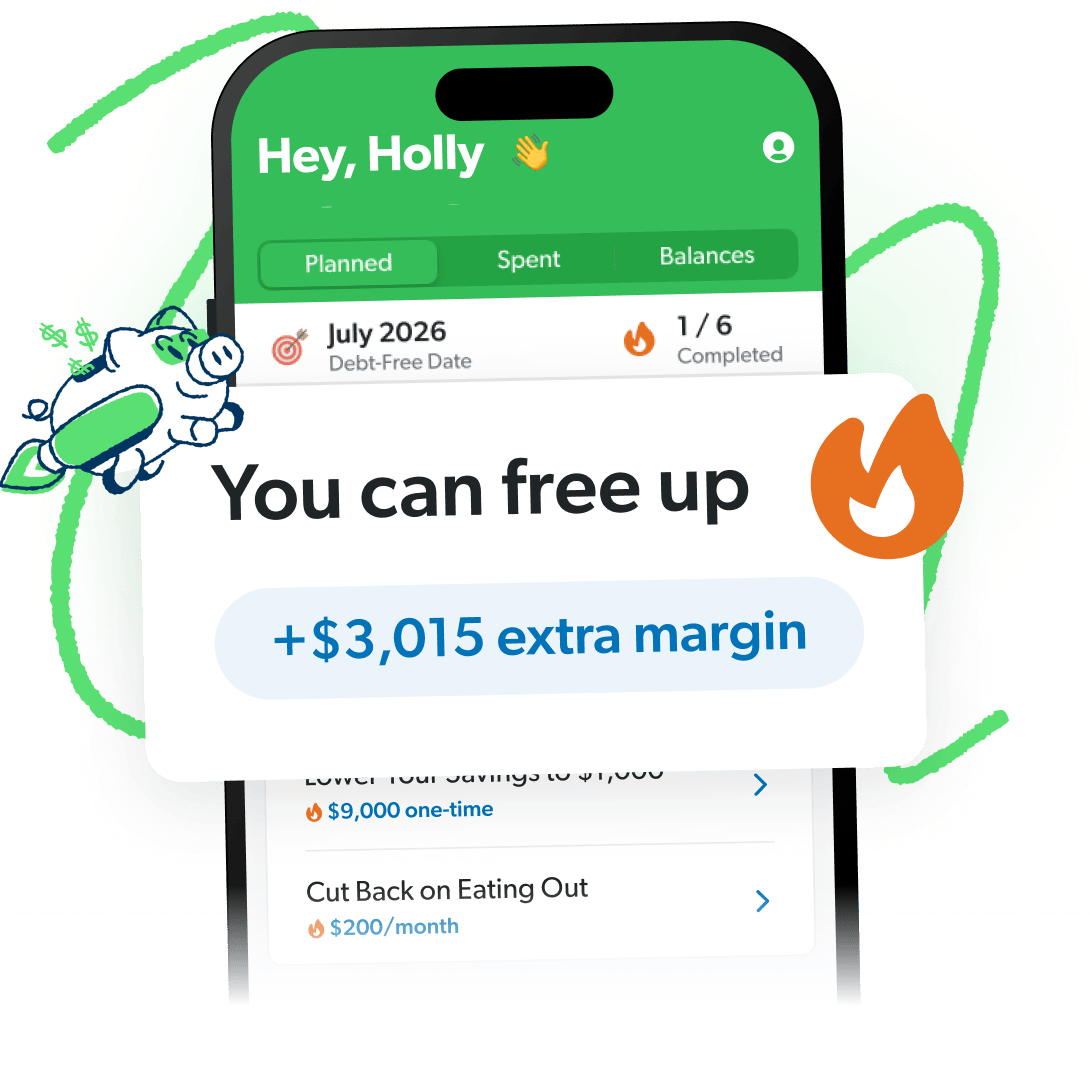

Free Up Margin. Make Real Progress.

The EveryDollar budget app helps you find hidden margin and put it to work so you can stack savings, crush debt, and build wealth that lasts.

3. Switch to reusable items.

Okay, here’s a tiny, practical way to cut spending. Stop buying paper towels, sandwich bags, and single-use water bottles. Switch to reusable items.

Because guess what—using the hand towels you already have tucked in a drawer or cabinet somewhere instead of a new paper towel sheet every time you make a mess means fewer trips to the store (and to the dumpster). It’s a small change that will add up over time.

4. Buy generic.

You don’t need brand-name everything. You can splurge on a few items—that’s your right as a shopper. But look into how much you could save by buying generic grocery items, medications, trash bags, cleaning supplies and more. This is a quick and incredibly simple way to cut your spending every time you shop!

