Key Takeaways

- The average American debt (per U.S. adult) is $66,772.

- Each student loan borrower owes an average of $38,290.

- The typical household in the U.S. has nearly $36,357 in car debt.

Wondering just how much debt the average American has? We’ve got you covered! We’re going to look at the average American debt and break it down by age and different types of debt, like student loans, mortgages and credit cards.

Pay off debt fast and save more money with Financial Peace University.

These numbers may make it look like everyone is drowning in debt, but that’s just not true! Plenty of people are living their best life without owing money to anyone else. So, we’re also going to set the record straight and show you how you can become debt-free. Let’s hop in.

How Many Americans Are in Debt?

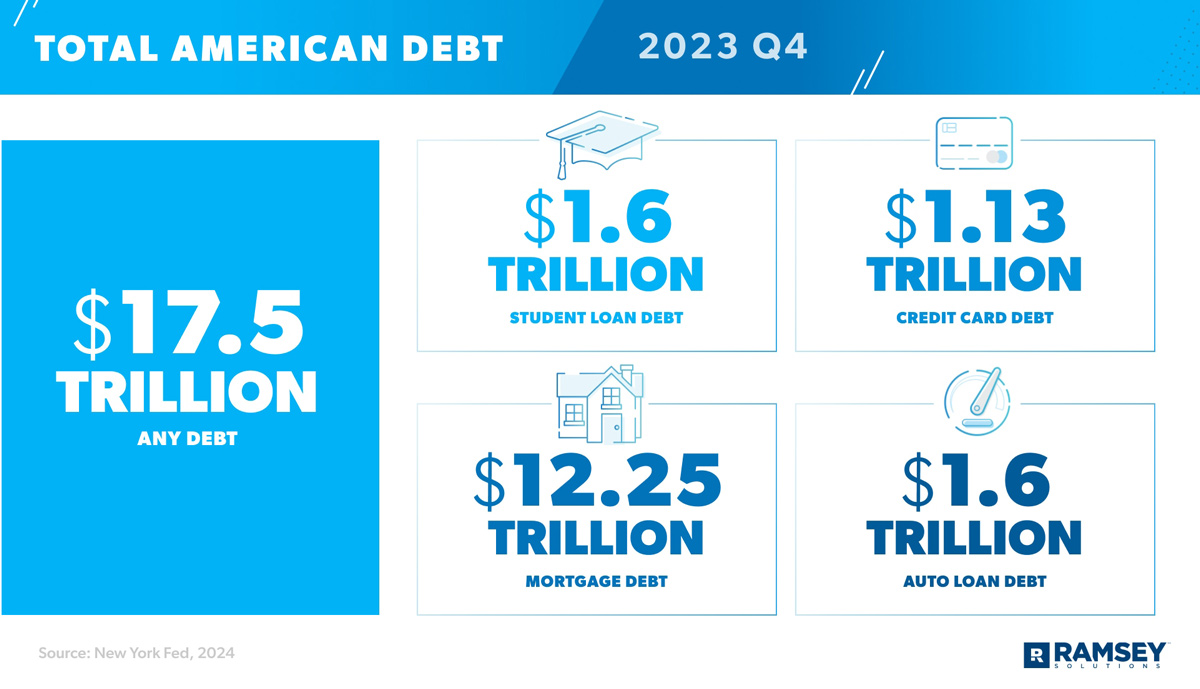

Even though household net worth is on the rise in America (at $156 trillion at the end of 2023)—so is debt.1 The total personal debt in the U.S. is at an all-time high of $17.5 trillion.2 The average American debt (per U.S. adult) is $66,772, and 77% of American households have at least some type of debt.3,4,5

As a reminder, debt is owing any money to anybody for any reason. If you have debt, you’ve most likely agreed on terms of repayment, and those terms mean specific payments at specific time periods until the debt is paid off—typically with interest (the extra cost the lender charges you for borrowing their money).

Some of the most common types of debt in America include credit cards, student loans, auto loans, home equity lines of credit (HELOCs), and mortgages. Though Americans of all ages use these debt products, some age groups are more in debt than others—so we’ll look at not only American totals and averages, but also at debt across various age groups.

