Personal Finance for Your State!

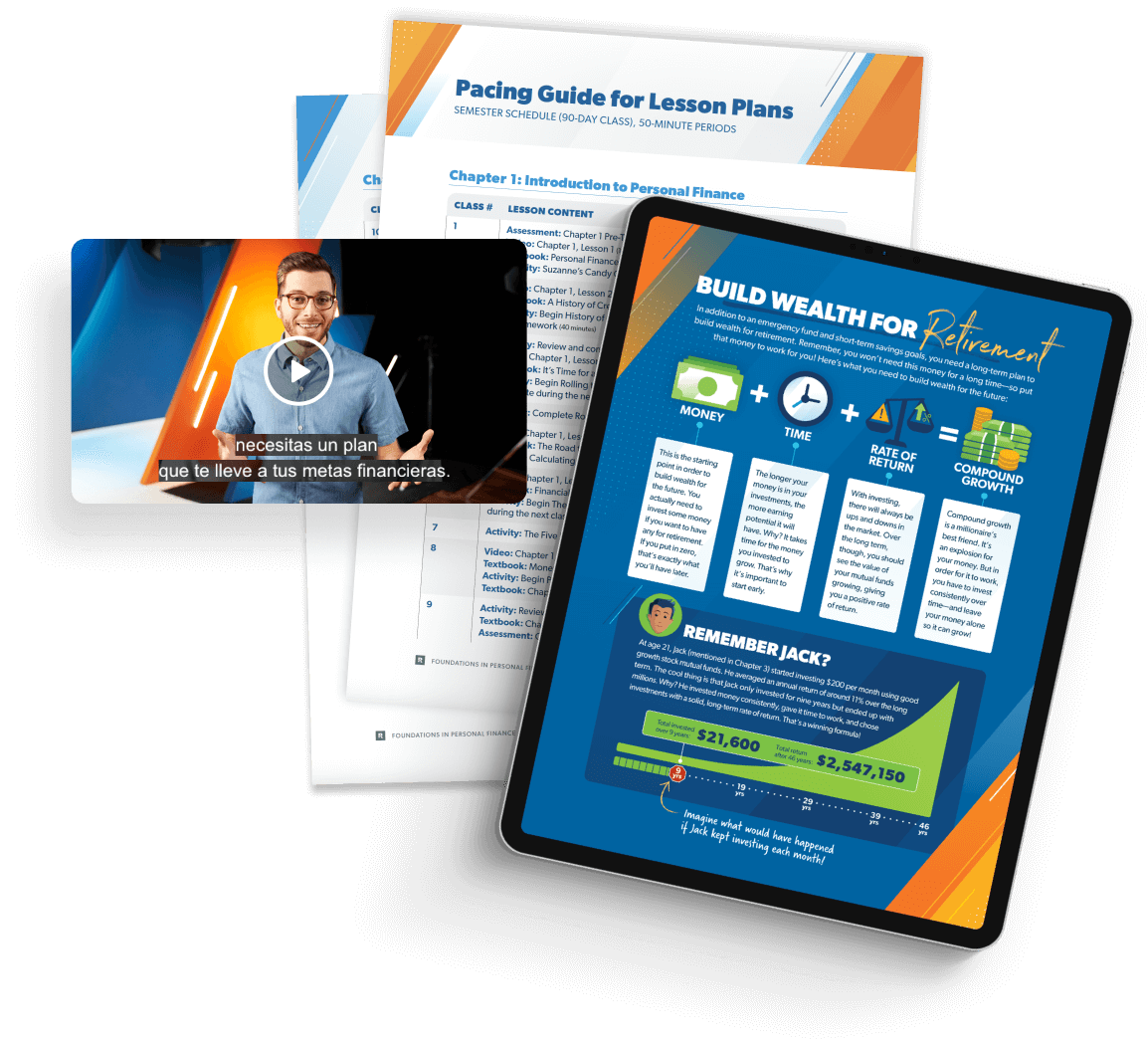

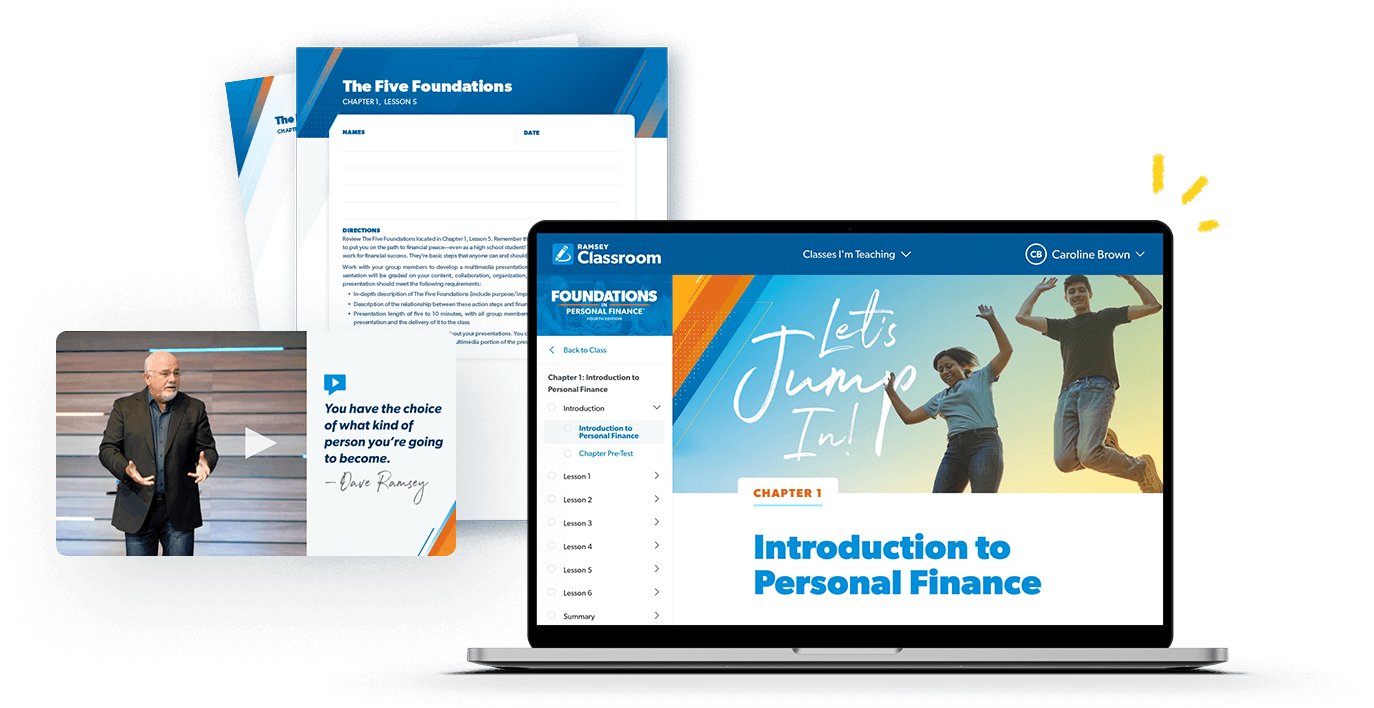

Provide hope, confidence and life-change with Foundations in Personal Finance, a high school curriculum that meets your state standards.

Florida educators, start here. Texas educators, start here.

Schedule a Demo Today

We look forward to connecting with you soon!

Life-Change in Action: Watch the Case Study

See how students in Texas are breaking the cycle of poverty and taking control of their financial future.

