EveryDollar Budget App

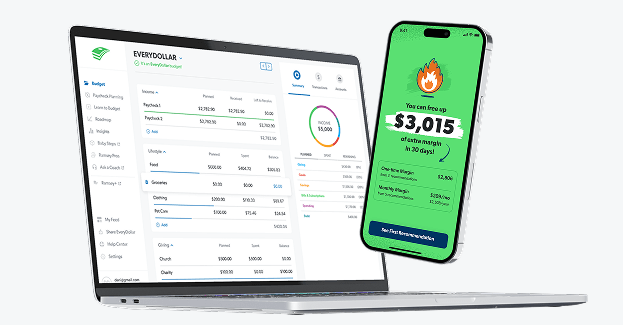

With EveryDollar, you’ll find extra margin every month and get a personalized plan to make the most of it. Every day.

Guide Contents

A budget is a plan for your money: every single dollar that’s coming in (income) and going out (expenses). When you learn how to budget—and make one every month—you give your money purpose. You. Take. Control.

Let’s put some breathing room in your budget. With EveryDollar, you’ll keep tabs on your spending and find extra margin every month—starting with $3,015 in just 15 minutes. You’ll feel like you got a raise!

No matter how you feel about budgeting right now, no matter what money goals you have, and no matter what your income is—you can make (and keep) a budget in just five steps. Seriously!

But first: Before you start, open up your online bank account or pull out those hard copy bank statements for the past couple of months. Trust us—it makes the process way easier when you can look back at your numbers.

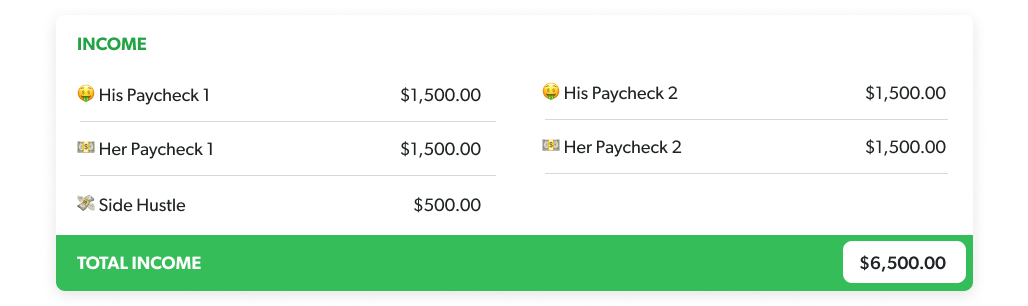

Income is any money you plan to get during that month.

Create separate Income budget lines for every paycheck you (and your spouse, if you’re married) make, plus anything extra coming in (like a side hustle).

