Key Takeaways

- The average American debt per U.S. adult is over $66,000.

- With the right plan and focus, you can pay off all your debt—no matter your income.

- Budgeting is how you create a spending plan, which is a key step in getting rid of debt.

- The best way to pay off debt is the debt snowball method.

Debt’s heavy. And too many of us are carrying that weight around every single month. But it’s hard to know how to get ahead, especially if your income’s on the lower end.

Still—if you have a goal to get debt out of your life, you can make it happen. And once the debt’s gone, all that money you were sending out every month to pay on your debt will be back in your budget. So it’s completely worth it. It really is!

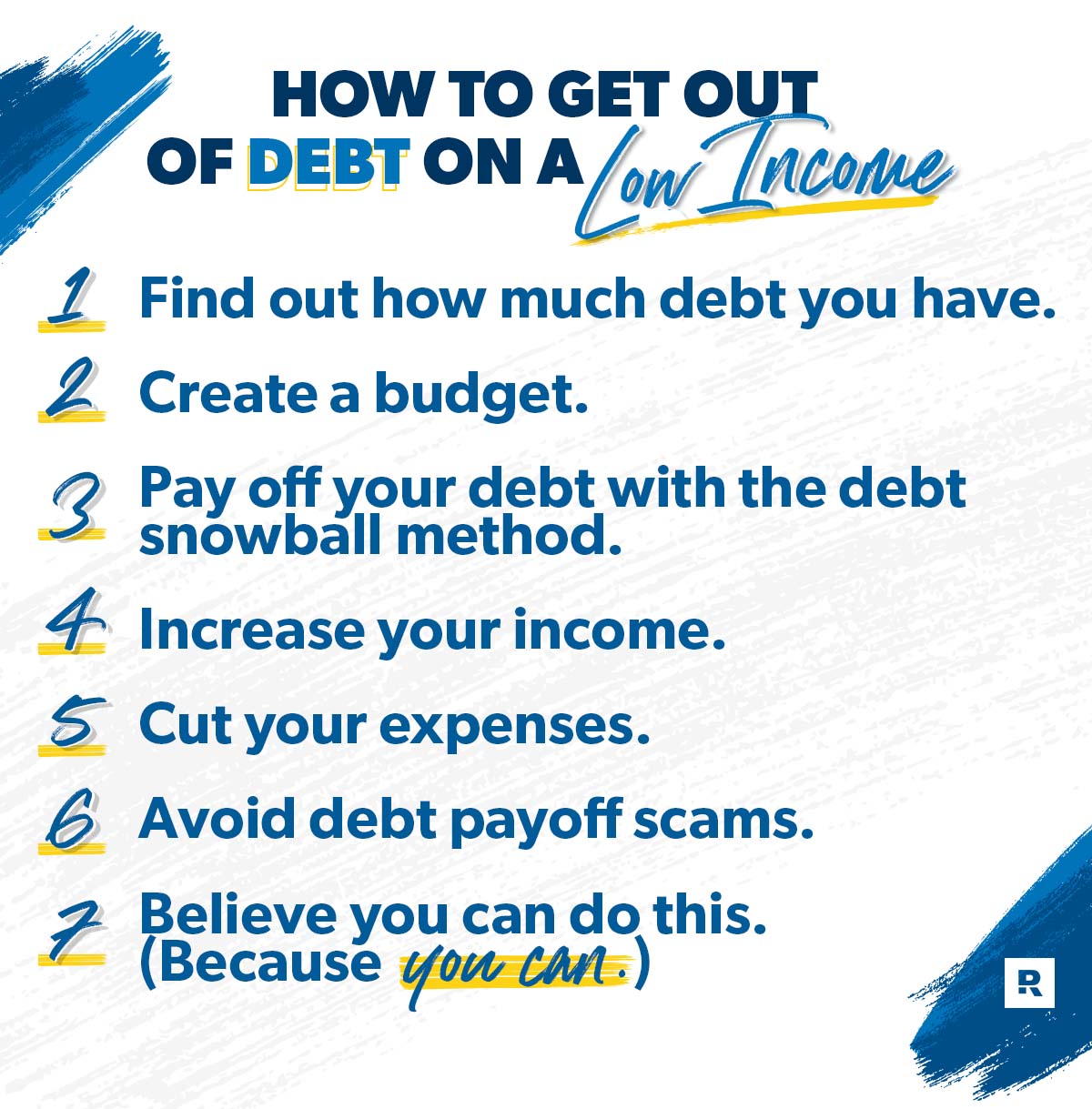

But how can you do it? Follow these seven steps to pay off debt on a low income:

- Find out how much debt you have.