Find More Margin. Beat Debt Faster.

Paying off debt doesn’t have to take forever. With the EveryDollar budgeting app, you’ll find extra margin every month so you can pay off debt faster.

Average American Debt at a Glance

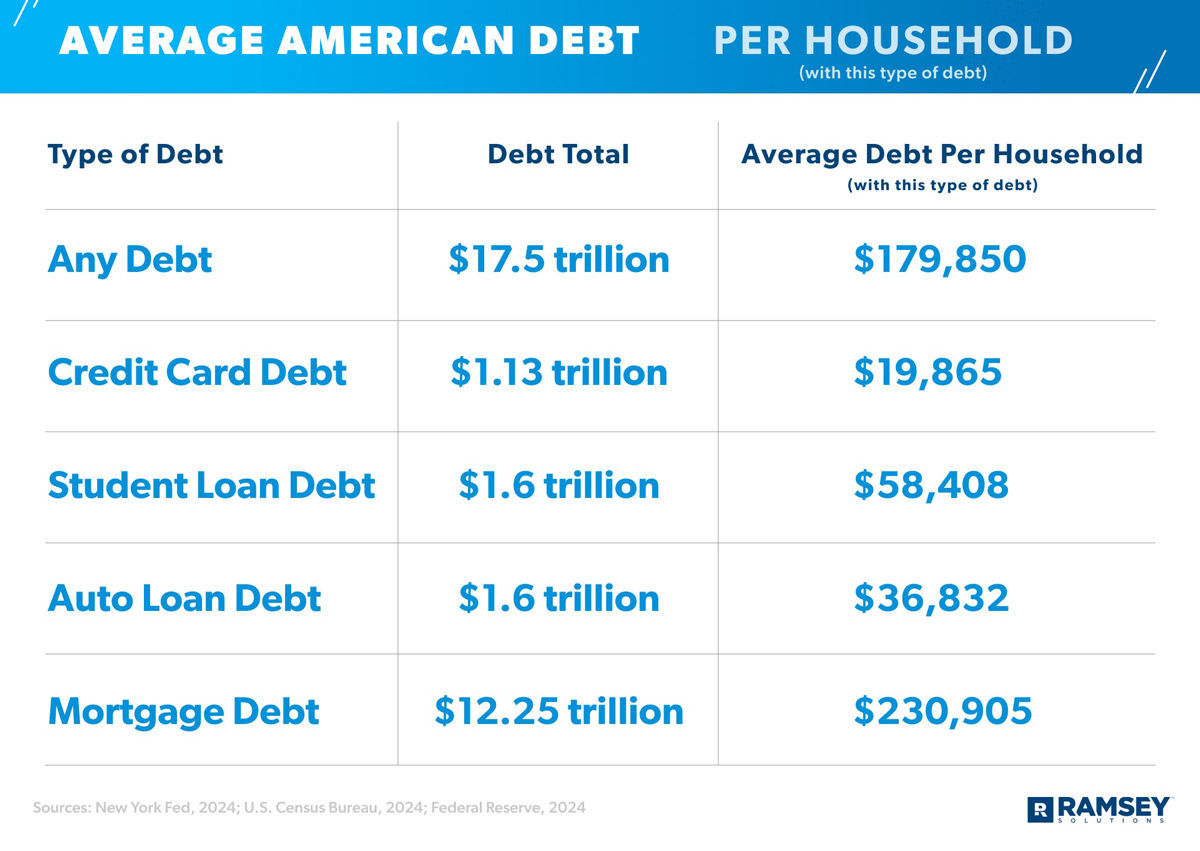

Let’s look at the overall totals for American debt and the average debt per household in five categories.

How Much Debt Does the Average American Have?

