Get Out of Debt

You don’t need a finance degree to transform your money—it’s 80% behavior and 20% head knowledge. Get the plan and budget that put you in charge once and for all.

years of providing hope

lives positively impacted

found in margin

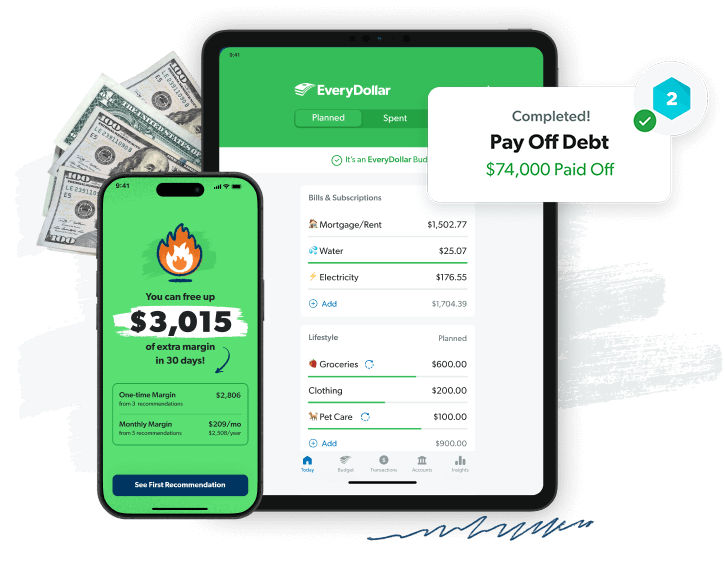

. . . be weird in 2026! With our EveryDollar budget app, you’ll find extra money to beat debt, build wealth, and live like no one else.

Do tax prep early this year with a service you trust. Whether you plan to file solo or need a pro’s support, we’ll help you get there with ease.

You work too hard to feel this broke! Get the tools that give your budget a purpose—and start winning with money.

The 7 Baby Steps are the proven plan that gives your budget the power to transform your money. Answer a few questions and find out which step you’re on.

Join our team of experts as they answer tough questions from real people about budgeting, saving, getting out of debt and building wealth.

A budget is a simple plan for your money—helping you breathe easier and reach your goals.

Monday, March 2 | Hour 0

Thursday, February 26 | Hour 0

Tuesday, February 24 | Hour 0

Filter what episodes and topics you want to hear using the Ramsey Network app.

Get weekly emails you’ll actually love—with practical advice, real stories and tips that’ll make you laugh, learn and take action.

Step 1: Save $1,000 for your starter emergency fund.

Step 2: Pay off all debt (except the house) using the debt snowball.

Step 3: Save 3–6 months of expenses in a fully funded emergency fund.

Step 4: Invest 15% of your household income in retirement.

Step 5: Save for your children’s college fund.

Step 6: Pay off your home early.

Step 7: Build wealth and give.