- Create a budget.

- Pay off your debt with the debt snowball method.

- Increase your income.

- Cut your expenses.

- Avoid debt payoff scams.

- Believe you can do this. (Because you can.)

How to Pay Off Debt With a Low Income

If you’re feeling the weight of debt, you aren’t alone. The average American debt per U.S. adult is $66,772.1,2,3 And credit card interest rates are at an all-time high of 22.63%.4 The numbers are painful. But you can get out, even on a low income. Here’s how:

1. Find out how much debt you have.

You can’t conquer something if you don’t know what you’re up against. The same goes for your debt. So, you’ve got to sit down, pull out the bills (or open up the online accounts), and list out your debts.

Whatever amount you’re staring down, you can pay it off. And looking at that total shouldn’t feel defeating. It’s the first step toward getting out of debt and finding freedom!

2. Create a budget.

A budget is just a plan for your money. Whatever your income or your financial goals, you need to budget.

When you set up your budget, you’ll see how you’ve been spending your money. Then you can start making the changes you need to get some confidence—and pay off your debt.

Also, people have told us they feel like they got a raise when they start budgeting! That’s because they’re being intentional with their money.

EveryDollar budgeter Sarah Fragnito says, “Until you look at your finances, you don’t realize how much of your money is going to waste.” That’s right—you might have more money to work on your debt payoff goal than you even think. And a budget will show you!

It’s time to get intentional with your income. Make that budget.