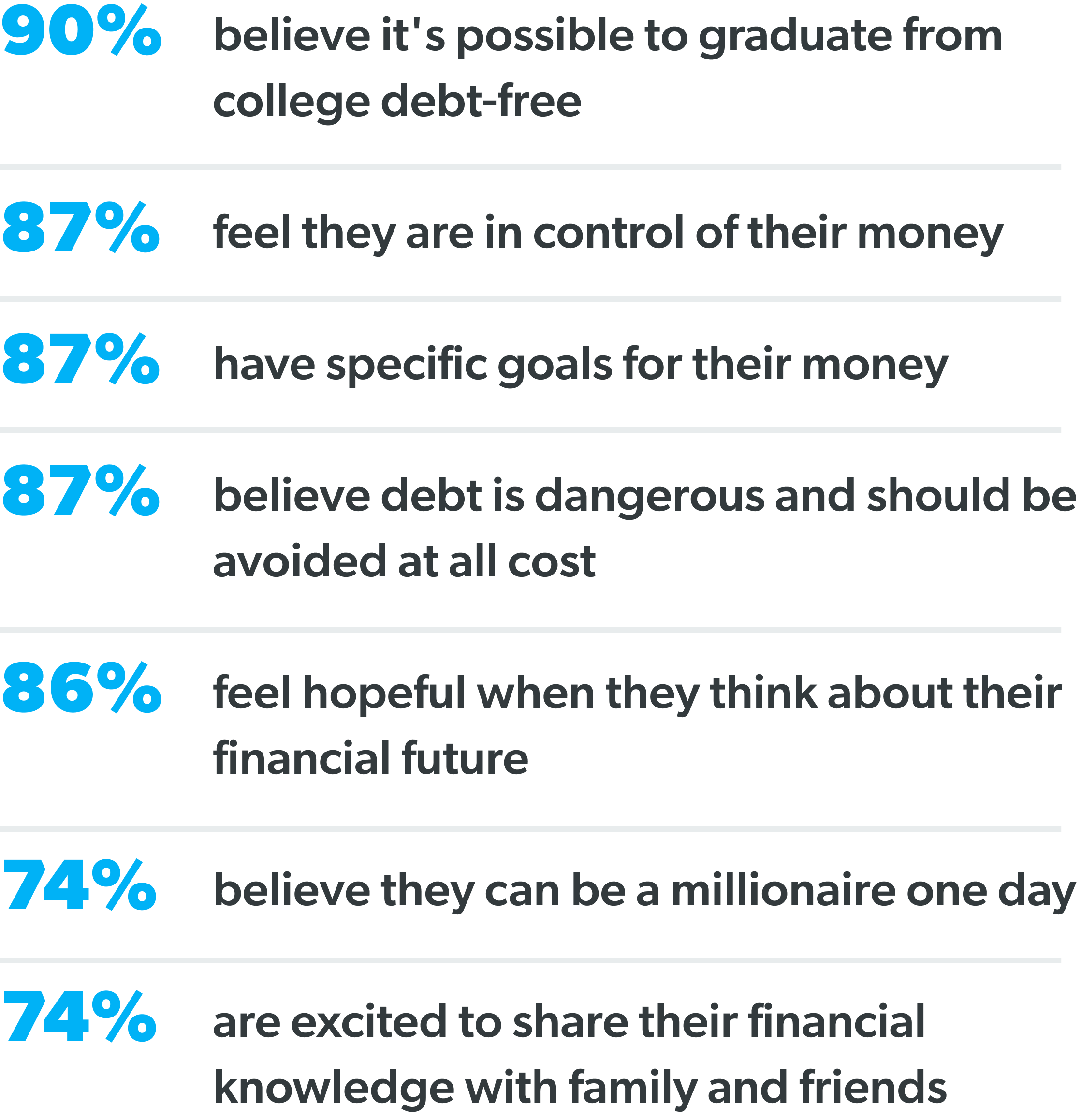

In a survey of 3,851 students who took a Foundations in Personal Finance course:

Source: The Ramsey Education Curriculum Effectiveness Survey, 2023

Try Foundations Today—for Free

Test-drive the curriculum with a free trial of Chapter 1—including reading content, video lessons and classroom activities.

We're Here to Help

Get tools and support to help you win in the classroom.

-

Curriculum support and training

-

Help center

-

Professional development

Explore More Curriculum Options

Entrepreneurship

Teach your students how to start and run their own business with Foundations in Entrepreneurship.

Higher Education

Bring our college-level personal finance curriculum and resources to your campus.

Table of Contents

The Foundations in Personal Finance high school curriculum consists of 13 chapters of essential personal finance principles like how to budget, save, avoid debt, invest, be a wise consumer and much more!

Personal Finance

-

Chapter 1: Introduction to Personal Finance

-

Introduces the topic of personal finance, explores the evolution of credit and consumerism in America, and highlights the importance of both knowledge and behavior when it comes to managing money.

