Remember the good ol’ days when getting gasoline for your car cost you under $1 a gallon? Okay, maybe not. Some of us weren’t even born or driving a car yet (hi there, 1988).1 But those sure sound like nice times.

Meanwhile, back in June of 2022, gas prices hit a peak, setting a record of $5.01 a gallon.2 Yuck. Thankfully, that number’s dropped. Still, filling up the gas tank isn’t cheap.

But with these tips you’ll learn how to save money on gas—without having to trade in your SUV for a horse and buggy.

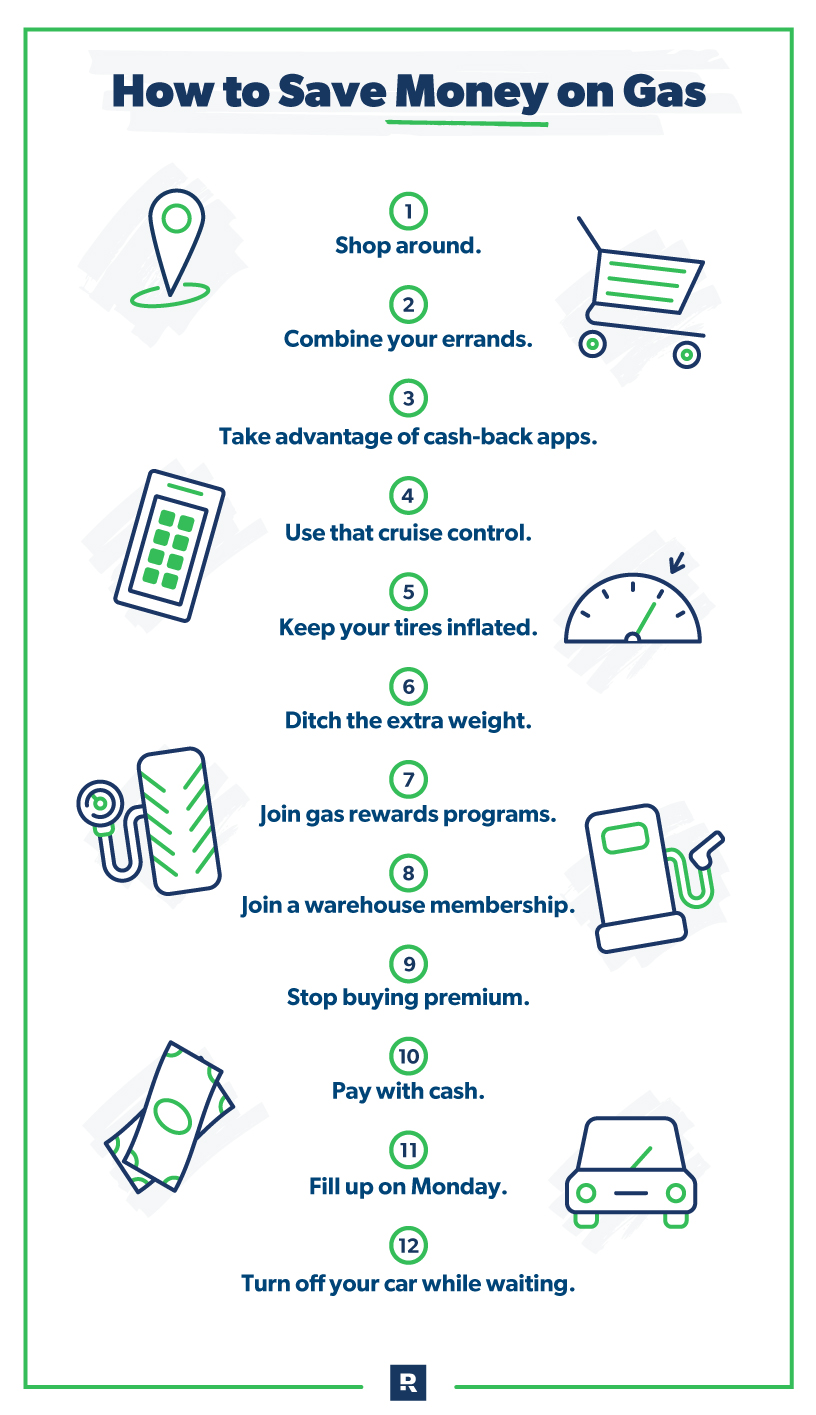

How to Save Money on Gas

1. Shop around for the best gas prices.

Sure, sometimes you’re riding on empty and you’ve got to get gas as quickly as possible. But if you plan ahead, you can really figure out some slick ways to save money on gas.

Get expert money advice to reach your money goals faster!

One way is to use an app like GasBuddy or Waze that searches your local area to find the cheapest gas prices around. Or you can pay attention on your way to and from work or the kids’ school to see which places offer the best prices.

2. Combine your errands.

Don’t make a special trip to get milk when you can just pick it up on the way home from work. You can cut back on trips to the grocery store in general by meal planning and keeping a list of all the household essentials you need. The fewer trips out, the less you pay in gas.

