Get Out of Debt

You don’t need a finance degree to transform your money—it’s 80% behavior and 20% head knowledge. Get the plan and budget you need to help you take control for good.

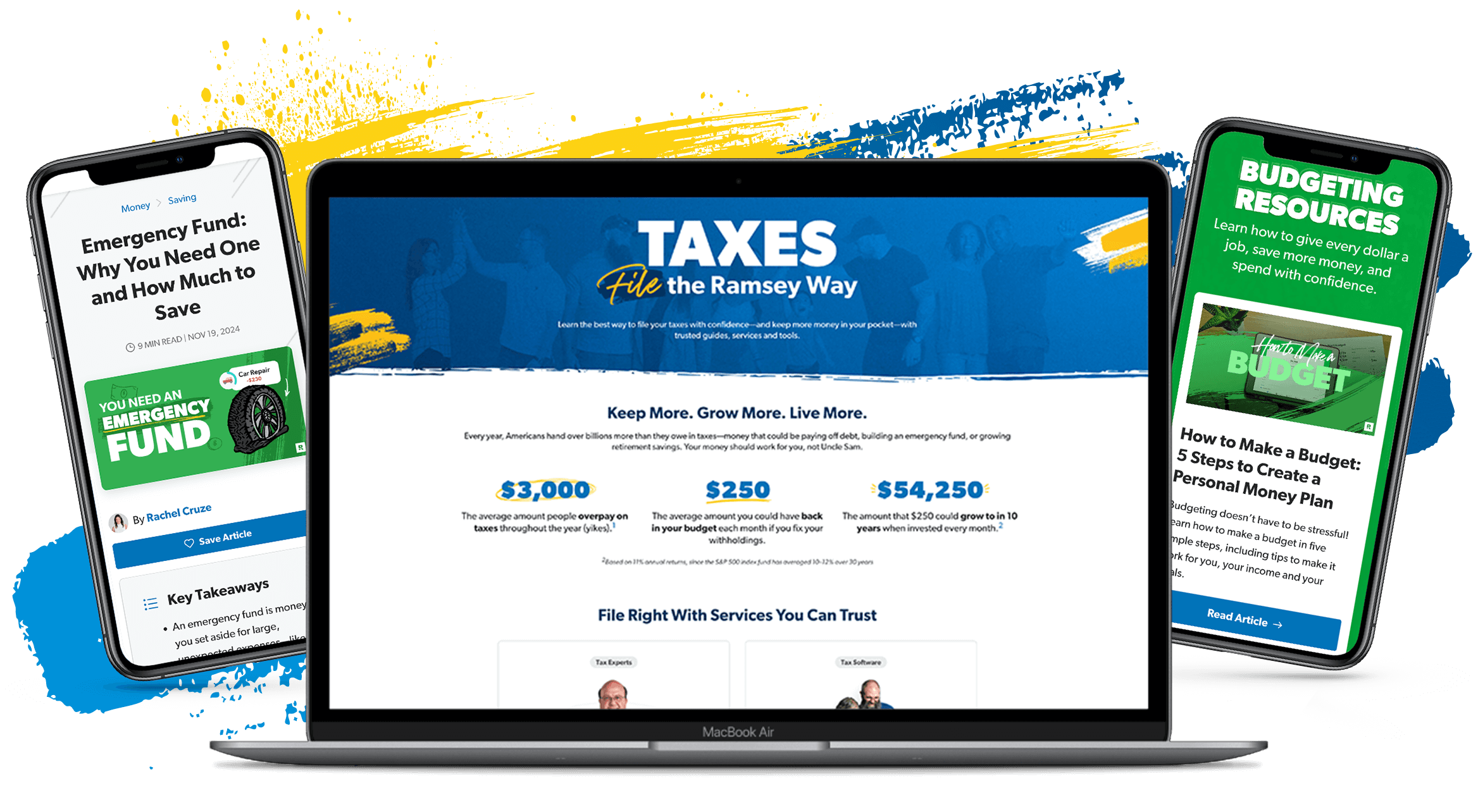

In just 15 minutes, EveryDollar helps you find thousands in margin and builds you a personalized plan to make the most of your money.

You work too hard to feel this broke! Get the tools that give your budget a purpose—and start winning with money.

The 7 Baby Steps are the proven plan that gives your budget the power to transform your money. Answer a few questions and find out which step you’re on.

Don’t settle for being “normal” with money. Get tips and action steps to help you make the most of every dollar.

You’ve probably heard of the 50/30/20 rule, but is it a helpful (or even realistic) way to budget? Find out how this method works and how to create a budget that best fits you.

If you aren’t where you want to be with your finances right now—you aren't alone. And you aren't stuck either! Try this list of 10 things to do differently with your money and make 2025 the best yet.

This money trend can help you save over $5,000 in a little over three months! Learn how the 100 Envelope Challenge works so you can start saving today.

Scholarships are one of the best ways to pay for college without debt! But with so many scholarship options out there, it's hard to even know where to look. Here are some tips to get you started.

Let’s take a look at what makes you eligible for a Pell Grant, how it works, whether you have to pay it back, and how much of this funding you can get for school.

What’s the secret to sticking to your budget? Tracking your expenses! Learn how to track your expenses all month long so you can say goodbye to overspending.

Wanting to go to grad school? Thinking about taking out a Grad PLUS Loan to help cover the cost? Get the facts about Grad PLUS Loans and find out more ways to pay for your education.

The Public Service Loan Forgiveness (PSLF) program was created as an incentive for people to work in certain service careers. Sounds great, right? Well, there’s a lot more to PSLF than it seems.

Student loans are a problem, and they don't seem to be going anywhere—but there’s hope. Here’s everything you need to know about the student loan crisis.

Join our team of experts as they answer tough questions from real people about budgeting, saving, getting out of debt and building wealth.

A budget is a simple plan for your money—helping you breathe easier and reach your goals.

Filter what episodes and topics you want to hear using the Ramsey Network app.

Every week, receive expert guidance and practical steps to help you stay on track with your goals and create a strong financial future.

Step 1: Save $1,000 for your starter emergency fund.

Step 2: Pay off all debt (except the house) using the debt snowball.

Step 3: Save 3–6 months of expenses in a fully funded emergency fund.

Step 4: Invest 15% of your household income in retirement.

Step 5: Save for your children’s college fund.

Step 6: Pay off your home early.

Step 7: Build wealth and give.