- Lesson 1: Personal Finance and You

- Lesson 2: A History of Credit and Debt

- Lesson 3: It’s Time for a Change

- Lesson 4: The Road to Financial Success

- Lesson 5: Financial Literacy

- Lesson 6: Money Personalities and Relationships

-

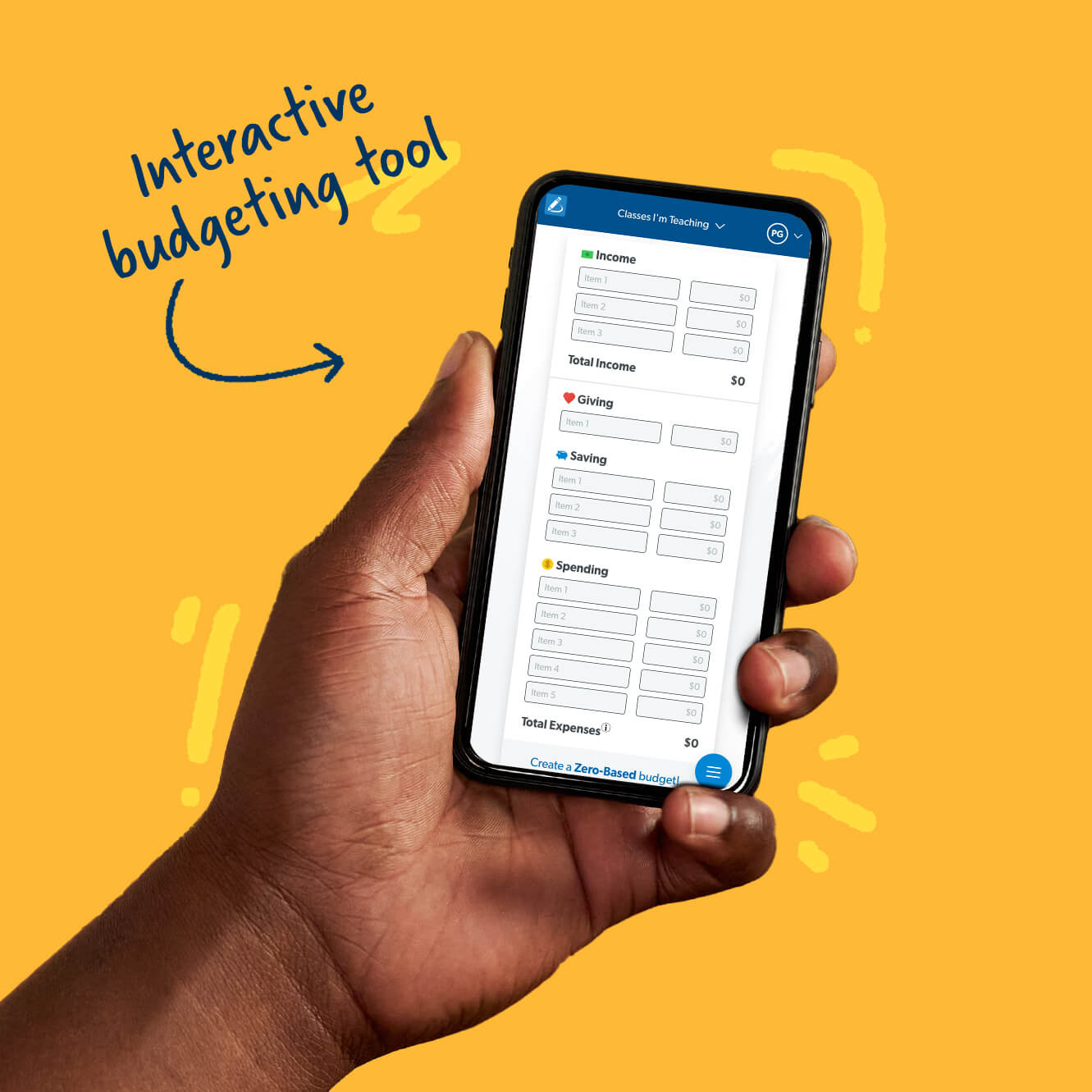

Chapter 2: Budgeting Basics

-

Dives into why budgeting is key to taking control of money—and how students can get started right now.

- Lesson 1: The Benefits of Budgeting

- Lesson 2: Components of a Budget

- Lesson 3: Building a Zero-Based Budget

- Lesson 4: Tracking Your Expenses

- Lesson 5: Make Budgeting a Habit

- Lesson 6: Relationships and Budgeting

-

Chapter 3: Saving Money

-

Emphasizes the importance of saving and explains three reasons why students should save money: emergencies, large purchases, and wealth building.

- Lesson 1: Saving Money Takes Discipline

- Lesson 2: Three Basic Reasons to Save

- Lesson 3: Saving for Emergencies

- Lesson 4: Saving for Large Purchases

- Lesson 5: Building Wealth

- Lesson 6: Compound Interest and Growth

-

Chapter 4: Credit and Debt

-

Identifies the dangers of debt, debunks some credit myths, explains the credit report and score, and provides practical strategies to get out of debt—and stay out.

