Key Takeaways

- Half of Americans worry daily about their money and live paycheck to paycheck.

- These six key economic indicators can give us a clue about what’s in store in 2026: the stock market, the housing market, interest rates and inflation, the unemployment rate, consumer confidence and gross domestic product (GDP).

- While the stock market was forecast to slow down in 2025, growth in many sectors (especially tech) was stronger than expected. Some of those gains may continue in 2026.

- In the housing market, inventory remains low—many homeowners are stuck because of relatively high rates. Mortgage rates have recently come down and may drop more in 2026, but finding an affordable home remains challenging for many potential home buyers.

- The stock market will always have a few stocks that perform far better—or worse—than the rest. But the best thing you can do as an investor is focus on things you can control, like monthly budgeting and consistently investing for retirement.

- Here's a simple strategy for your investments: Once you’re debt-free and have a fully funded emergency fund, invest 15% of your gross income for retirement in good growth stock mutual funds using tax-advantaged retirement accounts.

As we kick off the new year, a lot of folks are on edge about the economy and their personal finances. According to Ramsey Solutions’ State of Personal Finance study, only about half the country feels happy about their money. The other half either worries daily about their personal finances or lives paycheck to paycheck. Plus, only 47% of Americans are investing for the future—and 41% say they’d rather enjoy life now than save for retirement.

Market chaos, inflation, your future—work with a pro to navigate this stuff.

How about you? Are you feeling good about your financial situation and the economy as a whole? Or are you a little queasy about what’s ahead?

However you feel, it’s important to remember what you can and can’t control. For example, you can’t control the economy, but you can control how much (and how consistently) you invest—no matter what’s happening on Wall Street.

How Much Can You Save for Retirement in 2026?

According to The National Study of Millionaires, the path to becoming a millionaire runs through your 401(k). That’s where 8 in 10 millionaires built their wealth. And thanks to adjustments for inflation, you’ll be able to save a little more in your workplace retirement accounts this year.

- For 2026, the IRS is raising the annual contribution limit for employer-sponsored retirement plans to $24,500. This includes those who contribute to a 401(k), a 403(b), most 457 plans and the federal government’s Thrift Savings Plan.1

- If you’re nearing retirement and need to catch up on your savings, you can also put an extra $8,000 into your plan if you’re age 50 or older. And if you’re 60–63 years old, you have an even higher catch-up contribution limit of $11,250.2

What about the annual limit for individual retirement accounts (IRAs)? You can save up to $7,500 in your IRA accounts in 2026—and that goes for Roth and traditional IRAs. If you’re 50 or older, you can make a catch-up contribution of $1,100, bringing your 2026 IRA contribution limit to $8,600.3

You’ll also be able to save a little bit more in your Health Savings Account (HSA) if you have one. For 2026, individuals can save up to $4,400, while families can put $8,750 into their HSAs.4 It’s a nice bump, so take advantage if you can!

|

Account Type |

Contribution Limit |

|

Employer-sponsored retirement plans: 401(k), 403(b), 457(b) |

$24,5005 |

|

Traditional and Roth IRA |

$7,500 |

|

SIMPLE IRA |

$17,000 |

|

Health Savings Account (HSA) |

$4,400 (individual) / $8,750 (family)6 |

What Are Economic Indicators?

Economic indicators are just statistics and trends that give us insight into how the economy is doing and where it might be headed (that’s the short and sweet version). Think of these economic indicators as thermometers that help us keep an eye on the temperature of the overall economy.

Here are six of the major economic indicators to watch in 2026:

- Stock Market

- Housing Market

- Interest Rates and Inflation

- Unemployment Rate

- Consumer Confidence

- Gross Domestic Product

Let’s take a look at these indicators and find out what they could mean for you and your money.

1. Stock Market

The stock market is kind of like your local supermarket. But instead of buying bread and milk, you’re buying and selling stocks (which are basically small pieces of ownership in a company).

