Introduction

As 2025 ends, many Americans are looking to 2026 with hope and optimism—seeing the new year as an opportunity to make real change. However, Americans are also feeling uncertain about their current money situations, with some struggling or in crisis. In fact, the data show that the country is split in half on many money topics and scenarios, including the number of those living paycheck to paycheck.

The final edition of The State of Personal Finance for 2025 will look over some of the key data points assessing where Americans are with money—as well as what perceptions Americans have about it, both true and false.

Executive Summary

- When asked what one word best describes their financial outlook for 2026, 32% of U.S. adults chose hopeful and 26% chose confident.

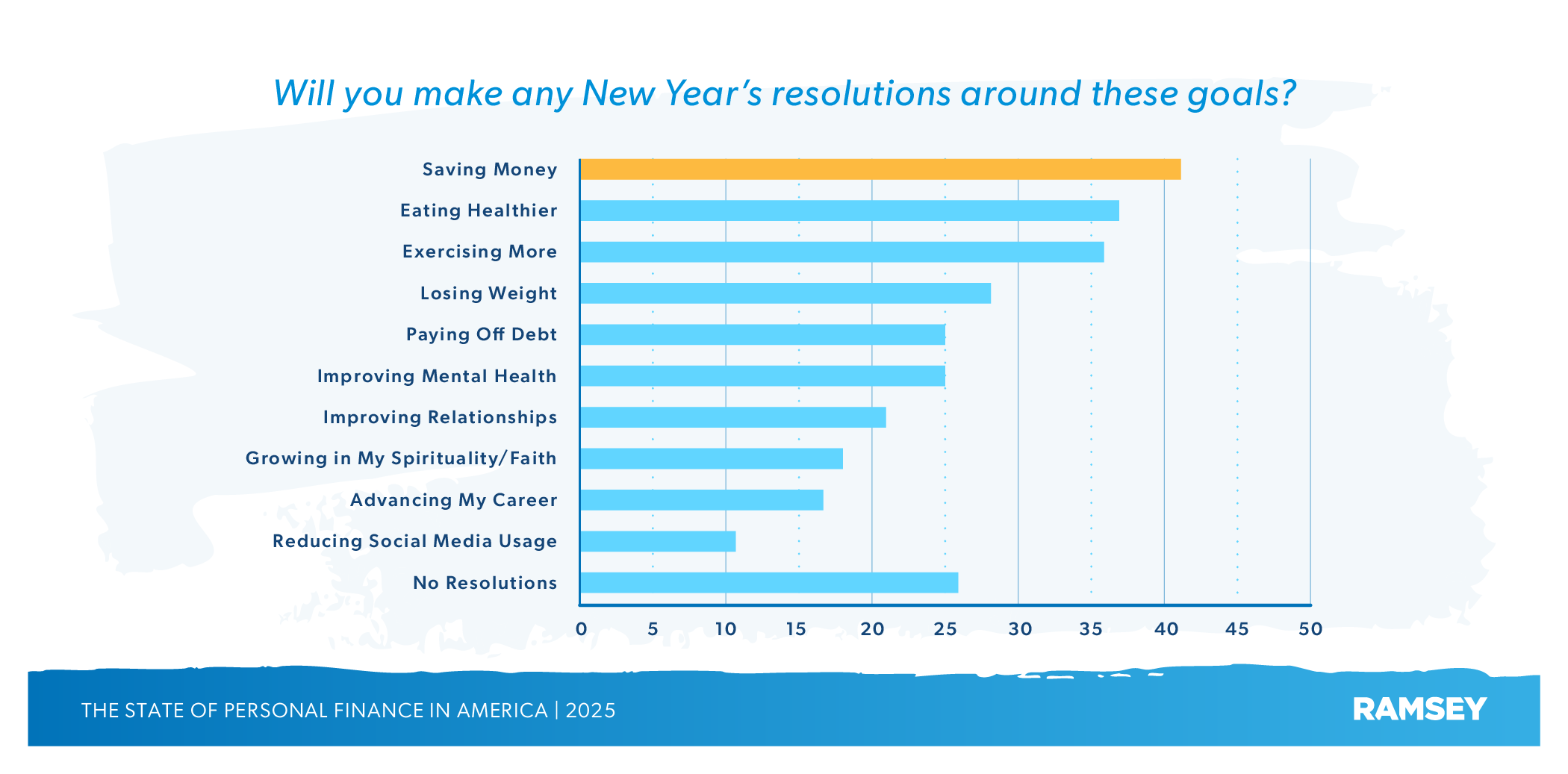

- The top New Year’s resolution for 2026 is saving money, edging out other common resolutions like eating healthier, exercising and losing weight.

