Let’s be real. The only “money management” most of us learned growing up was how to balance a checkbook (which is right up there with learning how to send a fax). But money management is important because if you don’t intentionally manage your money, it will manage you.

The key to good money management is having the right habits in place—like creating a budget, tracking your expenses, paying off debt, saving for the future, and being generous. All things that helped me go from broke and in debt to debt-free millionaire over the course of a decade.

So, if you want to learn how to manage your money better, listen up! I’m giving you my best money management tips to help you take control of your finances for good.

What Is Money Management?

Money management is the process of handling your finances by budgeting, spending, saving, investing and giving.

Now, there’s corporate money management (sometimes called investment management). Just picture people in suits talking about things like “capital expenditures” and “retained earnings.”

But then there’s personal money management—that’s what I’m talking about here. Simply put, money management is how you manage your money. (Shocking, I know.)

Good money management is just as important as brushing your teeth (and flossing daily, if your dentist asks). Like good oral hygiene, how you manage your money affects your quality of life. And trust me, it can keep things from being super painful later on.

10 Money Management Tips to Help You Make the Most of Your Finances

Thankfully, personal finance is 80% behavior and only 20% head knowledge. So that means anybody can learn how to manage money well.

Here are my top 10 tips to help you start managing your money like a pro:

- Take financial inventory.

- Do a monthly budget.

- Track your expenses.

- Build an emergency fund.

- Pay off and avoid debt.

- Lower your spending.

- Save up for large purchases.

- Invest for your future.

- Protect yourself with insurance.

- Be generous with your money.

1. Take financial inventory.

The first step to managing money is knowing what you’re dealing with. That’s right, it’s time to be brave and look in the financial mirror.

Start by logging in to any financial accounts you have (bank accounts, credit card accounts, student loan accounts). Then make a list of every unpaid bill, any recurring expenses, debts, credit cards, auto loans . . . everything. Leave no subscription or payment unturned. You need to know exactly how much money is coming in, how much debt you owe, and what you’re paying for every single month.

I know this part can be a little intimidating, especially if you’ve made some money mistakes you’d rather not think about (hey, we’ve all been there—me included). But you’ve got to face the brutal facts if you want to make progress.

2. Do a monthly budget.

The best way to manage your money is with a budget. Without one, you’re basically just winging it every month, hoping there’ll be enough money to keep the lights on and food in the fridge. But that just leaves you broke, anxious and stressed.

A budget puts you in the driver’s seat. You get to be the one deciding how to spend your hard-earned money—not the government, the credit card companies, or even your mother-in-law (she means well . . . probably).

There’s a lot of budgeting methods out there, but a zero-based budget works best. It’s where your income minus your expenses equals zero. That doesn’t mean you have zero dollars at the end of the month. It just means you gave every single dollar a job to do . . . whether that’s giving, saving, paying off debt, or spending!