- Lesson 1: Beware of Credit and Debt

- Lesson 2: Sources and Types of Credit

- Lesson 3: Credit Scores and Credit Reports

- Lesson 4: The Truth About Credit Cards

- Lesson 5: The Truth About Car Loans

- Lesson 6: Getting and Staying Out of Debt

-

Chapter 5: Consumer Awareness

-

Highlights the importance of being a smart consumer as part of a healthy financial plan, explains strategies to manage spending behavior, exposes common consumer scams, and identifies consumer rights.

- Lesson 1: The Psychology of Sales

- Lesson 2: Buyer Beware

- Lesson 3: The Marketing Machine

- Lesson 4: Becoming a Smart Spender

- Lesson 5: Protecting Yourself as a Consumer

- Lesson 6: Your Spending Behavior

-

Chapter 6: Career Readiness

-

Examines how students can find the right career path and create strategies to land a job they’ll love so they can thrive and enjoy their work. They’ll also discover tips for building a resumé and presenting themselves well during a job interview.

- Lesson 1: Work Matters

- Lesson 2: Resumé and Interview Basics

- Lesson 3: An Entrepreneurial Mindset

- Lesson 4: The Path to Your Dream Job

- Lesson 5: Exploring Career Options

- Lesson 6: Be a Lifelong Learner

-

Chapter 7: College Planning

-

Explores the variety of educational options available after high school, highlights the dangers of student loans, and explains how students can pay cash for college and avoid student loan debt.

- Lesson 1: The Path to Intentionality

- Lesson 2: Explore Your Options

- Lesson 3: Consider the Cost

- Lesson 4: Reduce Your Cost

- Lesson 5: Build Your College Resume

- Lesson 6: Maximize Your Investment

-

Chapter 8: Financial Services

-

Explores the services provided by banks and credit unions, including the different options and features. Students will learn about responsible banking, how to manage their accounts, and the importance of keeping records.

- Lesson 1: The Purpose of Banks

- Lesson 2: Types of Financial Institutions

- Lesson 3: Your Bank Accounts

- Lesson 4: Responsible Banking

-

Chapter 9: The Role of Insurance

-

Breaks down the purpose of insurance, explains how insurance works, shows how insurance protects a person’s assets, and highlights the eight basic types of insurance everyone needs to have in place.

- Lesson 1: Insurance Is Important

- Lesson 2: Auto Insurance

- Lesson 3: Homeowners and Renters Insurance

- Lesson 4: Health Insurance

- Lesson 5: Life Insurance

- Lesson 6: Other Types of Insurances

-

Chapter 10: Income and Taxes

-

Digs into a huge reality in life: If someone earns an income, they’re going to pay taxes. This chapter also breaks down the basics of different types of taxes—like sales, excise, and federal taxes—including how they impact a person’s income and spending.

- Lesson 1: What Happened to My Money?

- Lesson 2: Taxes on Your Paycheck

- Lesson 3: Income Tax Basics

- Lesson 4: Filing Your Income Taxes

- Lesson 5: Taxes on Other Types of Income

- Lesson 6: Taxes on Things You Buy

-

Chapter 11: Housing and Real Estate

-

Identifies the differences between renting and homeownership. Students will discover the financial costs related to having their own place to live, and they’ll learn what to do when they’re ready to buy a house.

