Get Out of Debt

You don’t need a finance degree to transform your money—it’s 80% behavior and 20% head knowledge. Get the plan and budget you need to help you take control for good.

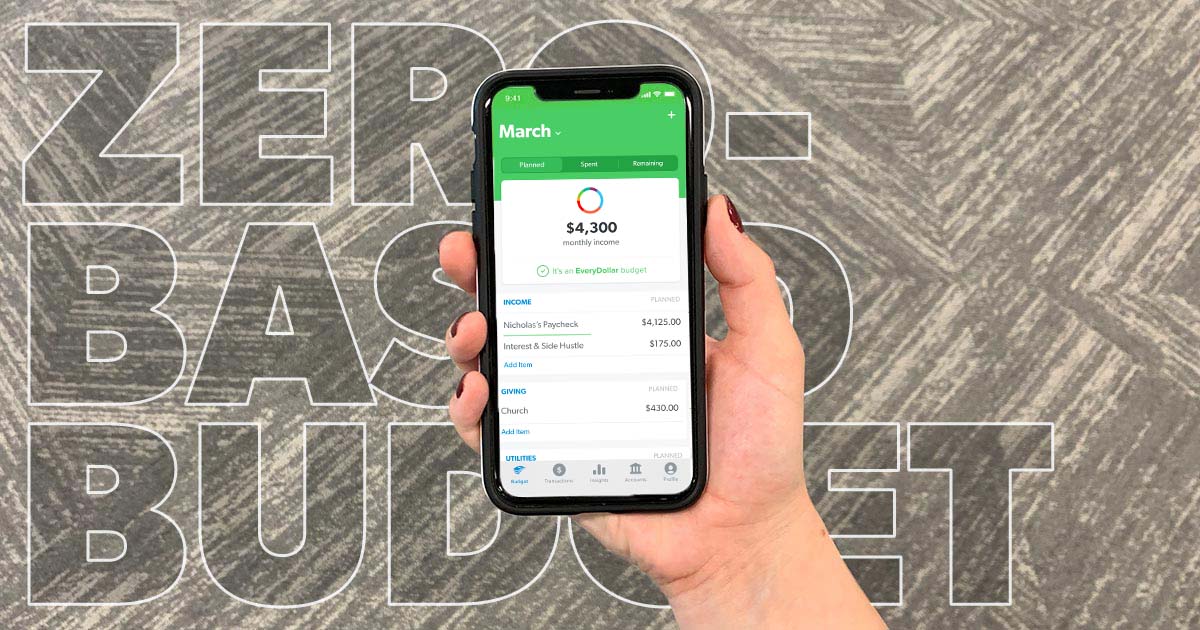

In just 15 minutes, EveryDollar helps you find thousands in margin and builds you a personalized plan to make the most of your money.

You work too hard to feel this broke! Get the tools that give your budget a purpose—and start winning with money.

The 7 Baby Steps are the proven plan that gives your budget the power to transform your money. Answer a few questions and find out which step you’re on.

Don’t settle for being “normal” with money. Get tips and action steps to help you make the most of every dollar.

Is ALDI cheaper than Walmart? I put them both to the test in this real grocery price comparison. See who comes out on top for meat, dairy, produce and more.

Whether you're new to budgeting or looking to improve, these budgeting tips will help you take control, stay on track, and feel confident with your money.

Learn how to stick to a budget with these 11 practical tips to build better habits, avoid overspending, and actually make progress with your money each month.

The average grocery cost per month is $504. But how much you spend on groceries will depend on your income, family size, dietary restrictions and lifestyle.

Learn how the cash envelope system (aka cash stuffing) helps you budget with cash, stop overspending, and take control of your money—one envelope at a time.

Looking to make extra money this year? Explore this list of 41 legit side hustles—from online freelance jobs to creative part-time gigs you can start today.

Tired of wondering where your paycheck goes every month? Learn how zero-based budgeting works, why it beats other methods, and how to do it—step by step.

Need more time to file your taxes? No problem! Ramsey SmartTax makes it easy to file a tax extension in five simple steps so you can breathe a little easier on Tax Day.

Is your paycheck different from month to month? Learn how to manage irregular income and create a budget that keeps you in control—no matter how much you earn.

Join our team of experts as they answer tough questions from real people about budgeting, saving, getting out of debt and building wealth.

A budget is a simple plan for your money—helping you breathe easier and reach your goals.

Filter what episodes and topics you want to hear using the Ramsey Network app.

Every week, receive expert guidance and practical steps to help you stay on track with your goals and create a strong financial future.

Step 1: Save $1,000 for your starter emergency fund.

Step 2: Pay off all debt (except the house) using the debt snowball.

Step 3: Save 3–6 months of expenses in a fully funded emergency fund.

Step 4: Invest 15% of your household income in retirement.

Step 5: Save for your children’s college fund.

Step 6: Pay off your home early.

Step 7: Build wealth and give.