- 55% of U.S. adults say they plan on saving more money in 2026, and 1 in 4 plan to do more charitable giving.

- A supermajority of Americans (79%) is at least somewhat optimistic about their financial future.

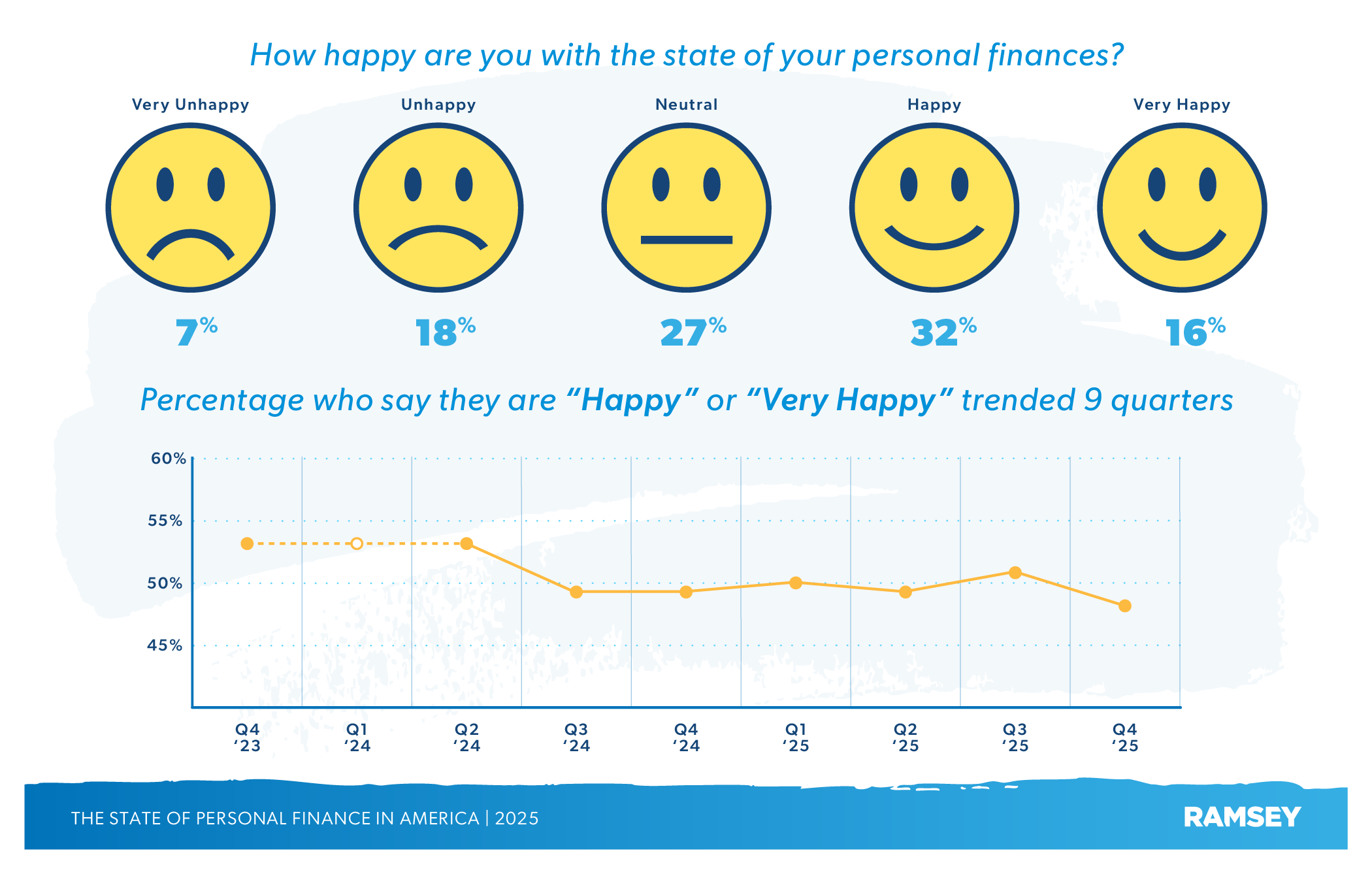

- Just under half of Americans (48%) say they are “happy” or “very happy” with the current state of their personal finances.