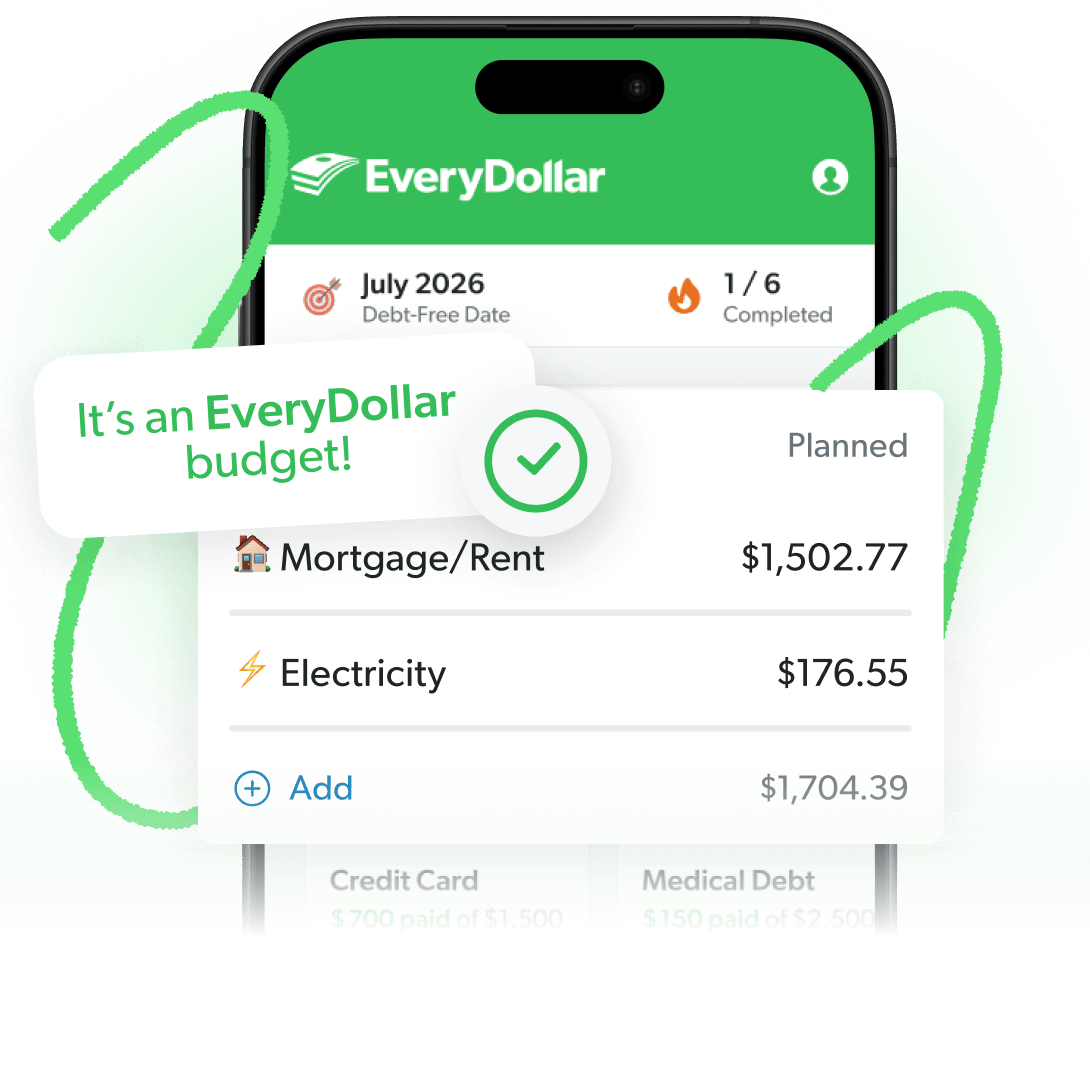

And if you’re not sure how to start budgeting, don’t worry. There’s an app for that—it’s called EveryDollar. Download it for free, plug in your numbers, and tell your money where to go for the month.

Find Margin You Didn’t Know You Had With EveryDollar

The EveryDollar budgeting app helps you find extra money every month so you can beat debt, build wealth, and make progress. Every. Day.

3. Track your expenses.

When it comes to budgeting, sitting down and doing the actual budget is only the first step. You also have to track your expenses.

Because if you just put some numbers down but never actually track your spending throughout the month, how will you know if you’re where you need to be? You won’t. You’ll just end up with an overdrafted bank account (which is the financial version of a charley horse).

The easiest way to track your expenses is with EveryDollar. You can even connect to your bank account so your transactions stream right into your budget. Then all you have to do is drag and drop. Boom! Tracking done.

4. Build an emergency fund.

Emergency fund, rainy-day fund, disaster fund, never-go-into-debt-again fund, or my personal favorite . . . oopsie-daisy fund. No matter what you call it, it’s important to have one. An emergency fund gives you peace of mind because you know you’re financially prepared for whatever comes your way.

If you’re in debt, save up $1,000 for your starter emergency fund. Over time, you’ll beef up your emergency fund to cover 3–6 months of expenses. But before you do that, you’ll need to tackle the biggest threat to good money management: debt.

5. Pay off and avoid debt.

Debt is dumb. There, I said it. And I’ll say it again and again as many times as I need to. While social media and your broke friends tell you that“debt is a tool to build wealth,” it’s actually what keeps you from building wealth. It steals your income and your peace. Debt causes you to pay for the past instead of building for the future.

Avoid debt like it’s lava—or spam (the edible kind and the email kind). Once you allow it into your life, it’s hard to get rid of it. And anyone trying to sell you debt as a good way to manage your money is just straight up scamming you (and probably spamming you).

If you already have debt, focus on paying it off using the debt snowball method. Here’s how it works: You list your debts from smallest to largest balance (not worrying about the interest rates). Then pay minimum payments on all your debts but the smallest one. You’ll throw any extra cash you can get at that smallest debt until it’s paid off. Then you’ll roll what you were paying on it into the payment on your next-smallest debt.