- Lesson 1: Living on Your Own

- Lesson 2: Renting vs. Owning

- Lesson 3: Renting 101

- Lesson 4: Buying a House

-

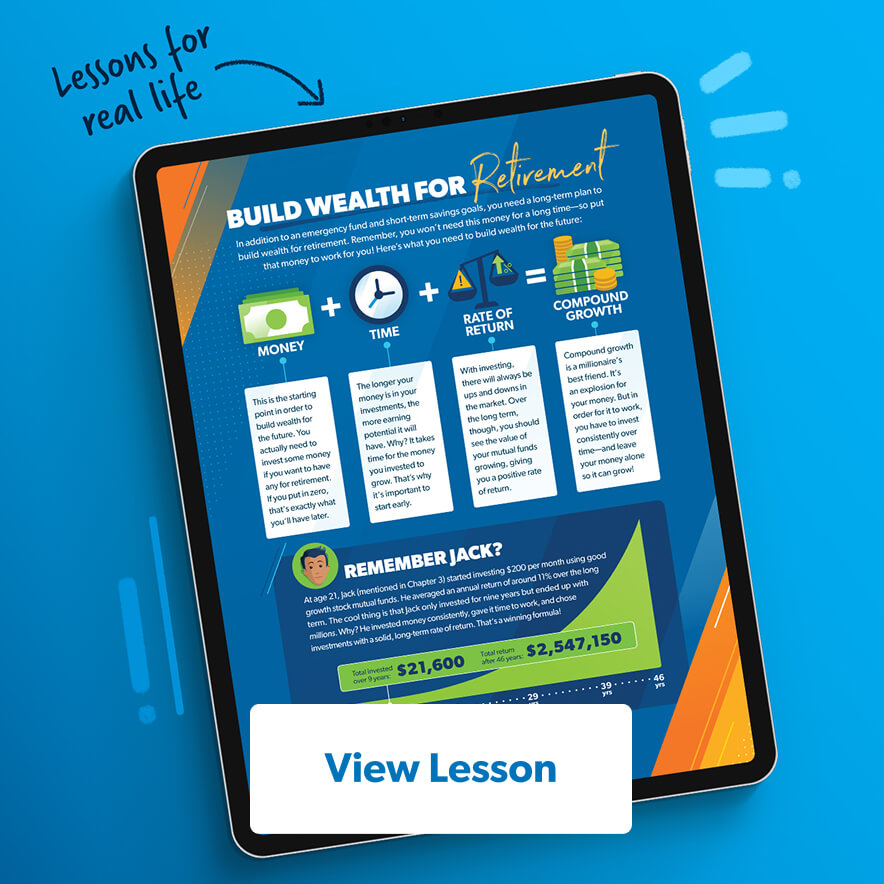

Chapter 12: Investing and Retirement

-

Dives into the basics of preparing for retirement, investing for the future by understanding the stock market and mutual funds, and planning to live a life bursting with generosity.

- Lesson 1: Money for the Future

- Lesson 2: Understanding Investments

- Lesson 3: Investing Through Retirement Plans

- Lesson 4: Protecting Your Investments

- Lesson 5: Planning for Retirement

- Lesson 6: Outrageous Generosity

-

Chapter 13: Global Economics

-

Examines how the global economy impacts personal financial decisions and how different global economic systems influence decisions about goods and services that are used around the world.

- Lesson 1: Macroeconomics and Global Activity

- Lesson 2: Economic Systems

- Lesson 3: The U.S. Economy

- Lesson 4: Thinking Globally

Frequently Asked Questions

-

How do I get a quote?

-

Simply fill out the form above and our team will reach out. You can then request a quote and our team will provide you with one based on your class size and student needs.

-

Does Foundations in Personal Finance support online or virtual learning?

-

Yes! Foundations in Personal Finance is available in a fully digital option, as well as a print and streaming option. No matter what delivery method you choose, a printed Teachers Guide is availabe for purchase.

-

Can Foundations be translated to other languages?

-

Yes! Foundations in Personal Finance includes Spanish closed captions and transcriptions for all videos, downloadable student textbook PDFs, student activities and chapter assessments in PDFs, and parent resources. Our digital platform works with popular web browser plugins like Google Translate to help other non-English speaking students translate text and read content aloud in languages like Haitian, Haitian Creole, Portuguese and many more.

-

Does Foundations in Personal Finance support differentiated learning?

-

Yes! We have extended learning prompts specifically for differentiated learning in the Teacher Guide.

-

How long does it take to teach Foundations?

-

Foundations is designed as a semester-long course with stand-alone chapters. We provide you with flexible pacing guides that you can choose from, but if you don’t need a full semester course, the stand-alone chapters allow you to make the course fit your schedule—not the other way around.

-

How many schools have used Foundations?

-

More than 45% of schools across the country have used the Foundations curriculum. This means more than 7 million students have learned how to budget, save, spend wisely and invest. It’s a generation equipped to live out their dreams and give to the world around them.

Don't see what you're looking for? Contact your curriculum advisor at 615-843-9439.

State and National

Standards Correlations

The Foundations in Personal Finance curriculum meets or exceeds standards in all 50 states. The curriculum also meets all national standards for personal finance.

National Jump$tart

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida Personal Finance and Money Management

Florida Economics and Personal Finance

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Texas Proc '24

Utah

Vermont

Virginia

Washington

West Virginia

Wisconsin

Wyoming