5. Make your own things around the house.

Don’t spend money on things you can make yourself. This is the day of DIY. Pinterest, YouTube and social media are full of tutorials on how to make your own soaps, household cleaners, dog food, laundry detergent, ant killer, face scrubs—you get the idea.

The list of DIY options is longer than this article. For a small investment in ingredients, you can save big in the long run on a lot of the daily essentials.

6. Use less water.

You can also cut spending by lowering your bills. For example, work on using less water around the house. Take quicker showers. Don’t run the dishwasher unless it’s full. And turn the tap off while you’re doing everyday things, like brushing your teeth or shampooing your hair. It’s another small habit that’s super simple and will add up to some serious savings.

7. Figure out if refinancing your mortgage is right for you.

A lot of people refinance to get a lower monthly payment. And sure, that might free up some money in your budget today. But all it really does is keep you in debt longer.

The right way to refinance is to sign up for a shorter mortgage term. That usually results in a higher mortgage payment, but it also gives you a quicker payoff date. And that will save you thousands in the long run. But how do you know if it’s a good plan for you?

First, learn everything you need to know about how to refinance your mortgage. Then, using our (free) mortgage calculator, run the numbers on your mortgage to see how much you could save. Before you make a final decision on a refinance though, always connect with a mortgage expert.

How to Cut Spending on Food

Where do Americans tend to overspend the most? Food. That makes it an easy target for savings. But maybe cutting your food budget down sounds impossible? Fear not. It’s actually super possible. Here’s how:

8. Meal plan.

How does meal planning help you cut spending? Making an intentional plan for food helps you avoid all those “Oh no, what’s for dinner?” trips to the drive-thru.

So, plan out each meal you’re going to make in a week. Then you’ll always have stuff on hand for breakfast, lunch, dinner and snack time. When you make a meal plan, you know what you’ll be eating, so you know exactly what to buy. That means you spend less and waste less!

9. Eat leftovers.

Once you make a meal, don’t let what’s left after dinner die a slow and moldy death in a Tupperware coffin in your fridge. That wastes food and money. Put that food to good use. Enjoy it for lunch the next day or put a leftovers night on the meal plan calendar for the week. This keeps you from buying new meals every mealtime, and it’s a super easy way to stop spending money.

10. Brown-bag your lunch.

Speaking of lunches—stop your daily restaurant routine. And stop giving your dollars to the vending machine or office snack shop throughout the day.

Remember how we said you should meal plan for snacks too? Keep some midday munchies at your desk and bring your lunch to work most days of the week.

It’s okay to eat out sometimes—if it’s in the budget. But bringing in leftovers or brown-bagging a sandwich, fruit and pretzels like you did in your middle school days is a wonderful way to cut spending on food.

11. Order your groceries online.

When you order your groceries online, you can track the total cost as you go. Then if you’re over budget, you can delete items from your virtual cart before you check out.

You don’t have to walk through the grocery store with a calculator in hand to make sure you aren’t shocked at the register. You’ll know exactly what you’ll be paying before you complete the order, and you’re far less likely to impulse buy that family-size bag of sour gummy worms.

Try it out! Just remember, you’re trying to cut costs, not add a new temptation into your life. So, if the online shopping makes you more spendy, go back to shopping in store.

12. Hit up those BOGOs, weekly ads and coupons.

Stores with BOGO (buy one, get one) offers are basically begging you to save money. They’re setting out their best offers so you can swoop in and grab them. How about following this money-saving move?

Make those meal plans based on your grocery store’s weekly ads. You can even stock up the pantry and freezer for the future. Just make sure your purchases fit your budget, never buy stuff just because it’s on sale, and don’t forget what you’ve bought when you’re making meal plans weeks later. Wasting isn’t saving.

And don't forget about coupons! You've probably heard it a thousand times, but it's true that coupons really do save you money. Even coupons you find online can sometimes be used at the physical store.

13. Brew your own coffee.

If you’re spending around $6 a day at your fave coffee shop, that adds up to $42 a week and around $180 a month. Instead, you could cut that expense down to around $25 a month by brewing your own coffee. Then put that $155 to work other places in your budget!

How to Cut Spending on Entertainment

So, yeah, entertainment can be expensive. But it doesn’t have to be. Here are ways to cut spending on entertainment so you can have fun—without the guilt.

14. Pause or cut subscriptions and memberships.

Did you know instead of canceling a subscription or membership, you can sometimes pause or freeze it? Yup! Look through your apps and talk to your gym to see if they’ll let you do this.