- 20% of Americans feel like they’re getting ahead with their money, but 35% report they feel trapped in a cycle of debt.

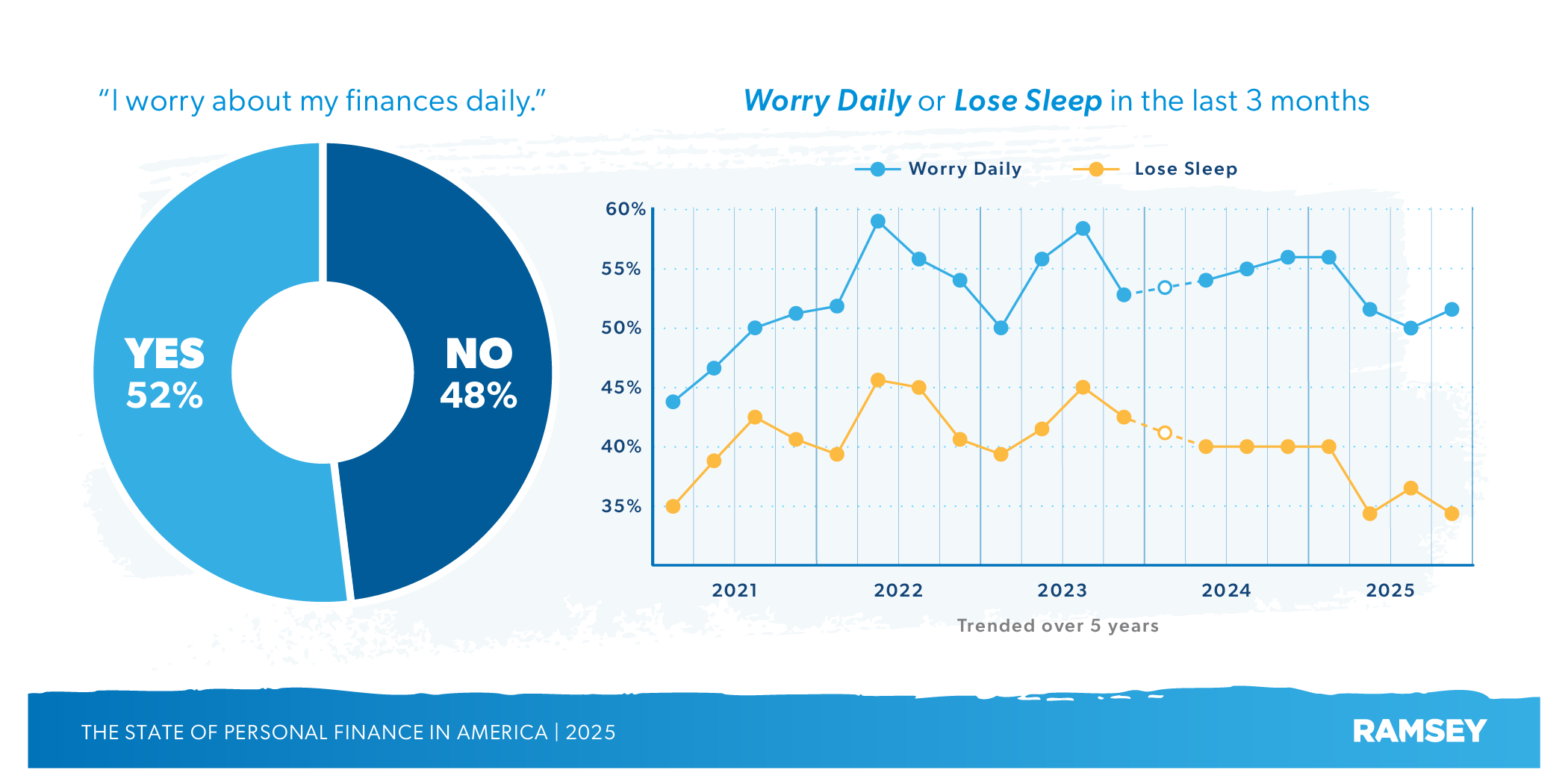

- About half of U.S. adults (52%) worry daily about their finances.