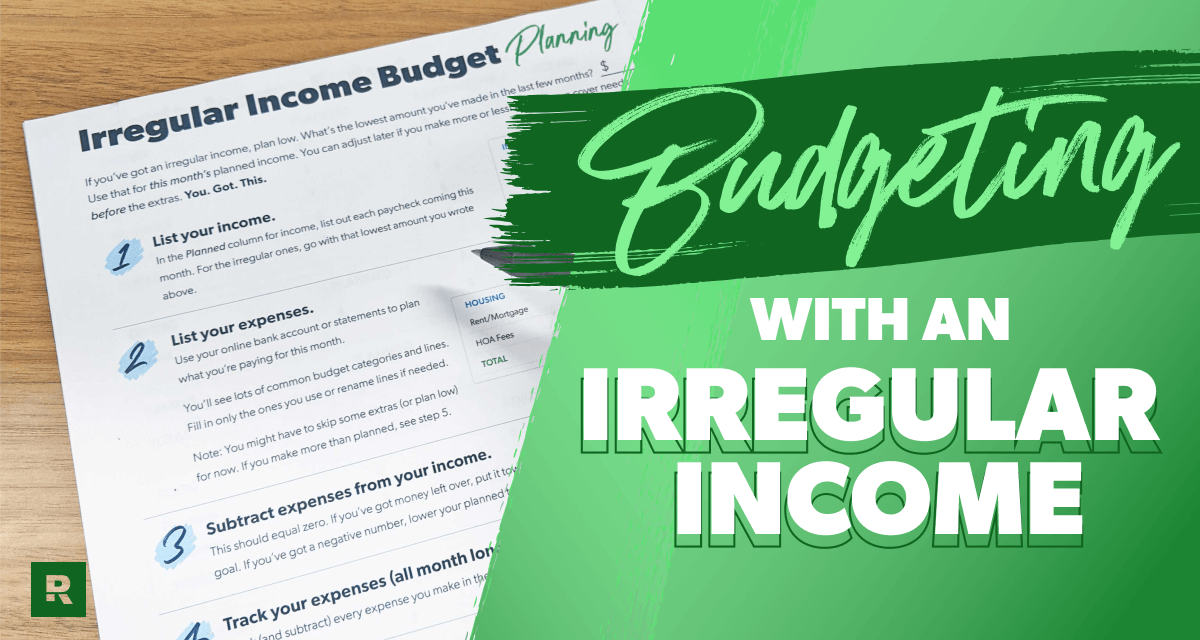

Do you have an irregular income?

If you’ve got an irregular income, take a look at what you’ve made the last few months and list the lowest amount as this month’s planned income budget line. You can adjust later in the month if you make more and add that extra money to your money goal or another budget line. Check out our Irregular Income Budget Planning form for more help here!

Now that you’ve planned for the money coming in, you can plan for the money going out. It’s time to list your expenses! (Yep, this is when that bank account or statement gets super helpful.)

Think through these main areas as you’re jotting down expenses:

Before you put the things you pay for every month into your budget, set aside money for giving. We believe in putting 10% of your income here and always having a spirit of generosity!

Also, if you don’t have an emergency fund yet, you need to make saving one of your priorities. We talk about this more in the How to Budget for Your Money Goals section.

Next, cover your Four Walls. That’s food, utilities, shelter and transportation. Make a budget category for each of these, and then you can create budget lines underneath each category.

Think of a budget category as a folder and the budget lines as the files inside it. Or the category is like a playlist, and the lines are like the songs.

For example, Food is a budget category, and Groceries is a budget line that goes under it!

Speaking of which—that grocery budget line is super hard to guess at first, so just start with a really good estimate based on your past spending. You’ll learn what you actually need to budget after a few months.

Next up, list all other monthly expenses.

Okay, that was a lot. To recap, here are those common expenses. We’ve got things in here that might not apply to you, but it should give you a good idea of what your budget categories might look like!

Subtract all your expenses from your income. This number should equal zero. We call this a zero-based budget.

Now, a zero-based budget doesn’t mean you let your bank account reach zero. Leave a little buffer in there of about $100–300.

It also doesn’t mean you blow all your money. And here’s the reason we love this method: Zero-based budgeting just means you give every dollar a job to do—giving, saving, spending. It’s all accounted for and has a purpose.

Don’t leave it there. You’ll end up mindlessly spending it on dollar bin items and one-click wonders. Put those dollars to work by adding any “extra” money toward your current money goal.

You just need to cut expenses until your income minus your expenses equals zero. (Hint: Start with those Eating Out and Entertainment budget lines.)

You can also get a side hustle or work overtime. Just remember—if you increase your income, don’t increase your spending! The extra cash should cover your budgeted expenses.

Tracking your transactions means you account for everything that happens with your money all month long.

That means when you make money, you track it in your budget. When you buy absolutely anything, you track it in your budget. This step gets your eyes on your spending—so you don’t overspend.

This is such a huge key to winning with budgeting (and money) that we have a whole section below about how to do it and why it’s important.

While your budget shouldn’t change too much from month to month, the fact is, no two months are exactly the same. That’s why you create a new budget every single month—before the month begins.

Start by copying over this month’s budget to the next. Then make changes for anything new that’s coming.

