Key Takeaways

- Budgeting is key to taking control of your money. You’re telling it where to go every month instead of wondering where it went.

- A budget is only effective if you track all your spending—no matter how small—to prevent overspending.

- Your budget must be flexible enough to plan for seasonal costs, holidays or quarterly expenses.

- Sticking to a budget is harder than making one, but you can master it with a change in attitude and some discipline.

Want to save more, pay off debt, and finally stop stressing about money? Budgeting is how you make it happen! Because when you tell your money where to go—instead of wondering where it went—you’re the one in control. Even millionaires do it!

And guess what? Budgeting doesn’t have to be overwhelming. I’ll walk you through how to make a budget step by step. Trust me, once you start, you’ll wonder why you didn’t do it sooner!

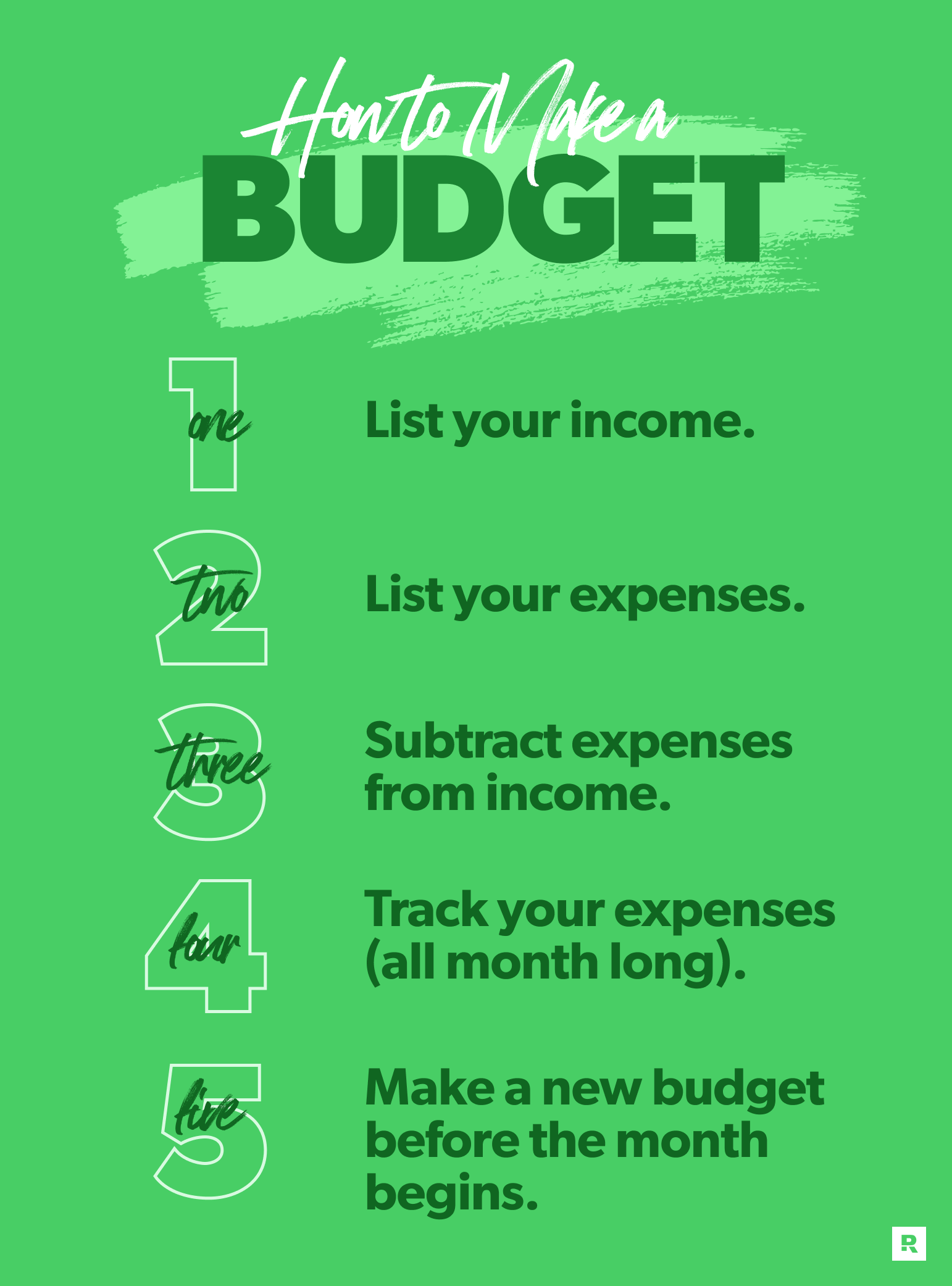

Here’s how to make a budget in five steps:

1. List your income.

2. List your expenses.

3. Subtract expenses from income.

4. Track your expenses (all month long).

5. Make a new budget before the month begins.

How to Make a Budget: 5 Simple Steps

Before you start your budget, decide which budgeting method you’ll use. You can create a budget with paper and pencil, a computer spreadsheet or a budgeting app.