Credit Card Debt

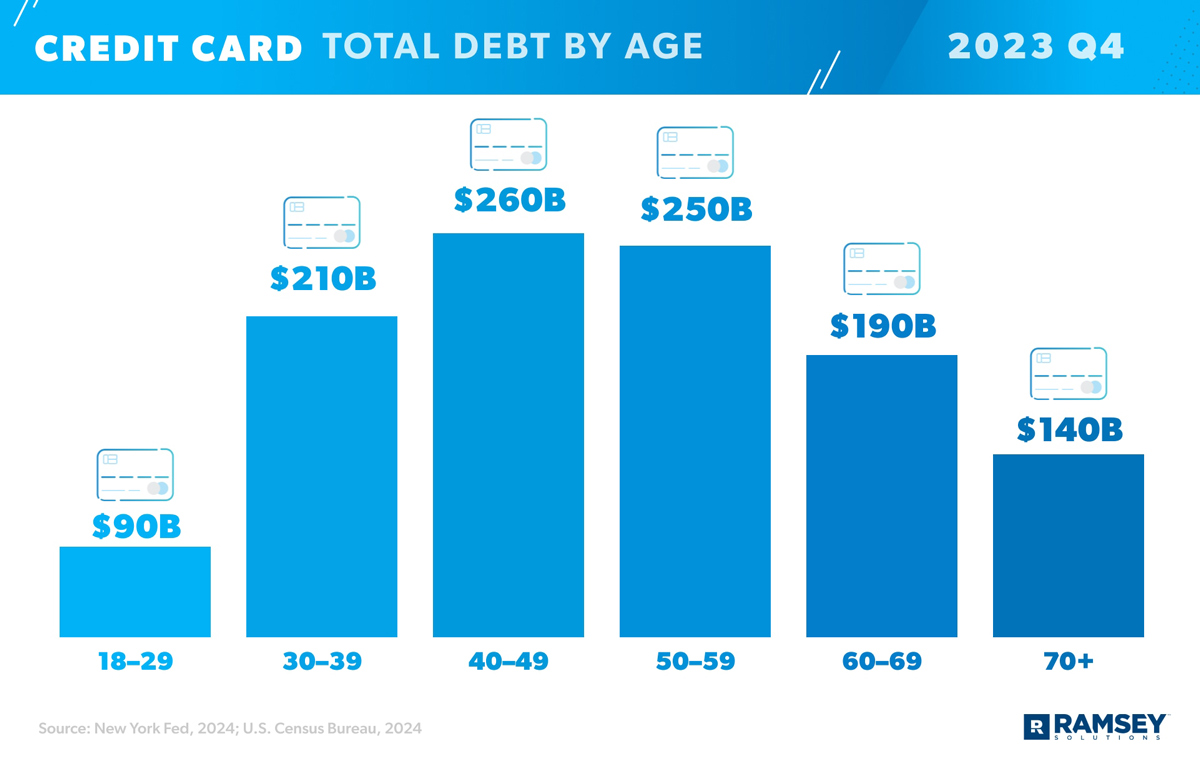

Eight out of 10 adults in America have at least one credit card, and 48% of them carry a balance within a given year (meaning they don’t pay their credit cards down to zero each month, so they have credit card debt).6 That’s over 100 million people with this kind of debt.7,8 The average credit card debt per person is $6,501—with the total in America hitting $1.13 trillion.9,10

The average APR (annual percentage rate, or interest rate) on credit cards is 22.63%.11 And those 100 million people with credit card balances pay that interest. Think of it like this: If you multiply 22.63% by the $1.13 trillion Americans owe, that’s about $256 billion that credit card companies will make on interest alone.

Student Loan Debt

The total student loan debt in America is currently at $1.6 trillion, with each borrower owing an average of $38,290 (as of summer 2023).12,13 The fastest-growing debt in America, student loan debt has doubled since the Great Recession and makes up 9% of the country’s debt total.14