Where does the money come from? You can cut back spending somewhere else and move that money over to this category or crank up your income for the month. (Time for an extra freelance gig!)

P.S. Having an accountability partner really helps during those first months of budgeting (and during the whole journey, tbh).

If you’re new to budgeting, this calculator is a solid starting point. Just type in your monthly take-home pay, and you’ll get an example budget to help you begin.

Enter your income and the calculator will show the national averages for most budget categories as a starting point. A few of these are recommendations (like giving). Most just reflect average spending (like debt). Don't have debt? Yay! Move that money to your current money goal.

With EveryDollar, you’ll find extra margin every month and get a personalized plan to make the most of it. Every day.

Use our envelope system to pay cash for those hard-to-wrangle budget lines (like Groceries, Restaurants and Entertainment).

With six colors to choose from, this leather wallet is the most stylish way to organize your spending.

Want to try the pen and paper method first? Download Dave Ramsey's budgeting forms from Financial Peace University to help you get started.

Ready for one of the biggest secrets for how to budget—and do it really, really well? Good, because we don’t want to keep it a secret. Here it is: Track. Your. Transactions.

Every single one.

It’s the fourth step in our five-step budgeting breakdown, and now we’ll dive into the how and why of this “secret” way to level up your budgeting.

Pro tip: With EveryDollar, tracking is a breeze. You can connect your budget to your bank so transactions stream right in. You just drag and drop them to the right budget line. Boom.

Listen: Tracking your transactions is super important because it helps you:

Every money goal starts with a budget. Because a budget is how you tell your money where to go. And if you want that money going toward paying off debt, saving for vacation, or prepping for emergencies . . . well . . . you need to budget for it.

Here are some tips for how to budget for your money goals:

If you don’t know which money goal to go after first, check out the 7 Baby Steps (aka the proven plan to save money, get out of debt, and build wealth).

Pro tip: If your goal is to pay off debt or save for emergencies, it’s best to work those one at a time. After you free up your income and have the security of that stacked emergency fund, you’ll have margin to multitask on other goals like investing, saving for the kids’ college, or paying off your house.

If you’re trying to save money for a big expense, create a sinking fund. This is a way to save up by setting aside money each month. You just divide the amount of money you need by the months you’ve got to save. Voilà. Now you know how much to put in your monthly budget for this money goal.

Like if you need $1,200 for a summer vacation in four months, you’d need to save $300 a month.

If you want to pay off debt, check out the debt snowball method.

If you want to save up an emergency fund, you need two things: a budget line for emergency fund savings and the mindset that this is a priority with your money!

Okay, but were does that money come from? The extra for your vacation savings or debt snowball momentum or emergency fund growth? Good. Question. Here are a few ways to get more money to put toward your money goals:

Some money goals take longer than others. Don’t. Give. Up. You have what it takes to pay off your debt, save for the future, build yourself legit financial security . . . the list goes on. Keep budgeting. Keep working. You got this!

From groceries to summer vacations and everything in between—a budget helps you spend and save on purpose. And these tips will help you do it all with confidence.

One of our top budget tips is to pick the best method out there: zero-based budgeting.

Zero-based budgeting is how you get intentional with your money. All of it. Any “extra” money left after you list out your expenses doesn’t stay extra. It’s given a purpose and a job—put it into a budget line so it doesn’t get spent accidentally.

Remember, you work hard for your money. It should work hard for you. Every. Single. Dollar. That’s the power of the zero-based budget!

Have you ever made a goal that was totally setting you up for failure? Like saying you’ll read ten books a month when you barely have any free time? If you want to succeed, you have to push yourself—but you also have to be realistic.

The same is true with your budget. Push yourself to spend better and save more—but be realistic with your life as well. When you keep it real, you can really win.

You may want to break some of your budget lines into weekly portions to help you spread out your spending. This is super helpful if you get paid more than once a month—but it’s a great trick for any budgeter.