Personally, I prefer to use Ramsey’s budgeting app, EveryDollar, because it’s super easy to input all my numbers and access my budget on the go. But it’s totally okay if you want to write out everything on a sheet of paper first (or try this free budget template and budget calculator).

Step 1: List your income.

The first step to building your budget is to list your income. Income is any money you plan to get during the month—that means your normal paychecks and any extra money you earn through a side hustle, garage sale, freelance work or anything like that.

You work weekends as a barista or babysitter? That’s income, and it goes in your budget.

You can create separate income budget lines for every paycheck you (and your spouse) get, plus anything extra coming in. (Note: You’re working with net income here, meaning what you bring in after taxes or anything else that’s taken out of your paycheck.)

Here’s an example of how to list your income in your budget:

His Paycheck 1: $1,500

Her Paycheck 1: $2,300

His Paycheck 2: $1,500

Her Paycheck 2: $2,300

Side Hustle: $500

Total Income: $8,100

What if I don’t make the same income every month?

If you’ve got an irregular income, take a look at what you’ve made the last few months and list the lowest amount as this month’s income budget line. You can adjust later in the month if you make more and add that extra money to your money goal or another budget line.

Step 2: List your expenses.

Now that you’ve planned for the money coming in, you can plan for the money going out. It’s time to list your monthly expenses!

Here's A Tip

Go ahead and open up your online bank account or grab your recent bank statements. That will give you the info you need to start filling out numbers for your expenses.

Know your budgeting priorities.

When planning for the month ahead, you want to make sure you budget for certain expenses before others. That said, list your expenses in this order:

- Giving. I believe in putting 10% of your income here—it’s a great way to start your budget with a spirit of generosity.

- Saving. You’ve got to pay yourself first before you pay everyone else! This could be an emergency fund or another savings goal. (Side note: If you’ve got debt, you need to pay it off before you build your savings. So use your “save” money toward your Baby Step 1 emergency fund and your debt snowball instead.)

- The Four Walls. You want to prioritize these essentials: food, utilities, shelter and transportation. Create a budget category for each of these, as well as budget lines underneath for your specific expenses.

- All other monthly expenses. Start with the important stuff—like insurance, debt and childcare. Then move on to nonessentials—like personal spending, fun money and entertainment. And be sure to include a miscellaneous line for unexpected expenses!

You also need to consider your money goals. If you don’t know what goal to focus on right now, check out the 7 Baby Steps. This plan breaks the most important money goals into easy-to-understand, actionable steps!

Customize your budget categories and budget lines.

Keep in mind, everyone’s exact budget percentages are going to be different depending on their income and lifestyle. But here’s an example of what your budget expenses might look like:

Budget Category: Food

Groceries: $600

Eating Out: $150

Budget Category: Utilities

Electricity: $130

Water: $60

Natural Gas: $40

Budget Category: Shelter/Housing

Mortgage: $1,450

HOA Fees: $50

Budget Category: Transportation

Gas: $180

Think of a budget category as a folder and the budget lines as the files inside it. Feel free to create as many budget categories and budget lines as you need to make sure all your expenses are accounted for.

Your budget will most likely have both fixed and variable expenses. Fixed expenses stay the same every month, like your rent or mortgage. Variable expenses change, like groceries or gasoline.

And don’t worry if that grocery budget line is way off at first. That’s where most people tend to overspend. It usually takes a couple of months to get the hang of budgeting, so just start with your best estimate based on your past spending (again, looking at your bank transaction history will help with this.)

The Budgeting App That Finds Hidden Margin

You’ve got more margin than you think. EveryDollar helps you find it in minutes so you can start making real money progress, really fast.

Step 3: Subtract expenses from income.

Next, subtract all your expenses from your income. Since a zero-based budget is the goal, you want this number to be zero. Yes, zero.

Now, this doesn’t mean you spend every single cent you earn. It also doesn’t mean you let your bank account reach zero (I recommend leaving a buffer in there of about $100–300).

Zero-based budgeting just means you give every dollar a job to do—whether it’s spending, giving, saving or paying off debt. It’s all accounted for and given a purpose. It’s the reason I love this method.