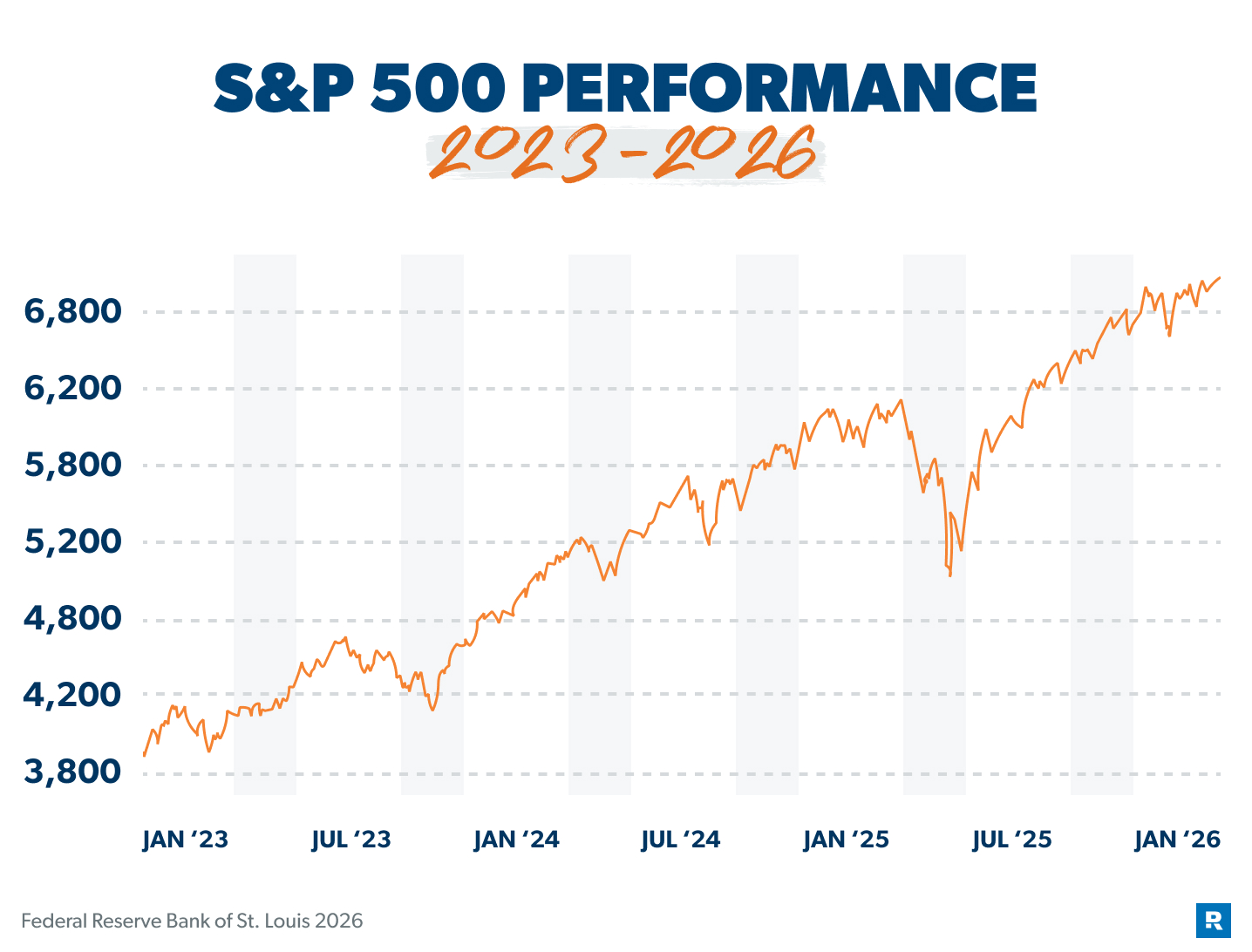

The S&P 500 index, which measures the performance of 500 of the largest companies whose stocks trade on the New York Stock Exchange and Nasdaq, is considered the most accurate measure of the stock market as a whole. When this index increases, the economy is usually doing well.