For example, if you give yourself $200 for Personal Spending, think of it as $50 a week. If you plan for $600 on groceries, that’s like spending about $150 a week.

Sometimes thinking in these bite-sized amounts makes it easier to stick to your budget.

We mentioned this before, but you need a little space for anything that pops up or you forget (like school photos or your anniversary—wait, don’t forget that!). A Miscellaneous budget line helps you cover these expenses without busting your budget or running to the credit card. Speaking of which . . .

We’ve got about a million reasons (at least) to stop using your credit cards, but here are just two.

First: If you’re using credit cards to cash flow your spending—using them to pay for normal monthly expenses and making a bulk payment at the end of the month—that’s a bad money management system.

Paying that lump sum means you don’t see just how often you buy breakfast biscuits on the way to work. What if you’re literally eating away at what could be a healthy retirement fund? When you track every expense, your expenses can’t hide from you.

Second: If you’re getting behind on payments, you’re racking up interest. (Research done by Ramsey Solutions shows 4 out of 10 credit card holders fall in this category, by the way.) And you’re getting stuck in the cycle of paying off last month’s expenses this month.

You can never get ahead that way. Budget this month’s money to pay for this month’s expenses—and to save for the future! That’s how you stay in control of your money.

The decisions you made yesterday don’t have to determine today. When you make mistakes with your money (and you will—everyone does) don’t throw a pity party. Keep. Moving. Forward.

Don’t worry about what everyone on social media appears to have. Some of them are lying. Some are in debt up to their designer sunglasses. And a few really do have their lives together.

But those people worked hard for it—and that’s what you’ll do too.

Work hard defending your budget—saying no or not now when you need to—because being true to yourself, your budget and your money goals is more valuable than anything you could ever buy.

It usually takes three months to get a handle on this whole budgeting thing. It won’t be perfect the first time or the second time. But you’ll get there! Give yourself grace as you go.

Budgeting isn’t a sprint. It’s a marathon, a commitment, a lifestyle! Keep all these tips for staying motivated in your back pocket—pull them out whenever things get hard.

And when it does get tough, remember: You. Are. Tougher.

Do yourself a huge budgeting favor and get an accountability partner.

Here’s why: When you’re in the thick of making any goal happen, knowing you’ve got someone checking in makes all the difference. And budgeting on the reg is not only a great goal—it’s also the foundation of hitting all your other money goals!

Here's some info to help when you're looking for and working with your accountability partner.

Get with your accountability partner every month to check in and set up the next budget. If you’re married, do this together and in person at a monthly budget meeting. If you’re working with a friend or family member, you’re welcome to make your budget alone, but never skip the check-in.

If you aren’t sure what to actually do in these meetings, grab yourself a copy of our budget meeting guides—we’ve got a classic and couples edition.

Listen—there’s no shame in asking someone to help you keep your eye on the goal. Just the opposite. There’s incredible strength in seeking accountability. So, get with your accountability partner and start planning those budget meetings. Today!

Got a spouse? Boom. You’ve got a built-in accountability partner. Which brings its own challenges (and we’ll get to that in a second).

But if you need to hand-pick your accountability partner—or as a couple you want to find another couple to check in with—this list of characteristics will help you find a top-notch one.

Look back over all those characteristics we just mentioned. Yeah, if you're married you’ve got a built-in accountability partner, but that doesn’t mean you can skip being a high-quality accountability partner.

Be encouraging, empowering, honest, judgment-free, vulnerable, trustworthy and present with your spouse! Always—but especially when you’re talking about money.

And what if you feel like you’re miles away from being able to have successful budget meetings with your spouse, because you’re not even on the same page about money? Have a conversation together and follow these four guidelines (from our budgeting BFF and money expert Rachel Cruze).

1. Be honest.

When you’re talking about money, dreams and building your life together, it’s important to be vulnerable and honest with your partner. These types of conversations are the ones that build or strengthen the foundation of your relationship and ultimately your life together.

Be honest about what you believe and how you feel, then allow your spouse to do the same.