3. Take advantage of cash-back apps.

Apps can make your life a little easier—especially when they give you cash for things you already do. Check out cash-back apps like Upside that will reward you with cash every time you fill up.

4. Use that cruise control.

Stumped on how to save money on gas while driving on the open road? If you’re spending lots of time on the interstate, here’s a simple tip: Turn on your cruise control and save on gasoline and leg cramps.

5. Keep your tires inflated.

There’s a savings myth out there that overinflating your tires can save you money on gas. The reality is, this is a bit of a Goldilocks situation. Overinflating doesn’t help anything, and underinflating can actually hurt your gas mileage. But nailing the recommended tire pressure for your car is like that perfect bowl of porridge—just right. And those just-right savings will add up over time.

6. Ditch the extra weight.

Take everything off your roof rack and unpack the trunk or cargo space. Turns out, the more your car is weighed down, the harder your engine has to work to lug all your junk around. And a harder-working engine is a gas-guzzling engine.

So, clean out your car, and enjoy less clutter and fewer trips to the gas station. Who knew figuring out how to save on gas was as simple as getting all the junk out of your car?

7. Join gas rewards programs.

Hear us loud and clear: We’re not talking about credit card “reward” points here. (Ew.) We mean that your grocery store might offer gas rewards—discounts on gasoline for buying stuff you have to buy anyway.

You might have to sign up for a rewards card, but these are usually 100% free and 100% worth it. Cheaper gas from the place you already go to stock up on snacks? Yes, please.

8. Join a warehouse membership.

Here’s how to save money on gas with the cash you’re already spending at those bulk-buy stores (you know the ones). Some warehouse stores offer lower gas prices to members.

Now, that membership will cost you something, but if you’re already a member, you might as well take advantage of that extra savings. And if you’re not a member, before you commit to anything, be sure the annual fee is worth it to save money on gas and other things (like all that bulk cereal shopping).

9. Stop buying premium.

Unless you have a fancy car with a manual that says it needs premium gas, the regular unleaded gas option works just fine. Switching to regular gas is probably the easiest way to save money on gas. You could save 20 to 60 cents per gallon just by making that quick switch, and most drivers don’t even notice the difference. Just be sure you double-check that premium gas isn’t a deal breaker for your car—or you could have some serious car repairs to pay for in the future.

Bonus tip: If you’re shopping for a car, remember that a premium-gas-only option means a bigger transportation expense. Every. Month.

10. Pay with cash.

Cash is king—even at the pump! Some gas stations charge a lower price per gallon if you pay with cash. It’s their way of skipping the processing fees. Sure, you’ll have to actually walk some extra steps to pay the cashier, but it’s worth it if you can save a few bucks every time you fill up.

11. Fill up on Monday.

Monday is typically the cheapest day of the week to fill up your tank, with Friday coming in as a close second. And whatever you do, avoid the gas station on Wednesday, Thursday and Saturday if you want to save money in your transportation budget category.3

12. Turn off your car while waiting.

Here’s a simple way to save money on gas—turn the car off when you’re not actually driving it. Think about it. You’re sitting in your car for 5, 10, maybe even 15 minutes waiting on someone else to get in—and probably jamming out to your favorite song. We’ve all been there. But next time, turn the car off. Keeping your car running wastes gas even if you’re not driving anywhere!

What to Do With the Money You Save on Gas

Okay, so you’re saving cash with those tips. Great! But now that you’ve figured out how to save money on gas, what should you do with the extra money? We’re glad you asked.

But first, budget.

Having extra money in the budget every month is a beautiful feeling. But don’t ignore it or you’ll spend it here and there without even noticing. No, thank you.

To keep that from happening, make a budget. Give the extra savings a job to do! What job? Follow the next couple of tips in order. These are the first of something we call the 7 Baby Steps (our proven plan for saving money, ditching debt, and building financial security).

1. Save it.

The first job you should give this extra money is to build up a starter emergency fund (if you don’t already have one). That’s $1,000 in savings as a safety net for when life happens. Once you’ve got this, jump into our next step.

2. Pay off debt.

Debt keeps you and your money living in the past. You can’t get ahead when you’re paying off something from last month—or last year. So, once you’ve got your starter emergency fund, put any extra money toward paying off debt with the debt snowball method. Because being stuck in the past is bad for your hairstyle, your relationships and your money.

3. Save even more.

Once you’re debt-free, it’s back to saving until you’ve got a fully funded emergency fund of 3–6 months of expenses. Then you’ll be ready for even bigger unexpected life moments—like a job loss, an emergency root canal, or a storm blowing the roof of your house away.

4. Invest it.

When you’re debt-free with a solid emergency fund, start investing 15% of your take-home pay. Retirement is coming—so be ready for it!

Look at you, building that financial security for today, paying off the past, and prepping for the future. Oh, and saving money on gas. Pretty powerful stuff here.

You Got This

Okay. It’s time to get going with these tips. Download EveryDollar (our free budgeting app) to make a plan for all your money. Then start working through these gas-saving tips to get more money in the budget so you can make more progress with your money goals.