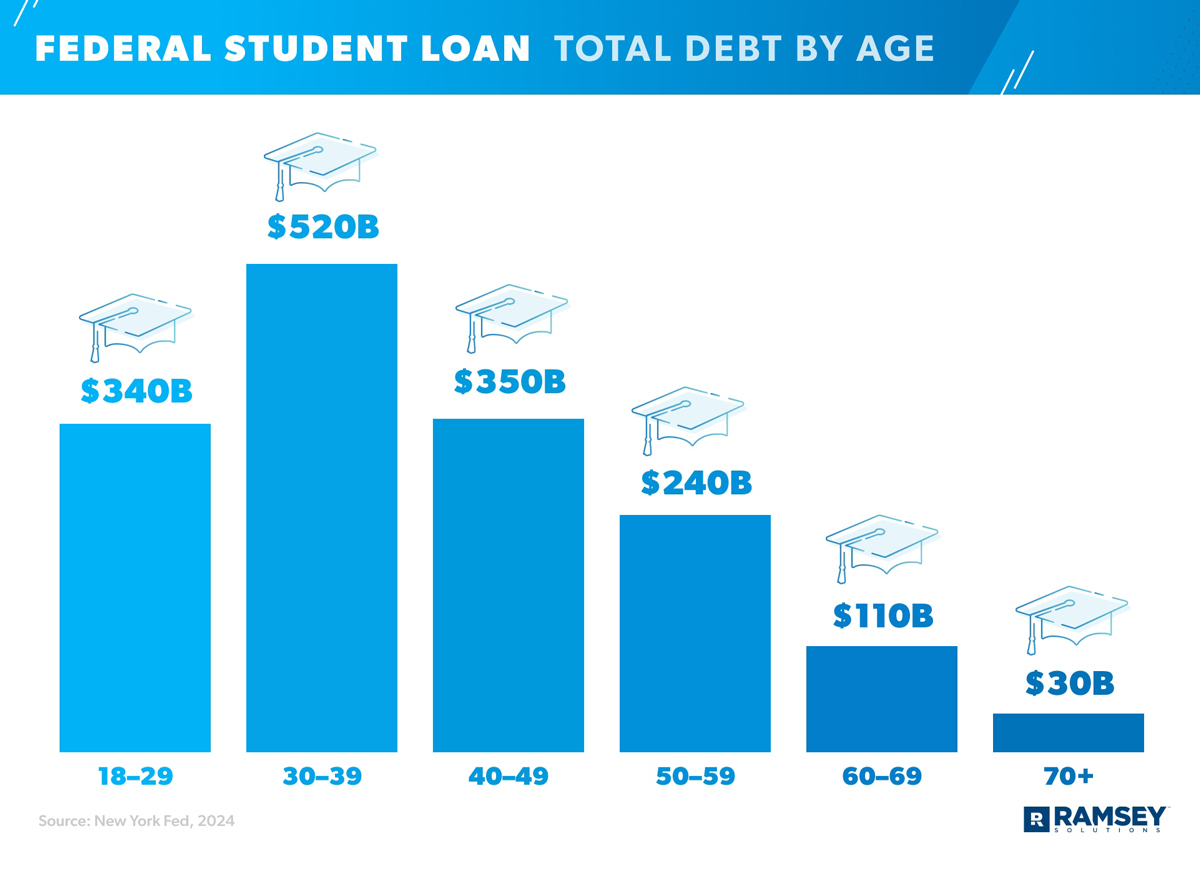

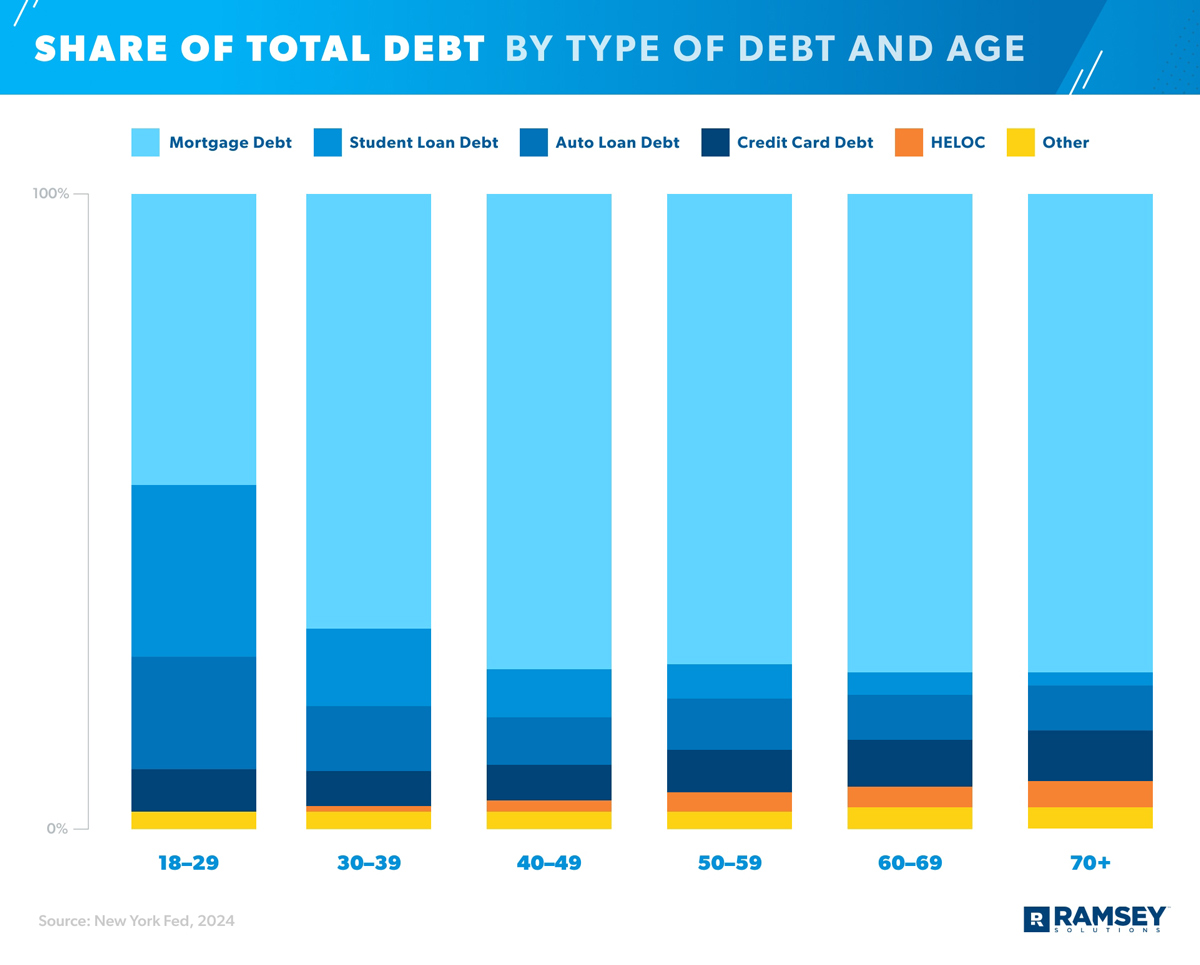

Student loan debt for Americans ages 18–29 is $340 billion. And for Americans ages 70+, they collectively owe $30 billion—even though student loans only account for around 2% of their debt.15 (Yes, some 70-year-olds are paying for college—theirs or someone else’s. Let that sink in.)

Young adults say the weight of student loans keeps them from basic financial and life decisions. For example, 44% delay investing in retirement, and 33% put off buying a home. And 14% even wait to get married because of their student loan debt.16

Auto Loan Debt

Total American auto loan debt is $1.60 trillion.17 About 35% percent of U.S. households (that’s around 44 million) have this kind of debt, with an average of $36,357 per household.18,19,20

So, how much are these people paying each month? Well, the average monthly car payment is $738 for new vehicles and $532 for used.21

HELOC Debt

A HELOC (home equity line of credit) is a loan that allows you to borrow cash against the current value of your home, using the equity you’ve built up in your home as collateral. In other words, you’re giving up the equity you’ve earned and trading it in for more debt.

There are over 13.1 million HELOCs in the United States, and the total debt across them all is $360 billion. That means the average person with a HELOC owes $27,272.22

Older Americans have the highest percentage of HELOC debt. HELOCs take up almost none of the debt held by those ages 18–29, and less than 1% of the debt held by those ages 30–39, but that percentage rises to nearly 5% for those 70-plus.23

Mortgage Debt

For most people, housing is their biggest monthly expense. That means they pay a larger percentage of their monthly income to rent or a mortgage than any other budget category (think of categories like utilities, groceries, insurance, etc.).