- 1 in 3 Americans (34%) say they have lost sleep in the past three months over their money worries—the lowest number in five years.

- 34% of Americans (88 million U.S. adults) say they are struggling or in crisis with their finances.

- A little over a third of Americans (38%) say they spent more than they planned last month.

- Half of Americans (51%) are living paycheck to paycheck.

- Only 45% of Americans are “very confident” they could handle a $1,000 emergency expense, like a car repair.

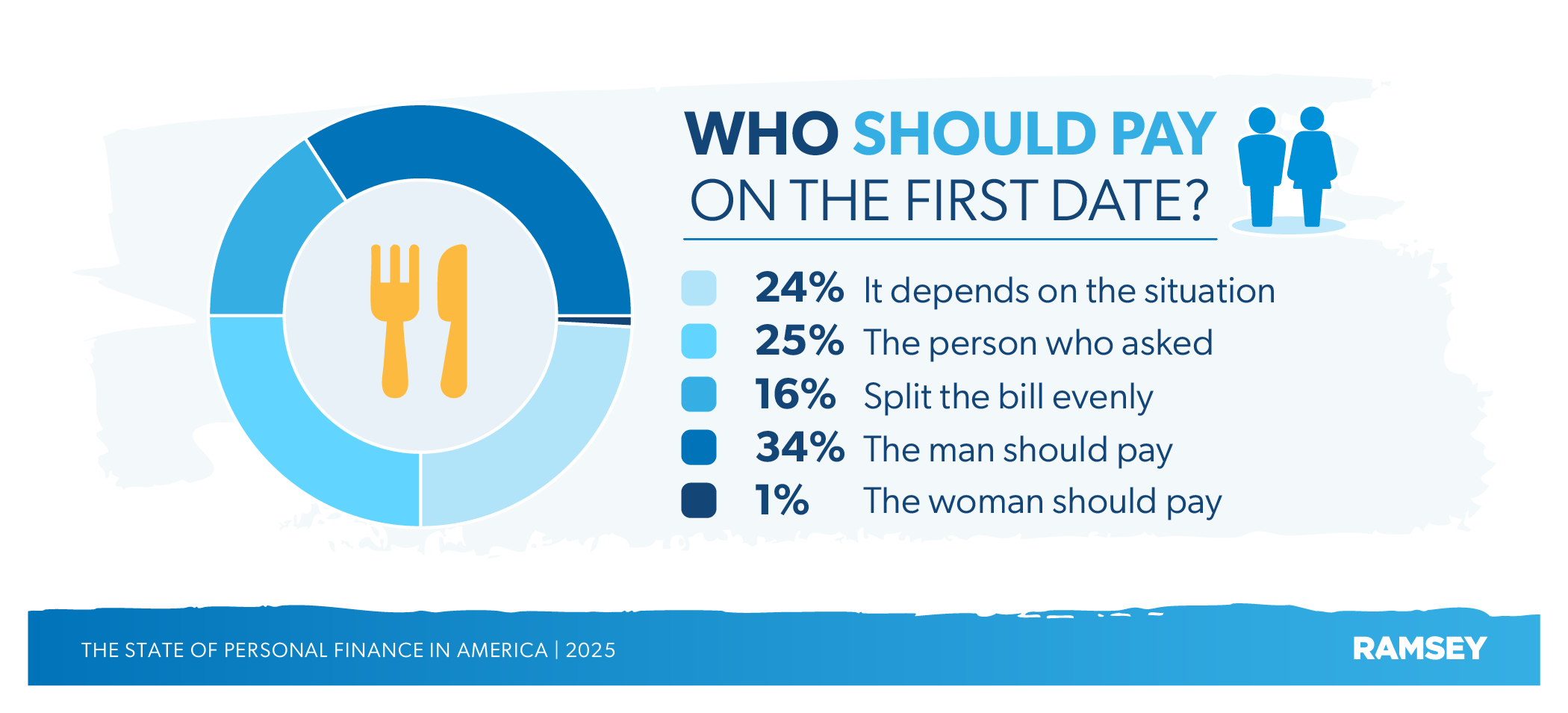

- 34% of Americans believe that the man should pay for dinner on a first date, followed by 25% believing the person who asked for the date should pay and 24% believing “it depends.”