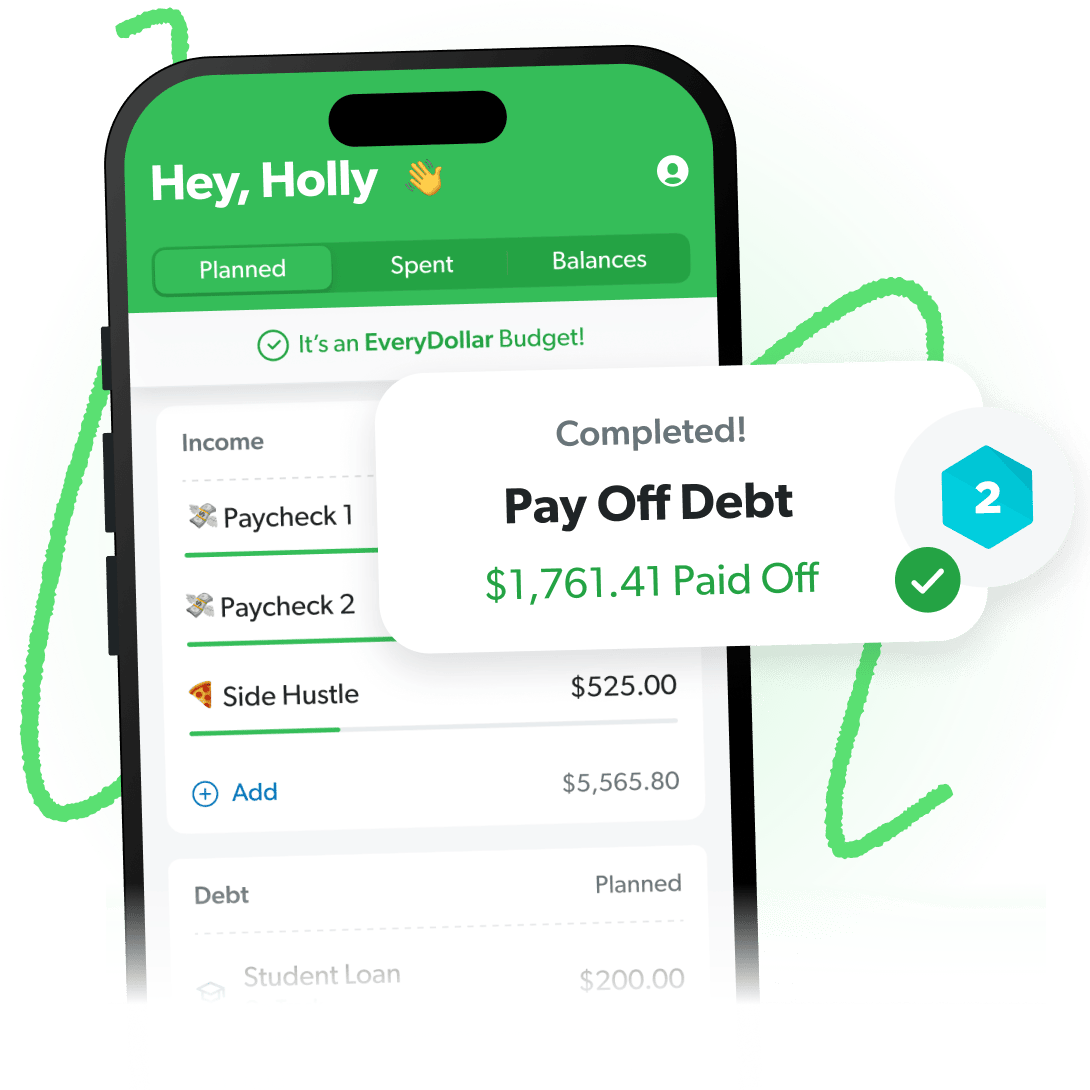

Find More Margin. Beat Debt Faster.

Paying off debt doesn’t have to take forever. With the EveryDollar budgeting app, you’ll find extra margin every month so you can pay off debt faster.

3. Pay off your debt with the debt snowball method.

Once your budget is in place, it’s time to do the thing. Pay. Off. The. Debt.

The best way to do this, no matter your income, is called the debt snowball method. Here’s how it goes:

- List your debts from smallest to largest, no matter the interest rate.

- Make minimum payments on all your debts except the smallest.

- Pay as much as possible on your smallest debt.

- When it’s paid off, move everything that was going to that debt to the next-smallest.

- Repeat until every debt is gone.

So, why aren’t you focusing on interest rates right now? Because you need a quick win. When you knock out the smallest debt first, you get motivation. When you pile that payment onto the next debt, you get momentum. Motivation plus momentum equals victory.

You’ll be like a snowball rolling down a hill, getting bigger and stronger with every debt you knock over.

Okay, but with a lower income, how do you get that “as much as possible” to throw at your debt? The next two steps will help.

4. Increase your income.

One way to get extra money packed onto your debt snowball is to increase your income. This can look like a lot of different things:

- Grabbing a side hustle.

- Taking on freelance clients.

- Selling stuff.

- Switching jobs.

- Working overtime.

Yes, all this is extra work, but it’s also extra income. And remember—this is just a season. The debt will be gone, and the amount of your income you get to keep will shoot up when you don’t have to make payments anymore.

5. Cut your expenses.

Another way to get more margin in your budget is to cut some spending. That can look like trimming back on some budget lines—and cutting others out completely. (Say it again: This is just a season!)

Here are a few quick tips for lowering expenses:

- Meal plan to lower your food budget.

- Cut out restaurants.

- Combine your errands to save on gas.

- Stick to only clothing purchases you need.

- Cut back to just the free TV streaming services.

- Look into warehouse memberships to save on groceries, household items and gas.

Quick note: For both steps 4 and 5, make sure you put all the extra money in the budget toward your debt snowball. All of it. It’s so easy to turn those savings into splurges without even meaning to. But now’s not the time for that. This is the time to crush your debt.

6. Avoid debt payoff scams.

Here’s the deal: There are plenty of companies out there who know you’re in a tight spot. They’re wolves on the prowl, and they’re ready to pounce so they can make money off your situation. Don’t fall for the scams.

Here are some examples of debt payoff schemes to avoid:

- Personal loans: Don’t take out a loan from a bank, a family member or a friend to pay off your debt. That’s going backward.

- Credit cards: Avoid credit card balance transfers or trying to juggle your debt by paying off a loan with a credit card. It usually means more interest (and more debt) in the end.

- Debt consolidation: This seems like a good idea at first because you’re bundling your debts into one payment—but that one payment can come with higher interest and a longer payoff term, which means you’re in debt even longer.

- HELOC: This is when you borrow against the equity in your home and you’re basically trading something you actually own for more debt.

All of these methods are promising debt relief, but only thing they bring is more heartache. Don’t let someone take advantage of you right now—or ever. Stay far, far away.

7. Believe you can do this. (Because you can.)

Okay, now you know how to pay off debt, no matter your income. But the truth is, it won’t always be easy.

You have to take a serious look at how you deal with your money (and start a budget, pronto). You have to make extra money or tighten up spending. You have to stay the course, even when companies try to tempt you with offers that seem too good to be true (because, well, they are). And you have to believe you can do this. (Because you can.)

And our EveryDollar budgeting app can help!

EveryDollar shows you how to find thousands of dollars of hidden margin (no, really) and builds you a personalized, step-by-step plan to beat debt way faster. Plus, you’ll track your progress right in the app until every dollar of debt is history!

So, what are you waiting for? Start EveryDollar for free today!