Americans with a mortgage pay a median monthly payment of $2,006.24 Accounting for 70% of all American debt, mortgage debt carries the highest total at $12.25 trillion.25 There are over 84 million outstanding mortgages in our country, and the average balance on each of them is $145,833.26

Average American Debt by Age

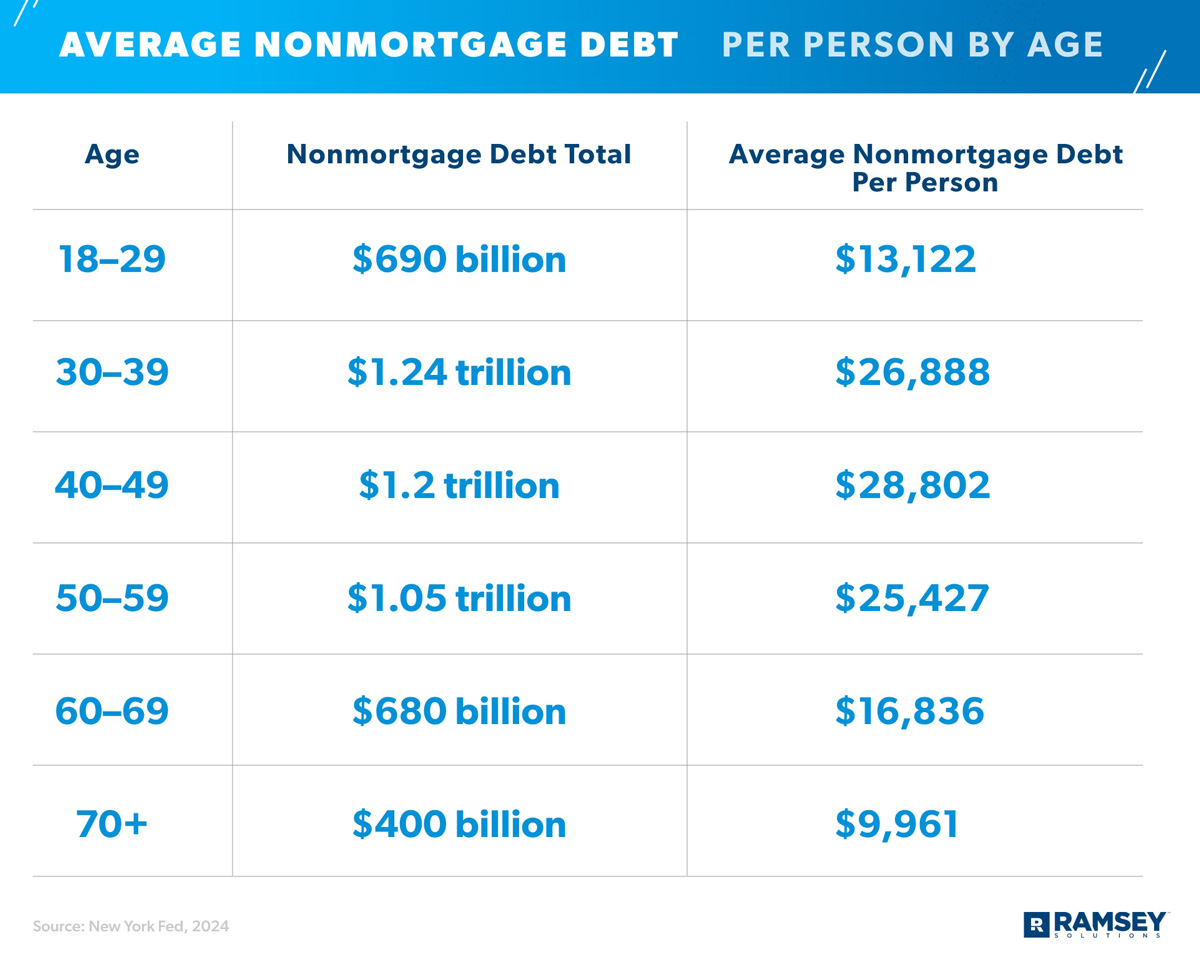

So, we’ve broken out some of the average American debt totals by age already, but here’s an overview of debt totals and averages by age. Note: These averages include all American adults, both those with and without debt—that’s how the data is reported each year.