- When asked if they would rather have a partner who is romantic but bad with money or financially stable but not very exciting, 63% of Americans went with the latter.

- Just over half of married couples (56%) report they never had a serious conversation about money before getting married.

Download a PDF version of the report.

Americans Are Looking at 2026 With Optimism

As one year ends and another begins, many people see the transition as an opportunity to make things better—a chance to start over and work on real, lasting personal improvement. And at the end of 2025, most Americans appeared to be generally optimistic about 2026. When asked what one word best describes their financial outlook for the new year, 32% of Americans chose hopeful, followed by 26% choosing confident.

Making resolutions has been the traditional way of setting goals for the new year (though a quarter of Americans say they don’t make resolutions), and saving money was the most common resolution made for the second year in a row (41%)—edging out staple resolutions like eating healthier (37%), exercising more (36%) and losing weight (28%). Regardless of whether they made a resolution or not, 55% of Americans overall say they plan on saving more money in 2026. And 1 in 4 plan to increase their charitable giving.

Resolutions aside, a supermajority of Americans (79%) is at least somewhat optimistic about their financial future. Millennials were the most optimistic of any demographic measured (52%). In addition, 63% of Americans say they’re hopeful they’ll achieve their financial goals one day.

Half of Americans Remain Satisfied With Their Personal Finances

There may be optimism about 2026, but only half of Americans (48%) say they are “happy” or “very happy” with the state of their personal finances. These numbers have remained statistically unchanged since Q4 of 2023.

Demographically, males and Gen Z saw the largest drop in people satisfied with their personal finances—62 to 55% and 55 to 41%, respectively. And married people were more likely to be happy with their finances compared to singles (61% vs. 37%).

Compared to where they were a year ago, only 26% of Americans say they are better off financially today. That’s down from the data’s peak in 2021 (36%) but up from the low seen in 2022 (21%). Those under 45 years old are more likely to say they are better off today than a year ago—though the numbers are still well under 50% (31% of millennials and 28% of Gen Z).

Though half of Americans are satisfied with their financial situation, many more feel trapped and not able to make real progress with their money—like they’re caught on a hamster wheel, running and running, but going nowhere. And 35% report they feel trapped in a cycle of debt. Only 20% of Americans feel like they’re getting ahead with their money.

Worries and Struggles With Money Stay Steady

Mirroring the data on financial satisfaction, about half of Americans (52%) worry daily about their finances. That datapoint has stayed steady, remaining in the 50% range since the last quarter of 2023.

One in 3 Americans (34%) say they’ve lost sleep in the past three months over their money worries. But on the positive side, the number of Americans losing sleep over money is now the lowest it’s been in five years.

Though most of the data points about money worries have trended right down the middle, it’s interesting that just 34% of Americans say they’re actually struggling or in crisis with their finances—the same percentage of Americans losing sleep (which often go hand in hand). And like the previously

mentioned points, that number has remained steady across six quarters. Getting more granular, women are more likely to say they were struggling financially, as are Gen Xers.

Overspending—whether it’s intentional or not—can be a source of money anxiety. A little over a third of Americans (38%) say they spent more than they planned in the last month, which also correlates with the number of those struggling or in crisis. However, just about half (46%) say they spent what they had actually planned.

Debt is another cause of money anxiety. Because debt prevents people from using their income to save and build wealth, it’s no surprise that Americans with debt are twice as likely to be struggling as those who are debt-free.

If you’ve got a shaky financial foundation, life will feel uncertain, especially if you have difficulty providing the basics of life—what we call the Four Walls: food, utilities, shelter and transportation. Just under half of U.S. adults (45%) report some difficulty paying bills, with 37% having difficulty providing food and 1 in 3 saying they paid a bill late in the last three months.