You work hard for your money, right? Well, it should work hard for you! Every. Single. Dollar.

What if I have money left over?

If you have money left over after covering your expenses, don’t let it go unbudgeted. Without a plan, it’s easy to waste it on coffee or impulsive online purchases. Put those extra dollars to work by directing them toward your current money goal.

What if I don’t have enough to cover all my expenses?

Or what if you end up with a negative number? You just need to go back through your budget and cut expenses until you break even. Hint: Start with your eating out and entertainment budget lines. If dining out is your guilty pleasure, cutting back might sting at first. But here’s the bottom line: You can't spend more than you earn.

If you’re still struggling to make ends meet after cutting expenses, don’t forget the power of increasing your income with a side hustle or selling stuff. Just remember to resist the urge to spend more when your income rises. That extra cash should go toward your planned expenses.

And if the idea of doing a bunch of addition and subtraction seems like a lot, don’t stress. Our budget app EveryDollar will do the math for you. It’s literally made for zero-based budgeting.

Step 4: Track your expenses (all month long).

Want to master budgeting? Here’s the secret: Track. Every. Expense.

A budget is just wishful thinking without this step—like planning to train for a marathon but never leaving the couch.

Tracking your transactions means you know exactly where your money is going all month long. Gas? Subtract it from transportation. Rent? From housing. Morning coffee? From personal spending.

Find a tracking routine that works for you—daily, weekly or right after each purchase. Then adjust as needed. If your electricity bill is higher than expected, shift money from another category to cover the difference. If your water bill is lower, put the extra toward your financial goals.

Tracking your expenses throughout the month helps you:

- Stay accountable. Tracking your expenses keeps you accountable to your budget, yourself and your money goals. And if you’re married, tracking also keeps you accountable to your spouse. After all, you’re both in this money thing together. (And EveryDollar lets you share an account so you can budget as a team. No secrets. No pretending a purchase didn’t happen.)

- Avoid overspending. As you enter expenses, you see how much you have left in every budget line. You’ll know exactly how much you can spend so you don’t go over.

- Stay on top of the budget. Your budget is not a set-it-and-forget-it project. When you track transactions, you’re constantly in your budget. You can make adjustments so you know where your money is going—all the time.

- Learn and adjust your spending habits. Tracking can show you the areas that tend to trip you up, and it can also help you get back on track with your goals.

Step 5: Make a new budget before the month begins.

While your budget shouldn’t change too much from month to month, the fact is, no two months are exactly the same. That’s why you need to create a new budget every single month—before the month begins.

When you’re ready to start your next budget, just copy over this month’s budget to the next (pro tip: EveryDollar will automatically do this for you). Then make changes for anything new that’s coming up.

Here are some examples of month-specific expenses to prep for:

- Celebrations (birthdays, anniversaries)

- Holidays

- Seasonal expenses (back to school, sports, lawn care)

- Semiannual expenses (insurance premiums, car maintenance, school tuition)

- Annual expenses (subscription renewals, yearly exams, pet vaccinations)

I recommend creating a budget category called something like “Month-Specific Stuff” or “Alternating Expenses” or “Discretionary” (if you like using big words). Then just add whatever lines you need for that month and delete the ones from last month you no longer need.

And that’s it—that’s how you make a budget!

Sticking to Your Budget

So, making a budget isn’t as bad as you thought, right? It’s pretty easy when you get the hang of it. But sticking to the budget is where most people get in trouble and give up, because budgeting isn’t something you put on autopilot.

You’ve got to be intentional about it, checking in with how you’re doing as the month goes on and adjusting accordingly. And those impulse purchases and seasonal sales can be pretty enticing (trust me, I’ve been there!), but you have to actively say “no way” to all of them.

It's a lot of work, but mastering a budget is mostly about changing your attitude. See, you shouldn’t look at a budget as restricting your spending or spoiling your fun—it’s a tool that allows you to spend without worry. You can still give yourself fun money. Just put it in the budget at the beginning of the month!

There are lots of fun ways to stay motivated with your budget. You can celebrate your big and little money wins (paying off a credit card, cutting expenses for 30 days), visualize your goals, get an app to help you, or surround yourself with budget-minded people. With the right attitude and lots of discipline, you can reach your money goals!

How to Make a Monthly Budget With Confidence

Ready to start telling your money where to go (instead of always wondering where it went)? Make it easier on yourself and download our EveryDollar budgeting app.

EveryDollar does more than just help you track your spending and manage your money—it actually helps you find more margin every month! Just download the app, answer a few questions, and we’ll build you a plan to free up thousands in margin to put toward your goals.

Start EveryDollar for free right now!