First, here’s an overview of consumer (or nonmortgage) debt by age.

Now we’ll look at each age group’s total debt broken into percentage by debt type. Notice younger Americans have a higher percentage of student loans, but older Americans have a higher percentage of mortgage debt.

For more information on debt levels across generations, check out our research study.

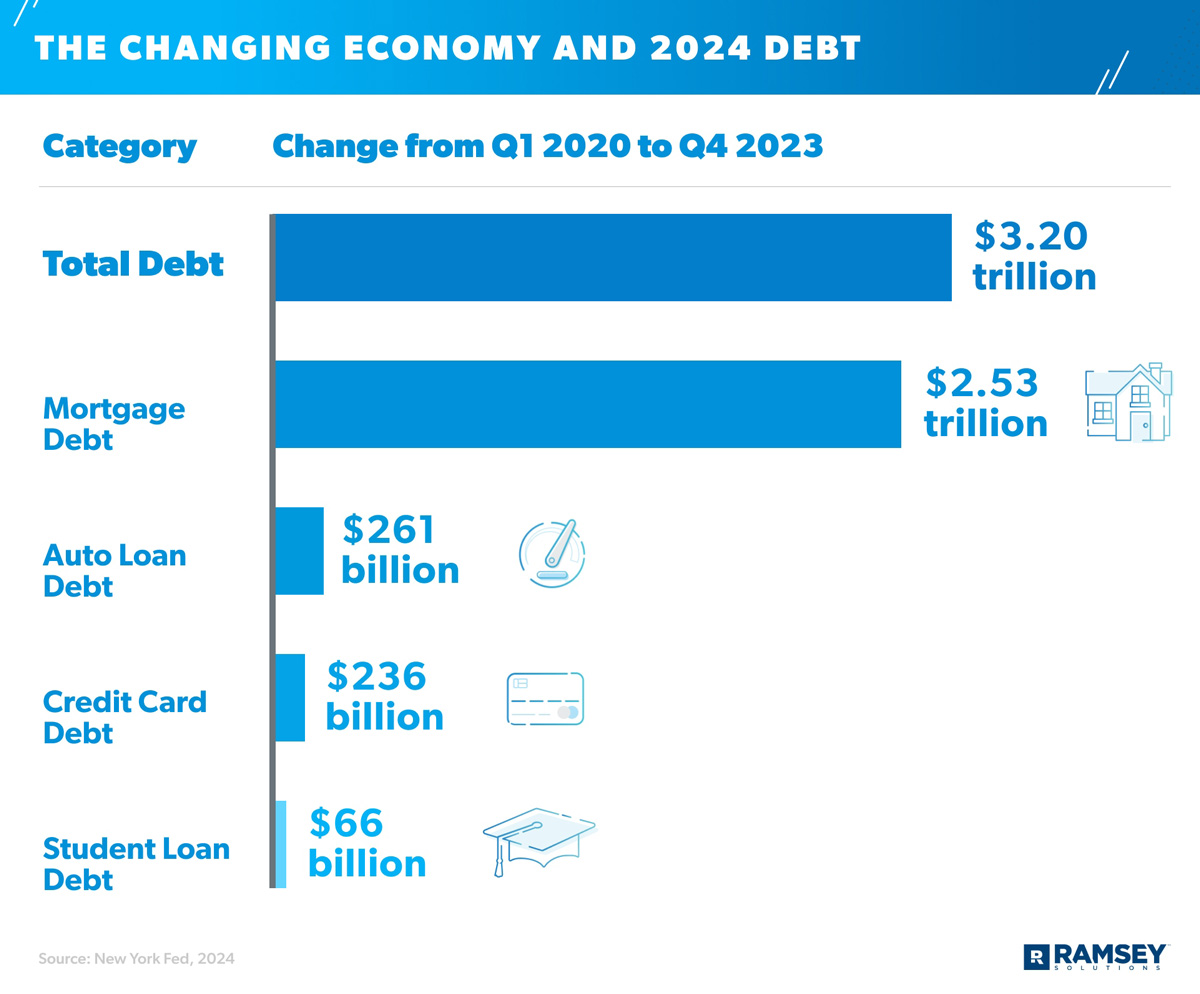

The Changing Economy and 2024 Debt

You probably don’t need us to tell you that life has gotten a lot more expensive over the last few years. Specifically, the overall inflation rate in the U.S. since 2020 is 19%. (That means, on average, everything now costs 19% more than it did four years ago.)27

