Personal Finance

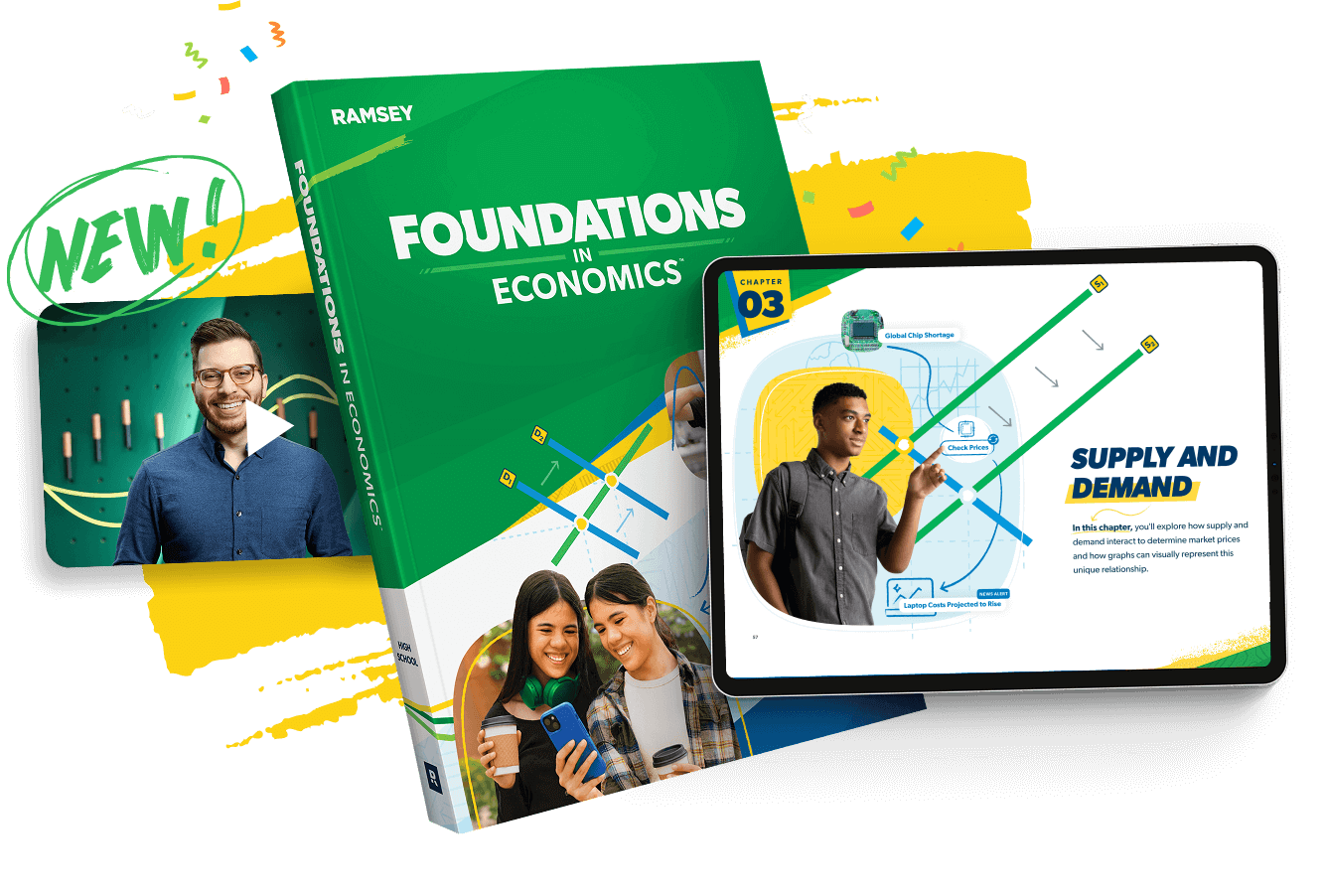

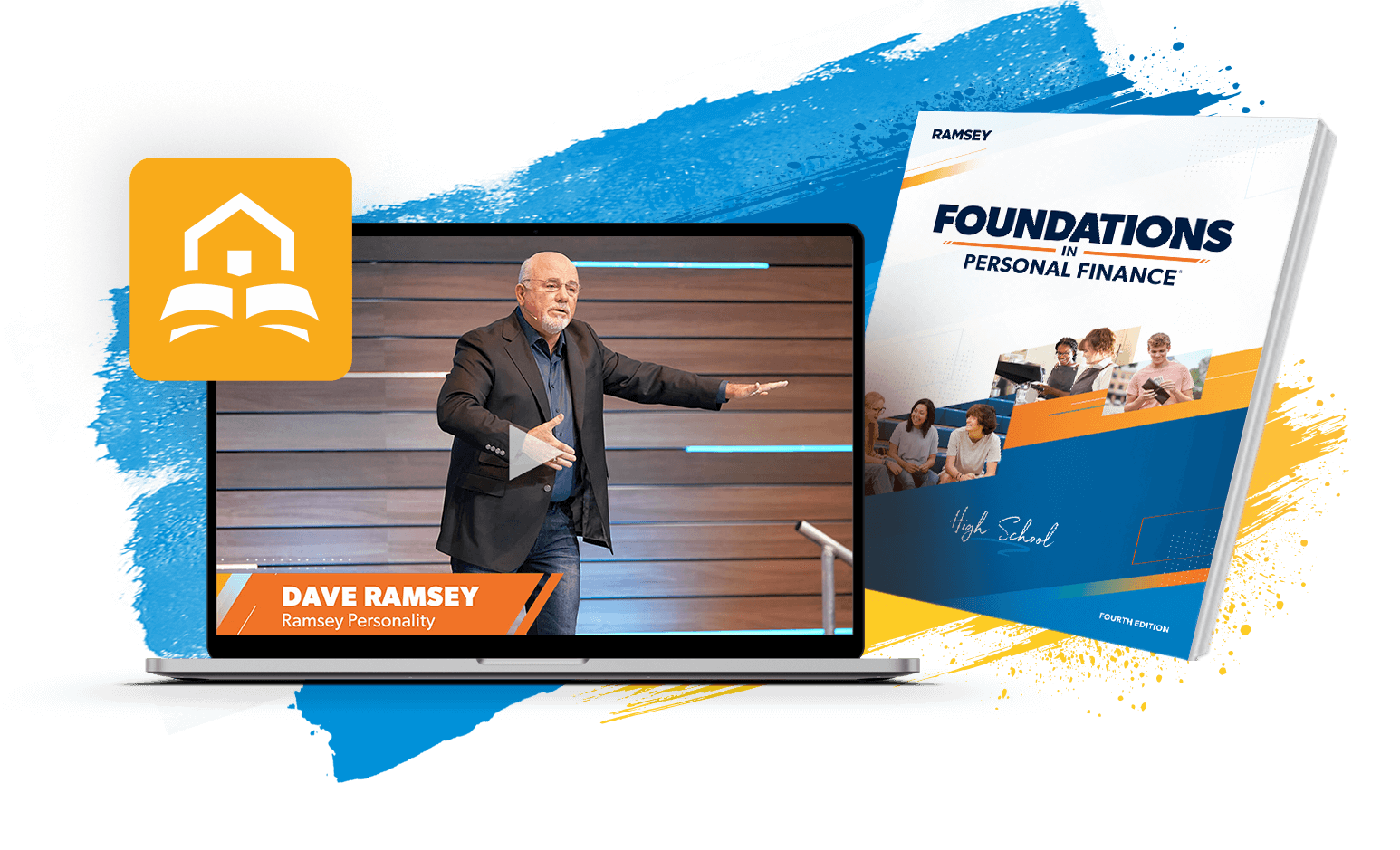

Curriculum for public and private high schools.

Curriculum for public and private high schools.

Curriculum for public and private high schools.

Curriculum for homeschool families and co-ops.

Too many students enter adulthood with debt, worry and stress. We’re on a mission to change that, and we invite you to join us! We believe in giving every student the confidence, security and hope of knowing how to manage their money and their lives.

We believe personal finance is 20% head knowledge and 80% behavior. We teach practical skills for real-life situations, so students are prepared for the real world. Our curriculum is built to help students set and achieve their goals—and empower them to find work they’re passionate about.

Ramsey Education began more than two decades ago when financial expert Dave Ramsey kept hearing the same thing from radio callers about money: "I wish I’d learned this stuff in high school!" That feedback inspired us to create a personal finance curriculum for high school students—to teach them how money really works.

as a trusted curriculum by educators

of high schools have

taught our curriculum

student lives changed

U.S. high schools and 500,000 students served annually

“I feel extremely confident with handling my money now . . . I have saved $800 for my emergency fund and paid cash for my car."

Foundations in Personal Finance Student

“[Foundations] had everything we needed—the lessons, activities, quizzes, and the tests at the end of the unit, all in Spanish, which is a huge bonus for our students. I've had so many of them telling me that they've started a savings account and that their parents have started a savings account.”

