“Bob and Emily providing this sponsorship to my class is amazing. The impact that they’re making by this sponsorship is hopefully going to create generational change within our community.” — Kristin Sliger, Personal Finance Teacher

Remember what it felt like when you didn't know how money worked? Well, millions of high school students graduate every year without learning basic money skills and end up living paycheck to paycheck.

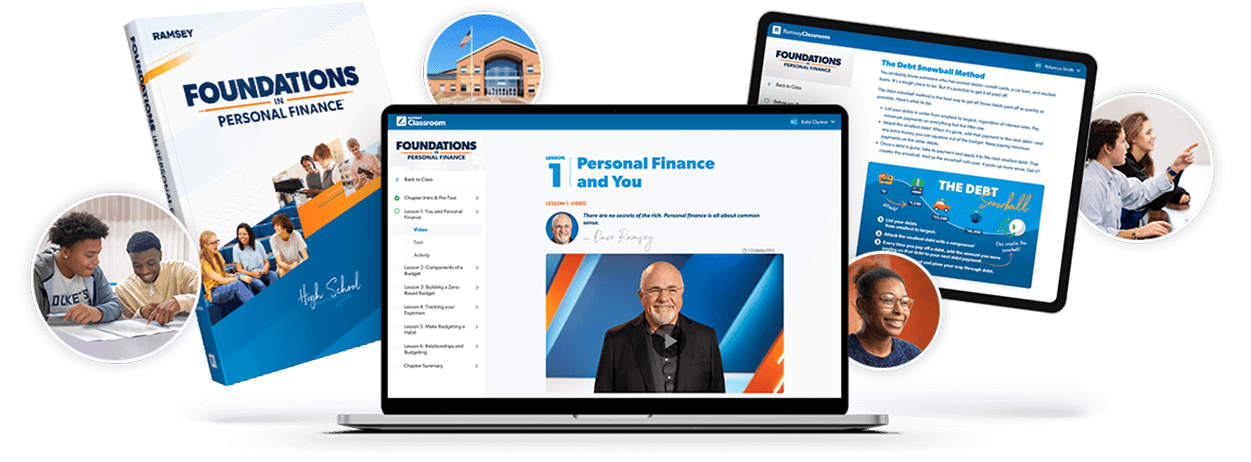

We created the Foundations in Personal Finance curriculum so students can learn the right way to handle money before they graduate. By sponsoring a school, you’ll get our Foundations in Personal Finance curriculum in the hands of teachers in your community—and help prevent students from making the same money mistakes we all made.

STEP 1

STEP 2

STEP 3

STEP 4

A Sponsorship Advisor will be in touch soon to help you identify your school(s) and give you a custom quote.

Legal mumbo jumbo is no one’s cup of tea, but this is important stuff. By providing us your phone number and email address and clicking “Submit”, you are agreeing to be contacted by Ramsey Education via email, phone call, and/or text messages, and to the use of an automatic telephone dialing system, artificial or prerecorded voice, and/or AI-generated messages for the purpose of receiving advertisements for our products and services, and for the purposes outlined in our Privacy Policy and Terms of Use. Messaging and data rates may apply. Frequency varies.

You may opt-out of receiving text messages at any time by replying with the word STOP from the mobile device receiving the messages. You do not need to provide this consent to receive any products or services from Ramsey Solutions. However, if you opt out of receiving phone calls or text messages, you will not receive communications from Ramsey Education

“Bob and Emily providing this sponsorship to my class is amazing. The impact that they’re making by this sponsorship is hopefully going to create generational change within our community.” — Kristin Sliger, Personal Finance Teacher

"By just paying this little bit to sponsor a classroom, it is literally changing the lives of the people going through the curriculum." — Darren Tyler

Take a peek inside to see what students will learn!

Nope! We’ll handle the school onboarding process. Your sponsorship dollars will cover the cost of the Foundations curriculum as well as the training and tools needed to equip a teacher at that school to teach.

Your Sponsorship Advisor will give you a customized list of available high schools.

Yes! Your business logo or name will be visible on our digital curriculum and will remain there for as long as your sponsorship is in place.

Yes, If sponsoring as a business, you can write off the sponsorship as a marketing expense. If sponsoring as an individual your sponsorship advisor will walk you through how to make your sponsorship a charitable donation.

Yes, we will introduce you to the school and establish your relationship with them. Then you can connect with the teacher.

The Foundations in Personal Finance high school curriculum has 13 chapters. Click below to see each chapter’s contents.