Keep going until you’re completely debt-free. Then get yourself to the Ramsey Solutions Headquarters in Tennessee for your Debt-Free Scream!

6. Lower your spending.

You may not think you spend that much, but every grocery run and overpriced latte adds up (a dollar more for oat milk?). Remember that budget we talked about? Chances are, you’ll have trouble sticking to it the first couple months. But cutting back on your spending can help you live on less than you make and give you more margin.

Instead of eating out at restaurants when you don’t feel like cooking, start preparing your meals in advance. Rather than dropping $50 at the movies, plan a fun date night at home. Choose generic brands in the grocery store or cancel subscriptions you don’t use. There are plenty of ways to save money!

Not going to lie, it’ll probably be hard at first. But as soon as you train your brain to stop spending at the drop of a hat, you’ll realize you can do it. And when you see how much extra money you have at the end of the month, it becomes addicting. Pretty soon, you get more and more creative with other ways to save.

7. Save up for large purchases.

A new guitar. The latest Apple product. The Peloton you just know will get you to work out more (been there, sold that). It’s tempting to swipe a credit card or split it up into “four easy payments.” But we’re avoiding debt, remember?

A key part of managing your money well is knowing when to buy something. Because you want to own your stuff, rather than your stuff owning you. That means, if you don’t have enough to pay cash for it, it’s not the time to buy it. There are two words for that—delayed gratification.

If you’ve got your eye on something you can’t afford right now, you can create a sinking fund for it. Sinking funds are a great way to save for large purchases because you can budget for them over time to spread out the cost. And the best part? You won’t get stuck making payments for something you bought months ago.

8. Invest for your future.

All right, this is where the fun really begins. Because investing isn’t just about making sure you’ll have enough for retirement (though, that’s definitely the main reason to invest). It’s also a way to build some serious wealth—enough to live the life you want and be outrageously generous!

Here are some investing basics to remember:

- Invest 15% of your gross income into tax-favored retirement accounts like your 401(k) or a Roth IRA.

- Invest in good growth stock mutual funds.

- Work with a financial advisor.

Whether you’re 24 or 54, it’s never too early or too late to start! The sooner you prepare for your golden years, the better.

9. Protect yourself with insurance.

A big part of managing your money is playing defense—by having the right insurance. Basically, insurance transfers the expensive risks to someone else. Because the last thing you want is for your savings to get wiped out by a medical emergency, car accident or flood.

There are eight types of insurance everyone needs at some point: auto, health, life (if you have people depending on your income), homeowners or renters, long-term disability and identity theft protection, as well as long-term care (when you turn 60) and an umbrella policy (if your net worth is more than $500,000). Just watch out for companies that try to scare you into buying insurance you don’t need (like cancer insurance, burial insurance or whole life insurance).

If you need help figuring out what insurance to get, you can take this free Coverage Checkup quiz. And don’t forget to add those insurance premiums to your monthly budget!

10. Be generous with your money.

There’s no denying the connection between those who win with money and those who give back to others. The two go hand in hand like peanut butter and jelly (or peas and carrots, if you’re a Forrest Gump fan).

Studies have shown that being generous leads to more happiness, contentment and a better quality of life.1 Isn’t that the kind of person you want to be around or become?

It’s not financial success that causes people to be generous. It’s being generous throughout their financial journey (even when it’s hard) that allows them to win with money. So, don’t wait until you have a certain amount of money in your bank account or time on your calendar before you start practicing generosity. Be intentional about making generosity a regular part of your life today.

Learn the Best Way to Manage Your Money

If you want to reach your financial goals—whether it’s getting out of debt, saving up for emergencies, investing for retirement, or all of the above—you need a clear path to success. Good news: I have just the money management plan for you: the 7 Baby Steps.

The Baby Steps have helped thousands of people work their way out of debt and get on a path to building wealth (myself included). No matter where you are on your financial journey, this plan works.

If you want to learn how to follow the Baby Steps plan and manage your money the right way, Financial Peace University (FPU) will show you how. This class will teach you how to budget, pay off debt, save for emergencies, build wealth—and so much more!

Managing your money doesn’t have to be complicated, but you do have to put in the work. Find an FPU class near you and set yourself up for financial success!