Breaking it down further, Gen Z has the most trouble with bills (65%), half of millennials (54%) have paid a bill late, and Americans with kids in the home struggle more with bills than those without kids (57% vs. 41%).

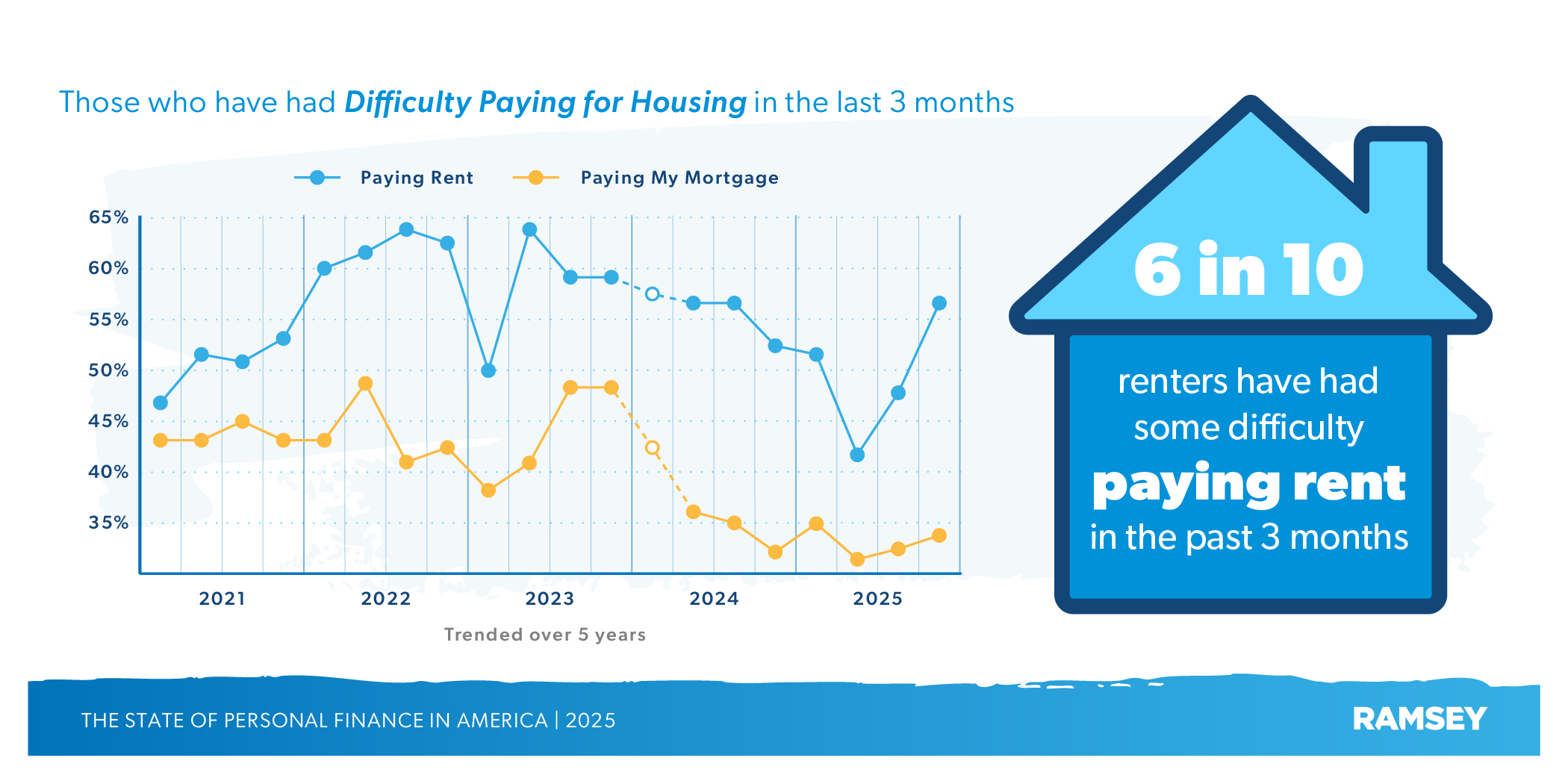

Zeroing in on housing specifically, the situation looks more concerning. Nearly 6 in 10 renters (57%) say they’ve had some difficulty making rent in the past three months—a 15-point leap over the past two quarters.

