We offer homeschool courses designed to equip teens with practical skills in personal finance, career readiness, and entrepreneurship.

We offer homeschool courses designed to equip teens with practical skills in personal finance, career readiness, and entrepreneurship.

Homeschool Curriculum

Grades 8–12

Personal Finance

By teaching your students wise money habits early, you'll change their lives forever. Give your teen the practical tools and behavior change that will set them up for a lifetime of financial peace!

Career

This course is designed to give your teens the tools they’ll need to uncover careers where they'll find success and fulfillment. Includes access to Ken Coleman's Get Clear Assessment for Students.

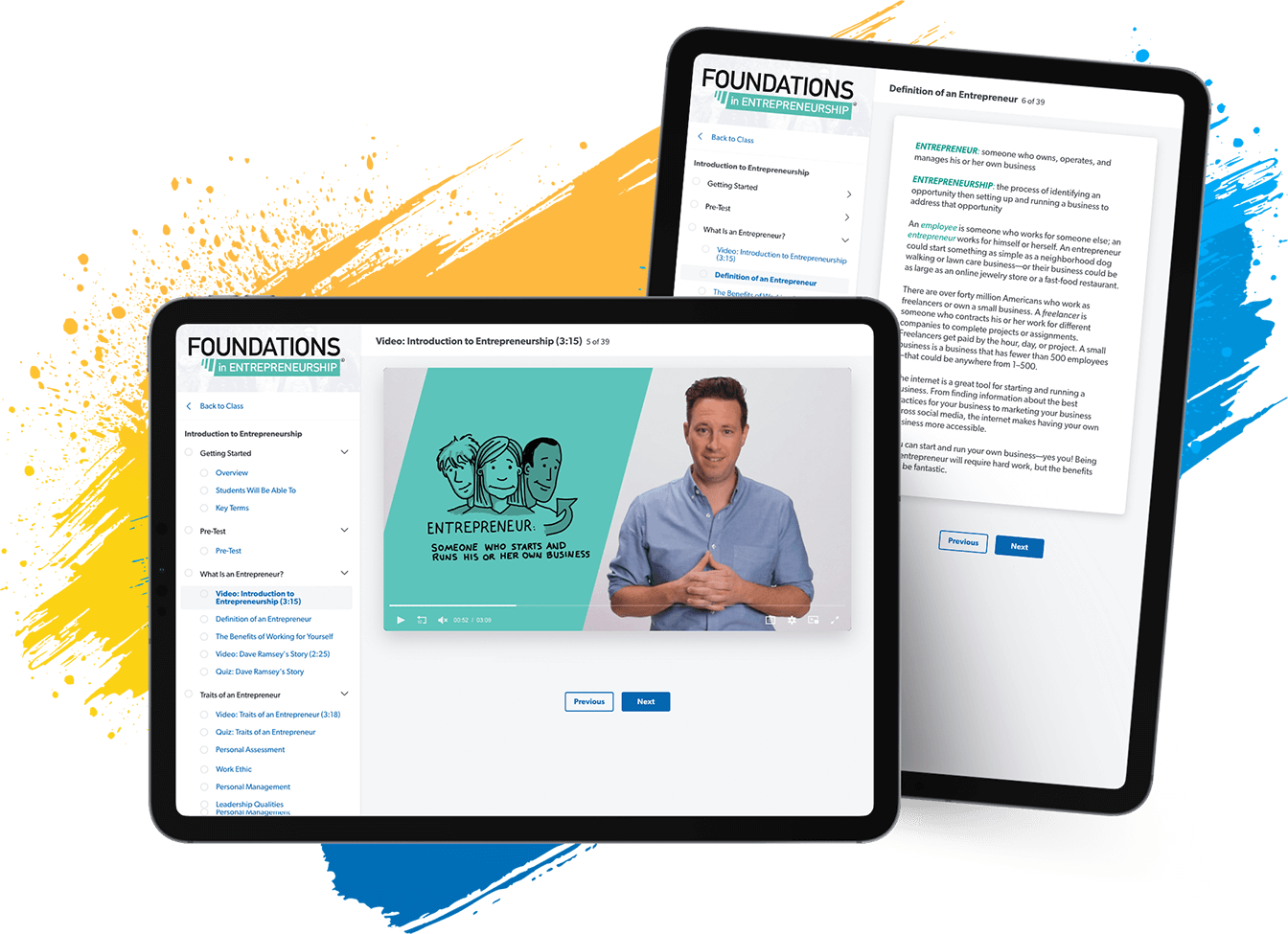

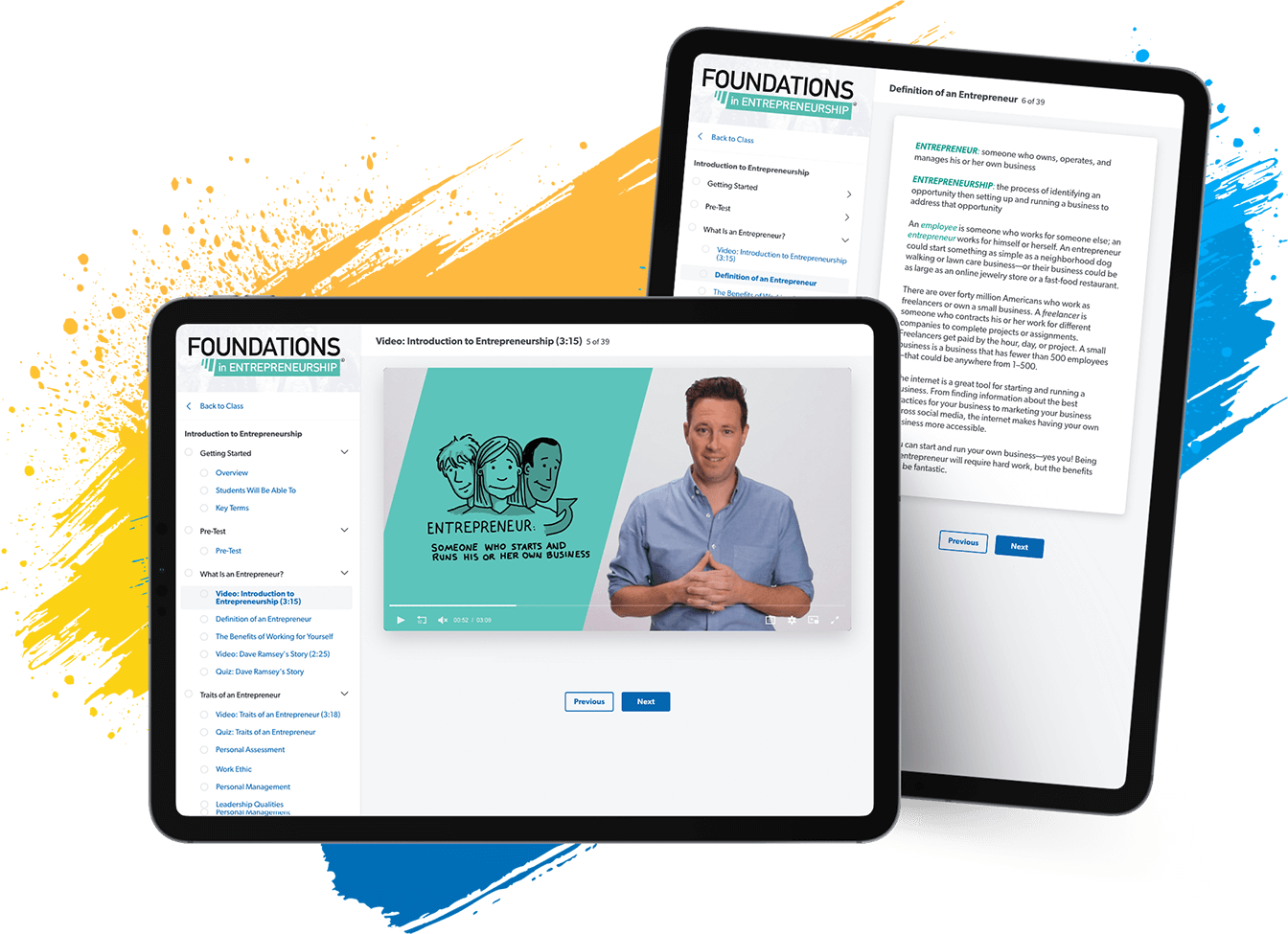

Entrepreneurship

The curriculum teaches an entrepreneurial mindset and covers essential business topics and allows the opportunity to develop a business idea through project-based learning.

Homeschool Curriculum

Grades 8–12

Personal Finance

By teaching your students wise money habits early, you'll change their lives forever. Give your teen the practical tools and behavior change that will set them up for a lifetime of financial peace!

Career

This course is designed to give your teens the tools they’ll need to uncover careers where they'll find success and fulfillment. Includes access to Ken Coleman's Get Clear Assessment for Students.

Entrepreneurship

The curriculum teaches an entrepreneurial mindset and covers essential business topics and allows the opportunity to develop a business idea through project-based learning.

Your teens will learn the money skills they’ll use now and for the rest of their lives so they’ll have a solid foundation when they’re out on their own.

- Independent Study learning options

- Teacher resources

- Devotionals, and more!

Available formats: Fully Digital, Print + Streaming

This course will guide your teen through four specific stages that’ll help them stand out in the job market.