The stock market is like a roller coaster—full of ups and downs that can make your head spin. Let’s take a quick look back at what’s happened with the stock market recently—and what we may be able to expect moving forward.

The stock market was resilient in 2025.

After a historic year for the stock market (and probably your retirement accounts) in 2024, the market did pretty well in 2025, all things considered. That’s especially true when you remember investors had to contend with inflation, tariffs and a government shutdown.

The stock market’s performance blew away more than one expert’s gloomy forecast: As the year wrapped up, the S&P 500 was up almost 18%.7 This was due in large part to huge gains in the tech sector.

Interest rate cuts (more on that later), lower-than-expected unemployment, cooling inflation, and investor optimism have all played a role in the stock market’s performance in 2025. So, what’s coming for 2026?

There are reasons for cautious optimism in 2026.

Remember, investing is a marathon, not a sprint. No matter what the stock market is doing, stay focused on the long term, avoid making decisions out of fear, and keep saving for retirement (as long as you’re out of debt and have a fully funded emergency fund in place).

The stock market might rise or fall over the course of the year, but it has a long history of trending upward. The historical average annual rate of return for the S&P 500 is about 12%.8 So stay focused and keep putting money in your 401(k) and your Roth IRA—don’t cash them out “just in case.”

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

Ramsey Solutions is a paid, non-client promoter of participating pros.

2. Housing Market

So, now that we’ve taken a look at what’s happening with the stock market, what’s in store for the housing market? Here are a few trends and projections that could affect homeowners as we move into a new year:

Location matters.

Nationally, the housing market in America has been growing every quarter since 20129—but of course, details matter. The housing market has been unpredictable lately. If you look hard enough at the quarterly data from the Federal Housing Finance Agency (FHFA), you might want to pull your hair out.

For example, if you own a home in Illinois, you probably experienced a 6.9% bump in your home’s value because of price growth during the third quarter of 2025. That’s great, right? But if you’re a homeowner somewhere in Florida, you might not feel so great—because home prices there declined by 2.3% during that same period.10

We won’t mince words—the projections by FHFA and Fannie Mae for 2026 are muted.11,12 But even if home prices in America grow at a slower rate than the historical average (around 5% per year), we should still see positive growth in 2026. House prices rose 1.7% from October 2024 to October 2025, and that modest growth is projected to continue in 2026—but like we said, location matters.13

Simply put, low housing inventory (a low supply of houses for sale) often leads to higher home prices. Supply and demand in your area can have a huge impact, which is one big reason why buying a home has gotten so expensive. That may begin to change in 2026—as long as other variables, like mortgage interest rates, get in step.

Housing inventory will likely increase.

Now, if you’re talking forecasts about real estate sales, the National Association of REALTORS® thinks we’ll see a 14% increase in home sales in 2026.14 Maybe they’re onto something: Fannie Mae projects growth of more than 25% in mortgage originations (like when people buy or refi) in 2026.15 On top of that, housing inventory is expected to grow (but remain below pre-2020 levels, when an abundance of homes for sale produced a buyer’s market).

Mortgage rates may ease a little.

Fannie Mae predicts the 30-year fixed rate will drop below 6% by the end of 2026, which could offer a little hope for buyers sidelined by relatively high mortgage rates.16 The good news? Those rates have already come down from recent highs.

By December 31, 2025, the average 30-year fixed mortgage rate had dropped to 6.15%, down from 7.79% in October 2023. And the 15-year rate was an even better deal at 5.44%, down from 6.0% just a year earlier).17

We may be a long way from the 2–3% rates we saw at the end of 2021, but rates are at least moving in the right direction. If you’ve been waiting to buy or sell, 2026 could be the year to do it.

