What Is Renters Insurance and How Does It Work?

8 Min Read | Jul 2, 2025

Key Takeaways

- Renters insurance protects your stuff. If your belongings are stolen, damaged or destroyed, renters insurance helps cover the cost to replace them.

- It’s easier to get and more affordable than you might think. Most renters pay less than $30 a month for thousands of dollars in coverage.

- Whether your landlord requires it or not, renters insurance is a no-brainer as it fills the gaps your landlord’s policy won’t cover.

If you’re a renter, you need renters insurance—no ifs, ands or buts about it! Unless everything you own fits in a backpack, your stuff is probably worth way more than you think. And leaving it all unprotected? Not the best idea.

That’s where renters insurance comes in. It’s the perfect backup plan if something goes wrong—like a fire, theft or busted pipe in your apartment. Plus, a lot of landlords require it (even though most renters still don’t have it).

In this guide, we’ll break down what renters insurance is, how it works, and why it’s totally worth it. We’ll also walk you through how to buy renters insurance—so you can check it off your to-do list and sleep a little easier.

Why Do I Need Renters Insurance?

Renters insurance provides personal property coverage—it helps you pay to replace your belongings if they’re damaged, vandalized or stolen while renting a house or apartment.

Like homeowners insurance, it’s one of the eight types of insurance you can’t go without. And don’t make the mistake of relying on your landlord’s insurance—that usually only covers the building, not your stuff.

Example time! Let’s pretend you’re renting and your apartment is broken into. Gasp! Your laptop, iPad, jewelry, Nintendo and TV? Poof! Stolen. All gone with the wind. Double gasp! What can you do?

Well, if you have renters insurance, all you have to do is file a claim and they’ll cut you a check to replace all your stolen items. (Sweet, right?)

In fact, when anything happens to your stuff, renters insurance can save the day in three big ways:

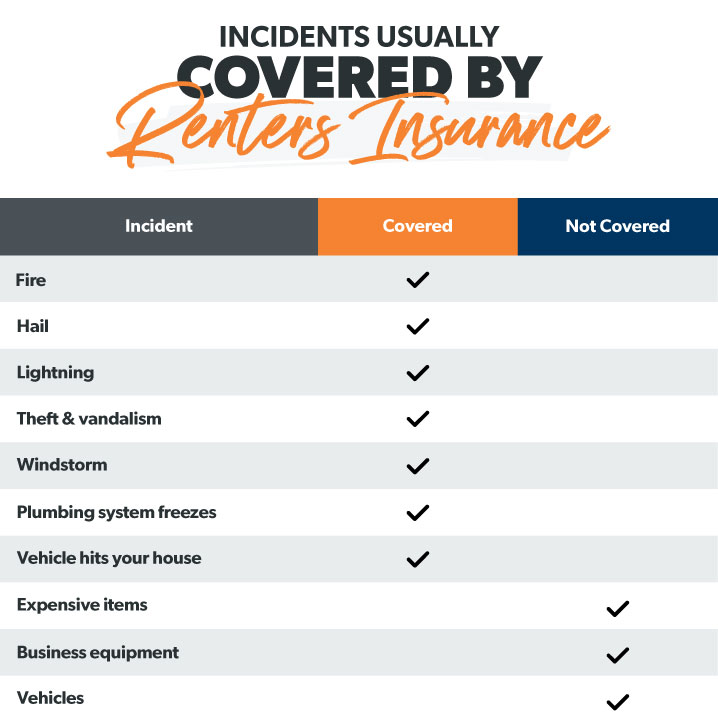

- Renters insurance covers the cost of replacing your belongings in the event of a theft, fire, storm, vandalism, electrical malfunction or plumbing issues.

- Renters insurance provides liability coverage—if someone gets injured at your place, renters insurance steps in to protect you financially from medical bills and/or legal fees.

- Renters insurance pays for additional living expenses—if you need to stay at a hotel while your apartment or house undergoes repairs.

Now that you know what renters insurance covers—and why it matters—you might be wondering: How do I get it? Great question! Let’s break it down.

How to Get Renters Insurance: 5 Tips

First off, don’t be overwhelmed. Follow these tips for getting coverage and you’ll become a renters insurance Jedi Master in no time (which is totally a real thing).

1. Research what your landlord covers.

Start by finding out what kind of insurance your landlord already has. They’re legally required to carry coverage on the building itself—but like we said, that won’t cover your personal stuff. It also probably won’t help with things like water backup or damage from a faulty appliance either. So don’t be shy—ask your landlord for a copy of their policy. That way, you’ll know exactly what gaps need to be filled with your own renters insurance.

2. Create an inventory.

Next, go through your place and record what you own. Estimate how much coverage you’ll need to replace everything. Group your stuff into categories like electronics and appliances, furniture, clothes and shoes, jewelry, soft furnishings and so on. Then tackle any special items, like that fancy exercise machine or expensive bicycle. For higher-end items, you may want to purchase something called floater insurance. This protects larger assets like art or antiques.