Here’s a look at how much some specific costs have gone up:

- Home Costs: In March of 2024, the median home price in America was $429,950. That’s an increase of over $130,000 since the start of 2020!28

- Car Prices: From June 2020 to June 2023, the price of a used car rose 32%.29

- Credit Card Interest Rates: The average interest rate for credit cards has gone from 16.61% at the start of 2020 to 22.63% in 2024.30

- Gas Prices: A gallon of gas cost 29% more in April 2024 than at the start of 2020.31

- Groceries: Grocery prices have increased by a whopping 25% over the past four years.32

- Rising Insurance Premiums: Insurance has gotten more expensive in pretty much every category, but auto insurance has gotten hit the hardest: a 36% increase since 2020.33

Unfortunately, rising costs like these have caused more and more people across the country to rely on debt to make ends meet. Here’s a look at exactly how much extra debt Americans have taken on just since 2020.

What to Do if You’re in Debt

If you’re in debt, these numbers show you’re not alone. Still—if you’re part of these statistics, you don’t have to stay there. You don’t have to keep giving such a big chunk of your paycheck to other people every month.

Here’s how you get debt out of your life once and for all with the debt snowball method.

1. Save a starter emergency fund.

Before you attack your debt, make sure you’ve got $1,000 saved as a starter emergency fund. Why? As you’re paying off debt, life will happen—we’re talking about the flat tire, leaking refrigerator and unexpected medical bill. If you don’t have money saved up to pay cash for emergencies, you’ll be tempted to pull out a credit card and go deeper in debt.

2. List out your debts from smallest to largest.

It might not be pretty, but it’s got to be done! People sometimes get so scared of this first step that they stop right here. Don’t. You can do this.

Yes, looking your debt in the eye might be difficult, but when you finally face the facts, you can follow a plan to attack it head on. You’re on the path away from money stress. So, keep walking.

3. Make minimum payments on all your debt except the smallest one.

Next, put as much money as possible on your smallest debt while continuing to pay minimum payments on the rest. Focusing on one debt at a time will help you make a lot more progress than you would otherwise.

4. Move on to the next debt.

Once your smallest debt is out of the way, put all the money you were throwing at it onto the next-smallest debt. Shift your focus to that debt, attack it with a vengeance, and continue making only minimum payments on everything else.

5. Repeat the cycle until you’re debt-free!

Keep going until you’ve paid everything off! And here’s some good news: When you start with your smallest debt and work your way up (instead of the other way around), you’ll get quick wins all along the way every time you pay something off, and those quick wins will keep you moving.

You’ve Got This!

If the numbers we looked at prove anything, it’s that debt is common. But here’s the truth about debt: It holds you back from living your financial dreams, both today and in the future. So, if you have debt, you’re worth the investment of time and energy to break away from it.

And guess what? You don’t have to figure everything out on your own either. You can learn the ins and outs of paying off debt (and the best ways to handle your money) in Financial Peace University.

This nine-lesson course will teach you the plan to get out—and stay out—of debt and get you pumped up to pay it off forever. And when you've built a solid foundation of knowledge, it makes the debt-free journey quicker and easier. That’s a true win-win.

Start Financial Peace University and begin your debt-free journey.

About the Stats

At times we used multiple sources for data on debt in average U.S. households, percentages of U.S. households with certain types of debt, and differences in these debt totals and types across age categories. In these cases, we interpreted data from across these sources to provide our best approximation of average debt. There are limitations to working across multiple sources, and we attempted to account for these limitations when possible. Still, variations from source to source could affect the precision of our results.