- 4 modules covering 16 lessons

- Activities with real world application

- Get Clear Career Assessment for Students

- Teacher resources and more!

With help from Dave Ramsey and his team of experts, your teen will learn essential business skills like management, communication, finance, HR, marketing and more.

- Fully digital content

- Auto-graded assessments

- Video lessons

- Activities and more!

Your teens will learn the money skills they’ll use now and for the rest of their lives so they’ll have a solid foundation when they’re out on their own.

- Independent Study learning options

- Teacher resources

- Devotionals, and more!

This course will guide your teen through four specific stages that’ll help them stand out in the job market.

- 4 modules covering 16 lessons

- Activities with real world application

- Get Clear Career Assessment for Students

- Teacher resources and more!

With help from Dave Ramsey and his team of experts, your teen will learn essential business skills like management, communication, finance, HR, marketing and more.

- Fully digital content

- Auto-graded assessments

- Video lessons

- Activities and more!

Thank you for your interest!

This course is currently in development and we hope to make it available soon. Check back here for updates.

Module 1: Work

The Super Red Racer: The Reward of Working

Module 2: Giving

The Big Birthday Surprise: The Joy of Giving

Module 3: Budgeting and Spending

Careless at the Carnival: The Guide to Spending

Module 4: Saving

My Fantastic Field Trip: The Importance of Saving

Download Samples

Take a peek into Foundations in Personal Finance with our free sample downloads!

Download Samples

Take a peek into Foundations in Career Discovery with our free sample downloads!

Download Samples

Take a peek into Foundations in Entrepreneurship with our free sample downloads!

Frequently Asked Questions for Parents

-

What’s the difference between the homeschool and classroom versions?

-

The core video lessons and textbook content (digital and print) are the same for both versions of Foundations in Personal Finance (FIPF).

Here’s how it all breaks down:FIPF Homeschool (for home use)

- Typically used at home for individual learning and is self-guided

- Includes 26 activities designed for individual students

- Uses a shared family account (the parent and student sign in using the same email and password, so keep this in mind if you're part of a co-op evaluating the materials)

- The parent/instructor purchases full curriculum access, including teacher resources, online videos, and more

- Includes devotionals to support a deeper study of the biblical perspective on finances, along with Family Table Talk prompts

FIPF Homeschool (for co-op use)

- If you’re an instructor for a homeschool co-op but want students to complete coursework at home and come together weekly for discussion, each family must purchase the full course ($89.99) for the first student and a sibling add-on ($29.99) for each additional child. This setup gives each student their own profile within the parent account.

- If your co-op plans to watch the curriculum videos together in person with the students following along in their textbooks (without students having online access), the instructor should purchase the full homeschool product for access to the videos and resources, with a $29.99 add-on book for each student.

- You can stream videos during group sessions and students can follow along using their textbooks. This model works well for many co-ops and small groups, but the add-on doesn’t give individual online access to the students, only through an activated parent/teacher account.

FIPF for the Classroom

- Typically used in a traditional classroom setting and is teacher guided

- Includes 72 activities, many of which are designed for groups

- The teacher has their own account with individual student logins

- The Ramsey Classroom platform allows students to have their own logins and provides teachers with greater control over class content, the grading of students’ work, and the management of student accounts

- Provides a printed student textbook for each student, which serves as a valuable long-term resource that students can keep

- Devotionals are not included but can be provided upon request

View sample content and learn more about the homeschool curriculum.

-

How long does it take to teach the curriculum?

-

Foundations in Personal Finance (FIPF) is designed to be flexible and can be completed as a semester-long course or as a year-long course with stand-alone chapters.

FIPF Classroom

- Includes 45-, 90-, and 180-day pacing guides

FIPF Homeschool

- Usually completed in a semester at a one chapter per week pace

- Includes a 39-week pacing guide

-

How much parent involvement is required?

-

- Foundations in Personal Finance for homeschool is designed to be self-guided, allowing parents to be involved as much or as little as they choose. Students can work through each part of the course on their own. They can take chapter pre-tests, watch video lessons, fill out the guided notes, read chapters, complete journal entries, and do all the activities independently.

- We highly recommend that parents actively teach or go through the material with their student to help them get the most out of the course.

- Foundations in Personal Finance for homeschool is designed to be self-guided, allowing parents to be involved as much or as little as they choose. Students can work through each part of the course on their own. They can take chapter pre-tests, watch video lessons, fill out the guided notes, read chapters, complete journal entries, and do all the activities independently.

-

Is the physical textbook required?

-

- A physical textbook is not required. The fully digital product includes a digital textbook that can be used instead.

- We highly recommend getting physical textbooks if students are required to (or want to) refer back to the content once their online access has expired.

-

If I purchase a curriculum, how do I get started?

-

Classroom Version

- You will receive an email with instructions for setting up your teacher account after completing your purchase.