Take video and pictures of your stuff. Write down brands, models and serial numbers if you know them. Save receipts for big-ticket items if you can. Keep all this in a safe place or on a spreadsheet saved to a cloud drive.

3. Research renters insurance policies.

No one likes homework. But this step will pay off if you ever actually have to make a claim on your renters policy. Do your research and get a feel for what’s covered and what isn’t. This will help later when it comes time to shop around. Now, there are two different kinds of renters insurance you’ll find:

- Replacement cost: This type of coverage might cost a little more, but it pays the full amount to replace your belongings. And trust us—it’s worth every penny. We always recommend replacement cost coverage.

- Actual cash value: This type of policy is cheaper, but that’s because it only covers what your stuff is worth at the time of damage.

Again, do yourself a favor and skip right to replacement cost coverage. Also, you’ll want to add some type of flood or earthquake insurance if you live in areas prone to these disasters.

4. Consider your liabilities.

Think about any extra liability coverage you might need. If you’re a smoker or have pets, you might want to increase your liability. You’ll be asked about these because both can affect your premium.

Also, consider how often you have company in your home—whether you host a book club or just plain old parties! The more people you have over, the more likely it is someone could get hurt. Increasing your liability coverage is really worth considering. It normally only costs a few dollars but can save you a bundle when disaster strikes. And if you think you’ll need more than the usual amount of liability coverage, check out umbrella insurance for extra protection.

5. Be ready to provide details.

Depending on where you live, you’ll be asked to answer these questions and more when it comes time to get a quote:

- What’s your full address and type of residence?

- Does your home have a smoke alarm, carbon monoxide detector, sprinkler system and security alarm?

- Is your home powered by electricity, gas or both?

- What floor do you live on if you’re in an apartment building?

- Who lives with you?

- Does your front door have a dead bolt?

If you don’t know the answers to these questions, you can reach out to your landlord. Provide as much detail as possible to get the best rate.

How Much Does Renters Insurance Cost?

Now that you know how to get renters insurance, how much does it cost? The good news? Not that much, actually.

The average person pays around $15 per month for renters insurance—or $170 per year.1 That’s about what it would cost to replace your fancy air fryer.

The cost of renters insurance varies based on things like where you live and how much coverage you want. For example, if you get $100,000 in personal property coverage, you’ll obviously pay more in premiums than if you got $25,000. And opting for replacement cost coverage instead of actual cash value will also increase your premium. Increasing your liability limit will also bump up your premium a bit.

If you want to bring your premium down, you could raise your deductible. (Your deductible is the amount you have to pay before your insurance company will start ponying up.) A higher deductible means you’ll pay less in monthly premiums but more out of pocket when you make a claim. It’s definitely worth raising your deductible if you can afford the extra risk.

You can also sometimes get discounts if you install extra security features like burglar alarms or dead bolt locks.

Keep in mind that even the higher end of a renters insurance premium costs less over the course of a year than replacing a damaged or stolen laptop or TV. And you don’t have to lose everything at once to be able to file a claim.

And a quick heads up—if you have roommates, your renters insurance won’t cover their stuff (and theirs won’t cover yours). So don’t try to lower the cost by splitting it like last night’s UberEats order.

Technically, you can add a roommate to your plan—but just don’t. It raises your premiums and splits your coverage (among other things). It’s not worth the hassle. Renters insurance is cheap. Keep it simple—get your own policy.

Get the right protection for your belongings.

Having a RamseyTrusted pro by your side means you’ll get quality renters insurance without breaking the bank.

Is Renters Insurance Worth It?

Renters insurance is a great deal and it’s absolutely worth it. It’s affordable and offers excellent protection for your things. And as the number of renters could increase across the country due to a lower housing market inventory, more people will need renters insurance. (If you don’t want to rent the rest of your life, check out these tips to get your finances on track.)

Without renters insurance, you’d have to drain your savings or go into debt to replace your stuff—not to mention you’ll be financially responsible if someone is hurt in an accident or dog bite in your home.

Think about it. You’re protecting your personal computer, TV, favorite armchair, those early hardback editions of Harry Potter you collected years ago, and that pair of shoes you love more than you should and just can’t find anywhere anymore.

Renters Insurance: A No-Brainer Policy

When you add up what your stuff is worth—not just in dollars and cents, but in memories and cherishment—it’s clear: The cost of renters insurance is a small price to pay for peace of mind. That’s why every renter needs it.

Next Steps

- The steps for how to buy renters insurance are pretty simple. If you’re ready to get started, you can hop online and start gathering quotes.

- Need a hand? Our RamseyTrusted® insurance pros can help you find the right coverage for you. They’re independent agents who work for you—which means you’re getting the best deal.