Not being able to pay basic bills or afford rent can be a consequence of living paycheck to paycheck. The money disappears as soon as it’s earned with virtually nothing left over, leaving you one missed paycheck away from disaster. And half of Americans (51%) are living that way—continuing the trend of evenly split datapoints.

The younger generations are having the worst time in the bills category, with 63% of millennials and 67% of Gen Z saying they live paycheck to paycheck.

If you’re living paycheck to paycheck, one emergency could land you in a tight spot—be it a broken water heater, a car repair, a hospital stay or another sudden expense. Yet, only 45% of Americans are “very confident” they could handle a $1,000 emergency expense.

Perception Is a Key Factor in Money Issues

While financial realities can be scary and difficult to deal with, perception and behavior can sometimes make things seem worse than they are. Americans have seen a rise in prices and the cost of living over the last five years, thanks to unprecedented amounts of inflation. But as things have started to normalize, some negative perceptions have remained.

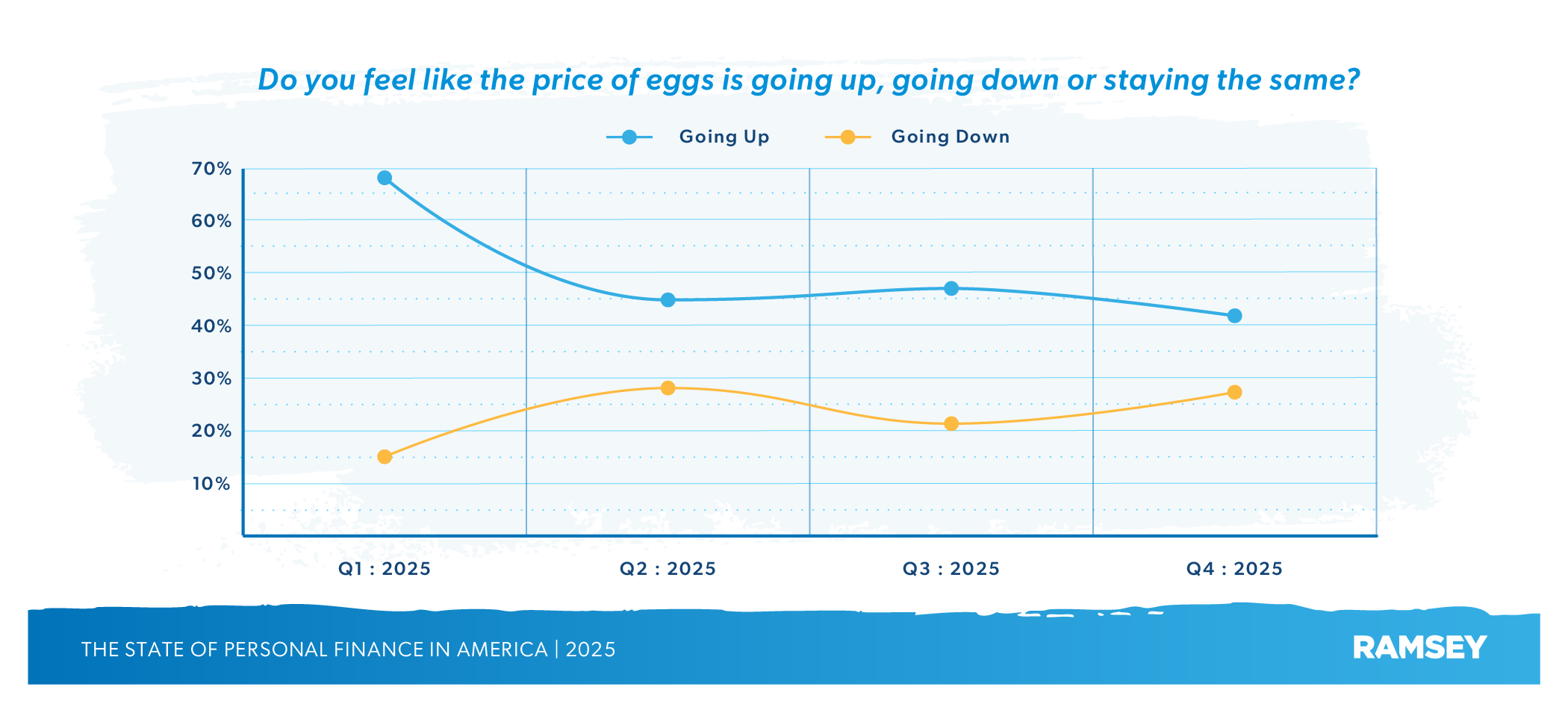

The price of eggs is a popular gauge of how the public perceives inflation. The media and politicians have used eggs as a political football, basing the success or failure of Washington policies on the price of a dozen eggs.

Since the start of 2025, the percentage of Americans who say the price of eggs is “going down” has risen from 15% to 27%—and they’re right. According to the Bureau of Labor Statistics, the price of a dozen eggs has actually fallen by over 50% from $6.23 in March 2025 to $3.49 in September.1

Perceptions about taxes can also be skewed and clouded. Due to the sheer volume of regulations and laws in the U.S. tax code, taxes can be confusing and frustrating (32% of Americans say they don’t look forward to filing), leading to misunderstanding about what Americans pay (or don’t pay) in taxes.

For example, a quarter of Americans (24%) don’t know the standard deduction is changing on 2025 tax returns, and another 40% aren’t sure—even though the standard deduction changes just about every year.

But not all perceptions are off. Just over half of Americans (53%) say $1 million is enough to retire on. This is actually true—so long as you plan carefully and have a solid investing strategy (which is why it’s important to work with a financial advisor both before and after retirement). It also depends on where you plan on living out your retirement, as your dollars can go further in some parts of the country than in others.

Money Is an Important Part of Relationships

Money is something that impacts our lives every day in many ways—especially in our most intimate relationships. It seems like money comes into play at every stage of a romantic relationship, and Americans are more aware of that fact in some stages than others.