2. Listen.

Really listen to your spouse. Don’t just listen to think up a response of your own.

Here’s an idea: When your spouse is talking, you can only ask questions. This will help you get to know the why behind how they actually feel. Then, when they’re finished, you can share your thoughts about what they said.

3. Stay calm.

When you raise your voice, your spouse will likely raise theirs to match. Then you’re both just talking loudly (or yelling) just to be heard. If you’re listening intently and asking questions, there will be no need for yelling. So, stay calm no matter what.

4. Show grace.

Being too hard on yourself or your spouse won’t help. Find a way to bring grace and truth together—and live in the center of the two. There will be hard truths that you’ll both have to sort through, but learning how to respond to each one with grace will go a long way.

If you want even more help with this, take Financial Peace University together. This nine-week class is perfect for any couple—whether you’ve been married five minutes or 50 years. You’ll learn how to start healthy conversations about money, set goals together, and start budgeting as a team.

Let’s be honest—sometimes all this budgeting stuff gets . . . well . . . exhausting. It can be tough to keep that financial drive alive.

Here are eight tips and tricks to keep the motivation going along the way.

If you hang out with senseless spenders, you can be tempted to do the same. Find some friends who won’t pressure you to do stuff outside of your budget.

Okay, not just any app. Our app—EveryDollar. Because you can try to keep up with pencil and paper or spreadsheets, but they aren’t as easy. And let’s face it, an easier budget is one you’re way more likely to stick to.

Dig deep and be honest about the reasons you want to take control of your money once and for all. That’s your why. And when things get tough or boring, remember your why!

Hang up images around the house of visuals that represent your goals. Paying off that car? Put a picture of it on your fridge to remember why you’re cooking at home instead of ordering that delivery pizza.

Lower the risk of budgeting burnout by budgeting for fun. Now, if you’re saving for an emergency fund or paying off debt, that fun money will be small. But it’s just for a season! You got this.

When you reach a goal—even a small one—celebrate! After you budget three months straight, pay off a debt, or cut extra spending for 30 days, treat yourself to a free or budget-friendly reward.

If you respond to stress by impulse buying things, replace that habit with a better one. A nice relaxing bath, a walk or run outside, a card game with the fam, a cup of chamomile tea—these are all great (and inexpensive) ideas.

Hey, burnout happens to us all. Go ahead and decide now what you’ll do when it comes. Just don’t give up on budgeting. It’s how you’ll make your money goals happen—and that’s worth fighting for!

If you’ve never budgeted before (or it’s been a while) jumping in can be challenging. You know what'll help you feel confident as you start? A budget template!

Is your paycheck different from month to month? Learn how to manage irregular income and create a budget that keeps you in control—no matter how much you earn.

Whether you're new to budgeting or looking to improve, these budgeting tips will help you take control, stay on track, and feel confident with your money.

A budget is a plan for your money—every single dollar that’s coming in (income) and going out (expenses).

Cover your Four Walls—food, utilities, shelter and transportation—before you budget for other essential expenses and fun.

This depends on what Baby Step you’re on (aka the proven path to saving money, ditching debt, and building wealth).

Once you are debt-free and have a fully funded emergency fund, start investing 15% of your gross household income in retirement accounts.

There are plenty of ways to budget: pencil and paper, spreadsheets, budgeting apps. Just make sure you budget every dollar, every month. If you want an easy, free way to create and keep up with your budget—check out our free EveryDollar app.

You’ve probably heard of the 50/30/20 rule or the 60% solution, but we use the zero-based budgeting method. This is when your income minus your expenses equals zero—aka you’re giving every dollar you make a job to do so none of it gets accidentally spent! It’s simple math that works no matter your household income.

It’s completely normal to have a few rocky budgets to start. It usually takes around three months to get comfortable with budgeting. You’ve got this.

Absolutely! When you’re listing your income, look over the last few months and pick the lowest amount you made as this month’s planned income budget line. You can adjust later in the month if you make more!