Get Out of Debt

You don’t need a finance degree to transform your money—it’s 80% behavior and 20% head knowledge. Get the plan and budget you need to help you take control for good.

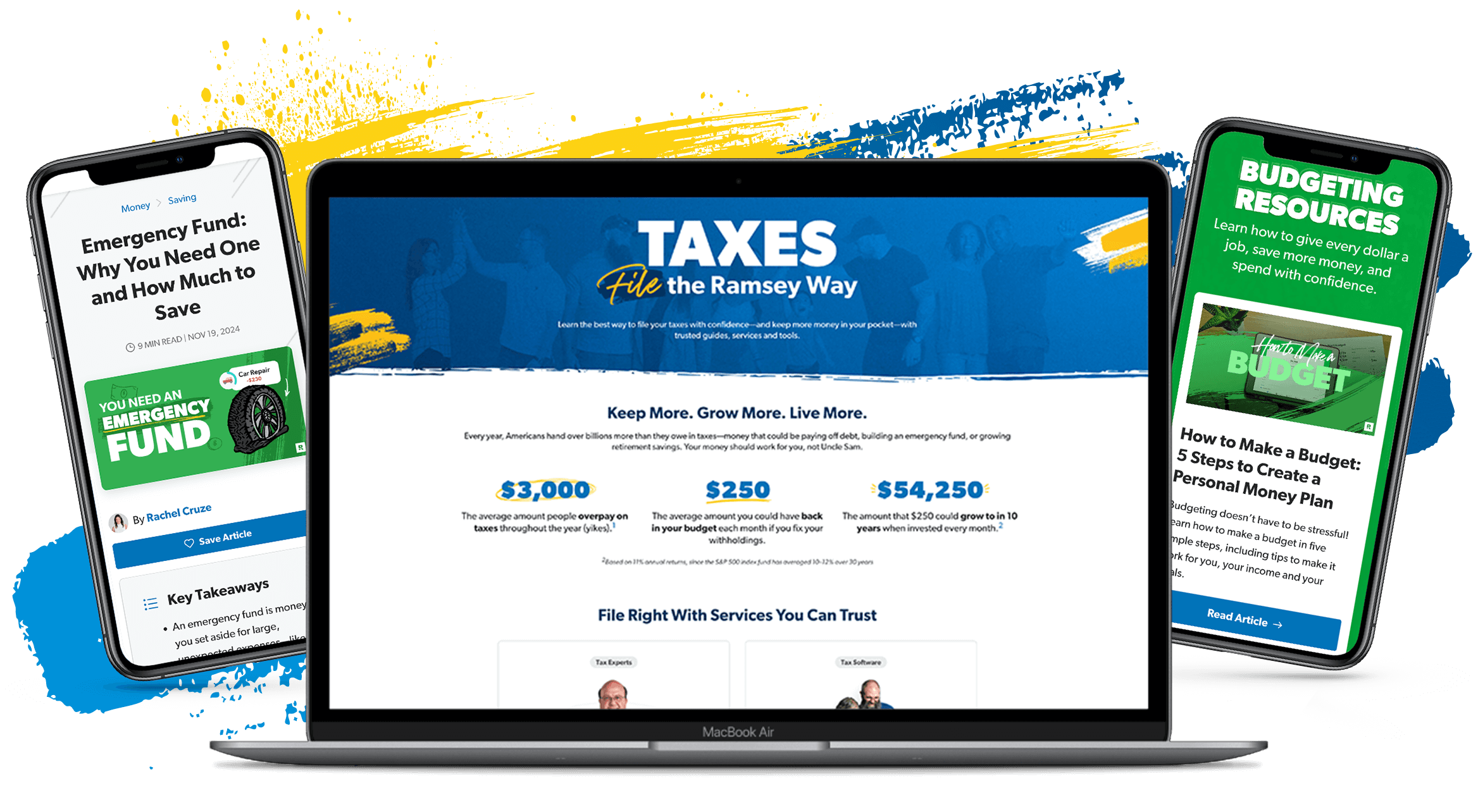

In just 15 minutes, EveryDollar helps you find thousands in margin and builds you a personalized plan to make the most of your money.

You work too hard to feel this broke! Get the tools that give your budget a purpose—and start winning with money.

The 7 Baby Steps are the proven plan that gives your budget the power to transform your money. Answer a few questions and find out which step you’re on.

Don’t settle for being “normal” with money. Get tips and action steps to help you make the most of every dollar.

The worst part about the budget isn't that it's difficult (because it's not). It's all the misunderstanding and myths floating out there about why you shouldn't budget.

Don't leave home without using this travel checklist first!

Need a tip to help you tip better? Here's one, plus 19 more!

2020 has been stressful enough, so don’t pile more on your plate than you can handle.

In this article, we’re pulling back the curtain on the fears that keep most people from budgeting—like the idea it’s too restrictive, too time-consuming, or just plain won’t work. Then we shine a flashlight on the truth: Budgeting is your best defense against financial horror stories.

Fall vibes on a budget? Yes, please. These DIY decorating tips will help you cozy up your home for the season—without cozying up to debt.

Do you have visions of cluttered paper work and backpacks covering your floor? Ah yes, it's back-to-school time again. But this year can be different! Let us help you get your home ready.

When you have a budget that reflects the goals and ideals you share as a couple, you can experience fabulous unity in your marriage. Learn how.`

You just found out the news: You’re having a baby! At first, you’re probably excited, maybe a little nervous. There are so many unknowns, right? Will the baby be a boy or a girl? Healthy? What color hair and eyes? And don’t forget . ….

Join our team of experts as they answer tough questions from real people about budgeting, saving, getting out of debt and building wealth.

A budget is a simple plan for your money—helping you breathe easier and reach your goals.

Filter what episodes and topics you want to hear using the Ramsey Network app.

Every week, receive expert guidance and practical steps to help you stay on track with your goals and create a strong financial future.

Step 1: Save $1,000 for your starter emergency fund.

Step 2: Pay off all debt (except the house) using the debt snowball.

Step 3: Save 3–6 months of expenses in a fully funded emergency fund.

Step 4: Invest 15% of your household income in retirement.

Step 5: Save for your children’s college fund.

Step 6: Pay off your home early.

Step 7: Build wealth and give.