As to whether it’s a seller’s market anymore, the jury’s still out—again, it depends on where you live. A lot of folks have hit pause until rates come down or inventories rise (or both).

And if you’re planning to buy? Our advice is simple: Be patient. It’s worth taking the time to find the right home for the right money. Sure, prices are still on the high side in some areas, but the feeding frenzy has mostly died down. If you have to take out a mortgage, a conventional 15-year fixed-rate mortgage is the only way to go. That’s because it’ll save you tens of thousands of dollars in interest over the life of your loan.

Whether you’re buying or selling, get in touch with one of our RamseyTrusted® real estate pros. They know your housing market like the back of their hand and can help you buy or sell your home—even in an unpredictable market!

3. Interest Rates and Inflation

Okay, hang with us here. The Federal Reserve (aka the Fed) is the U.S. central bank in charge of the nation’s policies on money. The Fed has two main goals: grow the economy at a sustainable rate and keep inflation under control.

The Fed has several ways to achieve these goals, but one of its main tools is raising and lowering interest rates. Now, the Fed doesn’t tell commercial banks what interest rates to charge on loans. Instead, it sets the federal funds rate, which is the interest rate banks charge each other for overnight loans, and it influences most other interest rates.

Lowering interest rates can give the economy a boost because people and businesses are more likely to borrow and spend money when borrowing is cheaper. But if too many dollars are chasing too few goods, prices rise—and that’s called inflation.

Raising interest rates can slow inflation down because it encourages people to spend less and save more. But if rates are too high, they can choke economic growth. When interest rates are high, businesses tend to spend less, and this can also lead to higher unemployment (layoffs). So, the Fed tries to find a balance that’s just right.

Inflation hit a 40-year high in 2022, impacting everything from how much we spent for a gallon of gas to the cost of a dozen eggs. The Fed responded by repeatedly raising interest rates throughout 2022 and 2023 to try to cool things down.18

As inflation finally started to lose steam, the Fed took a cautious approach and held rates steady for most of 2024 before lowering them toward the end of the year to try to support economic growth.

At the end of 2025, inflation hovered close to 3% (down from a high of 9.1% in June 2022), which is still above the Fed’s 2% target. The Fed projects that inflation will ease to around 2.5% in 2026 and finally settle at around 2% in 2027.19

According to The State of Personal Finance study, more than a third of Americans are losing sleep when it comes to their money. Right now, inflation is pretty much always in the news, so the struggle to pay bills comes with constant worry about how everything’s getting more expensive. If that’s you, here are some smart ways to deal with it:

- Adjust your budget. This means you might have to cut back on some things in order to pay for necessities. Look for ways to save money by using coupons, buying generic brands, or carpooling.

- Look for ways to boost your income. A side hustle is a great way to earn extra income for bills or your debt snowball. If you’re stuck in a dead-end job, maybe it’s time to start looking for a new opportunity.

- Keep investing for retirement. The best way to protect your nest egg from rising prices is to make sure your investments are growing faster than inflation. That’s why we recommend you invest in good growth stock mutual funds in your retirement accounts.

No matter how high or low interest rates are, borrowing money for things like a car loan or a home equity loan is always a bad idea. We want interest to work for you, not against you. Debt isn’t your friend. It takes your time and money, and it gives you headaches and heartaches in return.