Foundations in Personal Finance Teacher

“After taking this course, it gave me an idea of what applying for colleges looks like and the beauty of being able to apply for scholarships . . . and not taking out loans.”

Foundations in Personal Finance Student

“I do small business stuff in high school so I’ve been learning how to manage the finances and right now I’m saving up for my senior trip. I also paid cash for my car!”

Foundations in Personal Finance Student

“We have a high poverty rate. Some Foundations students have said they feel, for the first time, they’re not going to be poor—that they can break the cycle of poverty. They feel encouraged because they see another path for themselves. They see the light at the end of the tunnel.”

Foundations in Personal Finance Teacher

“Foundations taught me that you don’t have to come from money to have money. You can start from nothing, but if you work hard enough and you put your mind to it, you can be financially free.”

Foundations in Personal Finance Student

“This class taught me how to manage my money, how I can live without having to stress about money . . . I’m free to not live paycheck to paycheck, to not live like how my parents did.”

Foundations in Personal Finance Student

"Students are saying this is legit. This is stuff we’re going to use. It blew my mind when I had an 18-year-old student who went and opened a Roth IRA on his own the day after we started the investment chapter."

Foundations in Personal Finance Teacher

• Texas

• South Carolina

• Florida

Enter Our Teacher Appreciation Giveaway!

We’re excited to announce our Ramsey Education scholarship program. Foundations students apply here!