Homeschool Version

- For the print and digital product, you’ll need to wait for your student textbooks to arrive, then use the voucher code included to activate the course.

- For the fully digital product, you’ll receive an email with a voucher code and instructions after completing your purchase.

For additional homeschool questions, please visit the Help Center.

-

If my kid(s) are a part of a co-op, how do I move forward?

-

- Option 1: If your homeschool co-op isn’t using a curriculum from Ramsey Education, you can still purchase our homeschool product for a single child/student.

- Option 2: You can connect with your homeschool co-op administrator to see if the Ramsey Education curriculum is something they can bring to your co-op classroom.

Frequently Asked Questions for Co-Op Instructors

-

What’s the difference between the homeschool and classroom versions?

-

The core video lessons and textbook content (digital and print) are the same for both versions of Foundations in Personal Finance (FIPF). Here’s how it all breaks down:

FIPF Homeschool (for home use)

- Typically used at home for individual learning and is self-guided

- Includes 26 activities designed for individual students

- Uses a shared family account (the parent and student sign in using the same email and password, so keep this in mind if you're part of a co-op evaluating the materials)

- The parent/instructor purchases full curriculum access, including teacher resources, online videos, and more

- Includes devotionals to support a deeper study of the biblical perspective on finances, along with Family Table Talk prompts

FIPF Homeschool (for co-op use)

- If you’re an instructor for a homeschool co-op but want students to complete coursework at home and come together weekly for discussion, each family must purchase the full course ($89.99) for the first student and a sibling add-on ($29.99) for each additional child. This setup gives each student their own profile within the parent account.

- If your co-op plans to watch the curriculum videos together in person with the students following along in their textbooks (without students having online access), the instructor should purchase the full homeschool product for access to the videos and resources, with a $29.99 add-on book for each student.

- You can stream videos during group sessions and students can follow along using their textbooks. This model works well for many co-ops and small groups, but the add-on doesn’t give individual online access to the students, only through an activated parent/teacher account.

FIPF for the Classroom

- Typically used in a traditional classroom setting and is teacher guided

- Includes 72 activities, many of which are designed for groups

- The teacher has their own account with individual student logins

- The Ramsey Classroom platform allows students to have their own logins and provides teachers with greater control over class content, the grading of students’ work, and the management of student accounts

- Provides a printed student textbook for each student, which serves as a valuable long-term resource that students can keep

- Devotionals are not included but can be provided upon request

View sample content and learn more about the homeschool curriculum. -

Does Foundations in Personal Finance include religious content?

-

- Both the classroom and the homeschool versions include 134 quotes and sources references from a wide range of voices—from Aristotle and Maya Angelou to Thomas Jefferson and Nelson Mandela, and yes, even to King Solomon. These aren’t meant to preach, but to give students timeless wisdom and mental anchors for financial concepts.

- When biblical texts are included, they’re handled in a way that meets all constitutional guidelines for public schools. The curriculum is not devotional in nature—it doesn’t advance or inhibit religion. Its sole purpose is to help students build financial literacy and economic understanding.

- The homeschool version includes devotionals for each chapter found under the Teacher Resources as supplemental content.

-

What if I have more than one student?

-

Homeschool

- Pricing is based on a one student household with add-ons available to purchase for each additional student.

Classroom

- Pricing is based on the number of students you need to put through the course.

-

Is there a discount purchasing for 10+ homeschool students?

-

- There is no discount for purchases of more than 10 students.

- If you’re purchasing for more than 10 students, please call 877-410-3283. An advisor can help you determine if the classroom version is a better fit for you.

-

How long does it take to teach the curriculum?

-

Foundations in Personal Finance (FIPF) is designed to be flexible and can be completed as a semester-long course or as a year-long course with stand-alone chapters.

FIPF Classroom

- Includes 45-, 90-, and 180-day pacing guides

FIPF Homeschool

- Usually completed in a semester at a one chapter per week pace

- Includes a 39-week pacing guide

-

Is the physical textbook required?

-

- A physical textbook is not required. The fully digital product includes a digital textbook that can be used instead.

- We highly recommend getting physical textbooks if students are required to (or want to) refer back to the content once their online access has expired.

-

If I purchase a curriculum, how do I get started?

-

Classroom Version

- You will receive an email with instructions for setting up your teacher account after completing your purchase.

Homeschool Version

- For the print and digital product, you’ll need to wait for your student textbooks to arrive, then use the voucher code included to activate the course.

- For the fully digital product, you’ll receive an email with a voucher code and instructions after completing your purchase.

-

If I’m a homeschool co-op instructor, who can I contact for questions?

-

- General homeschool questions: homeschool.help@ramseysolutions.com

- Larger homeschool purchases: ramsey.education@ramseysolutions.com