4. Unemployment Rate

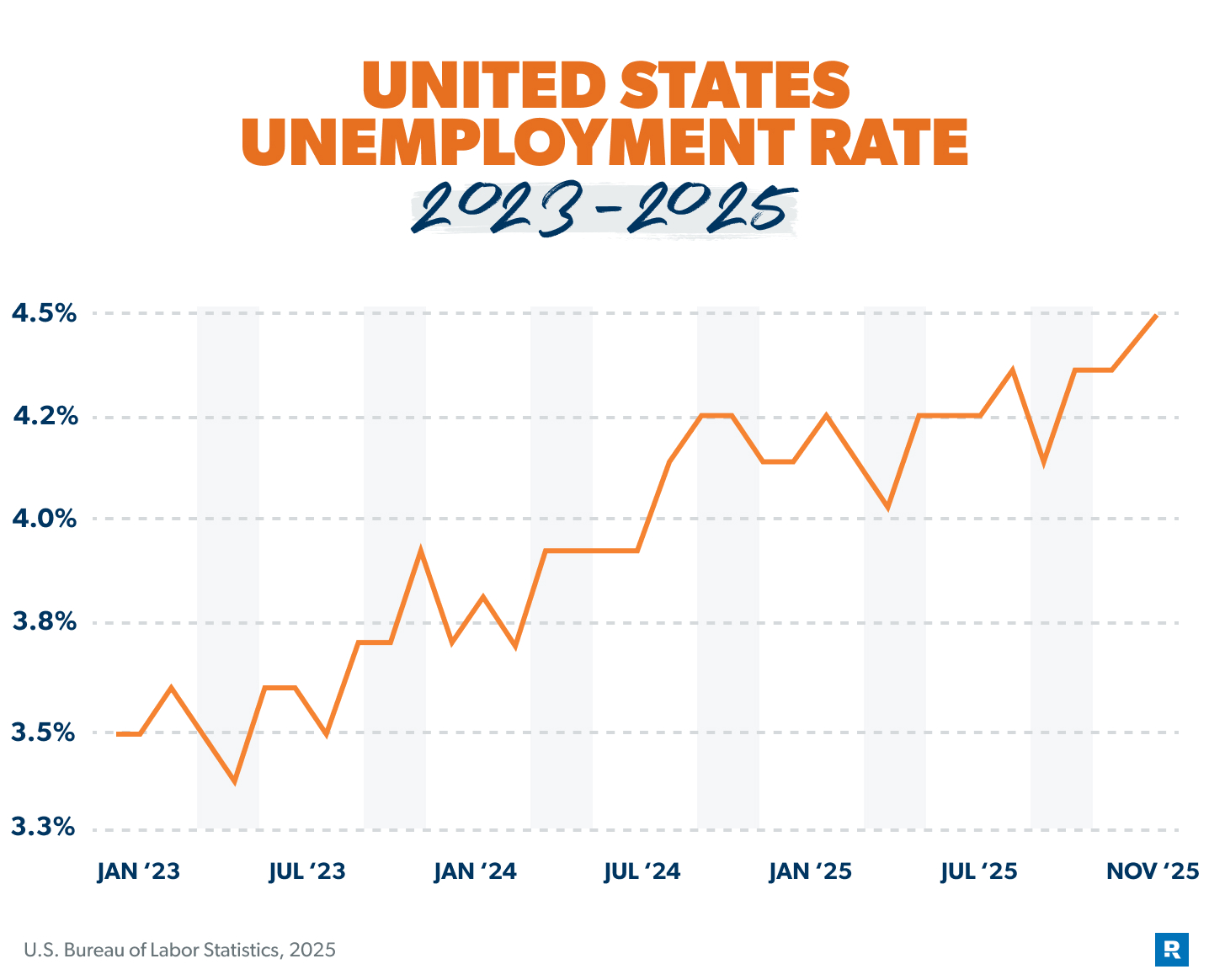

The unemployment rate is one of the clearest ways to see which way the economy is moving. One way it does that is by showing, as a percentage, how many Americans are out of work. In 2025, most changes were driven by—you guessed it—layoffs. Rising unemployment can be scary. When fewer people are working, the economy is weaker. Lower unemployment, however, means more people are finding work and the economy is getting stronger . . . which is what we all want.