While you’re checking, ask yourself which of these you really need. We aren’t out to bash these services. Some subscriptions are truly life-changing, and others are how you want to spend your fun money because you simply enjoy them. That’s totally fine!

But take some time to think about the stuff you don’t really even use, watch or read. If you’re trying to cut spending, cutting out that subscription box or magazine you never even open anymore could be just the thing.

15. Enjoy the great outdoors.

There’s a whole world out there, and it’s just waiting to be explored on the cheap. Hiking. Biking. Running. Stargazing. Getting outside for fun is an easy way to save money in your entertainment budget line. Because budget-friendly ways to reward yourself are a thing. An awesome thing!

16. Plan creative dates.

Myth: Expensive dates are the only way to keep romance alive.

Truth: You don’t have to spend a lot of money to show a lot of love. Cut your date night spending by planning creative, budget-friendly dates you’ll actually want to go on.

Fill a picnic basket with popcorn, apples, an assortment of cheeses and chocolate (of course)—then take it on a fun hike. Bring home Chinese takeout and eat straight out of the boxes while streaming your favorite show. Browse the aisles of a used bookstore before grabbing coffee and dessert.

Enjoy the quality company more than the cost.

17. Evaluate your TV choices.

If you’re paying high prices for your cable package but watching very few of the channels, you aren’t alone. Plenty of people are realizing they can save money and still get all the shows they want (and more!) by switching to streaming services.

Look into YouTube, Hulu, Netflix or Amazon Prime Video. Try watching recently aired episodes online. You don’t have to jump back to medieval days where your only entertainment was watching the knights joust. Just trade that cable bill for a lower-priced—but still awesome—option.

18. Download a library app.

Calling all book lovers . . . Listen up!

Libraries have officially joined the digital age. You no longer need to get off the couch, drive to your local library, and find a parking spot to check out a book.

Library apps are becoming more popular—and they’re free! You can browse for the book you want, put a hold on it (if it’s not immediately available) and then check it out when the time is right. It’s super easy and won’t cost you a dime!

Other Ways to Cut Spending

We’ve got a few more money-saving tricks up our sleeve. Here are some of our final tips on how to cut spending.

19. Take shopping apps off your phone.

Okay, don’t freak out. We aren’t saying you should never ever shop online. But when you take those store apps off your phone, you build a barrier between you and mindless scroll-shopping.

With those apps, your thumbs can just tap-tap-tap things you don’t really even need into your cart and into your mailbox. But you’ll think twice before getting on the laptop to buy that new sweater if you’ve got to get up off the couch to make it happen.

20. Go on a short-term spending freeze.

If you want to really challenge yourself, go on a spending freeze. This can mean doing a no-spend month challenge or jumping into a “nothing but the essentials” week—or month!

But if you decide to spend no money at all for an entire day, please check your gas tank first. (That’s another pro tip! Nobody wants you stranded on the side of the road.)

Spending freezes are a great way to cut spending for a while. They can also help you become more aware of your spending tendencies and more thankful for the stuff you already have.

21. Ditch your credit cards.

The best way to get ahead? Stop getting behind. Sounds logical, right? So, apply that logic to your money!

Using credit cards gets you behind in your finances because you’re still paying for your past. Instead, ditch the credit cards, switch to cash only, and start owning stuff for real.

When you cut those debt payments out of your budget, you can put that extra money toward your savings goals. That’s progress. That’s beautiful.

22. Buy used.

Use common sense on this. Don’t buy used tires, toothbrushes or tacos. But if you’re in the market for a car, tools, baby clothes, video games, books or a pet (shelter fur babies for the win!), then you’ll cut how much you spend by purchasing gently used items instead of new ones.

23. Wait before you buy.

If you’re looking at a big purchase, spend time checking prices, weighing the pros and cons, and thinking over if you really need the thing before you buy it. Sure, you wanted that new, genuine leather, flannel-lined laptop case the moment you first laid eyes on it. But will you still want it six months from now? Impulse buying can be expensive. Practice a little patience before making bigger purchases. You can save money by finding a lower price during that research time—or cut the cost completely by deciding not to buy after all.

24. Create a budget.

Okay, we’ve been using the word budget a lot. Here’s why: If you want to cut your spending, the first step is to make a plan for where your money should go. Every. Single. Dollar. That plan is called a budget. Now, we know a lot of people hate the word budget. It sounds restrictive. It sounds boring. It sounds difficult.

Ramsey’s EveryDollar budget app helps you find that hidden money fast and gives you step-by-step guidance to use it with purpose. Whether you want to knock out debt, stack up savings, or fund some fun, start EveryDollar for free and make it happen.