Money even comes up on the first date. And it appears that chivalry isn’t dead in America, as 34% of U.S. adults believe that the man should pay for dinner on a first date. However, some Americans believe the person who asked for the date should pay (25%) and some think “it depends” (24%). Only 1% said that the woman should pay.

Money is definitely a factor in deciding if someone is right to date or marry. When asked if they would rather have a partner who is romantic but bad with money or financially stable but not very exciting, 63% of Americans went with the latter. A majority of both men and women chose financially stable—though the point difference was wide, as women are much more likely to choose financial stability over romance (54% of men and 73% of women).

Ironically, once the relationship gets into serious territory, talk of money doesn’t happen for many people. Just over half of married couples (56%) report they never had a serious conversation about money before getting married. Communication about money is extremely important if a marriage

is going to be successful. In fact, married U.S. adults who rated their marriages as “great” were more likely to have had conversations about money before saying “I do.”

Conclusion

Americans remain mostly split down the middle on their perceptions of personal finance, and the numbers have been continuing along that path for some time. But the American people are nothing if not optimistic and are looking forward to the new year, despite some of the money challenges they face.

That hope and optimism are extremely important if any real, lasting improvement is going to be made. Winning with money is 80% behavior and 20% head knowledge. You have to believe you can do it and have a vision of where you want to go.

Many people may think that when times are tough, you can’t get ahead—but you absolutely can . . . if you’re willing to work at it. They key to success is having a plan and sticking to it. Get on a budget. Pay off debt. Say no to things you can’t afford. It might not be glamorous or flashy in the short term (you’ll need to make sacrifices), but it’ll set you up for future success.

About the Study

The State of Personal Finance is a quarterly research study conducted by Ramsey Solutions to gain an understanding of the personal finance behaviors and attitudes of Americans. The nationally representative sample of 1,005 U.S. adults was fielded from December 12–17, 2025, using a third-party research panel. Margin of error was ±3.08%.

Since January of 2021, The State of Personal Finance has surveyed over 19,000 U.S. adults. Research from the study has been shared on hundreds of media outlets, including Forbes, Fox News Channel, The New York Times and Good Morning America.