According to the U.S. Bureau of Labor Statistics, the unemployment rate stood at 4.5% in November 2025, up from 4.1% at the same time in 2024 and the highest it’s been since 2019.20,21 There are a lot of factors at play in the jobs picture:

- Federal agency layoffs and downsizing

- AI-related disruptions, especially for entry-level and white-collar jobs

- Shifts driven by inflation, consumer confidence, tariffs and other factors

The job market is showing signs of stress. There were only about half a million jobs added in the first 11 months of 2025, a sharp decline from the 1.6 million jobs added in the same period in 2024.22

The good news is that continued economic growth can lead to new jobs, giving the labor market a chance to create new opportunities in the coming year. Some industries, especially tech, are really humming along.

So, what does all that mean for your investments? Well, if job growth slows down, that means less growth for companies . . . which could hurt your investments in the short term. But don’t panic—this kind of thing happens from time to time. Work with your financial advisor to see if you need to make any adjustments to your portfolio or if you should just ride it out for the long haul.

5. Consumer Confidence

You can usually tell when someone feels confident. They walk with their head held high, and they have a swagger in their step. They also tend to spend more and save less! Well, that last part is what the Consumer Confidence Index says, at least.

The Consumer Confidence Index is a survey done by an organization called The Conference Board. The index measures how everyday Americans feel about the economy. Consumer confidence has been up and down lately, reflecting the uncertainty most Americans have felt in the aftermath of the COVID pandemic. In fact, consumer confidence has been trending downward since 2020 and isn’t projected to change direction in 2026.23

In the face of rising prices, many Americans are turning to credit cards and buy now, pay later plans—or dipping into their savings—to keep up their spending. In fact, Americans have piled up more than $1.23 trillion in credit card debt—which means more and more people are buying stuff they can’t afford with money they don’t have.24

With more Americans adding to their debt and savings rates slipping to some of the lowest levels in years, millions of families could be in trouble down the road.25 That’s why it’s more important than ever to get on a budget, stay away from debt, and keep saving and investing for the future to outpace inflation.

6. Gross Domestic Product

In a nutshell, gross domestic product (GDP) is the value of all goods and services produced in a country during a specific time period. The GDP of the United States is a huge number: about $29 trillion a year!26 GDP growth is a key measure of the health of a country’s economy.

The latest available numbers show that U.S. economy grew in 2025 at a rate of 4.3%, supported by strong consumer activity and increased investments in the stock market—especially in tech and AI-related businesses.27

Despite relatively high interest rates, inflation and other potential drags, the American economy has continued to grow thanks to stronger-than-expected consumer spending.

Here’s the Bottom Line

Whew! That was a lot of heavy lifting! The reason we took time to unpack all this stuff is because it’s the kind of thing you’ll hear about on the news or from your buddy at the gym. The difference is, we’re not going to tell you to do anything different with your investments because of what’s happening in the world.

The best thing to do with your investments is to keep things simple. Here’s how: Once you’ve paid off all debt (except the house) and saved 3–6 months of expenses in a fully funded emergency fund, invest 15% of your gross income for retirement. Put that money in good growth stock mutual funds using tax-advantaged retirement accounts.

And then just keep doing that. Over and over again. The key to building wealth is consistency. That’s what Baby Steps Millionaires have in common.

No matter what the stock market is doing, millionaires keep working hard and putting money away. They don’t get distracted. They don’t risk their hard-earned money in flashy investing trends they don’t fully understand. They don’t panic every time the stock market has a bad day.

And one day, they look up and see their nest egg has hit the seven-figure mark. That’s what winning looks like. And there’s no reason that can’t be you someday.

Next Steps

- Ready to learn the ins and outs of investing? Ramsey’s Complete Guide to Investing will show you how to grow your wealth and leave a legacy for those you care about.

- The most important factor for retirement success is your savings rate—how much you’re saving for retirement. Our Retirement Calculator can help you figure out whether or not you’re saving enough.

- If you’re ready to start investing, our SmartVestor program will connect you with investment professionals who can help you create a plan to save and invest for retirement.

This article provides general guidelines about investing topics. Your situation may be unique. To discuss a plan for your situation, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.